Pricing and NRR: What are the key questions?

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

The PeakSpan/Ibbaka survey results on Net Revenue Retention | State of the Industry - High Performers VS The Rest are now available to download.

What are the key business questions that SaaS leaders should be asking about NRR? What are the critical benchmarks?

Here are the questions we answer in this report.

What are the expectations for Net Revenue Retention (NRR) in 2023?

What SaaS verticals will have the best NRR performance?

How does growth motion impact NRR performance?

What organization design delivers the best NRR performance?

How do pricing metrics impact NRR performance?

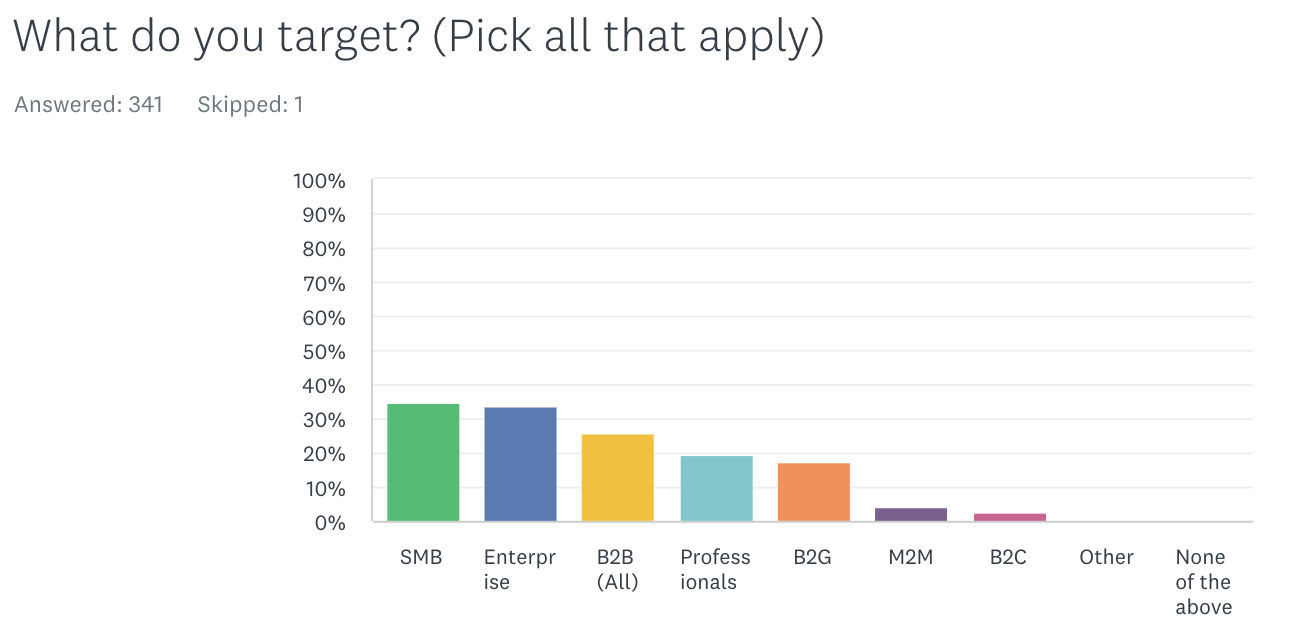

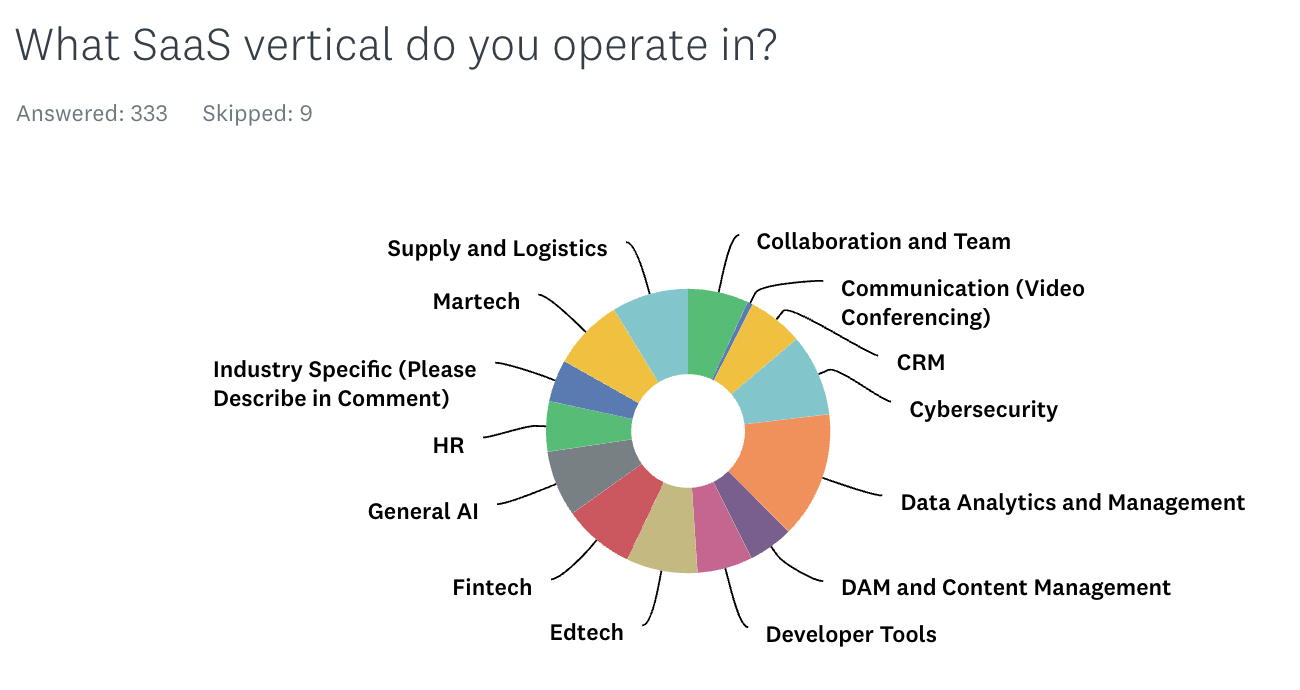

The report is the result of an in-depth survey of 341 SaaS companies in May and June of 2023. Companies from many different verticals participated, making it possible to track the divergence between different types of solutions.

One interesting thing to note is the emergence of an AI sector. These are companies providing AI services to other companies. An open question is whether this will cohere as a well defined vertical in its own right or be subsumed into specific applications or general computation providers. At this point, AI is seeing some unique pricing metrics specific to the structure of AI - tokens, models, calculations.

AI had the highest percent of companies expecting NRR of more than 130% in the current year and were among the most confident in their predictions. The other vertical doing well is Data Analytics, though in this case there is a more mixed story with some companies doing very well and others lagging.

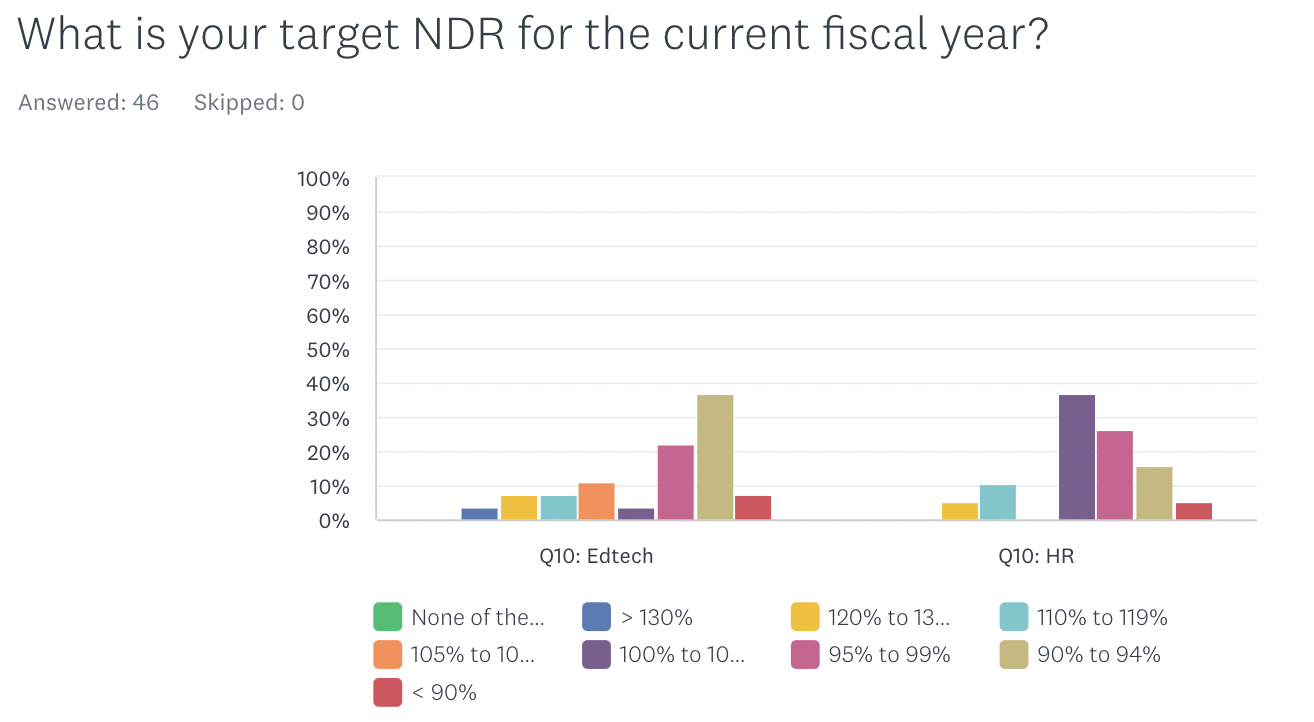

Another encouraging finding is that even in the most stressed verticals there are companies that are higher performers. According to this survey, EdTech and HR are the most stressed sectors when it comes to NRR performance.

Three EdTech companies and one HR company made it into the top performer group (NRR > 120).

Another important insight is that companies with two or more pricing metrics, that is to say hybrid pricing, outperformed companies with just one pricing metric. This is in part because the most common pricing metric remains User Based Pricing, but even companies using other types of metrics performed better when they had two or three pricing metrics.

Ibbaka uses insights from this survey in its work with its customers. This data helps with ideas on how to design packaging and what combinations of pricing metrics contribute to NRR. It can also help with organizational design. The companies with a dedicated team focused on NRR had the highest NRR performance. Those that relied on sales had the poorest performance.

This is just the tip of the iceberg. Next week we will be sharing the full report.

Read other posts on Net Dollar Retention

Pricing and NRR: What are the key questions? (this post)

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

Net Revenue Retention (NDR) impacts the value of your company