The evolution of AI pricing models - update for the end of 2025

Steven Forth is a principle at Ibbaka and valueIQ. Connect on LinkedIn

The most popular Ibbaka post in 2025, though, was from back in 2024. The Evolution of AI Pricing Models: From Consumption to Hybrid and Generative Approaches by Edward Wong, published in October 2024, had more than 3,000 views in 2025.

How do things look one year later?

The pace of change in AI and the agent world was hectic in 2025, and anything we thought in 2024 needs to be tested.

Here are the themes Edward picked up on back in October of last year.

A move to consumption-based pricing: Example Salesforce

The Rise of Value-Based Pricing: Example OpenAI

Hybrid pricing models: Example Intercom and the inclusion of outcomes in hybrid models

Generative pricing: proposed as a new approach to pricing

Looking back, these feel a bit generic. It is hard to disagree with these, and they were all part of the conversation in 2025. But they were not the main themes.

What were the main themes for 2025? We see four:

The emergence of credit-based pricing models as a common way to price agents

The impact of vibe coding and its implications for the speed of innovation, differentiation and how pricing is represented

The push for transparency as AI-enabled buying processes

AI-driven price increases as companies became more aware of costs and confident about value

The trends around vibe coding, credit based pricing and transparency reinforced each other.

Interactions between Vibe Coding, Credit Based Pricing and Pricing Transparency

The vibe coding apps use credit based pricing and are moving the state of the art forward. Want to know how to develop a credit-based pricing model? Study what Lovable, Bolt, Vercel and the other vibe coding apps are doing.

Credit based pricing works best when there is a lot of transparency. People want to know how many credits an action will consume before they commit to the action, they want to know how many credits they are likely to need, and they want it to be easy to buy more credits when they need them.

Credit based pricing is based on actions, and so is a type of usage based pricing. There is market pressure to link the price of a credit to the value of the action, and not to the underlying token cost (access to the foundation models that are used in vibe coding is metered in token consumption).

Vibe Coding

Vibe coding is the big development for 2025. The term came into common use in February when Andrej Karpathy described the concept as a new approach to programming where developers could "fully give in to the vibes, embrace exponentials, and forget that the code even exists." Vibe coding rapidly moved beyond programmers, with many people piling in to code their own apps. Lovable, one of the early entrants, saw ARR (Annual Recurring Revenue) reach $100 million in only eight months, and it took only four more months to get to $200 million in ARR.

Vibe coding is impacting pricing in many ways.

Reducing the cost of initial development by 90% to 95%

Increasing the cost of maintenance by some unknown amount

Increasing the number of tokens used for development and for operation

Encouraging the emergence of headless apps (apps with no user interface that are accessed through APIs)

Shifting buying away from large integrated applications to thousands of agile AI agents

All of the major vibe coding companies use credit-based pricing models, and they are setting the standard here. Much of the trend toward credit-based pricing is being driven by vibe coding and related applications.

Relevant posts

Comparing vibe coding pricing models

Will vibe coding applications do their own pricing and packaging?

Credit-Based Pricing

Credit-based pricing is a pricing and billing design pattern where the buyer commits to the purchase of a bucket of credits that they can use to pay for several different things. This makes the commitment predictable and transparent to the buyer and seller.

Credit-based pricing is emerging as a standard pricing pattern, one that can be combined with other common patterns like tiered (Good Better Best) or user-based pricing to create hybrid pricing models.

There are many open questions about credit-based pricing and the design of credit-based pricing models. One of the biggest is …

Is credit-based pricing a bridge to get across a period of uncertainty and rapid innovation, or will it become one of the dominant pricing patterns?

This is one of the key questions for 2026.

Relevant posts

Why tokens and credits are becoming a standard approach to pricing AI solutions

How granular should credit pricing models get?

The new currency: how credit models accelerate SaaS growth with Brandon Hickie reprise

Credit-Based Pricing - how companies are managing credits across GBB tiers

Five objections to credit-based pricing and how to manage them

Pricing (and Value) Transparency

One result of the move to credit-based pricing at vibe coding applications has been a push for transparency. Buyers/users struggled with early credit-based pricing models as they were not sure how many credits they needed and when they would run out. The vibe coding app providers have responded with much more transparent and predictable pricing models.

This is just the beginning of transparency, though. One of the biggest changes in 2025 is the growing domination of AI in the buying process (buying process, not sales process). This is pushing companies towards more transparency on their pricing and pricing pages, and in 2026, this is likely to carry on to value.

Relevant posts

What does AI mean for pricing transparency?

Is trust the foundation for value-based pricing?

Webinar: Why every SaaS App (and Agent) Needs a Value Model with Michael Mansard

AI-Driven Price Increases

SaaS pricing increased by an average of 8-12% in 2025, with some "aggressive movers" pushing hikes of 15-25%. SaaS price increases ran approximately 5x higher than general market inflation. Beyond list price hikes, effective costs for buyers rose by 20-30% due to the removal of discounts, stricter enforcement of usage limits, and the unbundling of features into paid add-ons.

A major driver was the "AI tax." Vendors moved away from simple "per-seat" pricing (which doesn't account for AI costs) toward hybrid or consumption-based models to ensure they covered the high cost of GPU compute required for AI features.

One of the big questions is whether these trends can be sustained in 2025. Some initial polling on LinkedIn is finding a divergence of opinion.

The poll question was “What will the trend in B2B software prices be in 2026?” The possible answers were:

Go up driven by innovation

Go up driven by costs

Go down driven by buyer fatigue

All over the place

The poll was distributed across Steven Forth’s Personal feed and the following groups: Professional Pricing Society, Network of Pricing Champions, SaaS, AIX (Artificial Intelligence Exchange) and Design Thinking. As of December 15, there had been 93 responses.

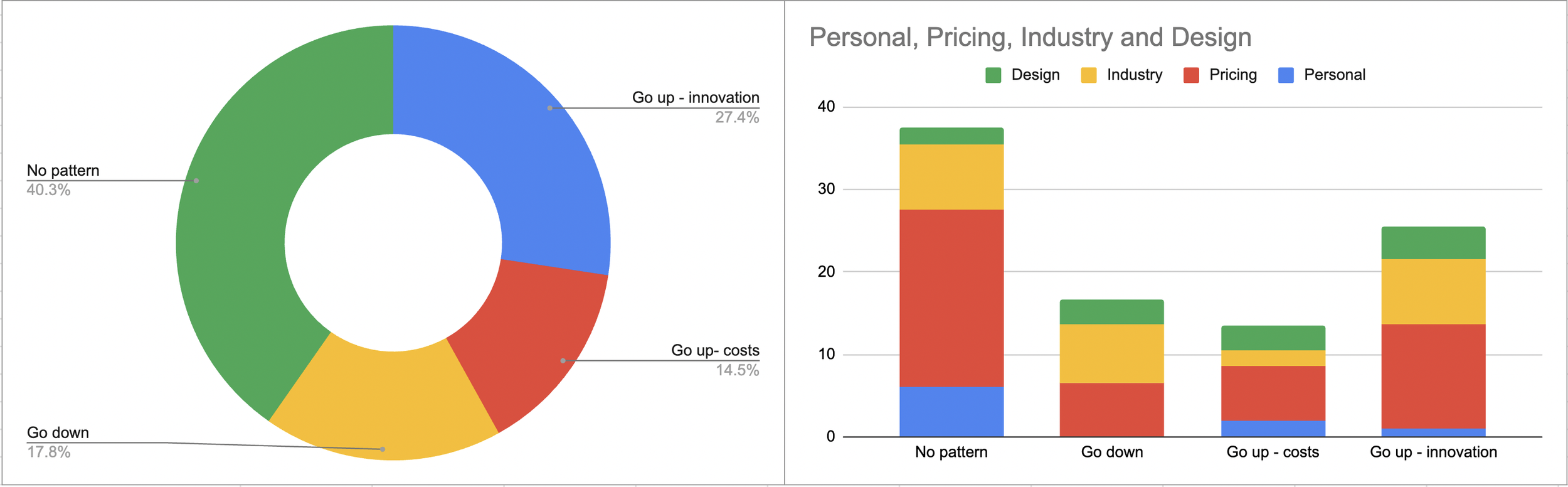

Results of an Ibbaka LinkedIn poll on B2B SaaS and Business AI pricing trends for 2026. Data collected December 12 to 15. N = 93.

Respondents were roughly split, 42% saying prices would continue to go up and 40% saying there would be no clear trend. Only 18% expected prices to go down next year. Of the 40 people who expected prices to go up, 65% thought this would be innovation-driven, and 355 thought it would be cost-driven. Most of the people who thought that costs would drive prices up in 2026 came from one of the pricing groups.

In an upcoming post, we will identify the critical uncertainties for 2026 and make some of our own predictions.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com