NDR Growth Tactics 6: Managing Churn

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Net Dollar Retention (NDR), or Net Revenue Retention (NRR) to use the more generic term, has become a priority for most SaaS businesses. The reasons are simple.

Customer Acquisition Costs (CAC) have already been covered so this is a very cost efficient form of growth

Buyers and investors want to be sure a solution delivers value; NDR growth is strong evidence of value

Positive NDR shows that the company has the ability to overcome the natural account churn that is part of any SaaS business

Ibbaka has a compelling framework for delivering NDR growth, one that is well supported in the Ibbaka Valio platform. We are sharing this framework in this series of eight posts.

NDR growth tactics 6: Reduce Churn (this post)

The six NDR factors are often shown using the NDR waterfall. This is a powerful tool to understand what levers are driving NDR and where actions should be focussed.

Managing churn

We say managing churn, not eliminating churn, or even reducing churn. Not all churn is bad. And it is generally impossible to completely eliminate churn.

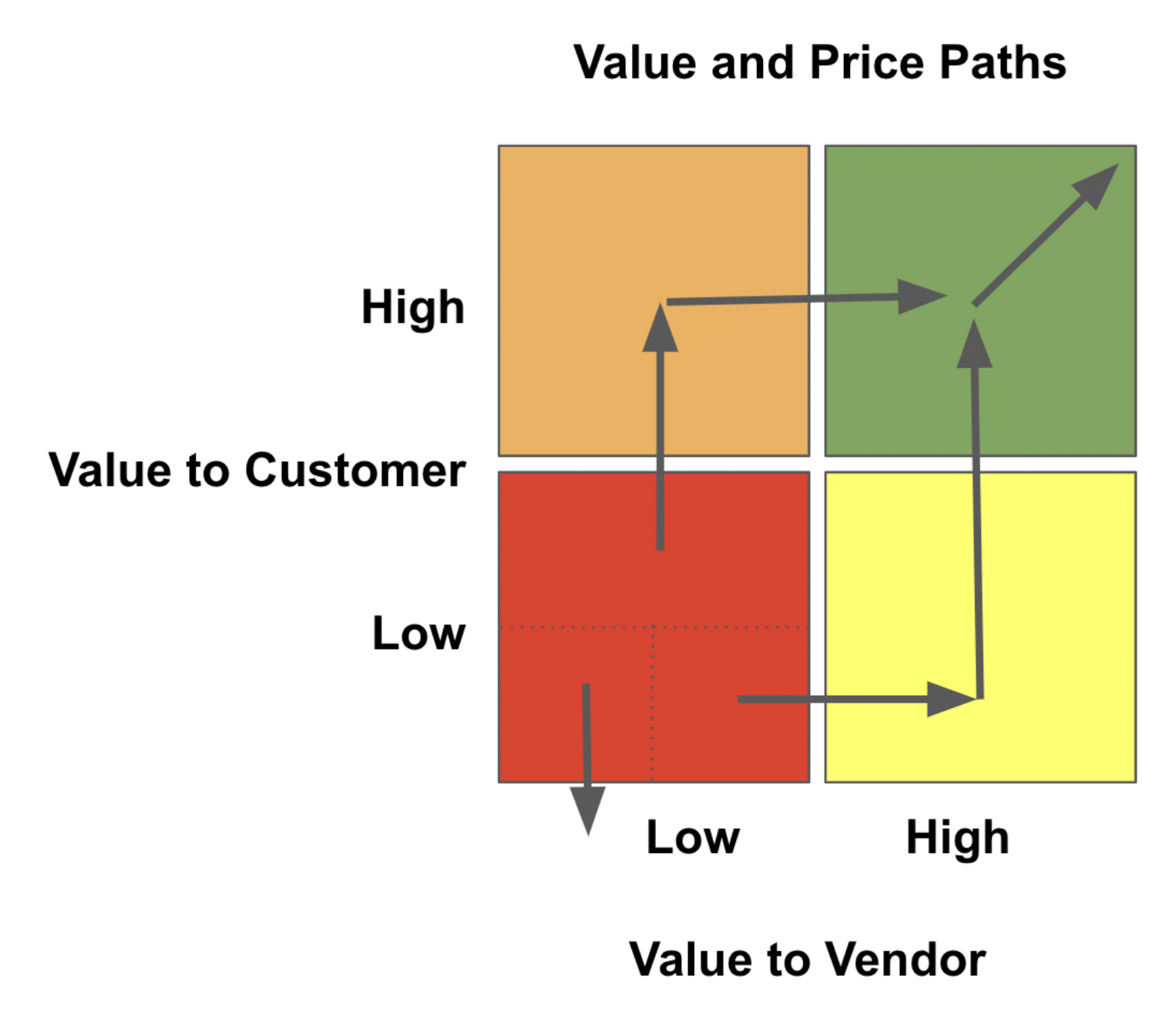

You have some customers for whom you provide relatively low value to customer (V2C) and who have a relatively low customer lifetime value. In many cases it is OK to lose these customers. They are a drag on your business. You are better off dropping the customers in the bottom left corner of the value and pricing paths map.

And even in the best of times there will some customer attrition. Customers will go out of business, some will merge, and a few will inevitably be lost to competitors. There is not much you can do about any of these things.

But that does not mean you should passively accept churn. It saps the vitality out of a subscription business. It is hard to make SaaS economics work with annual churn of more than 5%. And SaaS companies with annual churn of more than 10% may run out of people to sell to.

So how to manage churn?

The first step is to look at the reasons for churn, and segment your customers by why they are churning or are at risk of churn.

There are both extrinsic and intrinsic reasons for churn and you need to look at both.

Extrinsic factors (beyond your control)

Business conditions at your customers leading to

Headcount reductions

Lower level of business activity

Mergers that reduce and concentrate your customer base

Business conditions at your customers’ customers driving their own business performance

The pendulum has swung away from best of breed to comprehensive platforms

We covered this in more detail in NDR growth tactics 4: Avoid Package Shrinkage.

Intrinsic factors (that you can control)

The factors you can control turn on value delivery and value documentation.

Not enough value is being delivered

Poor customer fit

Poor onboarding

Poor customer support

Customers not completing value paths (CX or customer experience issues)

Value is not being documented (you are delivering value but not documenting that you delivered it)

Focus is on things like customer satisfaction (CSAT) or net promoter score (NPS) and not on the actual economic value being delivered

Value promises made by sales were not documented or followed up on

Value paths are not connecting

Customers are completing individual value paths, but are not able to stitch them together to complete larger and more impactful value delivery

There are integrations with third party apps that are not supported or have not been implemented (most solutions are part of a larger ecology) - integrations also tend to make solutions sticky and reduce churn

Packaging and pricing tactics to reduce churn

Let’s start with what not to do. DO NOT OFFER RETENTION DISCOUNTS.

Many SaaS companies respond to the threat of churn by offering a discount. This is a worst practice, or anti-pattern. Why?

It almost never works - most customers that receive a retention discount end up churning later on

It devalues your offer - buyers who receive discounts believe that the original price was too high and that your offer is not as valuable as you claimed

Word will get out - no matter how hard you try to keep retention discounts private, people in your market will hear about them, and expect the discounts too

So what should you do?

Your response will depend on your analysis of Value to Customer and Lifetime Value of a Customer. Let’s look at each of the four segments.

High V2C and High LTV

These companies should not be churning at all. If they are at risk of churm because of intrinsic factors you have a value communication and documentation problem. The best way to fix this is by acting early to document value and make sure that is communicated. Do this

in the application

in billing statements

in scheduled reviews (monthly or quarterly, not annually)

through periodic reports and alerts

High V2C and Low LTV

These customers are not likely to churn as they are getting a lot of value for what they are paying. You do have a pricing problem. Your pricing is not connected to value and you need to find a better way to make that connection. Consider adding a usage metric (one that is associated with value) to increase LTV.

Low V2C and High LTV

This segment is at risk of churning and you really need to keep them. Here you may need to change what you are offering. Below we describe this below giving two tactics.

Offer value enhancers

Offer a retention package

Low V2C and Low LTV

This customer segment needs to be further segmented.

Customers where you can enhance value, if you can enhance value, do that first

Customers that have a higher willingness to pay (WTP), increase prices

Customers where you cannot add more value and who have a low WTP, consider raising prices and letting these churn out, they are likely slowing down your growth

Use value enhancers to prevent churn

Rather than offering a retention discount, consider offering customers at risk of churn a value enhancer. There are several possibilities here.

Offer a package upgrade at the current price

Offer an additional value path (not always possible where value paths are deeply embedded in packages, try to engineer value paths first and then put them into packages)

Offer additional integrations at no cost

Offer a data package

Offer a professional services package

Offer a retention package to prevent churn

You may not be able to create value enhancers, or there may be some customers where it is not a value issue but a price issue. For these customers you may need to design an offer retention package. This is a special purpose package that has less value than your current entry package and that you can offer at a lower price without devaluing your other packages. Retention packages need to have the following properties.

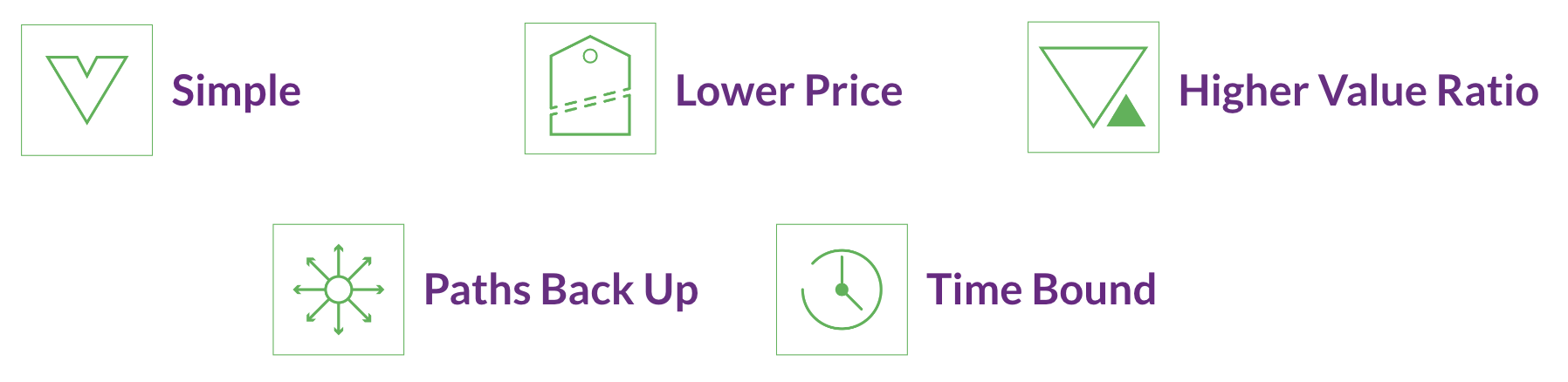

Simple - The retention package should be simple enough to offer with the equivalent of Product Led Growth. It should support just one value path (but it needs to support a complete value path). If you have different segments and use cases with different value paths you may need more than one retention package.

Lower Price - The price needs to be meaningfully lower than your lowest priced package. 30-50 percent lower.

Higher Value Ratio - The value ratio should be higher. If your strategy is to have a 20% value ratio for your entry package consider a 10% value ratio for your retention package.

Value Ratio (long term): Lifetime Customer Value / Value to Customer

Value Ratio (short term): Price / Value to Customer (for one subscription period)

Paths Back Up - You don’t want people stuck long term in the retention package, so make sure that paths back up are built into the package and into your customer success approach.

Time Bound - The retention package should only be offered for a short period. Generally one quarter or one year. Whatever you need to deliver and document value and pull people back in.

Conclusion

Managing churn is as important as bringing in new customers. The SaaS business model depends on it. If your annual churn is more than 5% this needs to be your top priority.

In the final post in this eight part series on NDR we will provide a decision tree on how to prioritize the different levers.

Download the NDR Report here

Read other posts on Net Dollar Retention

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

NDR Growth Tactics 6: Managing Churn (this post)

Net Revenue Retention (NDR) impacts the value of your company