Agent strategies at the major pricing software vendors

Steven Forth is CEO of Ibbaka. Connect on LinkedIn

AI business agents have been popping up everywhere. New agent first companies like valueIQ or Brighthive are bringing to market disruptive new systems of agents. Established companies are responding by layering agents onto their existing applications and data. According to the MarketsandMarkets research report on Agentic AI, the market for AI agents is projected to grow from $13.81 billion in 2025 to $140.80 billion by 2032, representing a CAGR of 39.3%. There is a lot at stake.

This post is part of an ongoing survey of how agents are disrupting conventional software.

One area where there has been a lot of activity is in the major pricing software platforms. These are the platforms used by large companies, mostly industrial companies and distributors, to manage price books and discounting, analyze the pocket price waterfall, and to recommend pricing for a specific deal. The same companies provide revenue management systems for airlines, hotels, and other industries where price is used in load balancing.

The four core companies in this space are:

PROS and Pricefx are leading in introducing and talking about agents. Pricefx has announced 125+ pricing agents and is offering introductory pricing where you can get all agents for less than $150,000 per year.

Some of the 125 Pricefx agents are:

Margin Leakage Agents

Discount strategy Agents

Upside Opportunity Agents

Account Optimization Agents

Portfolio Optimizer Agents

Price Harmony Agents

Governance & Compliance Agents

Competitive Readiness Agents

Quote Intelligence Agents

PROS also has a page announcing its agents. In this case, six agents are mentioned:

Sales Agent

Insights Agent

Revenue Management Agent

Fare Finder Agent

Rebate Agent

Vendavo and Zilliant do not seem to have packaged functionality as agents, but they do use AI (price and revenue optimization is based on AI and has been for many years) and are likely using generative AI in places.

Let’s compare the agent strategies of these four companies.

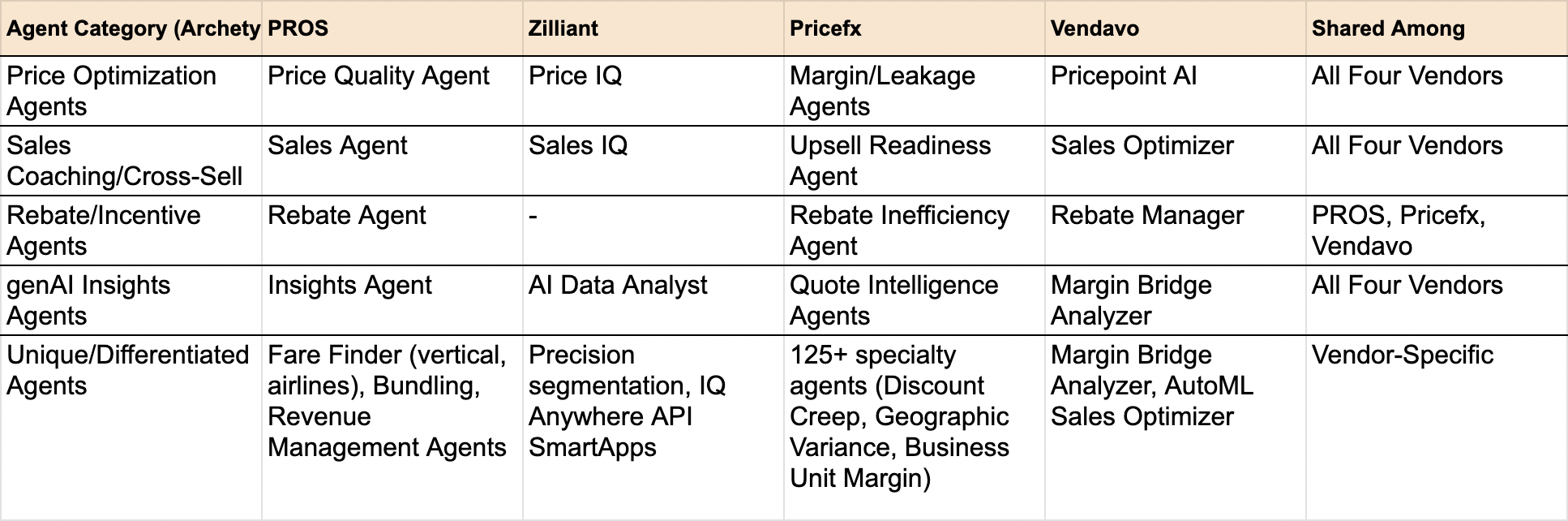

Agent strategies at pricing platform companies, Ibbaka, July 27, 2025.

These companies compete aggressively with each other, and they are going to be competing for agents. So let’s look at where they overlap and where they are differentiated.

Agent overlap and differentiation at pricing platform companies, Ibbaka July 27, 2025.

Not surprisingly, there is a lot of overlap for price optimization. This is, after all, the core value proposition for these companies. It does open a question, though …

Is price optimization functionality best offered through an agent or through the conventional UI?

This is a question the product teams at these companies should be asking themselves.

All four companies also offer some sort of general (dare I say generic) genAI analyst or insights agent. I doubt that anyone is willing to pay for these. Most companies that are at all serious about adopting AI will already have some form of AI, often trained on their own content, from one of the major AI vendors. Light wrappings on standard AI functionality are redundant.

What is interesting is the differentiation. Pricing power is based on differentiation, and agents offer a way for increasingly commoditized enterprise software to drive new differentiation.

PROS - You can see the legacy in revenue management (including airlines)

Zilliant - segmentation agent(s), AI is making possible more precise pricing for specific use cases and segments, and this is going to be important in the distribution sector

Pricefx - discount and margin management, flood the field

Vendavo - provide better support for sales (pricing and sales need to work together, and AI can be the bridge)

How many agents could a company offer?

The motivation for this post was Pricefx’s 125 agents. The number surprised me. I had grown used to legacy applications announcing 15-20 agents (Gong, for example, has 18).

How many agents can or should an enterprise vendor offer to the market?

A simple way to parse this is to look at how the agents fit into work. At Ibbaka, we think of this from four perspectives.

Task-Based: There can be one agent for each clearly defined step in a workflow. Ideally, the workflows are organized into value paths (see Core Concept: Value Path) so that one can define value and therefore price. Most of the roles that we play at work include multiple tasks, so one can offer quite a few task-based agents. We think 10 to 15 is reasonable.

Role-Based: Some companies are mapping agents directly to work roles. For example, Brighthive has mapped its agents to the different roles on a value team. The more roles an application explicitly supports, the more agents it will need. Still, there is cognitive load to managing agents, so the ceiling here is probably 3 to 5, given that agents from other companies will be present.

Generalist: These agents answer general questions about a domain. Pricing software companies are offering agents to have conversations about pricing. It is an open question whether there is enough differentiation here from the agents offered by the rapidly improving foundation model companies.

Subsurface: Not all agents interact directly with users. Some work away beneath the surface to connect data, develop contexts, and support other agents. Most user-focused agents will use several such agents under the hood, often agents from other companies. In the future A2A (agent-to-agent) economy, these agents will dominate the ecology,

Ibbaka’s heuristic for how many agents a legacy software application can offer.

So the number of agents one will offer to complement and extend an existing software application will depend on four things:

How you cover your core functionality, shared by other companies in your sector.

How you drive differentiation, and build value and pricing power.

How you are supporting workflows (preferably defined as value paths) or job roles.

How many subsurface agents you need, and whether these can be monetized (monetization and pricing of subsurface agents is going to be an important challenge for agent pricing).

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com