Pricing for NDR (Net Dollar Retention)

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Over the past six months, from late in 2021, we have seen growing concern with Net Dollar Retention (NDR) among company leaders and their investors. This was an early indicator of the malaise that is sweeping through the economy. In uncertain conditions, it is important to protect revenue from existing customers.

Definitions relevant to net dollar retention

Before we dig in, let’s start with some definitions.

Net Dollar Retention (NDR we use this with the same meaning as NRR or Net Revenue Retention)

Net Dollar Retention measures the contribution of your existing customer base to revenue growth. The formula is as follows.

Net Dollar Retention = (Recurring Revenue (RR) at Start of Period + Expansions + Upsells – Churn – Contractions)/RR at Start of Period

Basically, you add expansions and upsell to the RR at the beginning of the period and then subtract lost customers or churn and contractions (when a customer reduces the amount paid to you but does not churn). To get a percentage, you then take this number and divide by the recurring revenue at the start of the period. Net Dollar Retention is generally calculated monthly and annually, for fast moving businesses this could be daily or weekly, and one sometimes wants to look at longer time frames, three years or five years being the most common.

If NDR is greater than 100 the business will grow even without new customers; if it is less than 100 then new customers must be won to keep revenue constant, let alone to grow.

Customer Retention

Customer retention is simply the number of customers that stay with you.

Customer Retention = (Customers at End of Month - Customers at Beginning of Month) / Customers at Beginning of Month

Note that Customer Retention can be smaller than 100 and Net Dollar Retention greater than 100 if you are expanding the revenue from current customers and upselling current customers. Conversely, Customer Retention can be greater than 100 and Net Dollar Retention less than 100 if the average subscription is shrinking, something we are seeing in the current market.

Lifetime Value of a Customer (LTV)

Closely related to NDR is the Lifetime Value of a Customer. We can see this by comparing the equations for these two metrics.

Hubspot defines LTV as

Customer Value x Average Customer Lifespan

And then Customer Value as

Average Purchase Value x Average Purchase Frequency Rate

Note the connections between net dollar retention and lifetime customer value

Expansion, contraction and upsells change the customer value by changing the Average Purchase Value

Churn shortens the Customer Lifespan (which is 1 / churn rate)

These connections are critical to model for your company (every company has different dynamics) when deciding if and how to use one of the NDR pricing levers.

V2C (Value to Customer)

This is the value your solution provides to a specific customer. It requires a formal value model. At Ibbaka, we use the Economic Value Estimation or EVE approach as a foundation.

See Why value based pricing means something

EVE collects the data needed to calculate other measures of value like Return on Investment (ROI) and Total Cost of Ownership (TCO). Adding a discount rate makes is possible to calculate Internal Rate of Return (IRR) and Net Present Value (NPV).

Deciding on pricing actions to impact NDR requires a good understanding of value to customer and how it is changing as the business environment shifts.

Value is formalized in a value model, the value model and the pricing model should share variables.

Value Ratio

The value ratio is V2C / LTV. In high growth markets, this is is generally about 10X (one provides 10 times more value than one receives through price). In more mature markets this often moves closer to 3X, as risk and uncertainty are removed and more alternatives are available.

Pricing Model

The pricing model is the combination of packages that are priced, the pricing metrics and pricing levels for the packages, and the fences that help guide a buyer to one package or another.

Bundles are loose combinations of packages and are often priced as well.

Discounts should also be thought of as part of the pricing mode.

Value metric: the unit of consumption by which a user gets value

Pricing metric: the unit of consumption for which a buyer pays

NDR Pricing Levers

NDR Pring Levers are the pricing actions you can take to increase NDR.

Change price level - up or down

Adjust relative contribution of different components of the pricing/revenue model - for example increase the contribution of usage based pricing

Change pricing model design - pricing metrics, fences, packaging, service levels

Add a value path (a value path is a sequence of actions a user takes that results in something of value)

Add a package - retention packages are common

Remove a package - packages with high churm

Combine packages - to simplify an architecture

Change discounting - for example, many companies have ‘retention’ discounts

Provide value enhancers - sometimes one is better off by offering extra value rather than by discounting prices

NDR Value Levers

One way to grow NDR is to increase value. Creating, delivering and documenting value are key parts of the value cycle.

Willingness to Pay (WTP)

Willingness to Pay is the highest price a customer is willing to pay before they switch (or start looking for an alternative). It is framed by value (the higher the value the higher the willingness to pay) but a separate concept. Managing NDR requires an understanding the interactions between V2C and WTP.

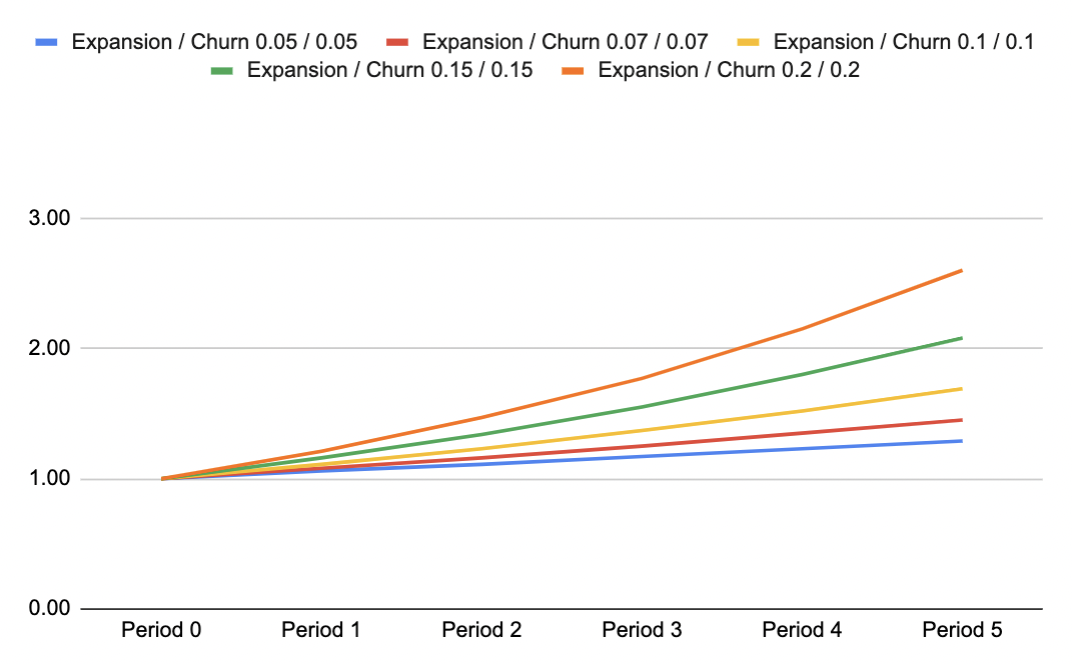

Expansion / Churn Ratio

One simple metric that SaaS businesses should track is the ratio of Expansion to Churn. One can compensate for churn by expanding revenues from existing customers.

This is another way to measure Net Dollar Retention, one that makes the dynamics more obvious.

If this ratio is …

Equal to 1, then revenues will stay flat (but the amount each customer has to pay will increase)

Greater than 1, then the company can grow organically within its existing customer base

Small than 1, then revenues from the existing customer base will decline

When evaluating this metric, one has to ask if the growth in revenue per customer is sustainable.

The strategic playing field

Most companies will have some level of churn. Even in the best of situations, some customers will merge (so that two customers become one), go out of business, or be acquired by a company that uses your competitor. This is just the nature of business. With the economic environment toughening churn is likely to go up even for the best run companies.

To keep NDR positive, greater than 100, one will have to grow revenues from existing customers. Putting aside the possibility of cross sell, this means convincing existing customers to either pay higher prices or to use more and then leverage usage based pricing. Both assume that willingness to pay (WTP) is at least stable and possibly increasing.

By combining the ratio of Expansion / Churn and three WTP possibilities we create nine scenarios. Only one of these is really attractive, the top right, where Expansion is larger than Churn and WTP is increasing. This is where you need to get your business.

There are two quasi sustainable scenarios.

Where the Expansion / Churn Ratio is >1 and WTP is stable, NDR should be sustainable, at least until the upper limit on WTP is tested.

When Expansion / Churn = 1 and WTP is increasing, NDR is stable and the focus can be on new logos to drive growth.

The other six scenarios are all negative. Three are not a cause for panic.

The best of these is when the Expansion / Churn ratio is < 1 but WTP is increasing. Here the solution is probably some form of price increase. The upward trend in WTP gives room for higher prices that will increase revenue expansion and move the Expansion / Churn Ratio to > 1.

When the Expansion / Churn ratio = 1 and WTP is stable there is no immediate concern but eventually you will hit a WTP wall and NDR will turn down. You need to reduce churn and if possible find ways to increase WTP, generally by providing more value.

When the Expansion / Churn ratio is > 1 but WTP is declining the two are on a collision course. You need to take action before the train wreck drops your business to the bottom left of this matrix. Increase value and reduce churn any way that you can, and only once you have stabilized the situation should you worry about expanding revenues from existing customers by raising prices.

The other three scenarios are red and immediate action is needed to protect the business.

In general, one needs to get churn under control and increase WTP first. This could mean price cuts to improve the value to customer (V2C), value enhancers to increase WTP, or in some cases, price increases laser targeted at those customers with a high value ratio (V2C/LTV).

Why does WTP change?

To get to the root of NDR challenges one needs to understand value to the customer. The interplay of V2C and WTP tells you what kind of problem you have.

If V2C and WTP are both increasing the company can easily push NDR over 100 and have an Expansion / Churn ratio of > 1. If you run one of these businesses, even in the current economic climate, congratulations. Keep doing what you are doing. It is working.

Hopefully you are in the row where V2C is increasing. If this is the case, and you can know this is you have a value model and track the variables at the customer level, then you can fix WTP and increase the amount of revenue you collect from a customer, at least up to a point.

If V2C is stable, NDR should be roughly 100, at least so long as the industry you sell to is stable or expanding.

One way to connect value to customer with willingness to pay is with usage based pricing. If you know how your customers will get value but there is low willingness to pay you can break through this barrier by directly connecting price to value.

If V2C is declining you need to fix your value problem first. If value to customer declines then it will eventually bring down WTP, put downward pressure on prices and lead to increased churn.

Eventually you hit a WTP wall. There is only so much you can increase price and only so much money (share of wallet). The below graph shows how much you have to increase revenue from a customer (Expansion) at different levels of churn.

Two things to note here. The curve is not linear. The rate of increase goes up over time. The higher the churn the faster this happens. You need to control churn. In fact, you probably need to keep churn under 10%. If you can do this you have at least a chance of making up for churn with expansion, at least for a few cycles.

(Cycle will depend on the pace of business, for most B2B SaaS businesses this is either monthly or annually.)

Which component of NDR are you focused on?

You have three levers to manage NDR.

You an increase prices to increase revenue from the same customer

You can sell more of the same to the same customer

You can sell new things to the same customers

Increase prices

If WTP and V2C are increasing you should consider increasing price. One way to estimate this is through the Value Ratio (V2C/LTV). In early stage and growth markets this is generally around 10%, but as a market matures and the value propositions become better understood by buyers and sellers this often moves up to 30%.

Increasing prices for your existing customer base takes careful planning. One needs to do a value and WTP study of your client base, study engagement, segment by value, WTP and engagement, and have a good communication and support plan. It is a lot of work but the results can be transformative. Many of our customers are able to increase LTV by 3X to 10X though a combination of higher prices and lower churn.

Sell more of the same thing

In some cases it is possible to sell more of the same thing to the same customers. One can sell more users, support more transactions, help them to complete more value paths.

The best way to do this is through usage based pricing. If usage tracks value (for example, with value path completion) there is generally little pushback, at least at first, and revenues grow naturally as use grows and more value is delivered.

Some of our customers reduce their base price when they layer in a value-based component. They then win this back quickly as usage grows and end up with happier customers and more revenue.

Sell new things

SaaS businesses know their customers and have customer success teams. This puts them in a good position to innovate and create new value streams for their customers that they can monetize. This is the only approach that will grow NDR long term. Every solution eventually gets commoditized and the differentiation value (the value above what is provided by other alternatives) goes down. As differentiation value declines so does pricing power and market pricing takes over. The only way out of this is to use customer understanding to start a new value cycle spinning.

Pricing is a system

Pricing is. more than a number on a price tag, or even the price tag itself. It is a system in which each part of the pricing design interacts with the other parts. Pricing metric, packaging, discounting all connect to value creation, communication and delivery. This is especially clear when pricing to improve NDR. The impact of price changes on revenue per customer, share of wallet, expansion revenue and churn have to be considered together.

Download the NDR Report here

Read other posts on Net Dollar Retention

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

Net Revenue Retention (NDR) impacts the value of your company

Pricing for NDR (Net Dollar Retention) (this post)