Will vibe coding applications do their own pricing and packaging?

Steven Forth is CEO of Ibbaka. Connect on LinkedIn

Three Predictions

New agents and applications will price themselves, and will regularly update pricing

This work will be done by specialist agents connected to vibe coding platforms

Pricing consulting as we know it today will disappear within three years

The Emergence of Vibe Coding

Vibe coding is a transformative innovation. Using applications like Replit, Lovable (what we use at Ibbaka), Bolt, and many others, one can generate applications and agents quickly, test them, and get feedback, bringing them into the world at speeds that were unimaginable six months ago.

Ibbaka’s first agent valueIQ is built in part using vibe coding on Lovable with Vellum as middleware.

What is vibe coding? AI instigator Andrej Karpathy says it best.

"a new kind of coding where you fully give in to the vibes, embrace exponentials, and forget that the code even exists"

Andrej Karapthy’s post on X on vibe coding.

Reid Hoffman pushed this further by asking Replit to build a prototype of LinkedIn, and was impressed by the result. This got me thinking, could I get Lovable (the vibe coding app I know best) to replicate common software applications and then propose packaging and pricing?

The results of my initial experiments were negative, the packaging proposals were average, and the pricing was a joke. But remember what Eten Mollick tells us, “Today’s AI is the worst AI you will ever use”.

How Will Vibe-Coded Agents and Apps Get Priced?

This got me thinking, if one can generate new agents and applications with vibe coding will the vibe coding apps eventually be able to package and price them?

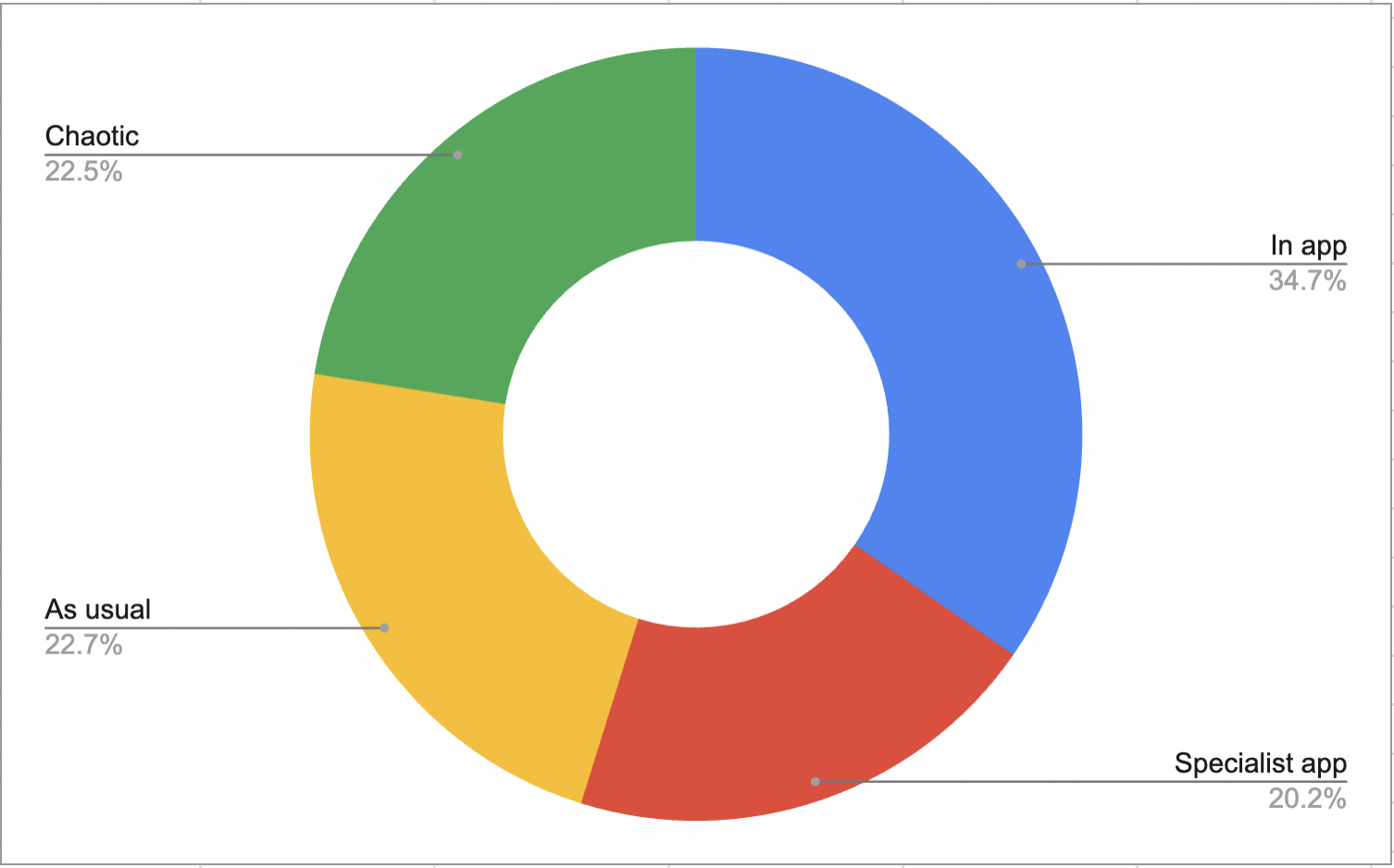

I sent out a little poll on LinkedIn, sharing it across my personal feed, Design Thinking, the Professional Pricing Society, AI Exchange (AIX), Software as a Service (SaaS) and Tech Start Up CEOs. The results were a bit disappointing, total N = 132, but here is what I got. Not a lot of consensus but having packaging and pricing done in app was the clear winner.

Results of Ibbaka poll on LinkedIn conducted June 25-27, 2025.

Breaking it down across the different groups one could see some differences.

Results of Ibbaka poll on LinkedIn conducted June 25-27, 2025, by LinkedIn group.

I was surprised that the respondents from the Professional Pricing Society gravitated to in-app pricing and packaging. And encouraged that the SaaS crowd believed that this would be done by specialist apps. I was puzzled that the Design Thinking community was stuck with the idea that packaging and pricing would continue as usual, given that designers are some of the people most disrupted by vibe coding. With vibe coding, a business user can talk to a computer and ask for what they want without involving a designer (maybe they should involve a designer, but it becomes optional).

Simulating the Poll with Generative AI

I wanted to explore this more, so I asked Perplexity Research to simulate responses to the poll.

I created a list of 25 roles I was interested in and put Perplexity to work.

Initial Results

Executive Leadership Perspectives

1. CEO of a Vibe Coding Company

Answer: a. generated inside the vibe coding app

The competitive landscape demands that we own the entire value chain. Platforms like Bolt, Replit, and Lovable are already demonstrating that AI can propose packaging and pricing. While current results are erratic, the trajectory is clear - AI will become sophisticated enough to handle pricing internally. This creates a seamless user experience and reduces friction in the development-to-deployment pipeline. We're seeing early evidence that vibe coding platforms can analyze project complexity, required resources, and market demand to suggest appropriate pricing structures.

2. CTO of a Vibe Coding Company

Answer: a. generated inside the vibe coding app

From a technical standpoint, integrating pricing intelligence directly into the platform makes architectural sense. We're already processing vast amounts of data about code complexity, resource requirements, and user behavior patterns. The same AI models that generate code can be trained to understand pricing optimization. The key is building robust data pipelines that feed real-time market intelligence, competitor analysis, and cost structures into our pricing algorithms. This approach eliminates external dependencies and enables dynamic pricing adjustments based on actual platform usage metrics.

3. CPO of a Vibe Coding Company

Answer: a. generated inside the vibe coding app

Product experience is paramount. Users expect seamless, integrated experiences where they can go from idea to deployment without switching between multiple tools. Having pricing generated within the platform creates a unified workflow that reduces cognitive load and accelerates time-to-market. We're seeing user research indicate that developers prefer platforms that can handle the entire lifecycle, including pricing recommendations. The challenge is ensuring the AI-generated pricing feels transparent and trustworthy to users.

Foundation Model Company Leadership

4. CEO of a Major Foundation Model Company

Answer: b. generated by a specialist packaging and pricing app

Foundation models are becoming commoditized rapidly - we're seeing 30x-50x cost differences between providers like OpenAI and DeepSeek. This commoditization will drive specialization. Pricing is a sophisticated discipline that requires deep market intelligence, competitive analysis, and economic modeling that goes beyond what coding platforms can reasonably build in-house. Specialist pricing agents will emerge as a critical infrastructure layer, similar to how payment processing became specialized. These agents will have access to broader market data and pricing expertise that individual platforms cannot match.

5. CTO of a Major Foundation Model Company

Answer: b. generated by a specialist packaging and pricing app

The technical complexity of optimal pricing requires specialized AI models trained specifically on pricing data, market dynamics, and economic principles. While vibe coding platforms excel at code generation, pricing optimization is a fundamentally different problem domain requiring different training data, model architectures, and real-time market feeds. Specialist pricing AI will have access to broader datasets across multiple platforms and can leverage transfer learning from various industries. This specialization will deliver superior pricing outcomes compared to integrated approaches.

6. CPO of a Foundation Model Company

Answer: b. generated by a specialist packaging and pricing app

From a product strategy perspective, pricing is too critical to be an afterthought feature within coding platforms. Specialist pricing applications will emerge because they can focus exclusively on solving pricing challenges with dedicated teams, specialized data sources, and purpose-built user experiences. This mirrors how other specialized functions like analytics, monitoring, and security evolved into dedicated platform categories. The market will demand best-in-class pricing intelligence, which requires focused investment that coding platforms cannot match while also innovating on their core development experience.

Established SaaS Company Leadership

7. CEO of an Established SaaS Company

Answer: c. conducted as usual

Despite AI advances, pricing remains fundamentally about understanding customer value, competitive positioning, and business strategy. These are human judgment calls that require deep market knowledge, customer empathy, and strategic thinking. We've seen multiple waves of "AI will automate everything" predictions, but critical business decisions still require human oversight. While AI can inform pricing decisions with data and analysis, the actual pricing strategy will continue to be set by experienced pricing professionals using established methodologies, just with better AI-powered tools.

8. CTO of an Established SaaS Company

Answer: d. chaotic

The transition period will be messy. We're seeing rapid experimentation with different pricing models - usage-based, outcome-based, agent-based, and hybrid models. Different platforms are trying different approaches without clear industry standards. The underlying cost structures are volatile due to fluctuating AI inference costs and uncertain demand patterns. This creates a perfect storm for pricing chaos as companies struggle to find sustainable models while competing aggressively. The market will need 2-3 years to stabilize around proven approaches.

9. CPO of an Established SaaS Company

Answer: c. conducted as usual

Product teams understand that pricing is deeply connected to product strategy, customer segmentation, and value positioning. AI can provide data and recommendations, but the actual pricing decisions need to align with broader product and go-to-market strategies that require human judgment. We'll use AI as a tool to inform pricing decisions - analyzing usage patterns, competitive intelligence, and market feedback - but the strategic pricing decisions will continue to be made by product and commercial teams using established frameworks.

10. CRO of an Established SaaS Company

Answer: c. conducted as usual

Revenue strategy requires understanding customer psychology, sales processes, and market dynamics that go beyond what AI can currently grasp. While AI can provide valuable insights and automate certain pricing adjustments, the core commercial strategy must be human-driven. Our sales teams need to understand and defend pricing decisions to customers, which requires human-crafted value propositions and negotiation strategies. AI will enhance our pricing capabilities but won't replace the fundamental commercial processes we've refined over the years.

11. CFO of an Established SaaS Company

Answer: c. conducted as usual

Financial planning and revenue modeling require an understanding of business fundamentals that AI cannot fully grasp yet. Pricing decisions have profound implications for cash flow, growth trajectories, and unit economics that require CFO-level strategic oversight. While we'll leverage AI for data analysis and scenario modeling, the actual pricing strategy must align with financial objectives, investor expectations, and long-term business sustainability. The financial implications are too significant to delegate to automated systems without human oversight.

12. CMO of an Established SaaS Company

Answer: c. conducted as usual

Brand positioning and market messaging are intrinsically linked to pricing strategy. Our pricing communicates brand values, competitive positioning, and customer expectations that require marketing expertise to optimize. AI can analyze market data and competitor pricing, but the actual pricing strategy must support broader marketing and brand objectives. Customer perception of value is psychological and cultural, requiring human understanding of market dynamics that AI cannot fully capture.

Pricing Consulting Experts

13. CEO of a Pricing Consulting Company

Answer: b. generated by a specialist packaging and pricing app

The complexity of optimal pricing requires specialized expertise that most companies lack in-house. We're already seeing demand for AI-powered pricing tools that can process market intelligence, competitive analysis, and value-based modeling at scale. Specialist pricing agents will emerge because pricing is a sophisticated discipline requiring dedicated focus, specialized data sources, and deep expertise in economic modeling. This creates a natural market opportunity for specialist solutions that can serve multiple industries and use cases more effectively than any single platform could build internally.

14. CTO of a Pricing Consulting Company

Answer: b. generated by a specialist packaging and pricing app

Building effective pricing AI requires specialized technical capabilities - access to market data feeds, competitive intelligence APIs, economic modeling frameworks, and pricing optimization algorithms. The technical stack for pricing intelligence is fundamentally different from code generation platforms. Specialist pricing applications can invest in sophisticated data pipelines, machine learning models trained specifically on pricing scenarios, and integration with enterprise systems that coding platforms cannot reasonably build as a side feature.

15. Consultant at a Pricing Consulting Company

Answer: b. generated by a specialist packaging and pricing app

In practice, optimal pricing requires an understanding of customer segments, competitive dynamics, value drivers, and market positioning that vary dramatically across industries and use cases. Specialist pricing tools can build this domain expertise and market intelligence at scale. Generic coding platforms cannot reasonably develop the specialized knowledge needed for effective pricing across different markets, business models, and customer types. The market is large enough to support dedicated pricing intelligence platforms.

16. Independent Pricing Consultant

Answer: e. other - hybrid approach combining specialist tools with human expertise

The future will likely involve specialist AI pricing tools providing recommendations that are then validated and refined by human experts. AI excels at processing large datasets and identifying patterns, but pricing strategy requires an understanding of customer psychology, competitive dynamics, and business context that still needs human judgment. The optimal approach combines AI-powered analysis with human strategic oversight, similar to how financial trading uses algorithmic tools with human traders.

Developer and Platform Perspectives

17. Model Developer on Hugging Face

Answer: a. generated inside the vibe coding app

From a developer experience perspective, integrated pricing makes the most sense. Hugging Face's pricing model demonstrates how AI platforms can handle complex pricing based on usage, model requirements, and deployment configurations. Vibe coding platforms have access to all the relevant data - code complexity, resource requirements, expected usage patterns - needed to generate appropriate pricing. The key is building transparent pricing models that developers can understand and predict, similar to how cloud platforms evolved their pricing transparency over time.

18. CEO of an AI-First Agent Development Company

Answer: a. generated inside the vibe coding app

Agent development platforms need to own the entire value proposition, including pricing intelligence. Our competitive advantage comes from understanding the full context of agent capabilities, market demand, and deployment requirements. External pricing tools would create friction and dependency that undermine our platform strategy. We're building AI systems that understand not just code generation but also market positioning and value optimization. This integrated approach creates stronger platform lock-in and better user experiences.

19. CTO of an AI-First Agent Development Company

Answer: a. generated inside the vibe coding app

The technical architecture supports integrated pricing intelligence. Our AI models already process information about agent complexity, performance requirements, and deployment scenarios. Adding pricing intelligence to this processing pipeline is a natural extension that leverages existing data flows and AI capabilities. External pricing tools would require additional integrations and data sharing that would complicate our technical stack. Internal pricing generation aligns with our platform architecture and data strategy.

20. CPO of an AI-First Agent Development Company

Answer: a. generated inside the vibe coding app

Product strategy demands integrated experiences where users can seamlessly move from development to deployment to pricing without context switching. External pricing tools break the product flow and create additional complexity that reduces adoption. Our users expect comprehensive platforms that handle the entire agent lifecycle. Pricing intelligence becomes a key differentiator when integrated effectively into the development experience, providing immediate feedback on commercial viability during the development process.

21. CRO of an AI-First Agent Development Company

Answer: d. chaotic

The market is too immature with rapid technological change and unclear value propositions. We're seeing wild experimentation with pricing models - per agent, per task, per outcome, usage-based, hybrid approaches. Customer expectations are still forming, competitive dynamics are fluid, and underlying costs are volatile due to changing AI infrastructure costs. This creates a chaotic environment where different platforms are trying radically different approaches without clear market validation. The chaos will continue until dominant patterns emerge.

22. CFO of an AI-First Agent Development Company

Answer: d. chaotic

The financial metrics are unstable due to rapidly changing AI infrastructure costs, unclear customer lifetime values, and experimental business models. Traditional SaaS financial modeling doesn't apply well to AI agents, creating uncertainty in pricing strategy. We're seeing dramatic cost reductions in foundation models creating pricing pressure while simultaneously increasing capabilities that should command premium pricing. This tension creates chaotic pricing dynamics that will take time to stabilize into sustainable business models.

23. CMO of an AI-First Agent Development Company

Answer: d. chaotic

Market positioning is extremely challenging when the technology capabilities are evolving rapidly and customer understanding is still developing. Marketing teams are struggling to communicate value propositions when the underlying capabilities are changing monthly. Pricing becomes chaotic when you cannot clearly articulate and defend the value proposition to customers. The market education process is ongoing, making it difficult to establish consistent pricing strategies across the industry.

Buyer Perspectives

24. Procurement Officer at a Company Buying AI Apps or Agents

Answer: c. conducted as usual

From a procurement perspective, we need predictable, comparable pricing structures that fit our existing evaluation and approval processes. Automated or dynamic pricing creates challenges for budgeting, vendor comparisons, and contract negotiations. We prefer traditional pricing models with clear terms, volume discounts, and enterprise-friendly structures. While AI may inform vendor pricing strategies, our procurement processes require human oversight and negotiation that align with standard commercial practices.

25. Business Buyer at a Company Buying AI Apps or Agents

Answer: e. other - combination of approaches depending on use case and maturity

Different types of AI applications will likely evolve different pricing approaches. Simple, commoditized tools may use automated pricing, while complex enterprise solutions will require traditional commercial processes. The market is likely to segment with different pricing approaches for different customer types and use cases. SMB buyers may accept automated pricing for convenience, while enterprise buyers will demand traditional sales processes with human oversight and customization.

Initial Monte Carlo

I am generally suspicious of single-point data; most of the data I actually use is muddy and distributed, so I wanted to see if Perplexity could redo this as a simulated Monte Carlo.

Simulated Monte Carlo of simulated poll responses, generated by Perplexity Research on June 27, 2025.

(Sorry about the overlapping title, I tried several times to get Perplexity to fix this with no success, working with generative AI can be like trying to lead a mule, see Why ChatGPT is the worst programming language ever).

The problem with this first pass is that it assumes that the initial answer generated for each role are correct. What happens is we redo this asking about the probabilities for how each role would give each response. Option A: integrated, Option B: specialist, Option C: traditional, Option D: chaotic.

Simulated Monte Carlo by role and answer for the Pricing and Packaging of Vibe Coding poll, generated by Perplexity Research, June 27, 2025. (A: integrated, B: specialist, C: traditional, D: chaotic)

This is more useful. It gives some insight into the range of different responses. Perplexity interpreted these results as follows.

High-Certainty Roles

Vibe coding leaders show tight confidence intervals (±17%) around Option A

Pricing experts show clear consensus for Option B (CI: 48-87%)

Procurement officers strongly favor Option C (CI: 34-82%)

High-Uncertainty Roles

Business buyers show no clear preference (all options 4-56%)

SaaS CTOs/CROs expect chaos (Option D CI: 24-75%)

Independent consultants show bimodal distribution (B:26-73%, A/D:4-42%)

Patterns by Function

Technical roles (CTOs, developers): Favor integrated solutions (A)

Commercial roles (CROs, CFOs): Expect chaos (D) or status quo (C)

Specialists (pricing experts): Strong preference for dedicated tools (B)

Buyers: Prefer traditional models (C) but acknowledge potential disruption

Conclusions and Predictions

Within the next three years most new agents and applications will price themselves, and will regularly update using insights from usage, sales performance, and by responding to comments in social media and review sites (check out the AI Directory Leaderboard and Agent Arena.

This work will be done by specialist agents connected to the vibe coding platform, but also connecting to other data sources to give a fully informed view of pricing.

Pricing consulting as we know it today will disappear within three years (this is true of almost all consulting). Some people, and firms, will be able to move up Roger Martin’s strategic choice cascade and focus on helping people define Winning Aspirations and maybe Where to Play choices. The lower you go in the strategic choice cascade, the more work will be taken over by AI.

Sign up for the beta to learn more about valueIQ.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com