Five objections to credit based pricing and how to manage them

Steven Forth is a principle at Ibbaka and valueIQ.ai. Connect on LinkedIn

Credit-based pricing is attracting a lot of attention in 2025. Major players like Microsoft, Salesforce and Hubspot have joined companies Snowflake, Databricks, Amazon Web Services in including credit-based pricing, especially for AI based functionality. Virtually all of the popular vibe coding apps (Lovable, Bolt, v), Cursor) use some form of credit based pricing.

On October 16 Ibbaka will host a webinar with one of the most knowledgeable people in the field, Brandon Hickie, Senior Director of Monetization at LinkedIn and a venture partner at Companyon Ventures. Brandon and Steven will cover key questions on the the why and how of credit-based pricing.

TL;DR (Too Long; Didn’t Read Summary)

Here are the five most common objections to credit-based pricing for B2B SaaS, business AI and AI agents.

1. Credit-Based Pricing is Too Complex

Objection: Complexity arises from rules around credits (rollover, transfer, recognition) as well as cost and system implementation issues.

Response: Use AI, automation, and transparent dashboards to explain, predict, and track credits. Promote transparency in all communications and sales materials to simplify perceived complexity.

2. Lack of Predictability

Objection: Both buyers and vendors find it difficult to forecast costs and revenue within credit-based models, impacting budgeting and valuation.

Response: Pre-purchase credit packages, clear volume discounts, and predictive analytics enhance predictability. Regularly share usage forecasts with customers, using automated tools for granular predictions.

3. Buyer Unfamiliarity

Objection: Buyers—especially in sales—are unfamiliar with this pricing model, risking confusion and friction in adoption.

Response: Invest in onboarding, buyer education, interactive demos, and self-explaining dashboards. Enable sales to articulate the model's mechanics and value easily; consider guided tools or agents for exploring pricing in real time.

4. Revenue Recognition Challenges

Objection: Finance and revops teams worry credit mechanics complicate booking, invoicing, collection, and recognition; credit rollover or non-expiry can confuse accounting.

Response: Clearly define the credit lifecycle (booked, invoiced, collected, recognized), credit expiration, and rollover rules. Align all policies with accounting standards and configure CRM, billing, and finance systems accordingly.

5. Credits Are Just Disguised Cost-Based Pricing

Objection: Some fear credit-based models simply mask cost-plus mechanics, undermining value-based pricing principles.

Response: Design credits to reflect units of customer value—not just internal costs—using value estimation for key actions. Assign credit costs by use case, offer hybrid pricing, and build packages for actual user needs.

Credit-based pricing, when managed with transparency, analytics, education, and value orientation, offers strong potential for scalable growth and trust in B2B SaaS and AI businesses

Not everyone supports credit-based pricing. Ibabka reached out to its community to see what the most common objections are and to see if and how these can be addressed.

We talked to people in sales, revops, product, CFOs and pricing experts to get a picture of the main objections to credit-based pricing models. The five most common objections were as follows.

Credit-based pricing is just too complex

There is not enough predictability, for the buyer and for the vendor

Buyers are not familiar with this pricing model and don’t understand it

It causes problems with revenue recognition

It is just disguised cost-based pricing

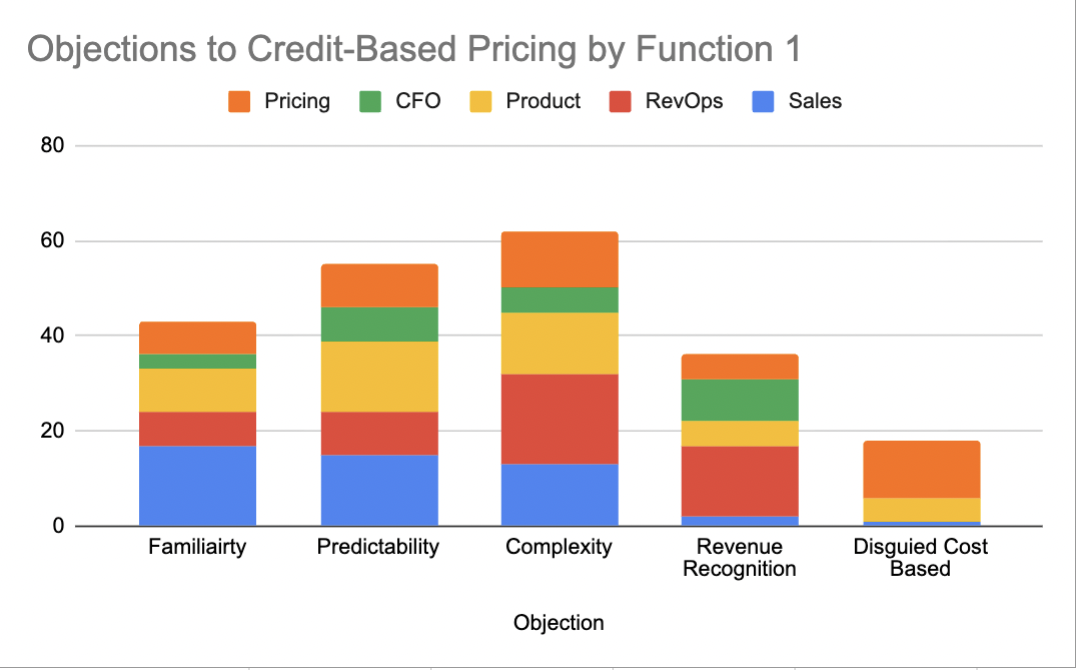

Ibbaka research on objections to credit-based pricing, from interviews conducted October 1 to 8.

Ibbaka research on objections to credit-based pricing, from interviews conducted October 1 to 8.

The top objections by function are …

Sales: Familiarity, Predictability, Complexity

Revops: Complexity, Revenue Recognition, Predictability

Product: Predictability, Complexity, Familiarity

CFO: Revenue Recognition, Predictability, Complexity

Pricing: Complexity, Disguided Cost Based, Predicability

Let’s work through each of these objections.

Credit-based pricing is just too complex

Credits, rollover rules, transfer of credits, implications for revenue recognition, tracking, prediction ….. it is all just too much.

There is a cost to implementing in the product, billing and financial system.

Complexity is the root of most other objections, from familiarity and predictability to revenue recognition.

Managing Complexity

AI is the cause of a lot of this complexity, but it is also the solution. These days one can quickly vibe code a credit-based pricing app that manages, explains and predicts credit usage and the implications for the price to be paid.

Adopting credit-based pricing also implies adopting new tools to manage

Transparency is a solvent that can dissolve complexity. To win acceptance credit pricing models need to be transparent. We find things complex when they are opaque and unpredictable.

John Maeda’s laws of simplicity are applicable here.

John Maeda’s Ten Laws of Simplicity. From

There is not enough predictability, for the buyer and for the vendor

After complexity, predictability is seen as the biggest challenge to credit-pricing models.

Predictability is important to both buyer and seller. Buyers need to be able to budget how much they will need to pay in any given period, and future periods. They also need to be able to connect price to value in a predictable manner.

The seller, vendor, also cares about having predictable revenue. Companies that can’t predict revenue get lower valuations, and can find it more difficult to manage cashflow.

There is a perception that credit-based pricing, as a form of usage-based pricing, is less predictable than other forms of pricing.

This does not have to be true.

Making credits predictable

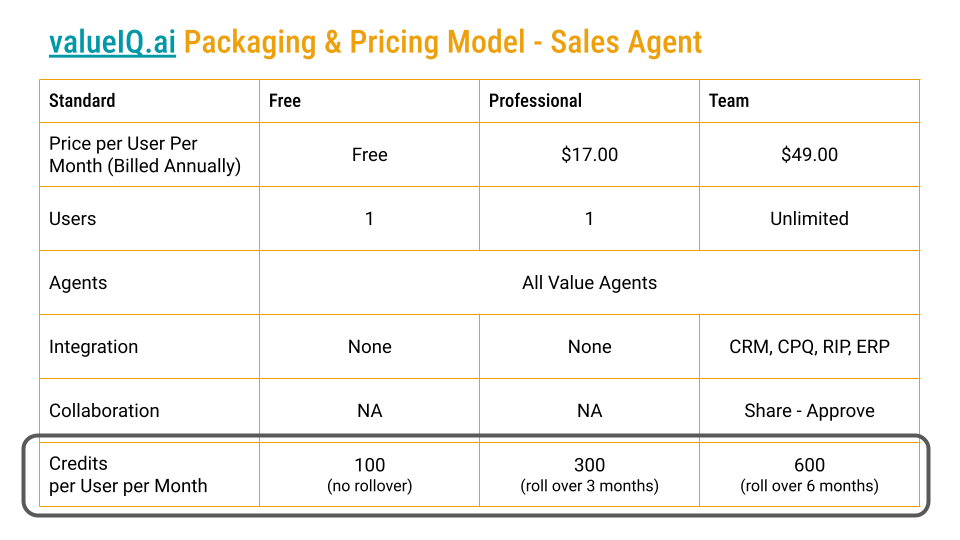

In most credit-based pricing models the buyer purchases a bucket of tokens in advance and does not pay for credits as consumed. There is generally some level of volume discount for buying tokens and in many cases different packages come with a standard number of credits. For example, valueIQ.ai provides more additional credits as one moves from Free - 100 Credits, Professional - 300 Credits, Team 600 Credits per User. For valueIQ, credit rollover also becomes more generous as one moves up tier.

valueIQ.ai pricing model for sales agent

Companies adopting credit-based pricing should also consider implementing predictive analytics. After a few months your prediction model should. be able to provide granular predictions for each customer. In the name of transparency, you can share those predictions with the user.

It is now easy to build a prediction model for credit consumption using a vibe coding app.

Buyers are not familiar with this pricing model and don’t understand it

Sales were most concerned that buyers be familiar with the pricing model so that they would not get bogged down in trying to explain it.

This objection is likely to melt away as more and more large vendors adopt some form of credit-based pricing.

Still, companies that want to introduce credit-based billing should also plan to invest in helping buyers understand pricing and value.

Market education on credit based pricing

The pricing model (credit-based or not) should be able to answer questions about itself and how well price tracks value. In the near future pricing models will include agents that can explain and explore the model with a user.

It causes problems with revenue recognition

Finance, and to a lesser extent revenue operations or revops, are concerned about the implications of credits for revenue recognition. Some basic definitions:

Booked - the buyer has committed in a binding way

Invoiced - an invoice has been issues

Collected - the invoice has been paid

Recognized - the service or deliverable has been provided and there is not forward commitment

All four of these need to be clearly defined in a credit-pricing model.

A credit that has not been consumed cannot be recognized.

A credit that rolls over into the future and does not expire may never be recognized, which is a big problem for revenue recognition.

Managing revenue recognition

When designing a credit-based pricing model define exactly how Booking, Invoicing, Collection and Recognition will work. This then needs to be implemented in CRM, Billing and Finance systems.

Credits must be used or expire. They can roll over for some fixed peiod of time but cannot rollover and then rollover and then rollover.

Credits are just disguised cost-based pricing

“Most credit-based pricing is a fancy form of cost-plus pricing.”

This is mostly a concern for people in pricing roles, who are often working to introduce or expand value based pricing.

Two reasons credit-based pricing is gaining popularity are that

The foundation model companies charge using tokens

Compute costs are a growing as a percent of operating costs

This has led some people to (i) equate credit-based pricing with token pricing and (ii) to adopt credit based pricing as a way to connect price to costs.

So the concern is real, at least in terms of general practice.

This does not have to be the case though.

Value based credit systems

The best practice in the design of credit based pricing is to start with a value. model (a Tom Nagle style Economic Value Estimation). Then one needs to design credits so that each credit represents a roughly equivalent amount of value when used across different use cases. This will never be precise. It is always going to approximate and an estimate and that is OK.

Here is a simple eight step approach to designing a value-based credit pricing model.

Create a granular value model for different agent actions

Develop a cost model tracking token consumption per action

Find the lowest common denominator for the credit unit

Assign credit costs to all actions

Design packages for common use cases (include enough for 3+ attempts)

Enable additional credit purchases

Consider hybrid pricing combinations

Define policies for scaling, rollover, pooling, and change management

See A guide to the design of credit-based pricing for AI agents

Recommendations

Manage Complexity

Credit-based pricing introduces layers of complexity, such as rollover rules, revenue recognition, tracking, and prediction, which can be challenging for both internal teams and customers.

Use modern tools and automation, possibly with AI and predictive analytics, to simplify management, forecast usage, and make the user experience straightforward.

Emphasize transparency—explain how credits are earned, spent, and tracked in clear language across sales collateral, dashboards, and contracts.

Enhance Predictability

Predictability is crucial for both buyers budgeting for costs and vendors forecasting revenue.

Structure packages so that credits are purchased in advance, with clear rules about credits included per tier (e.g., 100 for Free, 300 for Professional, 600 for Team), and clarify any rollover or expiry policies.

Implement predictive analytics to offer both internal teams and customers granular forecasts of credit consumption for better decision-making.

Invest in Buyer Education

Many buyers are unfamiliar with credit-based billing, so provide detailed onboarding materials, interactive demos, and self-explanatory dashboards.

Enable sales teams to quickly articulate the value and mechanics of credits, and consider deploying agents or guided tools that help prospects and customers explore the pricing model.

Address Revenue Recognition and Compliance

Clearly define when booked, invoiced, collected, and recognized states occur in the credit cycle to avoid accounting confusion.

Design policies for credit expiration and rollover that comply with accounting standards, ensuring credits do not perpetually roll over, which can impede proper revenue recognition.

Build Value-Based Credit Systems

Avoid simply linking credits to internal costs (like compute or tokens); instead, design credits to represent units of customer value.

Use economic value estimation techniques for each key customer action, and assign credit costs accordingly.

Offer hybrid pricing options and design credit packages around common user needs, including enough credits for repeated usage and enabling simple top-ups as needed.

Conclusions

Credit-based pricing presents both opportunities and challenges for B2B SaaS and business AI organizations striving for scalable value delivery. Leaders in product, GTM, revops, finance, and pricing must prioritize transparency, predictability, and robust education to overcome complexity and drive buyer trust. Applying best practices—such as leveraging automation, clearly defining credit cycles, implementing predictive analytics, and anchoring credits to demonstrable customer value—will empower companies to turn objections into advantages and maximize the impact of this evolving pricing model.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com.