How pricing can help fix NDR challenges

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

In the current economic climate many investors are moving from a focus on topline recurring revenue growth to a greater focus on Net Dollar Retention (or the more neutral Net Revenue Retention). A recent poll by Ibbaka asked “Which metric will most impact your company’s valuation in 2023?” If we had asked that question two years ago the answer would have been recurring revenue. Over the past nine months we sensed a sea change, so the below results are not a surprise.

We posted this poll in several places, but the general consensus was that Net Revenue Retention is where investors are focussing. There were other metrics mentioned in the comments, of course, the most common being Gross Profit, Rule of Forty (Growth + Profit > 40) and Net Cashflow.

Why the change from recurring revenue growth to net revenue retention? Fear. Inflation leading to higher interest rates, leading to a recession has left many concerned that SaaS growth will slow, that it will become more expensive to acquire new customers (CAC or customer acquisition costs will go up), and that the key to success is to grow within the current customer base. Growing revenues within the current customer base is also strong evidence that a solution is valuable and that the company providing the solution is resilient.

Ibbaka works closely with a number of private equity and venture capital firms to use the pricing lever to increase the value of their portfolio. We asked a number of these companies what NDR/NRR percentage they expect their portfolio companies to achieve.

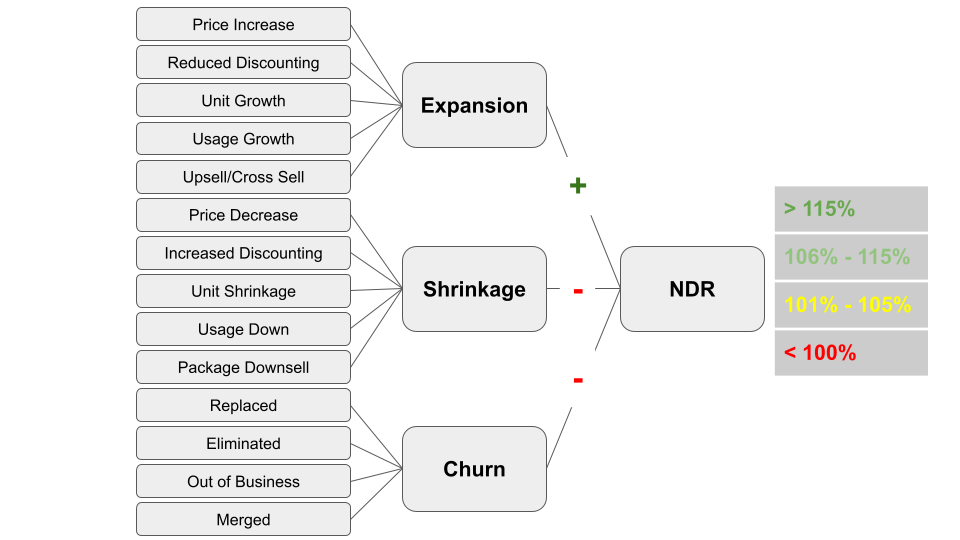

< 100% is a big red flag, and any follow on investment would require a plan to fix this

101% to 105% a caution, not strong enough to give confidence

106% to 115% good, not a concern, but not in itself an investment signal

> 115% a strong positive signal, a company achieving this is probably ready for additional investment

What are the levers for improving Net Dollar Retention (NDR)?

Net dollar retention is pretty simple on the surface. It is the year-to-year change in revenue from current customers. In other words, revenue form new customers is not counted. If NDR is 120% then a company can expect annual revenue growth of 20% even if it has no new sales.

Expansion is growth from price increases, adding units, or increasing use (if there is usage based pricing) less shrinkage from price cuts, discounting, loss of units or lower usage and churn.

The first thing to do when looking at your NDR/NRR is to build a simple model and see what is driving NRR for your business. A simplified model might look something like the following:

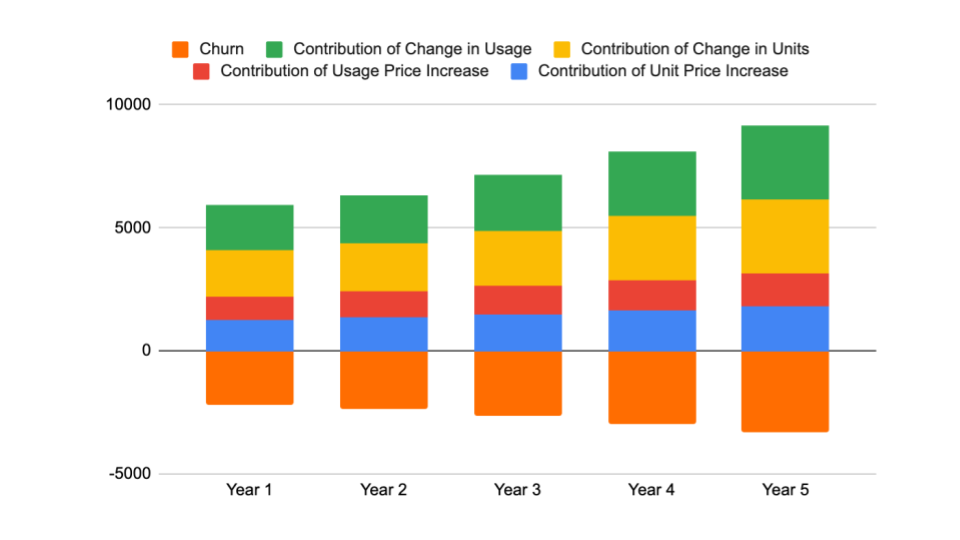

Which we can turn into a chart to show what is contributing to the changes in NDR.

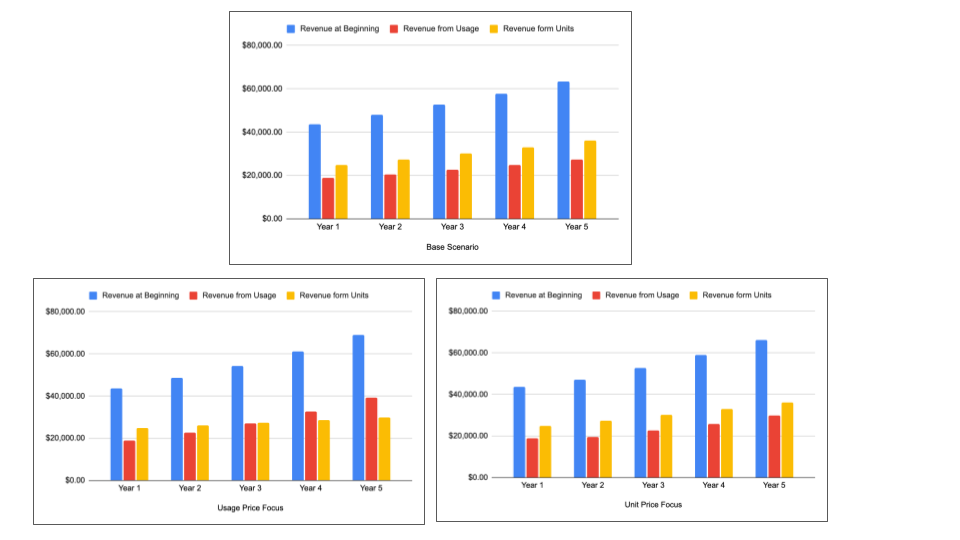

The above model is intentionally neutral. It assumes the same price increase and change for the number of units and the amount of usage. That is likely not a good tactical approach. In the real world, one will make a choice between a focus on usage and a focus on units. The pricing and packaging strategy will be optimized for increasing the number of pricing units or increasing usage. This will give quite different results over time.

In most businesses, there is some level of price elasticity. Volume changes with price, most often going down as price goes up (but not always). A more sophisticated model would take into account the impact of price changes on both units priced and usage. It is often worth while to accept some churn in return for higher prices.

Pricing and Net Dollar Retention (NDR)

To understand how pricing can be used to improve net dollar retention we need to dig a bit deeper and look at the inputs into Expansion, Shrinkage and Churn.

Let’s go through each of these one at a time and see how we can pull the pricing lever.

Pricing and NDR Expansion

Price Increase

The obvious way to increase NDR/NRR is to raise prices for existing clients. Easier said than done. There are often contractual commitments to consider, any price increase should be in line with increases in the value being delivered to customers and the impact of pricing on demand needs to be factored in. That said, price increases should always be on the table.

Ibbaka can provide you with a framework on how to increase prices for existing customers without driving up churn or alienating your customer base.

Reduced Discounting

Before one raises list prices it is important to get discounting under control. Raising prices when there is a lot of discounting is like pouring water into a sieve.

See Before taking pricing actions manage discounting.

Unit Growth

The other way to improve NDR/NRR is to sell more units. The unit is the unit of your basic pricing metric, this could be number of users, types of users, API connections, vehicles and so on. There is no end to the different possible pricing metrics. A good pricing metric tracks value.

Value Metric: The unit of consumption by which a user gets value.

Pricing Metric: The unit of consumption for which a buyer pays.

It is important to understand the relationship between price and volume within your current customers (internal price elasticity of demand). This can sometimes be estimated by looking at your internal financial and usage data. There is often room for a price increase that will not have much impact on internal demand, but this needs to be carefully tested.

Usage Growth

One of the best ways to improve NDR/NRR is to introduce some for of usage-based pricing. This does not mean completely replacing your current pricing metric, but rather adding in a usage pricing metric to give yourself more flexibility in responding to buyer needs.

It is fair that buyers pay more as they make more use of, and get more value from, your platform. Usage based pricing is one of the best ways to do this.

See Executing on usage based pricing and Usage based pricing is a complement and not a substitute.

The common order of operations when using the pricing lever to improve NDR/NRR is as follows.

Moving to hybrid pricing models

In our Pricing Transformations in 2023 post Kyle Poyar from OpenView Venture Partners had this to say.

We see the rise of pricing complexity (hybrid pricing) with companies supporting multiple go-to-market motions, monetization streams, and pricing models (Kyle Poyar)

The most common form of hybrid pricing is to combine

A platform fee

A unit fee

A usage fee

Having all 3 of these pricing levers available makes it much easier to optimize for NDR/NRR. It is not always the place to start, that would be better management of discounting, and it can take some time to implement, but the introduction of hybrid pricing is the best ways for most companies to drive improvement.

Download the NDR Report here

Read other posts on Net Dollar Retention

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

How pricing can help fix NDR challenges (this post)

Net Revenue Retention (NDR) impacts the value of your company