Comparing vibe coding pricing models

Steven Forth is CEO of Ibbaka. Connect on LinkedIn

Vibe coding is rewiring how we do software development. Everything from websites to internal tools, to AI agents and even enterprise software is being developed using vibe coding. Looking at the published pricing models of the different vibe coding platforms can give us insight into how they are thinking about value and growth.

Before we go on, let’s define vibe coding.

The term was introduced by leading AI researcher Andrej Karpathy on February 2 of this year. It is worth quoting his post in full.

There's a new kind of coding I call "vibe coding", where you fully give in to the vibes, embrace exponentials, and forget that the code even exists. It's possible because the LLMs (e.g., Cursor Composer w/ Sonnet) are getting too good. Also, I just talked to Composer with SuperWhisper, so I barely even touch the keyboard. I ask for the dumbest things, like "decrease the padding on the sidebar by half" because I'm too lazy to find it. I "Accept All" always, I don't read the diffs anymore. When I get error messages, I just copy and paste them in with no comment; usually, that fixes it. The code grows beyond my usual comprehension; I'd have to really read through it for a while. Sometimes the LLMs can't fix a bug, so I just work around it or ask for random changes until it goes away. It's not too bad for throwaway weekend projects, but still quite amusing. I'm building a project or webapp, but it's not really coding - I just see stuff, say stuff, run stuff, and copy and paste stuff, and it mostly works.

In the past few months, vibe coding applications have become some of the fastest growing applications in history, quickly growing to more than $100 million in recurring revenues and winning many users (including Ibbaka and our valueIQ.ai agents).

Some of the key vibe coding platforms are:

There are many others, including those built into popular design tools like Figma and those more focused on coding than product, like Cursor.

Let’s see how these different apps are priced and evaluate their pricing models.

I am doing this work using a set of agents that Ibbaka is developing for valueIQ. Lovable and Vellum are being used for this development.

The valueIQ agents leveraged are:

Pricing Extraction - extracts and structures pricing data from websites, spreadsheets, contracts, etc.

Pricing Enhancement - enhances the data from multiple sources

Pricing Analysis - does a preliminary analysis of the pricing model

Pricing Assessment - applies the Mansard 12-factor pricing assessment model

Pricing Comparison - compares pricing models

Let’s look at the different pricing models.

Pricing Model Comparison

Before we dive into the pricing let’s quickly compare functionality.

Comparing vibe coding platforms

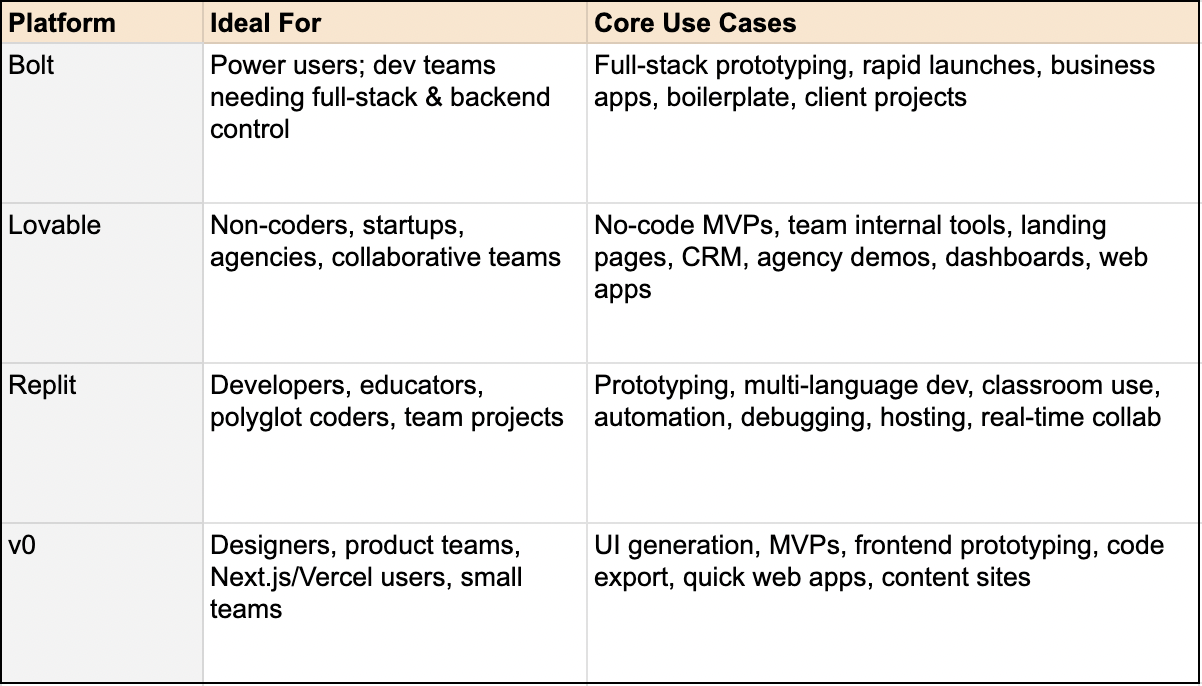

Digging a bit deeper, let’s look at use cases. What one thinks of a pricing model depends very much on the use case.

Vibe coding platforms by use case

On to the pricing models. I used the Pricing Assessment agent results for each pricing model and then used Perplexity to summarize them (we don’t have that functionality yet). Here is the summary of pricing models for each of the four vibe coding apps.

Comparing pricing models for vibe coding platforms

One of the big issues with these platforms is a lack of transparency around credit pricing.

What do you get for a credit (and could this be arbitrarily changed)?

Can you buy additional credits as needed?

Does the price of a credit change with scale?

Does the price of a credit change per plan?

How are credits connected to value?

Vibe coding apps are new, and pricing is still in motion. Expect pricing to change over the next few years. New pricing models will emerge (and this will be a source of differentiation). Credits will become more transparent and more tightly connected to value (we hope).

Pricing Model Assessment

Ibbaka has developed an agent to assess pricing models. It uses the Mansard 14-factor assessment approach. We’ve extended this assessment to look at pricing models from both a buyer and vendor point of view. A good pricing model for a vendor is not necessarily a good model for the buyer. Additionally, pricing model assessments are best done for specific use cases and customers, but unfolding that would make this post rather long, and in any case, the use cases for vibe coding are evolving rapidly.

For more details on this model see How to assess your pricing model.

Pricing model assessment for vibe coding platforms generated July 24, 2025 by the Ibbaka pricing model assessment agent.

This agent is only using publicly available data, so the results need to be taken with a grain of salt. The agent is also able to ingest pricing models as expressed in spreadsheets, contracts, and other formats, but the results are subject to privacy constraints.

All of the models perform well on the first factor, Measurability/Accessibility. This is generally true of credit or token-based pricing.

The weakest factor is 6. Long-term Defensibility. This is not a concern at this point in the pricing model evolution for vibe coding platforms.

Overall, Replit seems to be doing the best job with its pricing, and Lovable (the vibe coding app that Ibbaka most often turns to) seems to have some work to do.

Pricing model assessment averages for vibe coding platforms generated July 24, 2025 by the Ibbaka pricing model assessment agent.

A Value Model for Lovable

Ibbaka’s valueIQ agent is able to generate a value model from public information and then customize it for specific opportunities. Future paid versions will allow users to upload and customize value models and then add deal details from the CRM, Revenue Intelligence Platform, and other sources.

As pricing depends on value, we ran valueIQ on Lovable for Ibbaka’s agent development program. How much value will Lovable create? What does this imply for pricing?

Lovable should create a lot of value, primarily through enhancing revenue and reducing costs. Details in the screenshots below.

Almost $2 million in enhanced revenue from using Lovable. This turns a lot on the number of agents launched (can be known) and an assumption on revenues per agent (much harder to predict). The uncertainty here means the acceptable value capture ratio (price/value) will be quite low, less than 5%.

Screenshot from the Lovable value model generated by valueIQ, July 2024, 2025, revenue value drivers.

It is often easier to have a higher value capture ratio for cost value drivers. There is a lot of proprietary data here that I don’t want to disclose, so you will need to take my word that these estimates look very solid. A value capture ratio closer to 10% should work here. Typical value capture ratios vary quite a bit by sector maturity (perceived risk) and competitive environment (if I can get comparable value for a lower price, I will prefer that).

Screenshot from the Lovable value model generated by valueIQ, July 2024, 2025, cost value drivers.

There are a few shared variables between the equations in the Revenue Value Drivers and the Cost Value Drivers. This happens quite often. It is one reason for the rising popularity of hybrid pricing models.

Looking Into the Future

Where are we going in the pricing of vibe coding platforms?

The first thing will be for the companies to provide greater pricing transparency and address the questions identified above.

What do you get for a credit (and could this be arbitrarily changed)?

Can you buy additional credits as needed?

Does the price of a credit change with scale?

Does the price of a credit change per plan?

How are credits connected to value?

Then we will see tighter packaging of these platforms, with pricing better aligned to use cases. This will likely lead to hybrid pricing.

As the vibe coding platforms differentiate (if they differentiate), their pricing models are also likely to evolve in different directions.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com