B2B SaaS and Agentic AI Pricing Predictions for 2026

Predictions

API pricing is generalized, third parties are charged for API access, prices go up

Credit based pricing becomes the dominant model and absorbs user based pricing (pay for users with credits)

Credit wallets become standard (places to store and manage credits)

Synthetic data becomes the normal way to explore different pricing models and markets

Pricing and value become transparent and machine readable

Pricing of all enterprise applications goes down as buyers gravitate to basic packages

Pricing of chatbots goes down as they lose differentiation and cannot compete with the foundation models

Pricing of agents goes up as they become more capable and differentiated

Costs go up despite cheaper prices per token as more tokens are consumed and the true cost of maintaining vibe coded apps becomes clear

TL;DR (Too Long;Didn’t Read)

2026 is the year pricing architecture, not price points, becomes the competitive weapon in B2B SaaS and agentic AI; static price pages give way to dynamic, model-driven systems that learn and adapt.

Credit-based pricing will become the default pattern for new AI-native products and agents, with users, usage, and value all flowing through a unified credit model designed for both predictability and flexibility.

Credit wallets will move from experiment to standard infrastructure, letting customers prepay for a pool of credits that can be shared across products, users, and agents; your billing system will need to treat wallets as a first-class object.

API access will be priced as a core value driver, not an add-on; expect rising API prices, value-based metrics, and APIs that expose real functionality for both human developers and AI agents, all integrated into your credit model.

Pricing for legacy enterprise SaaS (especially per-user) and basic chatbots will trend down toward their variable cost, while pricing power shifts to sophisticated agents that automate higher-value, end-to-end work.

Costs will not fall as fast as hoped: cheaper tokens will be offset by heavier use of reasoning models and rising maintenance for vibe-coded, rapidly iterated applications, squeezing gross margins unless pricing is redesigned.

Machine-readable pricing and value models will become table stakes; buyer agents will screen you in or out before a human ever hits your website, making opaque pricing effectively invisible in AI-mediated buying journeys.

Synthetic data will quietly become critical pricing infrastructure, letting you safely simulate new credit ladders, agent tiers, and API bundles before pushing them into production and risking revenue or customer trust.

Over the next 90 days, executives should pick 1–2 product lines and intentionally move them to a “credit-first, agent-aware” architecture: define value metrics, launch a credit wallet, and expose agent-consumable APIs.

Winning companies will treat pricing as a strategic, cross-functional capability—on par with product and platform architecture—so they can design the future pricing landscape instead of being forced to operate inside someone else’s.

2025 was a year of generational change in the SaaS and B2B AI world. My personal experience, I felt there was more change in one year than I had seen in the past 40. That is from someone who lived the development of the Internet, the protocol revolution, the emergence of the World Wide Web, and the decay of online experience.

The changes were driven by

the rapid maturation in reasoning models,

the emergence of vibe coding,

agents as the packaging model and

credit based pricing as the pricing pattern for agents.

These four trends shape our predictions for 2026.

Reasoning Models

The brute force, scale first approach to Large Language Models (LLMs) seems to be reaching an asymptote. Merely adding more data, often data generated by earlier models, is not driving the expected improvements to performance and is becoming increasingly expensive.

The new vector of competition is reasoning models. These are models that try to mimic human System 2 reasoning. The terms come from Tversky and Kahneman.

System 1 reasoning is fast, automatic, intuitive, and effortless, relying on heuristics and emotions for quick judgments (like recognizing faces).

System 2 reasoning is slow, deliberate, analytical, and effortful, used for complex problems, logic, and self-control (like solving math problems).

Reasoning models perform much better than straight LLMs on complex research and reasoning tasks, but they remain brittle and can lose context if not carefully managed.

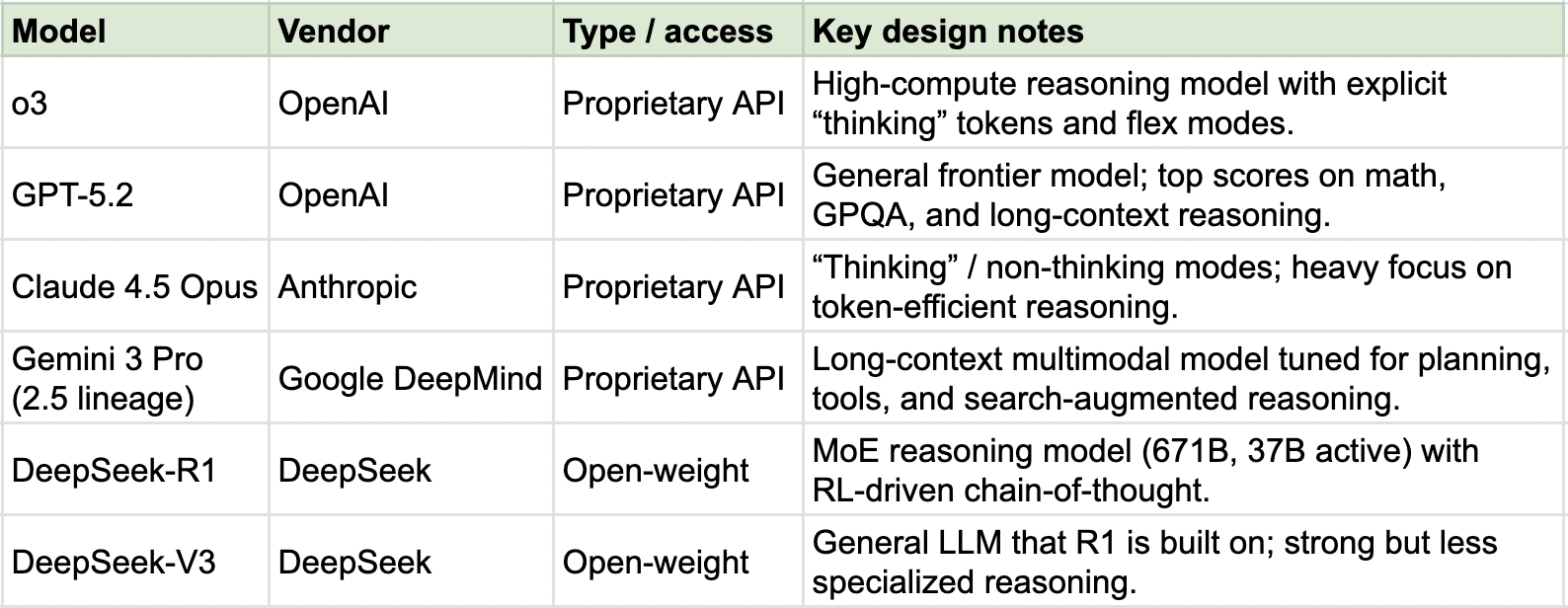

Leading Reasoning Models as at December 29, 2025, Ibbaka Research

Reasoning models will continue to develop rapidly in 2026, becoming more transparent and able to handle more context and longer time horizons. Most successful agents in 2026 will rely heavily on reasoning models and the per token cost of reasoning is likely to come down sharply.

One of the open questions for 2026 is whether the decrease in cost in reasoning tokens will outpace the increasing use of reasoning, or if the exponential growth in use of reasoning will continue to drive up operating costs.

Vibe Coding

Vibe coding exploded in 2025. Companies like Lovable, Bolt and Cursor saw use and revenues explode in 2025. Lovable took eight months to get to $100 million in Annual Recurring Revenue and then four more months to get to $200 million in ARR. New communities for pricers like Karan Sood’s Pricing Tribe or the front end of the valueIQ.ai agents were coded in Lovable.

Vibe coding is an AI-assisted way of building software where you describe what you want in natural language and let an AI system generate and iteratively refine the code for you. It emphasizes guiding the outcome through prompts rather than manually writing or deeply reviewing the underlying code.

Vibe coding is cutting the cost of application development by anywhere from 70% to 95% and opening application and agent development to subject matter experts, who can now create applications directly.

It is leading to the emergence of headless applications (applications that just provide an API and let buyers vibe code their own user experience) and this is increasing pressure on vendors to both provide more API access (to functionality and not just data) and to find new ways to price and monetize APIs.

One thing to consider with vibe coding is that although the cost of creating a new application and adding functionality is way, way down the cost of maintenance may be going up and we are going to see that bite in 2026.

For more on vibe coding and pricing see

Agent Packaging

Generative AI first showed up in enterprise applications as chatbots. In 2025 we moved on from chatbots to agents. Agents are much more sharply defined than chatbots and are able to take actions on behalf of a user.

An AI agent is a goal-driven software worker that uses AI to decide what to do next and then carries out business tasks on its own, not just respond with text.

In 2025 many existing applications added agents to complement or replace existing functionality while new software coming to market was othen positioned as an agent. There are now software agents supporting some part of most business processes, from product development, to marketing to sales and internal financial and planning functions.

Because most agents only address a small part of any complete business process there is concern that they are breaking up integrated value paths and will eventually make it more difficult to complete a process even if execution of individual steps is improved. In 2026 we will see a lot of effort to orchestrate flights of agents. There were numerous announcements about this from OpenAI AgentKit, Microsoft Foundry Google Gemini Enterprise and Anthropic the Claude Agent SDK.

For more on AI agents and their pricing see

Credit Based Pricing

The vibe coding platforms are priced using credit based pricing.

Credit based pricing is a system where customers purchase a bucket of credits in advance and then consume those credits as they perform actions or receive results from a product or AI agent. Each user action has a predefined credit cost, so the credits function as an internal currency that ties what the customer pays to the value delivered by those actions.

Many new applications were priced using credit based pricing, and there are now credits for everything from the number of questions in a survey, pricing analyst reports, SQL identification, customer complaint resolutions and just about anything else you can imagine.

Late in the year we began to see a pushback against credit based pricing with B2B SaaS eminence gris Mark Benioff saying that “"When we first started with Agentforce, we were talking about, oh, it's going to be so much per conversation... but customers have pushed for more flexibility," and advocating a return to ‘predictable’ per user pricing.

For more on credit based pricing and the backlash see

The valueIQ Pricing Intelligence Agent is now available, give it a try.

Factoring in other predictions

Other people have begun to release predictions for 2026, some of which are directly relevant to pricing. These also inform our predictions for 2026.

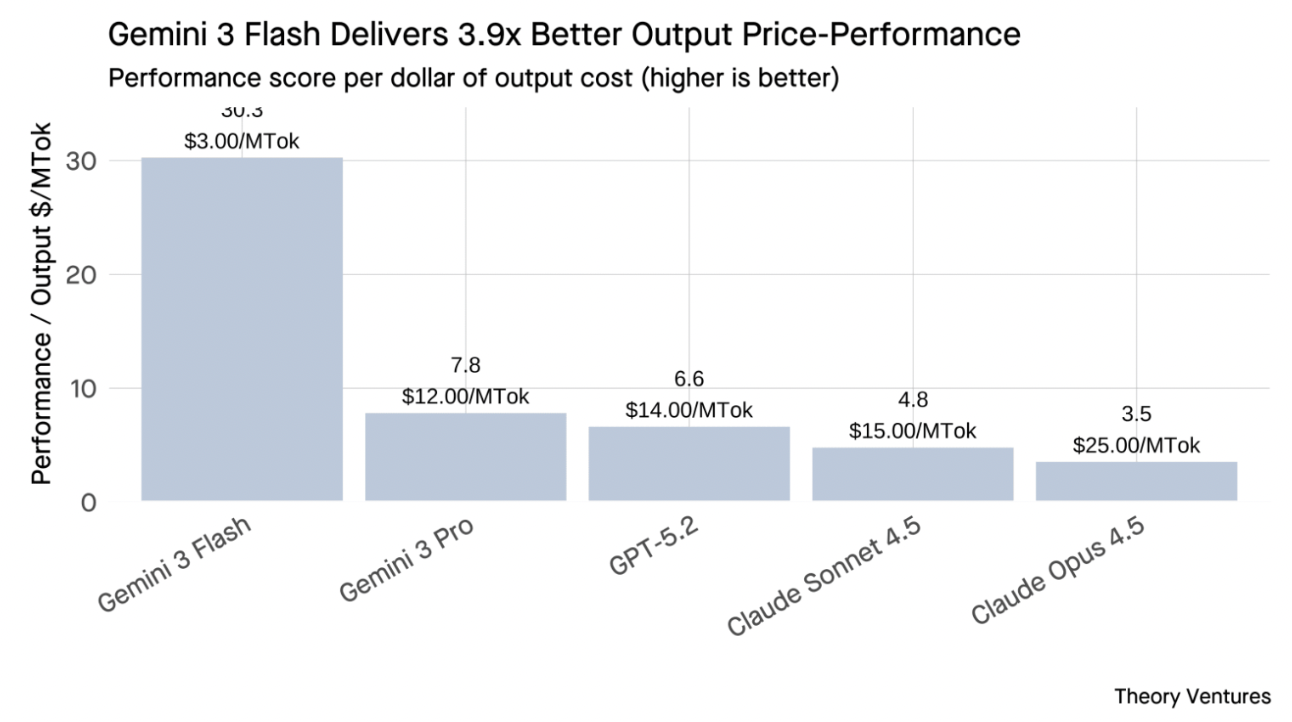

Tom Tunguz from Theory Ventures: 12 Predictions for 2026

1. Businesses pay more for AI agents than people for the first time.

12. Cloudflare becomes the gatekeeper for agentic payments.

Jason Lemkin at SaaSr: Top 10 SaaStr AI Predictions for 2026

1. 50%+ of B2B Sales Teams Will Be Smaller Than They Were in 2025.

2. AI Agents Will Handle 40-60% of Initial Customer Interactions. Not Just Support.

3. “Vibe Coding” (In Some Form or Other) Becomes the Default for Business Application Development.

5. AI Gross Margins Hit SaaS-Like Levels. Or At Least Start to Come Close.

7. Token-Based and Hybrid Pricing Models Become Standard (Even if It Doesn’t Replace Per Seat Pricing).

Kyle Poyar: Some unsolicited predictions for 2026

1. What ChatGPT says about your product becomes the top product marketing KPI.

4. People stop using automation as a muscle and prioritize AI that improves *quality* (conversion, CSAT, accuracy).

Our Predictions for 2026

API Pricing Become Generalized

Virtually all agents expose APIs (and these APIs will be able to call functionality and not just to access data)

Third Party Access to these APIs is priced (example: Salesforce will pay Qualtrics to access data and functionality)

The price of API access will rise sharply and will be priced on value metrics, APIs will be included in credit based pricing

Credit Based Pricing Becomes the Dominant Model

(see definition above)

Credit based pricing models become standard and almost all new applications and agents use this approach

We are explicitly going against the suggestion that there will be a reviersion to user based pricingUsers will be included in credit based pricing models

The key design goal will be to solve for predicability and flexibility; credit based pricing models will come with built in prediction models

Credit Wallets Become Standard

A credit wallet is a customer’s prepaid balance of internal credits or tokens that can be spent on products or services instead of paying per use in cash.

Major vendors such as Lovable are planning to offer Credit wallets from early in 2026

This will become a standard part of pricing/billing systems

Synthetic Data is Used to Explore Alternative Pricing Models

Synthetic data is artificially generated data that is designed to replicate the statistical patterns and relationships found in real transaction, customer, and market data, without directly using those real records.

Credit based pricing and prediction models need extensive modeling and testing to be effective

Companies will start to build and validate collections of synthetic data that they can use to test alternative pricing models, build prediction models and explore alternative markets

Price and Value Transparency

Most companies will have some form of machine readable pricing on their websites

Leading companies will also have machine readable value models on their websites

Buyer agents will evaluate pricing and value before going farther in the buying process

Pricing and Cost Predictions

Pricing for Enterprise Applications Trends Down

Conventional applications, especially those relying on user based pricing, will see prices trend down and buyers opt for less expensive packages (the distribution across Good, Better, Best will trend towards Good, Better and Best will see both unit and revenue share drop

Pricing for Chatbots Trends Down to their Variable Cost

Chatbots are now commoditized functionality and are table stakes, buyers will not pay extra for them

Pricing for AI Agents Trends Up

Agents will become more sophisticated, integrate more data and take on higher value tasks. Buyers will be willing to pay more for these agents when price is aligned with value and value models are connected directly with the application

Costs Continue to Rise (Especially Maintenance Costs)

The rapid decline in per token costs will be overwhelmed by the use of increasingly sophisticated reasoning models; token consumption will rise faster than per token prices come down

The reduction in development costs from vibe coding will be at least paritially counteracted by rising maintenance costs

(One of the key books to read in 2026 will be Stuart Brand’s new book Maintenance of Everything to be released late January.)

Future Considerations

We expect to see signs of the following in 2026 but they will not dominate the conversation or play a major role in pricing. People should be aware of these trends and begin to prepare for them. And remember what Canadian science fiction writer William Gibson said:

“The future is here, it is just not evenly distributed.”

The Attribution Problem Will Be Solved

One of the main things holding back outcome based pricing (the holy grail in pricing) is the attribution problem.

The attribution problem in pricing (and value) is the question of how to attribute price and value when many actions and actors contribute.

This problem is not widely acknowledged by pricing experts, mostly because they do not see a way to solve it. Advances in causal modeling and causal machine learning will provide a way forward. Within three to five years it will be part of the general pricing conversation and within ten years (maybe much faster) it will be solved.

Michael Mansard, Edward Wong and Steven Forth plan to work on this in 2026.

Ecosystem Level Credit Wallets

In 2026 most wallets will only cover one set of agents or only the agents from one vendor. In all likelihood, most complete workflows will make use of agents from multiple vendors. This is the real promise of agents and agent orchestration. Buyers are not going to want to manage multiple wallets and credits of different types with different rules for pooling (sharing of credits) or rollover (credit expiration). At some point there will be credits that can be used across multiple vendors. Large platform vendors are likely to provide the wallets used to manage these credits.

Spatial and World Models

Attention is moving on from the language models that we know now to spatial models and world models. There new models will provide much more compelling, and high value solutions than the current generation of large language models and reasoning models that are trapped inside the limitations of language. Two things to watch come from key researchers who helped to establish the current paradigm and are now redefining it …

Fei-Fei Lee and World Labs are building AIs with spatial intelligence

Yan LeCun with Alex LeBrun are starting Advanced Machine Intelligence Labs (AMI) to build world models

Conclusion

Pricing leaders who thrive in 2026 will not be the ones who guess the “right” price point, but the ones who design pricing systems that can learn, adapt, and scale with agents, credits, and wallets.

What to do in Q1

Over the next 90 days, every B2B SaaS and AI executive should pick one or two critical product lines and deliberately move them toward a credit-first, agent-aware pricing architecture. This means defining clear value metrics, standing up a credit wallet, and exposing APIs that let both human and AI buyers consume your capabilities in flexible, machine-readable ways.

Make your pricing and value machine readable

In a world of buyer agents, opaque pricing is invisible pricing. Commit to publishing machine-readable prices and at least a first-generation value model so that buyer agents can evaluate your offer before your sales team ever gets a meeting. If your competitors’ pricing can be parsed and simulated by agents and yours cannot, you will simply be filtered out.

Build a credit wallet strategy

Credit-based models are on track to become the dominant pattern for agents and vibe-coded applications, and credit wallets will be the mechanism that makes them usable at scale. Use 2026 to define how credits map to value, how they are pooled across users and agents, and how you will evolve from single-product wallets to ecosystem-level wallets as workflows span multiple vendors.

Use synthetic data to de-risk pricing actions

The most sophisticated pricing teams will use synthetic data to test new credit ladders, API bundles, and agent premium tiers before exposing them to real customers. Treat synthetic datasets and simulation environments as core pricing infrastructure, not experiments on the side, so you can safely explore aggressive new models while protecting revenue and customer trust.

Make pricing a strategic capability

2026 is the year that pricing for B2B SaaS and agentic AI shifts from static list pages to dynamic, model-driven systems that respond to usage, value, and context in real time. The companies that win will put cross-functional teams—product, finance, data science, and pricing—on this now, and treat pricing architecture with the same seriousness as product and platform architecture. The future of pricing is already here; the question is whether your organization will architect it or be forced to live inside someone else’s.

Some other people’s predictions to consider

Jason Lemkin at SaaSr: Top 10 SaaStr AI Predictions for 2026

Tom Tunguz from Theory Ventures: 12 Predictions for 2026

Kyle Poyar: Some unsolicited predictions for 2026

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com