Agent strategies in CRM (and the emergence of headless CRM)

Steven Forth is a principle at Ibbaka and valueIQ.ai. Connect on LinkedIn

Agents and agentic AI are eating away at most categories of B2B software. Ibbaka is researching the introduction of agents in different software categories and their impact on pricing. This is one of the key questions we are asking in this year’s NRR survey. Is the introduction of agents impacting NRR numbers?

For this report, we are focusing on the key category of Customer Relationship Management (CRM). Over the past two decades, CRM has emerged as one of the must-have applications that virtually all B2B SaaS companies have in one form or another. One trend we are noticing is the emergence of headless applications. These are applications that do not have a user interface, but instead provide a set of APIs and let users provide their own UX. This approach works well with agents and may disrupt the CRM space.

The reports to date are:

TL:DR

Agentic AI is rapidly transforming B2B SaaS, with autonomous agents now central in CRM and impacting pricing, adoption, and platform strategy.

"Headless CRM" is emerging, where core systems provide APIs and back-end logic, allowing users to build their own user interfaces, fueling faster agent and workflow innovation.

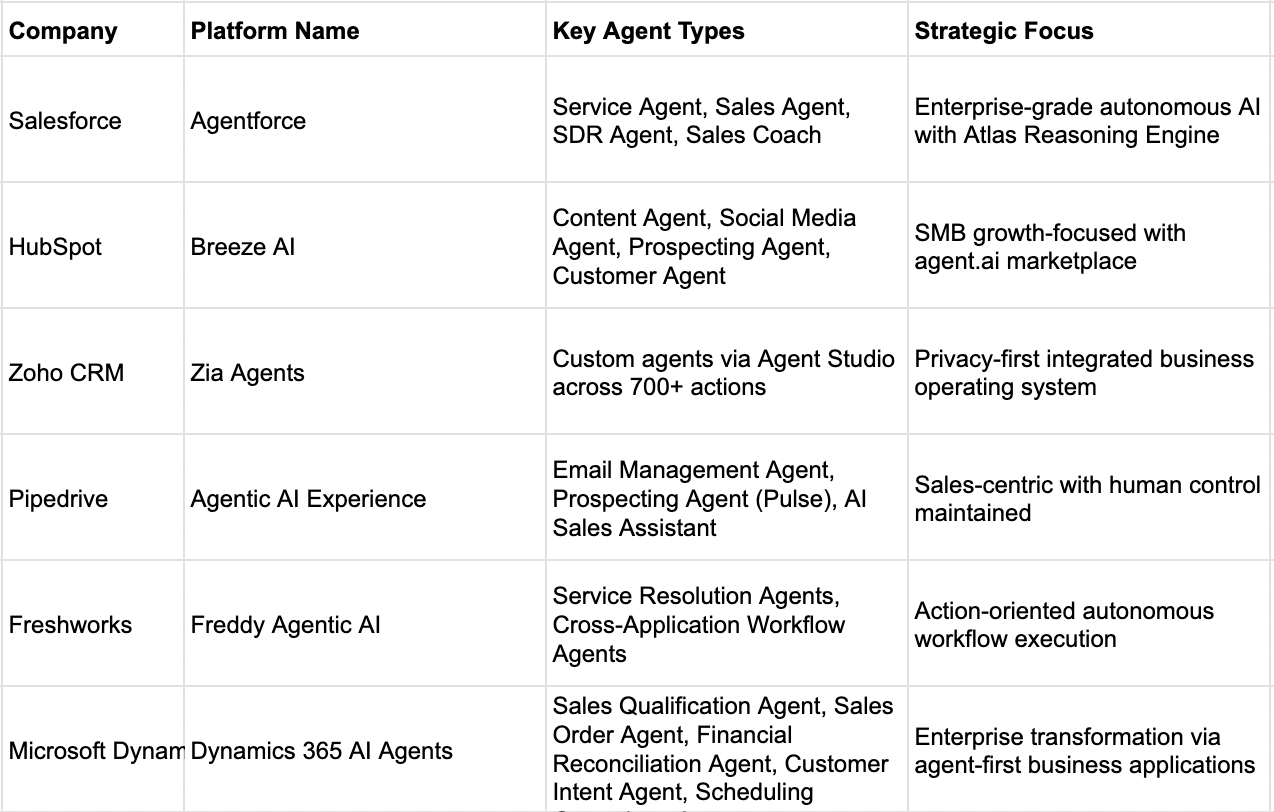

Major CRMs (Salesforce, HubSpot, Zoho, Pipedrive, Freshworks, Microsoft Dynamics) are introducing agentic capabilities via orchestration, workflow automation, and specialized agents like SDR and Sales Coach roles.

Strategic market focus divides into Enterprise governance/security (Salesforce, Microsoft), SMB rapid deployment (HubSpot, Pipedrive), and integrated suite approaches (Zoho, Freshworks).

Pricing models are shifting—large vendors increasingly use credit-based or usage-based pricing, embedded AI is included with subscription for some, while others pursue tiered or freemium pricing patterns.

Leading agent pricing examples:

Salesforce: multi-modal (subscription, action, or conversation-based) and Flex Credits

HubSpot: platform subscription + credit consumption

Zoho: embedded AI, no extra licensing fees

Others (e.g., Pipedrive, Freshworks, Microsoft): mix of subscription and platform-included AI

Headless CRM vendors like Directus, Strapi, Payload, and Sanity favor freemium strategies and usage metrics (API calls, storage, content entries) with dramatic tier jumps to drive upgrades.

Platform differentiation now hinges on agent sophistication, adoption friction, and transparent pricing instead of legacy user experiences.

Executives and pricing leaders must monitor agent adoption, pricing innovation, and headless CRM to maintain a competitive edge and maximize CLV (customer lifetime value).

CRMs covered in this research

In this research, we looked at the introduction of agents by the following major CRMs. CRM is a crowded space, so there are many other companies we could have included, but the major trends in agent adoption are apparent from these companies.

Salesforce Sales Cloud (and many supporting products)

The emergence of vibe coding applications like Lovable and Bolt has sparked a lot of interest in headless CRMs and CMS (Content Management Systems). These applications are often used with agents, so we include them here.

So, how are CRMs introducing agents?

Agents in the CRM world

Two of these companies are leading the agent economy: Salesforce and Microsoft. Let’s start with them.

Salesforce Agentforce

Salesforce has a strategic advantage compared to other CRM companies. Agentforce is a complete agentic AI platform with agent orchestration, data integration, and security as well a discrete agents. Key CRM agents include Agentforce SDR (Sales Development Representative) and Agentforce Sales Coach. These align with two common agent patterns: Role Replacement for the SDR agent and Role Coach for the sales coach.

Salesforce complements its sales agents with a suite of marketing agents and supports customers in developing their own agents.

Microsoft Dynamics CRM Agents

At Microsoft, the Sales Qualification Agent serves as an autonomous lead research and prioritization system. This agent has three modes: research, prioritization, and outreach. Microsoft also provides a sales chat agent that can interact directly with potential buyers and collect information while providing guidance.

Co-pilot for Sales takes the now-familiar co-pilot pattern and specializes it for sales coaching.

Like Salesforce, Microsoft also supports a complete agent ecology, with development tools, agent orchestration, data integration, and security.

Agents across CRMs

Each of the leading CRMs has its own strategy for adapting to the agent economy.

Ibbaka research on agent adoption in the CRM category, Part 1, October 6, 2025.

Ibbaka research on agent adoption in the CRM category, Part 2, October 6, 2025.

Market Segmentation: The table reveals three distinct strategic approaches:

Enterprise Focus: Salesforce and Microsoft prioritize comprehensive governance and security

SMB Optimization: HubSpot and Pipedrive emphasize ease of use and rapid deployment

Integrated Solutions: Zoho and Freshworks bridge markets with comprehensive business suite integration

Maturity Levels: Salesforce leads in customer adoption and revenue impact, while newer entrants like Pipedrive are just launching their agentic capabilities in 2025.

Differentiation Strategies: Each platform leverages core strengths - Salesforce's enterprise security, HubSpot's SMB focus, Zoho's privacy-first approach, Pipedrive's sales specialization, Freshworks' workflow automation, and Microsoft's ecosystem integration.

Agent Pricing Patterns IN CRM

The large vendors with diversified solutions, Microsoft, Salesforce, and Hubspot, are offering some version of credit-based pricing while the more focused vendors are embedding agents into their existing packages.

Ibbaka research on agent pricing in the CRM market, Part 1. October 6, 2025.

Ibbaka research on agent pricing in the CRM market, Part 2. October 6, 2025.

Three Strategic Approaches:

Premium Consumption (Salesforce, HubSpot): Usage-based pricing for enterprise sophistication

Integrated Value (Zoho, Microsoft): AI embedded in the platform costs to drive adoption

Accessible Subscription (Pipedrive): Traditional pricing with AI as a feature differentiator

Cost Predictability Spectrum:

Most Predictable: Zoho (no extra fees), Pipedrive (subscription-only), Microsoft (platform-included)

Moderately Predictable: Salesforce (flexible payment options)

Least Predictable: HubSpot (credit depletion), Freshworks (session-based scaling)

Market Positioning Through Price:

Enterprise Premium: Salesforce ($125+/user/month)

SMB Scaling: HubSpot ($800+/month platform minimum)

Budget Leader: Zoho ($10-32/user/month all-inclusive)

Sales Specialist: Pipedrive ($14-79/user/month)

Service ROI: Freshworks (complex but claims high ROI)

Ecosystem Lock-in: Microsoft (integrated platform pricing)

The pricing landscape reveals that organizations must balance cost predictability against advanced capabilities, with each platform targeting distinct market segments through its pricing philosophy.

Credit-Based Pricing of CRM Agents

The two dominant vendors, Salesforce and HubSpot, have some form of credit-based pricing, in line with the wider range of products and agents that they offer.

Salesforce - Flex Credits System

Primary Credit Model: 20 Flex Credits per AI agent action ($0.10 per action)

Credit Packages: 100,000 credits for $500

Credit Usage: Actions like email generation, lead scoring, and automated responses consume credits

Flexibility: Credits can be used across different Agentforce capabilities

HubSpot - HubSpot Credits

Credit Consumption: $0.01 per credit for AI actions

Usage Examples: Content generation, social media posts, email personalization

Billing Integration: Credits automatically deducted from account balance

Microsoft

At this time, Microsoft has separate credit-based pricing programs for its AI Copilot and AI Builder solutions. A limited number of AI credits are bundled into Microsoft 365 subscriptions.

Microsoft does not rely on credits in the ways that Salesforce and HubSpot do. Their goal is ecosystem lock-in rather than optimizing revenue from usage. AI functionality tends to be bundled as part of standard subscription bundles. Microsoft has the scale to execute on this strategy and absorb AI costs, at least for now. Microsoft Business Central users already have consumption-based billing through Azure meters rather than AI credits.

Headless CRM and Agents

One of the most interesting trends in 2025 is the emergence of headless applications. These apps have been percolating for several years, but the emergence of AI agents and vibe coding (applications like Lovable, Bolt, Cursor, v0, etc., that make it much easier and faster to build simple applications). CRM is one of the areas where this is most active, as there are now many agents available for the sales and adjacent functions (like revenue operations, account-based marketing, revenue intelligence, and so on).

The headless apps are not agents themselves so much as agent backends and enablers.

We looked at the pricing of four of the most popular headless applications in CRM: Directus, Strapi, Payload, and Sanity. One interesting thing to note is that these companies offer both on-prem and hosted options. Is this a sign that at least some companies want to take back control over their IT infrastructure?

This is also an area where open source approaches are getting traction. Once a function is well defined and standards begin to emerge, open source options tend to crop up. In mature categories, like CRM, companies have historically tried to differentiate using user experience. When this is no longer available, as with headless CRM, open source makes a lot of sense.

Ibbaka research on headless CRM pricing, Part 1. October 6, 2025.

Ibbaka research on headless CRM pricing, Part 2. October 6, 2025.

Key Pricing Patterns in the Headless CMS Market

Freemium as Market Entry Strategy

Most headless CMS platforms employ freemium models to reduce barriers to entry. Strapi offers a completely free cloud tier, Sanity provides 20 user seats at no cost, and Payload CMS maintains a free MIT-licensed self-hosted option. This approach supports a "land-and-expand" strategy where platforms capture developers early and monetize as projects scale.

Usage-Based Scaling Architecture

The dominant pattern involves pricing that scales with technical usage metrics rather than traditional business metrics. Common scaling factors include:

API call volumes: Sanity scales from 100K to 1M to 10M monthly API requests

Content entries: Directus limits range from 5K to 75K entries

Storage and bandwidth: Payload progresses from 3GB to 30GB database storage

This usage-based model aligns costs with actual platform utilization, making it attractive to both providers and customers.

Dramatic Tier Jumps Drive Decision Points

A consistent pattern across platforms is significant price increases between tiers—often 3-10x jumps. Examples include:

Payload CMS: $35 → $199 (5.7x increase)

Directus: $15 → $99 (6.6x increase)

Sanity: $99 → $949 (9.5x increase)

These dramatic jumps create clear decision points that force customers to carefully evaluate their needs and often drive upgrades to higher tiers.

Conclusions

The emergence of agentic AI and headless CRM in B2B SaaS signals a pivotal transition in the market, reshaping both platform capabilities and pricing strategies. Across the sector, SaaS and agentic AI executives face a landscape where platform differentiation increasingly stems from the sophistication of autonomous agents, ease of adoption, and pricing transparency.

As credit-based pricing and AI-embedded subscriptions become the norm, selecting the right approach will be essential for sustaining customer lifetime value and competitive edge. Executives and pricing leaders should continue to monitor agent adoption patterns, pricing innovations, and the impact of headless architectures to remain agile and deliver scalable value in this rapidly evolving market.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com.