NDR Growth Tactics 3: Promote Cross-Sell

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Net Dollar Retention (NDR), or Net Revenue Retention (NRR) to use the more generic term, has become a priority for most SaaS businesses. The reasons are simple.

Customer Acquisition Costs (CAC) have already been covered so this is a very cost efficient form of growth

Buyers and investors want to be sure a solution delivers value; NDR growth is strong evidence of value

Positive NDR shows that the company has the ability to overcome the natural account churn that is part of any SaaS business

Ibbaka has a compelling framework for delivering NDR growth, one that is well supported in the Ibbaka Valio platform. We are sharing this framework in this series of eight posts.

The six NDR factors are often shown using the NDR waterfall. This is a powerful tool to understand what levers are driving NDR and where actions should be focussed.

Cross sell as an NDR lever

The third of the positive NDR levers is cross sell. Of course cross sell can only occur when there is something to cross sell to. Cross sell falls into two broad categories.

Cross sell of related services

Cross sell of related products

Not every company will have products available for cross sell, but most will have the option of selling or bundling supporting services, so let’s start there.

Cross sell of related services

Buyers do not want to buy an application, they want a solution. As marketing guru Ted Levitt said “ people do not buy quarter inch drills, they buy quarter inch holes.” Most B2B applications can benefit from supporting services, many require them, even those with a Product Led Growth (PLG) motion.

One choice that companies make is to be product providers where the product drives almost all the revenue and if services are needed they are provided by partners. The TSIA refers to these as Product Providers. This is what many SaaS companies assume they should be.

A different path is that of the Product Extender. These companies sell a product and then wrap it with additional subscription services (referred to as ‘annuity services’ in the TSAI graphic). According to TSIA research, the Product Extender companies are more profitable than the Product Provider companies.

From Thomas Lah Why are SaaS companies unprofitable?

With SaaS companies under pressure to shore up revenues and improve NDR many are asking what additional subscription services they could add.

We are seeing some trends on these value-added subscription services.

Data feeds - find ways to provide data subscriptions that increase the value of your solution. This could be external data feeds that you can access, or it could be aggregate data from other users. It is not the data that the customer generates themselves from normal use, they are already paying for that.

Benchmarking - many companies want to benchmark themselves and make sure they are following best practices. This is not as compelling as data feeds that give actionable insights, but in some cases it can provide a small income boost.

Expert insights - you likely have deep domain expertise. You used that to build the solution, but you can also use that to help customers solve problems. You may even be able to realize they have problems before they are aware of it themselves. As you have the expertise already and access to data this can be extremely valuable to your customers and charged at a premium. In many cases, this consulting work will eventually lead to product enhancements.

When to charge for value-added subscriptions?

If the service or data is required to complete a core value path for your solution then do not charge for it, make it part of your solution and capture the value in your standard pricing.

If the service is only relevant to some of your customers, and it is a value-add rather than being part of the standard way you provide value, then consider offering it as a value-added subscription and driving cross sell.

“Value Path Definition: A series of actions taken by a user that results in something of value. Applications like Pendo can help you define value paths and track completion.”

Cross sell of related products

Larger companies will often have more than one product line. In this case there are product cross sell opportunities that can be used to juice up NDR.

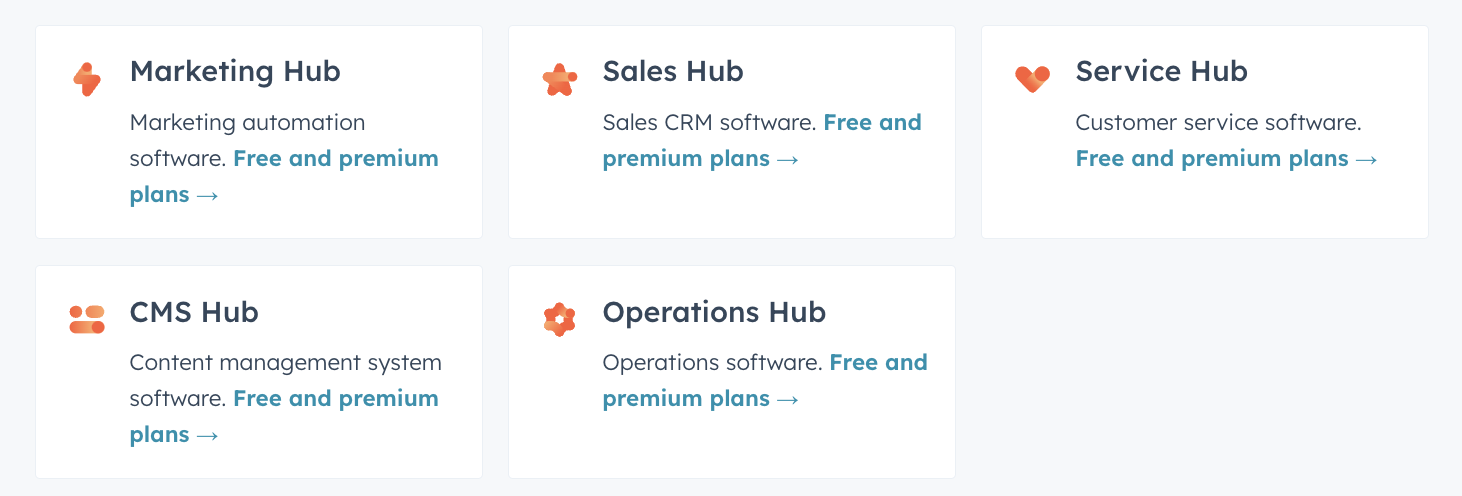

Hubspot, for example, has five product lines with many cross sell opportunities.

When should you add new products and product lines?

Different buyer - when the buyer is different it often makes sense to offer then a different product. Look at the HubSpot product lines above. In most companies each will have a different buyer.

Different user - user experience (UX) and customer experience (CX) have a big impact on pricing power and can even impact differentiation value. It is hard to design a good UX for people with different experiences, job roles and expectations. Different users often deserve different products. See Customer Experience (CX) Includes Price (and Value).

Disconnected value paths - Value paths are often sequenced with one path leading to another. When a set of value paths is not connected to other sets of value paths they generally belong in their own package.

Too many value paths - Even if all the other criteria are satisfied if you have more than 5-7 value paths you probably need to split the package into two different packages.

Different packages often have complementary value propositions and the value models for the different product lines can share variables. For example, at HubSpot the Marketing Hub generates the MQLs (Market Qualified Leads) that sales takes in as SQLs (Sales Qualified Leads), that get passed on to the Services Hub once the sale is completed. The value models for marketing, sales and customer service (or customer success) will often share some underlying variables making it easier to construct a combined value story for a bundle that combines products.

In the best case, the value of the combined offers is not just additive. A solution that delivers MQLs combined with another solution that increases the close rate on SQLs increases the value of the MQLs. The value model needs to capture these interactions.

Bundles can help drive cross sell

Make sure that there is someone who is accountable for cross sell. This could be someone in sales, in customer success, or if you are large enough, there could be a formal cross sell team.

Set up a cross sell lead generation process. This is a special form of Product Qualified Lead, with the lead scoring set up for cross sell rather than upsell.

“You are generating a large number of leads. Ask about our Sales Support System to convert leads into closed sales.”

One of the best ways to drive cross sell is with bundles. Create bundles that combine products that have strong synergies, where the value is more than just additive.

Bundles do not need to have price discounts to work. Rather than discounting prices, try including value added services like integration or onboarding support.

Bundles are also a good way to address the needs of well defined subsegments of customers. You may not want to commit to a formal package for a segment, but you can quickly put together a set of products, services, configurations and data that serve a specific, perhaps fleeting, need.

Download the NDR Report here

Read other posts on Net Dollar Retention

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

NDR Growth Tactics 3: Promote Cross-Sell (this post)

Net Revenue Retention (NDR) impacts the value of your company