Pricing and NRR: The Six Factors to Manage

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

The PeakSpan/Ibbaka survey results on Net Revenue Retention | State of the Industry - High Performers VS The Rest are now available to download.

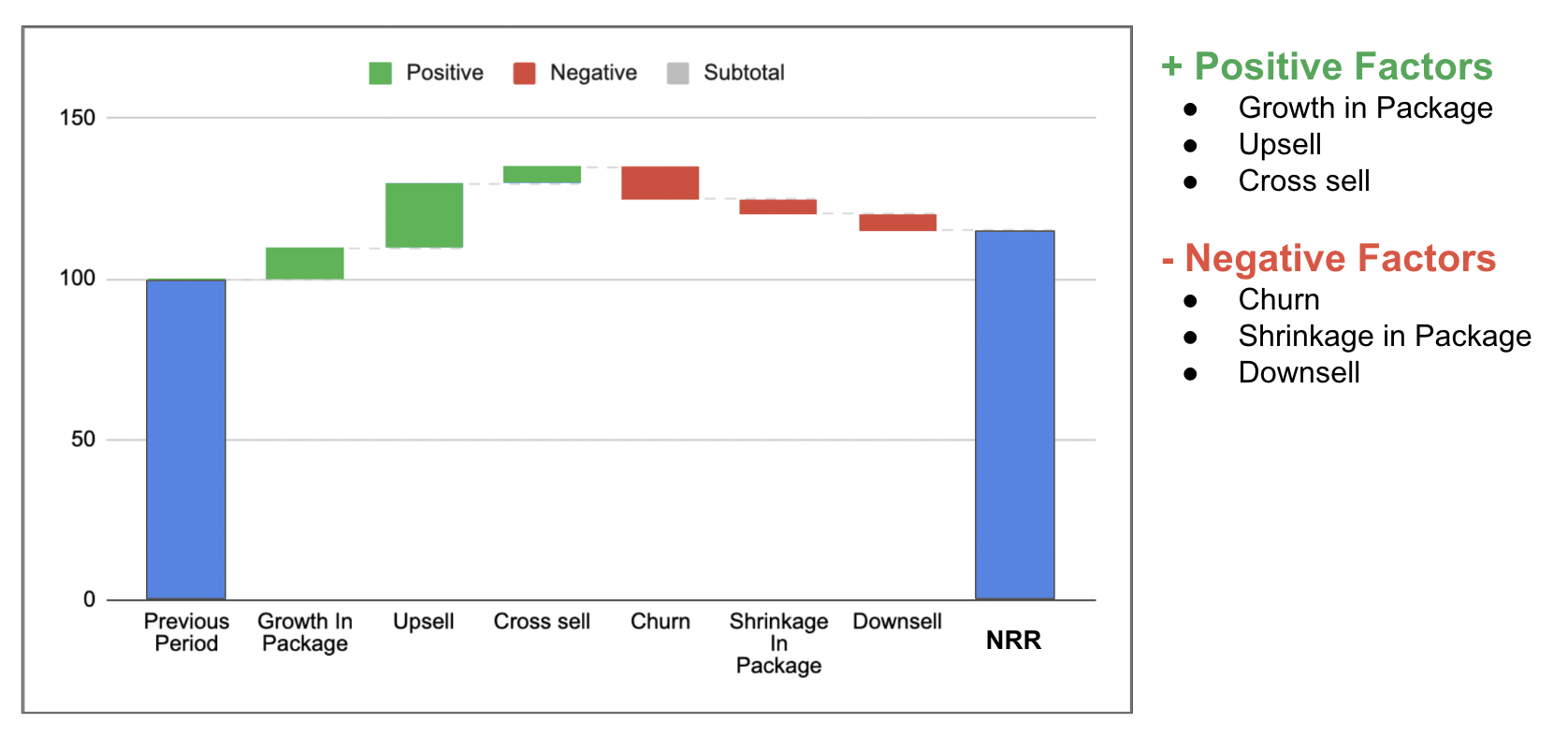

One of the unique things about this survey is that we asked about each of the six NRR factors and got insights into some typical NRR patterns. Understanding the NRR factors and where you should be focussed is one key to exceptional NRR performance.

The 6 NRR factors

What are the six NRR factors you are wondering? They are the six parts of your business that add up to the overall NRR Number. There are three positive factors and three negative factors.

Positive Factors

Grow in Package

Ideally, as adoption of your solution increases and your customers grow you will get more revenue from customers that have bought one of your existing packages.

This is most likely to happen if you have some form of usage metric or performance metric, and your customer success team is driving growing use and better outcomes for the customer.Upsell

Upsell occurs when one has a tiered packaging architecture (Good Better Best for example) and there are upsell paths from less expensive to more expensive packages.Cross sell

Companies using the independent modules package architecture (where one can buy modules independently) or a platform with extensions architecture (where there is a common platform that must be used and a number of optional modules) can win significant revenue expansion from cross sell.

Negative Factors

Shrink in Package

If one has a pricing design that allows for growth in package it is often possible for shrinkage as well. A number of companies have seen this happening in 2023 as usage tapers off or companies look for ways to reduce the number of users.Downsell

The counter to upsell, people moving to more expensive packages is downsell, people going from Best to Better or Better to Good. This can be discouraged with good packaging and pricing design, but it cannot be prevented altogether.Churn

Churn is the real drag on NRR. If churn is above 90% it is very difficult to have a high NRR.

NRR factor prioritization

Companies prioritize these factors differently. In examining the survey data we found different patterns and relationships between the pattern and performance.

The highest performing companies (about 10% of the total), those with NRR projected at more than 130, are highly focussed on the three positive growth levers. These companies have already solved for churn and designed packaging and pricing to optimize NRR performance.

Increasing upsell is the top priority for these companies, implying that they have upsell paths built into their product architecture.

Companies with high NRR performance (almost 30% of the total), are also focussed on upsell and growth in package, but also aspire to improve retention (reduce churn).

The largest number of companies (more than 40%) have reducing churn as their number one priority, followed by acting on the three positive factors.

There are companies with other patterns, some focussed on reducing shrinkage in package more than reducing churn, others where growth in package is more important than increasing upsell, but none of these other orders represented more than 5% of the total and there were no strong correlations with NRR performance.

NRR factor scenarios

Companies can have the same NRR number but get there in different ways. How one gets to the the NRR number has a big impact on tactics. Two companies could have identical NRR numbers but need to do take very different actions.

Here are three companies all with neutral NRR. This is the simplest case, these companies use the one big module packaging pattern and have no upsell or cross sell potential. The only way to counter churn is with growth in package.

One of these has significant chrun (7%) but is able to make up for this with good growth in package (10%) and relatively low shrinkage in package (3%) - it is important to note that companies with usage metrics or other ways to grow in package are also exposed to shrinkage in package and it is important to look at both factors. Ask why are some companies growing and others shrinking? What are the difference between these companies. Will measure taken to increase in package growth also lead to more in package shrinkage?

The second company, also with neutral NRR, is more of a middle of the road scenario. Churn is 3%, in package growth 5% and shrinkage 2% (so net in package growth is 3% and NRR is neutral at 100%).

The third company has enviably low churn of 3% that it balances with in package growth of 3%.

Each of these companies should consider different tactics to improve NRR.

Here are another three companies, all with NRR of 106% and churn of 7%.

Again, there are three different patterns and the actions needed are different.

Example one, high churn and high package growth, gets most of its lift from in package growth of 15%. There are some companies, like Snowflake, that are able to exceed this for prolonged periods. Even with shrinkage at some customers it has net in package growth of 13%. Churn chews up 7% of this leaving NRR at 106%. This company may want to look at introducing a GBB architecture or finding opportunities for cross sell.

Example two is more of a mixed bag with in package growth (+10% -2% for net +8%) and upsell (+3% -2% for net +1%) both contributing. Balance is good, but this company should pick either in package growth, upsell or cross sell and concentrate on tweaking packaging and pricing to get an improvement.

Example three is the inverse of example on. It has no growth in package (probably because it has no usage metric) and relies on upsell to drive NRR. In this case the introduction of a usage metric could have a big impact on NRR performance.

The lesson here is that NRR is a composite number and one needs to understand the contribution of each of the six NRR factors. Companies with the same NRR, and even the same churn, can have very different dynamics. Understanding your dynamics and then designing to improve them is the key to improving NRR performance.

Read other posts on Net Dollar Retention

Pricing and NRR: The 6 Factors to Manage (this post)

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

Net Revenue Retention (NDR) impacts the value of your company