Agent strategies in billing and subscription software

Steven Forth is CEO of Ibbaka. Connect on LinkedIn

Agents Are Eating Billing: 5 Moves Redefining Subscription Software

The summer of 2025 has seen the introduction of 100s of new agents as the agent economy conjures itself into existence. Last week, we looked at the agents being introduced by pricing software vendors. This week, we look at the adjacent space of billing software.

Billing software is an important sector, as it was Zuora that introduced the concept and many of the best practices for the subscription economy. The subscription economy is now being overtaken by the agent economy. Subscriptions are part of the agent economy, but don’t define it.

Agent Economy: “A new economic system where AI-powered agents autonomously perform, negotiate, and execute tasks or transactions, often directly with one another, fundamentally changing how businesses and services operate.”

The current generation of business agents is mostly only partially agentic, with the degree of autonomy varying greatly, but design patterns are beginning to emerge, see 6 design patterns for agent applications.

This post is part of an ongoing survey of how agents are disrupting conventional software.

Given the importance of billing and subscription services to the agent economy (see Ibbaka’s report Value, Pricing and Billing for the Agent Economy, April 2025), a search for agents in the space may give some insights into trends.

TL:DR

1. Market Leaders Emerge Through Agent-First Strategies

Stripe Billing, Chargebee, LogiSense, and Paid are building comprehensive agent ecosystems with dedicated toolkits and infrastructure, while traditional players like Zuora and Recurly are merely adding AI features to existing platforms. This fundamental strategic difference is creating a new competitive hierarchy in the market.

2. Universal Capabilities with Distinct Differentiation

All nine vendors offer the same four core agent capabilities: automated billing processing, payment optimization, analytics/insights, and usage metering. However, differentiation comes through specialized focus areas - Stripe leads in agent infrastructure, Chargebee dominates developer ecosystems, LogiSense specializes in autonomous operations, and Paid pioneers AI-native billing.

3. Pricing Transparency Drives Competitive Advantage

Companies with clear, transparent pricing models (Chargebee, Maxio, Stripe) are gaining market share over those using traditional enterprise custom pricing. Usage-based and outcome-based pricing frameworks are becoming essential for AI agent economics, with companies like LogiSense and Paid pioneering dynamic pricing models.

4. Agent-to-Agent Commerce Represents the Next Frontier

Stripe Billing leads the industry with comprehensive agent-to-agent transaction capabilities, including virtual card processing for autonomous AI agents. This represents a fundamental shift from human-centric billing to fully autonomous commercial interactions between AI systems.

5. Industry Disruption is Accelerating

New AI-native entrants like Paid are building platforms specifically for the agent economy, while established players risk commoditization if they continue treating AI as a feature enhancement rather than a core transformation. The divide between agent-centric and traditional approaches is creating strategic vulnerability for companies slow to adapt.

Here’s the Field—And How They’re Playing

The 9 Billing and Subscription Management Vendors Considered

(Let us know if there is a vendor that should be added at info@ibbaka.com.)

We looked at the agent strategies of 9 of the leading billing and subscription management companies:

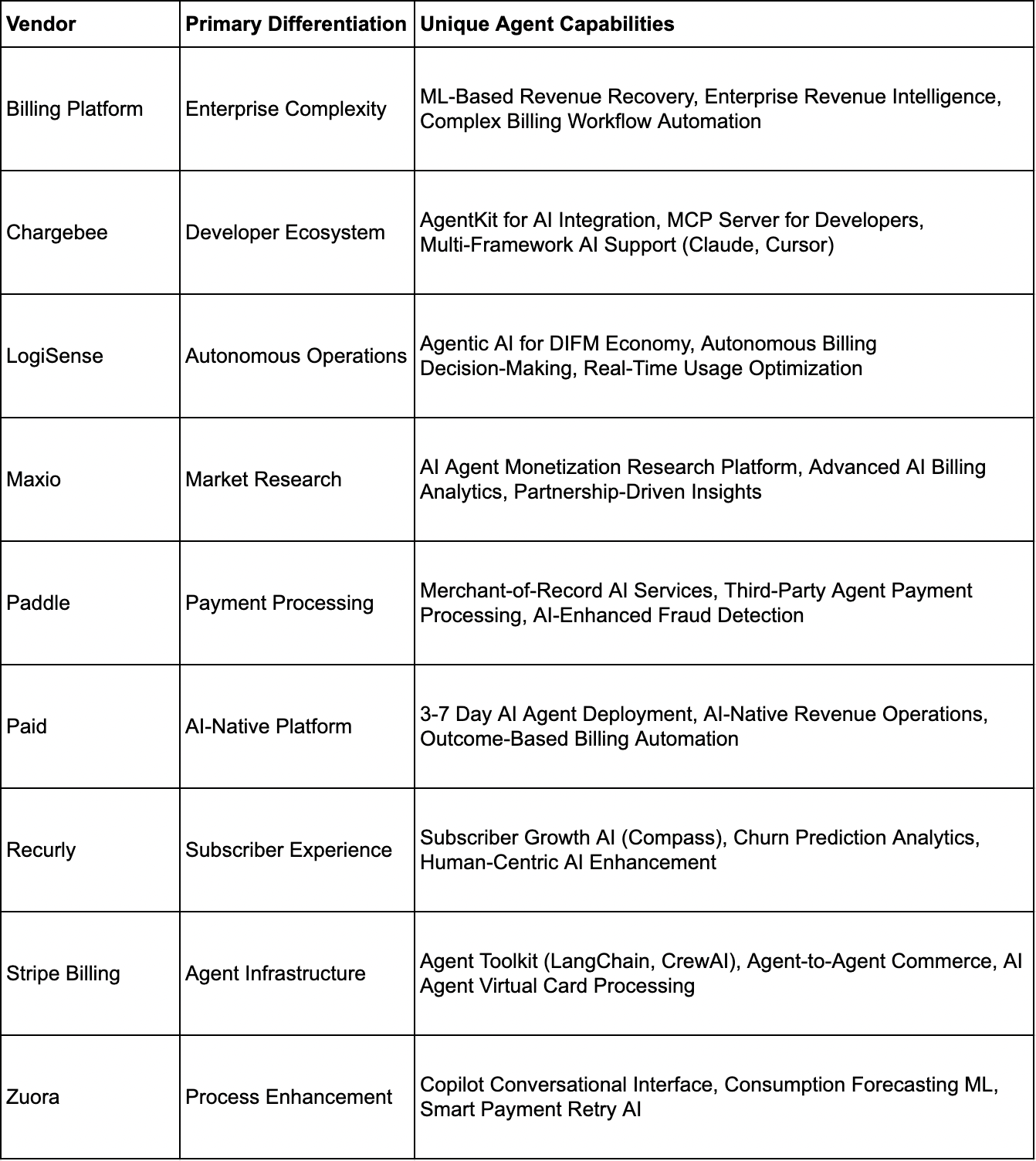

Agent Strategies of Billing and Subscription Management Companies

Agent strategies of Billing and Subscription Management Companies, August 3, 2025. From Ibbaka Research.

The billing and subscription management companies are approaching the agent economy in two ways:

By supporting the unique billing and pricing requirements for agents, including pricing for collections of agents

By enabling the creation of agents by their customers

This is quite different from the pricing software vendors, who have focused more on introducing their own agents (Pricefx has announced 125+ agents that its customers can adopt).

The exception is Paid, a new company that is focused directly on the agent space. Paid does have a billing agent.

This raises the question of how a Billing Agent might differ from the standard functionality expected from billing and subscription management companies.

Billing agent vs. standard functionality. Ibbaka August 3, 2025.

Agent differentiation of Billing and Subscription Management Companies

It can sometimes be difficult to differentiate the billing and subscription companies. They all do more or less the same thing. Agent strategy gives some insight into this.

Agent differentiation of Billing and Subscription Management Companies, August 3, 2025. From Ibbaka Research

Three Ways to Stand Out in Billing’s Agent Age

Giving customers the ability to create their own agents (Stripe Billing being a prime example)

Providing billing agents (where the disruptor Paid is leading)

Prediction (not new, but increasingly important, and the companies that do this will have a real advantage)

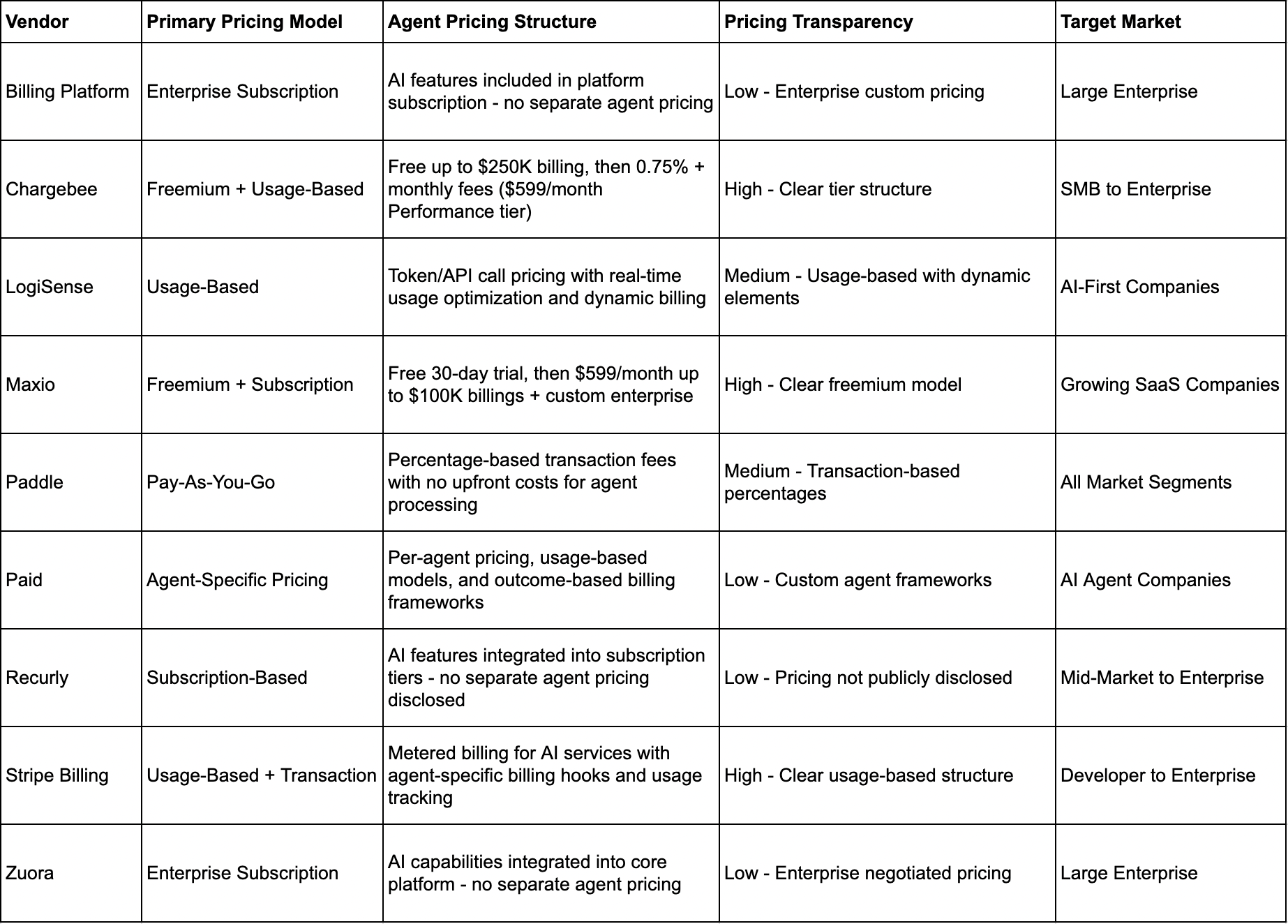

Agent Pricing: Still Catching Up

With the exception of Chargebee, Maxio, and Stripe Billing, this category does not do a good job of providing pricing transparency. That is understandable for someone like Paid, who is just getting started, but disappointing for other companies.

None of these companies is following the emerging best practice in agent pricing of using credit-based pricing, which gives buyers and sellers the flexibility they need to price collections of agents.

It is ironic that billing and subscription management companies, the key place where pricing is executed, have somewhat antiquated approaches to pricing themselves.

Agent pricing of Billing and Subscription Management Companies, August 3, 2025. From Ibbaka Research

Betting on the Next 12 Months

Billing and subscription management companies are taking many different approaches to AI agents. This is likely to change quickly over the next 12 months. Some predictions…

Each of the main vendors will announce 5 to 10 AI agents and move to join the agent economy

Stripe Billing’s agent building offer will give it a competitive edge as it will be able to see what agents its customers want to build with

Credit-based pricing of agents will emerge as companies experiment with different agents

Pricing will become more transparent as AIs play a larger role in the buying process (OK, that may be more of an aspiration than a prediction)

The Bottom Line

The agent economy is rewriting the competitive hierarchy in billing and subscription software. Agent-first strategies are creating new leaders; legacy “add-ons” are becoming strategic deadweight. Vendors who build for, price for, and empower agent-driven business models will own the future.

Navigating this new landscape? Want to benchmark your agent strategy?

📩 info@ibbaka.com—the inbox is open.

Buckle up. The billing wars just went agentic.