Agent strategies at Revenue Intelligence Platforms

Steven Forth is CEO of Ibbaka. Connect on LinkedIn

Back in 2024, before the shift to the agent economy began in earnest, Revenue Intelligence Platforms were one of the hottest categories in B2B SaaS. Virtually all sales teams were adopting software like Gong, Clari, and Salesloft to make sales activities more effective.

A lot has changed since 2024. We are living in a different world, where generative AI, vibe coding, and agents have fused to rewrite how we develop, consume, and price functionality.

How are agents transforming Revenue Intelligence Platforms, and how are these agents being priced?

This is the third in a series of reports on agent strategies in different software categories.

The reports to date are:

TL:DR

All major Revenue Intelligence Platforms (Gong, Clari, Salesloft, People.ai, Revenue.io, Clozd) now embed generative AI agents for conversation analysis, forecasting, deal management, and automation.

Four pricing models: all-inclusive (Gong, Revenue.io), premium add-ons (Clari), enterprise bundles (Salesloft, People.ai), and service-integrated (Clozd).

No standalone agents—all tied to main platforms, unlike Intercom’s Fin.ai.

Pricing transparency is low, except for Revenue.io and partially Clari—likely to change as buyers demand clearer ROI.

Disruptors like Oliv.ai offer modular, cross-platform agents with transparent tiered pricing, even discounts for Gong users.

Future success will hinge on pricing clarity, interoperability, and delivering measurable value—not just AI sophistication.

Revenue Intelligence is the AI-driven process of capturing and analyzing all customer interactions across channels to generate real-time, actionable insights for sales and revenue teams. It provides data-backed analysis of the entire sales process to improve forecasting, performance, and revenue outcomes.

So what are the agent strategies of the leading companies in this category?

We will look at the following companies:

Note that Clari and Salesloft have announced a merger (August 7, 2025)

Let us know if there are other companies you would like to see added to this analysis.

Agent strategies by Revenue Intelligence Companies

There are some common themes across all of these companies.

Every company offers some form of conversational AI interface

All companies provide AI-powered analysis of sales conversations

There is universal adoption of predictive analytics and trend analysis

Other common agents are:

Deal management agents

Pipeline management agents

Email automation agents

Content generation agents

Workflow orchestration agents

Here is the big picture.

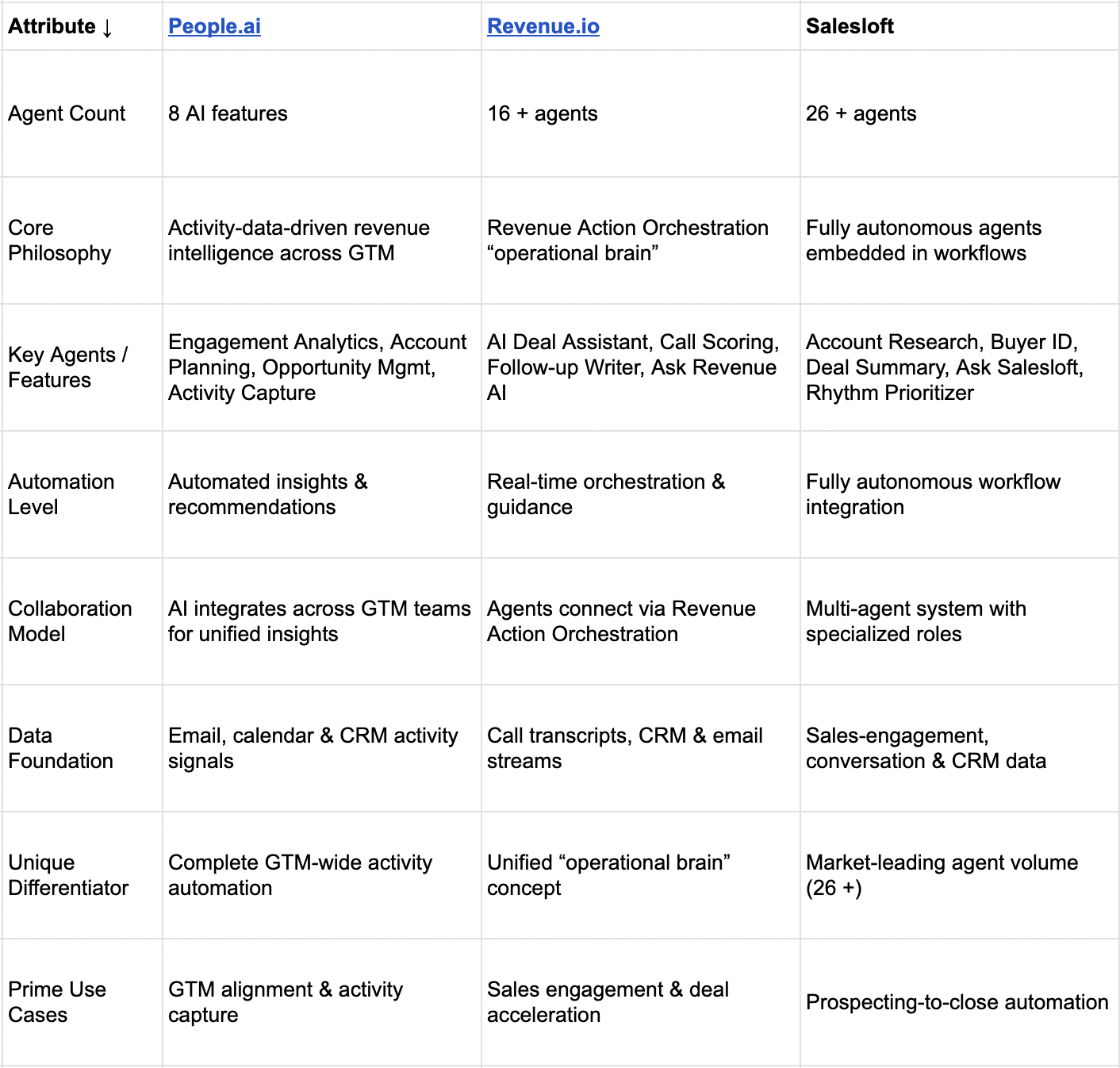

Agent specific attributes of revenue intelligence platforms, 1 of 2, Ibbaka, August 9, 2025.

Agent specific attributes of revenue intelligence platforms, 2 of 2, Ibbaka, August 9, 2025.

Looking at the core capabilities of the different companies shows the differentiation a bit more clearly.

Core capabilities of revenue intelligence platforms, Ibbaka August 9, 2025.

Here is how the companies differ across functional categories.

Agent functionality of revenue intelligence platforms, Ibbaka August 9, 2025.

Agent pricing by the revenue intelligence companies

These companies sell agents as add-ons to their core applications. None of them is offering standalone agents. Contrast this with what Intercom is doing with Fin.ai, which is bundled into standard plans or can be purchased as a standalone agent and used with other customer support platforms.

Imagine the stir it would cause if Gong offered an agent that could be used with Clari!

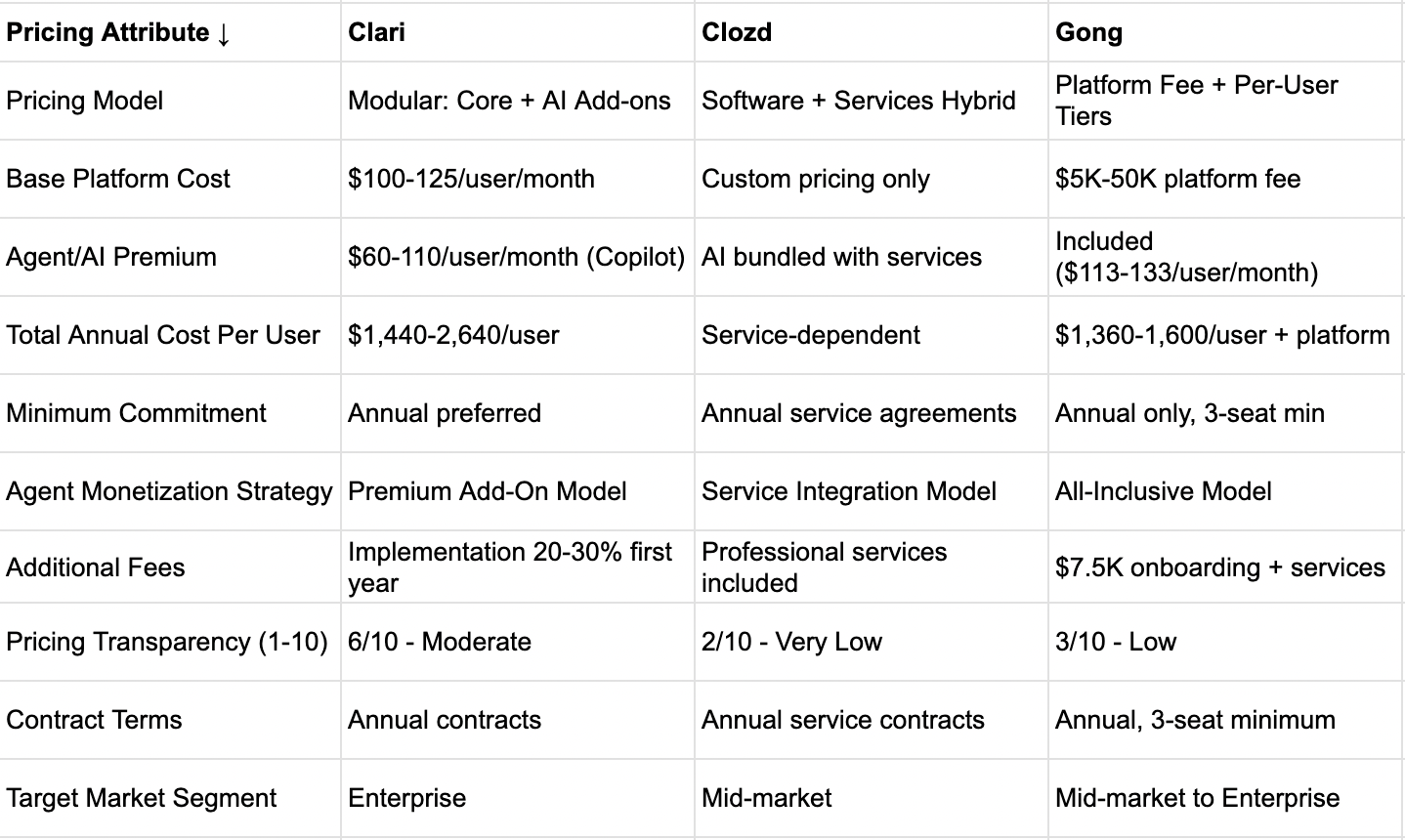

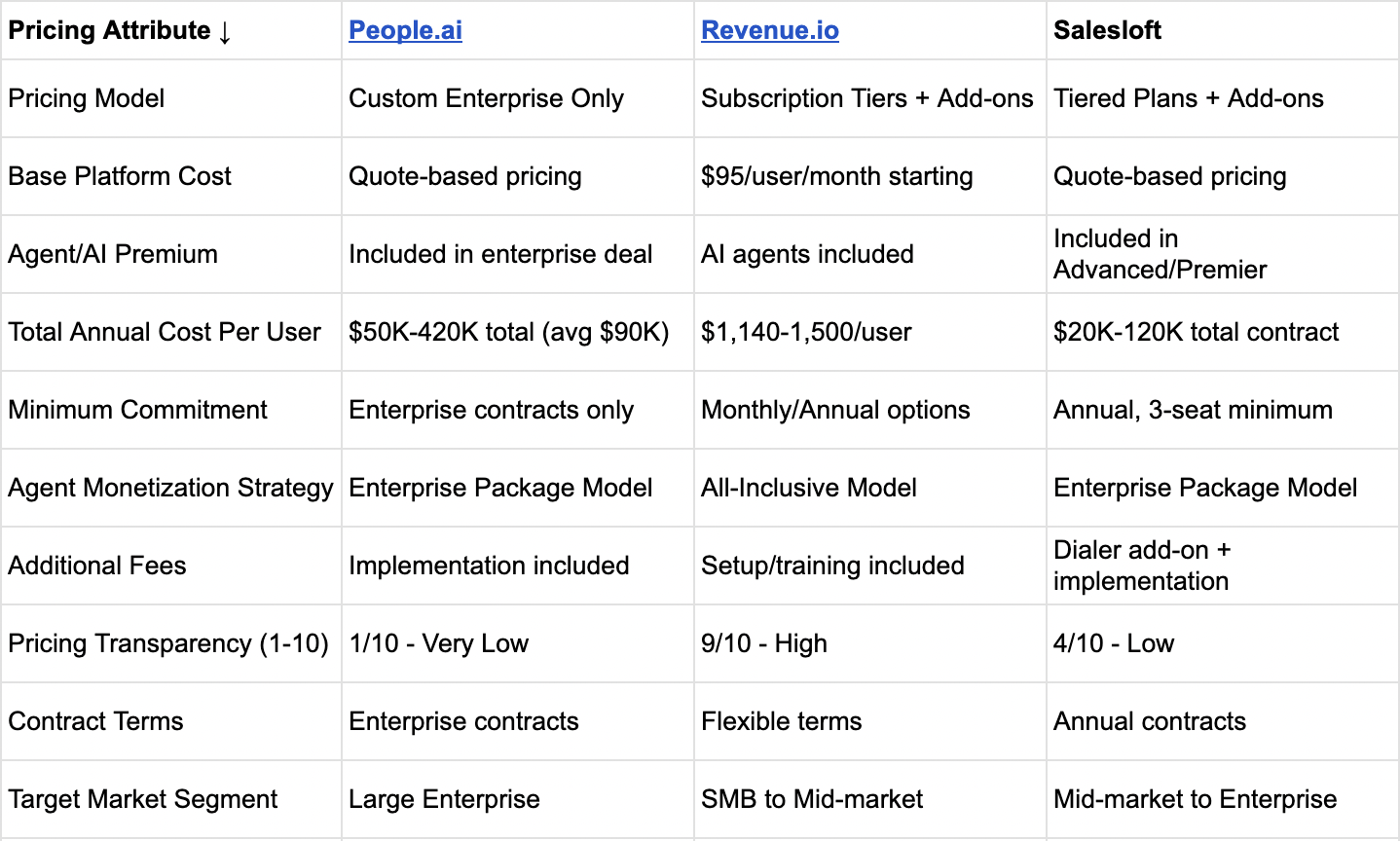

Agent pricing by revenue intelligence platforms, 1 of 2, Ibbaka August 9, 2025

Agent pricing by revenue intelligence platforms, 2 of 2 Ibbaka August 9, 2025

There are four general patterns apparent (these are also seen in other categories).

All-Inclusive Subscription (Revenue.io, Gong)

Philosophy: AI agents included in base subscription without premium

Approach: Single price point covers all agent capabilities

Advantage: Simplified procurement and no upselling friction

Premium Add-On Model (Clari)

Philosophy: Separate pricing for AI agent capabilities as add-on modules

Approach: Core platform + Copilot premium for Revenue Context™ agents

Advantage: Allows graduated adoption and premium positioning

Enterprise Package Model (Salesloft, People.ai)

Philosophy: Agents bundled in enterprise plans without separate pricing

Approach: All-inclusive enterprise deals with agents as included value

Advantage: Reduces pricing complexity for large deployments

Service Integration Model (Clozd)

Philosophy: AI features integrated with professional service delivery

Approach: Human-AI hybrid model with service-based pricing

Advantage: Combines technology with expertise for specialized use cases

There is a general lack of pricing transparency (with the exception of Revenue.io and, to some extent, Clari). This is surprising as these solutions are in a sales-adjacent space. CRMs such as Hubspot, Salesforce, Microsoft Dynamics, and Zoho score high on pricing transparency. Lack of pricing transparency makes it hard to estimate value. This may have worked in the past, but as we move into a world of buying AIs, more pricing transparency will be expected.

By making agents dependent on the underlying application and its data, these companies are opening an opportunity for disruptive agent-first companies. This is already beginning to happen.

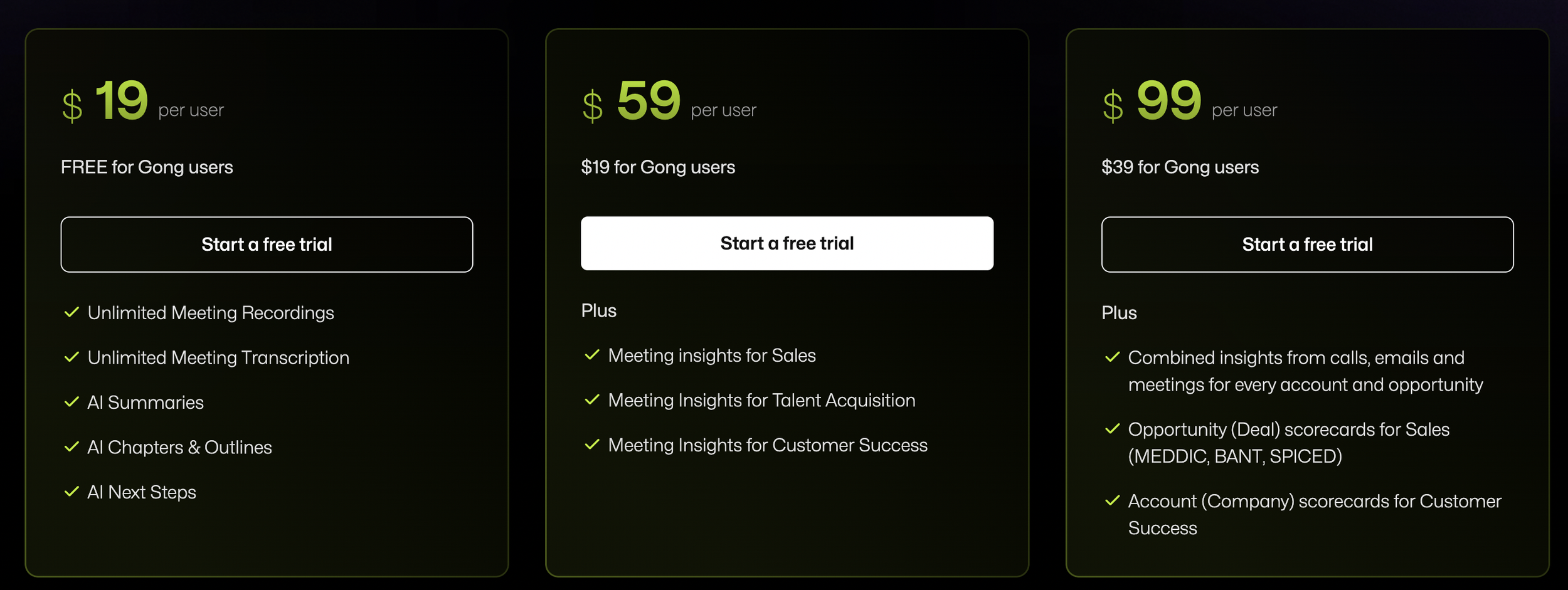

Oliv.ai is an agent-first approach

“Get AI agents powered by accurate & unbiased deal intelligence. Oliv analyzes every deal in-depth, and the AI agents take care of the work for you so you can focus on strategy and closing deals.”

Oliv is a direct threat to the established vendors. It has a clear value proposition and has tiered its agents so that the ‘intelligence’ builds across tiers.

Oliv.ai pricing page accessed August 9, 2025.

The basic tier is pretty basic; hard to see what this is doing that I could not do with one of the standard applications.

Even the middle tier does not do a good job of explaining the value of the ‘plus.’

Again, this will have to compete against some pretty sophisticated assistants like ChatGPT, powered by GPT-5.

The top plan, at $99 per user per month(only $39 for Gong users), does offer functionality that goes well beyond what can easily be done with ChatGPT (I have tried to configure these sorts of prompt systems in ChatGPT and Perplexity).

Some other observations.

The discount for Gong users is interesting. It appears to be an attempt to lure Gong users over to Oliv. It is meant to answer the objection, “We have already invested in Gong.” From a value perspective, it could be said to represent the additional value that Oliv delivers beyond what Gong can provide. Will other agent vendors adopt this strategy? It will be worth watching to see if this becomes common among agent disruptors.

The pricing curve is linear. This generally means that not much thought has been put into it. It is OK as a starting point, but expect this to change over time. Watch to see if it becomes concave (a pricing curve is convex when the middle tier is priced higher than what one would get from a linear approach, if the middle tier here was priced at $69, the pricing curve would be convex).

Conclusions

The agent economy is reshaping the Revenue Intelligence Platform landscape at an accelerating pace. While established players like Gong, Clari, and Salesloft are embedding agents as add-ons or enterprise bundle features, their strategies remain largely tethered to their core applications and data ecosystems. This creates both a comfort zone for their existing customers and an opening for agile, agent-first disruptors like Oliv.ai to challenge the status quo with modular, cross-platform tools and transparent pricing.

As agents mature, pricing transparency and interoperability will become decisive factors in adoption. Buyers—whether human or AI-driven—will increasingly demand clear value propositions, measurable ROI, and the freedom to integrate best-of-breed agents across platforms. The companies that thrive will be those that evolve beyond locking agents into proprietary environments, embrace data portability, and experiment with new pricing models that better reflect agent-driven outcomes.

The winners in this new environment will not be defined solely by who has the most advanced AI capabilities, but by who can package, price, and position agents in ways that deliver tangible, demonstrable value across the customer’s entire revenue ecosystem.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com