Agent strategies in the learning space (LMS, LCMS, LXP, Microlearning)

Steven Forth is CEO of Ibbaka. Connect on LinkedIn

The emergence of AI has introduced a lot of uncertainty in the workforce and led to a lot of companies to emphasize the need to learn new skills and for people to be able to work with AI. One recent issue is the need for people to become ‘managers of agents.’ See, for example, Tom Tunguz June post, The Rise of the Agent Manager.

Learning technology is the software category used to manage organizational learning and includes the LMS (Learning Management System), LCMS (Learning Content Management System, LRS (Learning Record Store), LXP (Learning Experience Platform as well as microlearning. AI agents that integrate learning and performance are beginning to appear, with Khanmigo from the Khan Academy being an early example.

How are agents being adopted and priced in the learning technology space?

This is the fourth in a series of reports on agent strategies and pricing in different software categories.

The reports to date are:

TL:DR

Generative AI agents are changing the learning tech sector (LMS, LCMS, LXP, microlearning), with most companies using agents to complement existing features, while a few are beginning to introduce new or replacement functions.

Four core agent strategies are used:

Human-Augmentation (enhancing people, e.g., 360Learning, AbsorbLMS)

Automation-First (replacing admin functions, e.g., Docebo, D2L)

Innovation-Driven (new functionality, mainly smaller players like Disco, Yellow.ai)

Hybrid (blending all approaches, e.g., Cornerstone, Adobe).

Eight agent types are common: learning, chatbot/conversational, goal-based, reflex/model-based, utility, adaptive/personalization, HR/support, and assessment/feedback.

Agent pricing is shifting from basic per-user models to:

Bundled (included with subscription)

Tiered (basic/advanced AI in different plans)

Premium add-on (extra cost)

Usage/outcome-based (pay per activity or result)

AI features are raising prices (by 30–50%), with buyers responding by reducing seat counts and being selective in what functionality they pay for.

The industry is moving toward value-based and flexible models (per role, per usage, per outcome), with the future favoring platforms that create measurable, customer-aligned value through their AI agents.

Who to cover?

The learning space is crowded and historically has been the locus of a lot of innovation. There is a salad of acronyms: LMS (Learning Management System), LCMS (Learning Content Management System, LRS (Learning Record Store), LXP (Learning Experience Platform). And that is only the tip of the iceberg. There is also microlearning, personalized learning, learning recommendation systems, virtual labs, and on and on. And all of these solutions are starting to use AI. For a general study of the adoption of generative AI in learning technology, see the July 2025 Fosway Report AI Insights 2025: Learning Systems.

This research is focused on how different companies are introducing AI agents to their solutions and on the agent-first companies that are threatening to disrupt them. We focus on the following companies:

We also look at the following agents:

This is a rapidly changing space, so by the time you read this, there will be new alternatives.

Agents at Established Companies

Let’s explore the agent strategies of the established learning companies.

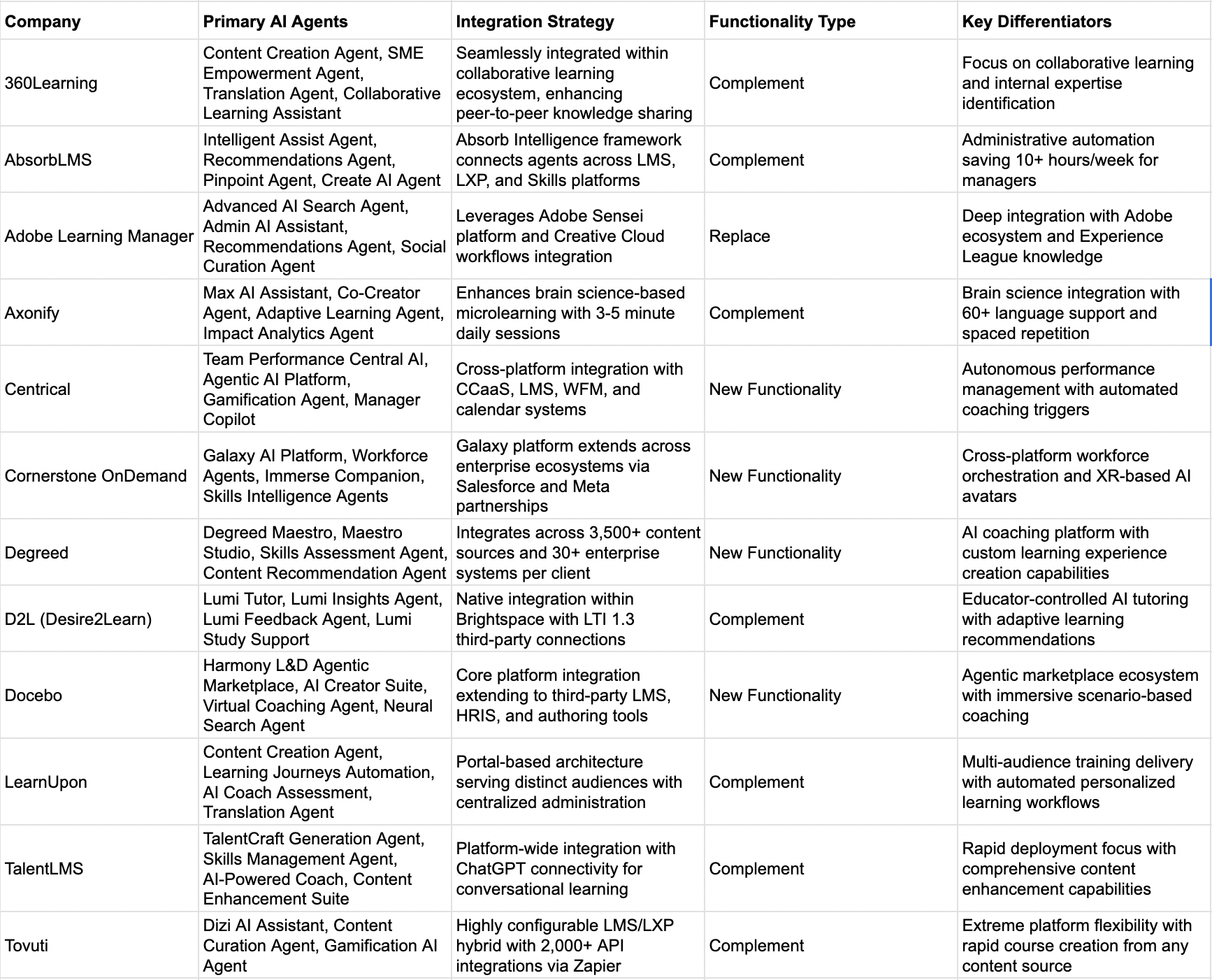

The following table summarizes agent strategies at different learning technology companies.

Agent strategies at learning technology companies (LMS, LCMS, LXP, microlearning). Ibbaka research, August 16, 2025.

The dominant approach is to complement existing functionality, seven out of 12 or almost 60% (360Learning, AbsorbLMS, Axonify, D2L, LearnUpon, TalentLMS and Tovuti). Four companies, 33%, are using agents to introduce new functionality (Centrical, Cornerstone, Degreed and Docebo). Only one company, Adobe, is replacing current functionality with agents.

A prediction, when we redo this research again in 12 months, the majority of companies will be using agents to introduce net new functionality, and at least a quarter of companies will be retiring current functionality to replace it with agents.

Let’s see if there are patterns to be found in this collection of agents.

Design patterns for learning technology agents

We found eight types of agents being deployed across these twelve companies.

Learning Agents: Adapt and improve through user interaction and feedback, personalize learning paths, and optimize engagement.

Conversational/Chatbot Agents: Provide virtual assistance, answer queries, and facilitate support (like Docebo AI agent chat, Cognigy Copilot).

Goal-Based Agents: Make decisions and select actions to achieve specific learning or workflow outcomes.

Reflex and Model-Based Reflex Agents: Respond to set triggers or monitor learner activity, often seen in tool automation and reminders (e.g., D2L Brightspace Intelligent Agents).

Utility-Based Agents: Evaluate different available learning options and select ones that maximize user or organizational goals.

Adaptive/Personalization Agents: Automatically curate and surface content, recommend courses, and personalize the experience based on user needs (widely used in learning platforms).

Employee/HR-Oriented Agents: Assist with onboarding, scheduling, compliance, and skill tracking.

Assessment & Feedback Agents: Analyze learner performance, identify knowledge gaps, and provide feedback or nudge interventions.

Types of agents at different learning technology companies, 1 of 2. Ibbaka research, August 15, 2025.

Types of agents at different learning technology companies, 2 of 2. Ibbaka research, August 15, 2025.

The next step will be to combine different types of agents into systems that help people to learn and organizations to manage the learning, skills, and capabilities of their employees.

Agent strategies in the learning technology space

There are four distinct strategies apparent in the learning technology space.

Human-Augmentation Strategy companies prioritize employee experience and trust-building, following human-centered AI principles that emphasize augmentation over automation.

Automation-First Strategy companies focus on immediate ROI through operational efficiency, targeting high-volume, rule-based processes for automation.

Innovation-Driven Strategy companies bet on emerging technologies to create differentiated offerings and capture new market segments

Hybrid Strategy companies recognize that different organizational contexts require different AI approaches, offering flexibility and customization

The following tables show how each company is leveraging these strategies.

Agent adoption strategies in the learning technology space. 1 of 2. Ibbaka research August 15, 2025

Agent adoption strategies in the learning technology space. 1 of 2. Ibbaka research August 15, 2025

The established vendors are gravitating to either Human Augmentation (360Learning, AbrobLMS, LearnUpon, TalentCards) or Automation (Docebo, D2L, Brightspace, Cognify). Innovation is being driven by smaller companies like (Disco , Yellow.ai). The largest vendors, like Cornerstone OnDemand are taking a hybrid approach.

How agents are being priced in the learning technology space

It is not enough to develop new agents. One needs to understand how they create value and who they create value for and then come up with a price.

How are these agents being priced?

Agent pricing strategies by learning technology companies. 1 of 2. Ibbaka research, August 15, 2025

Agent pricing strategies by learning technology companies. 2 of 2. Ibbaka research, August 15, 2025

Agents and AI functionality are pushing prices up by 30 to 50% in the learning space. Vendors believe their new offers have significant value, and they have to capture development and, more importantly, compute costs. Buyers are not as convinced. They are responding by trying to reduce seat counts (and after all, AI is supposed to reduce the number of people in targeted business functions) and are being selective about when and how they invest in new functionality.

Most companies are bundling AI agents in with other functionality and keeping with the conventional per-seat pricing that dominates in this category. This makes some sense for learning apps. It is the individual who learns after all, and most HRIS (Human Resources Information Systems) applications use per-person (per employee) pricing. Is this enough, though, in an agent economy?

Ibbaka’s agent pricing layer cake considers four types of pricing metrics:

Role Layer: Job to be Done or Agent Type

Access Layer: Assured Access or Retainers

Usage Layer: How Often the Agent is Used

Outcome Layer: Results and Value Delivered

Per-user pricing on its own does not map well to this approach, but there are several paths forward.

Roles: In the near future, each role or each task in most organizations will have its own agent meant to support learning and performance. Pricing will likely be per agent type, and as the agents get personalized to each person, to the number of people x roles, with each person playing more than one role.

Usage: Outside of the learning technology space, many vendors are moving to some form of credit-based pricing. Learning technology has not yet seen the explosion in the number of agents being seen in other segments (there are no companies like Pricefx with its 125+ agents or McKinsey with its rumored 12,000+ agents). Credit-based pricing is one way to implement usage pricing, one that is much more flexible than more restrictive alternatives.

Outcomes: Learning agents are primed for outcome-based pricing. They often meet the three requirements of Alignment, Attribution, and Predictability. Expect to see several dozen learning agents with outcome-based pricing over the next twelve months.

Conclusions

The adoption of AI agents will reshape the learning technology sector and how it prices. Most companies still lean on agent-powered features to complement human abilities and improve existing workflows, though momentum is shifting toward the creation of entirely new functions—and, in some cases, the outright replacement of legacy processes. Meanwhile, experimentation is underway with diverse pricing models, with hybrid and usage-based pricing dominating.

The category is likely to see a move away from traditional per-seat pricing toward more nuanced approaches, including pricing tied to agent roles, usage intensity, and learning outcomes. As AI agent technologies mature and proliferate, value alignment and flexibility will become critical. Vendors must ensure their models deliver tangible results for buyers and adapt to evolving needs, while customers become more selective and cost-conscious about their investments. Credit-based pricing models are one way to achieve this flexibility. Ultimately, the future of agent-driven learning platforms will belong to those who can best align technological innovation with measurable value and clear customer demand.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com