From Pricing to Profit: 5 Critical Webinars Every B2B SaaS Leader Must Watch

Liam Hannaford is Marketing Manager of Ibbaka. Connect on LinkedIn

The B2B SaaS Monetization Revolution: Why 75% of Companies Are Fighting Yesterday's War

Time moves differently in the pricing world. What worked yesterday becomes obsolete before you notice the shift. And right now, 75% of B2B SaaS companies are caught in a time warp, clinging to monetization models while the market transforms around them.

At Ibbaka, we've been deep in the trenches of this transformation, hosting critical conversations with industry leaders who are actually winning in 2025. What we discovered challenges everything you think you know about SaaS pricing, particularly the surprising truth about transparency (spoiler: it's more nuanced than the experts predicted).

If you’re looking to unlock the most advanced thinking in AI and SaaS pricing, we’re making our full set of expert webinar decks available by request. Just fill out the quick form at the bottom of this page, and you’ll receive these exclusive resources directly in your inbox. This is critical, practitioner-grade content you won’t find anywhere else—including frameworks, infographics, benchmarks, and strategic guidance from the industry’s top pricing minds: Marcos Rivera, Steven Forth, Michael Mansard, Mark Stiving, and Kyle Poyar.

Time to access the best of the best.

What This Deep-Dive Analysis Reveals

Drawing from 500+ B2B SaaS companies and Kyle Poyar's comprehensive State of B2B Monetization survey, this analysis uncovers:

The transparency paradox that's reshaping buyer expectations

How AI is dismantling traditional user-based pricing models

Why outcome-based pricing is poised for a 400% adoption surge by 2028

The hybrid pricing explosion is driving 21% median growth rates

Why most companies lack the organizational capabilities to adapt

Whether you missed our webinar series or want to revisit the key insights, what follows brings together the most actionable intelligence from five essential sessions. Each finding includes direct pathways to implementation—because understanding the shift isn't enough if you can't execute on it.

Let's explore the data that's redefining the rules and what 2025 really holds for B2B SaaS monetization.

The Transparency Paradox: When Less Becomes More

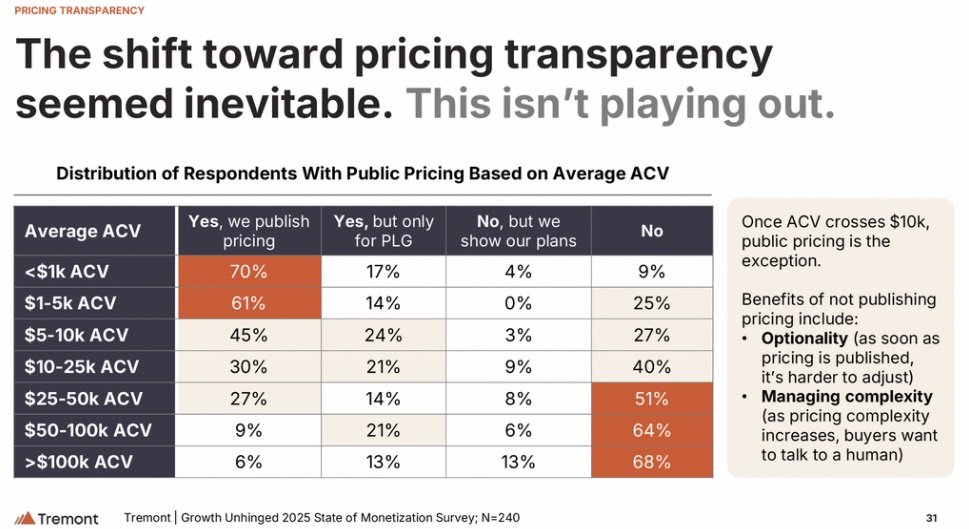

The expectation: 2025 would usher in an era of universal pricing transparency.

The reality: Only 45% of SaaS companies display pricing online, and the reasons reveal a sophisticated strategic calculus.

From Kyle Poyar’s State of Monetization 2025 Survey Report

This isn't about companies being secretive; it's about recognizing that transparency has context. Companies with average contract values below $5,000 and product-led growth strategies embrace open pricing. Enterprise-focused organizations with higher ACVs maintain pricing opacity for strategic reasons:

Pricing Evolution Complexity: AI-focused businesses haven't solidified their models. Publishing creates consistency pressure that limits future agility, particularly critical in rapidly evolving markets.

Hybrid Model Sophistication: As pricing incorporates AI credits, usage tiers, and multiple value metrics, buyers inherently distrust simple website pricing. They prefer human consultation for complex solutions.

Strategic Flexibility Priority: Companies prioritize rapid pricing adaptation over transparency benefits, especially in the AI landscape, where costs and capabilities shift monthly.

The insight? Transparency isn't binary; it's strategic. The companies that thrive understand when to show their cards and when to keep them close.

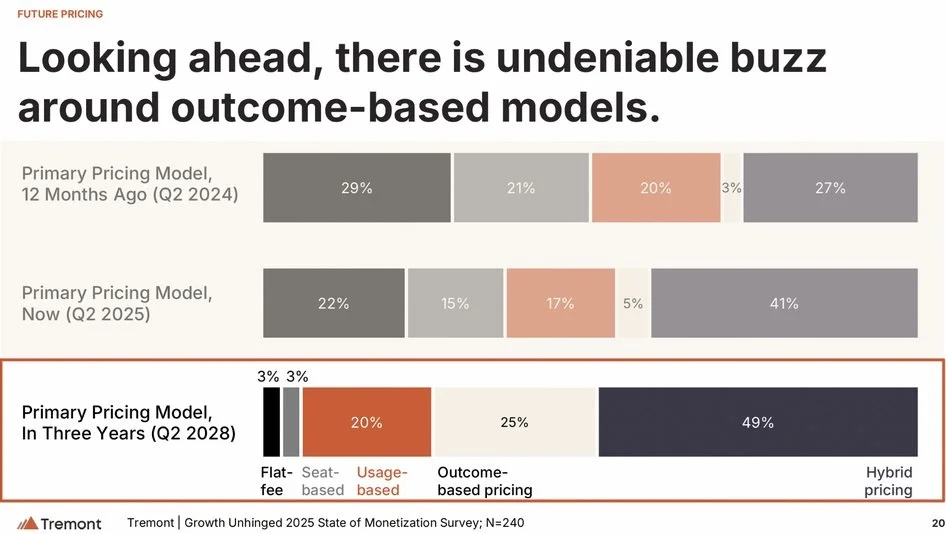

Outcome-Based Pricing: From Holy Grail to Reality

From Kyle Poyar’s State of Monetization 2025 Survey Report

Here's where the data gets exciting: outcome-based pricing adoption is set to increase 400% by 2028. Currently, only 5% use it as their primary model. By 2028, that number jumps to 25%.

But adoption faces the CAMP framework challenge:

Consistency: Can all customers value the same outcomes without contract complexity?

Attribution: Can vendors convince customers they deserve credit for achieved outcomes?

Measurability: Can outcomes be tracked in real-time without customer dependency?

Predictability: Can outcome achievement be forecasted with reasonable accuracy?

Early adopters are pioneering breakthrough approaches:

Work-Based Models: EvenUp and CaseMark charge per completed task

Success-Based Models: AirHelp takes 35% of successful flight compensation claims

Per-Resolution Models: Intercom's Fin AI charges $0.99 per resolved conversation

The pattern is clear: when AI agents function as autonomous workers, outcome-based pricing creates natural value alignment. This isn't theoretical anymore…it's happening.

Building Agile Pricing Functions: The Organizational Imperative

75% of companies are organizationally unprepared for pricing evolution. This creates what we call "pricing no-man's land"—particularly affecting companies in the $5-20M ARR range where pricing ownership falls through organizational cracks.

The Hot Potato Problem follows predictable stages:

Early Stage: CEO/Founder decision-making

Growth Stage: Bounces between Sales, Product, Marketing, Finance, Operations

Scale Stage: Lacks clear ownership, creating strategic blind spots

Modern SaaS companies need pricing functions capable of:

Rapid Market Response: 74% made pricing changes in the past year

Multi-Model Support: Hybrid pricing adoption jumped from 27% to 41%

Real-Time Data Integration: AI-driven models require sophisticated tracking

Successful companies implement:

Dynamic Pricing Systems: AI-powered optimization projected to increase profitability by 30%

Cross-Functional Teams: Dedicated personnel bridging product, sales, and finance

Advanced Billing Infrastructure: Platforms handling hybrid models and outcome measurement

The winners aren't just changing their pricing, they're building organizational capabilities to keep changing.

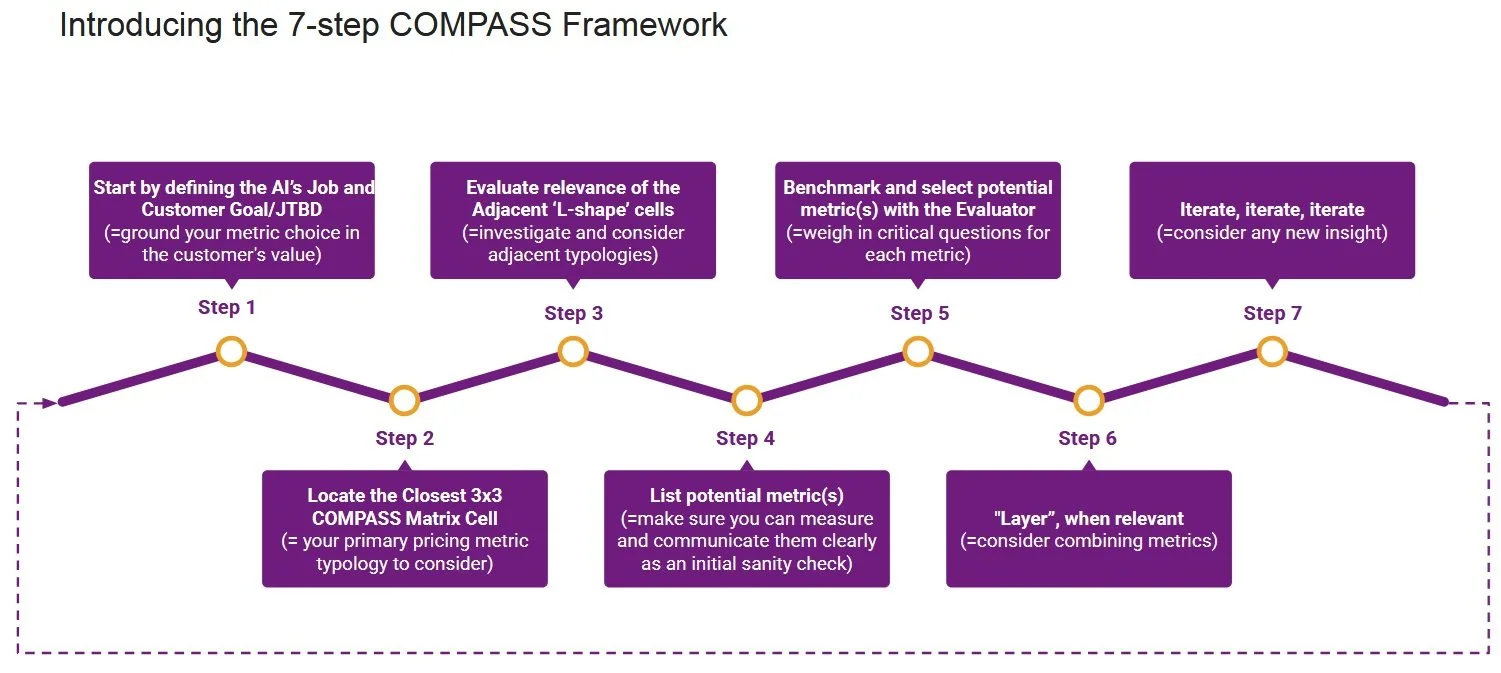

COMPASS: A Practical Framework for Pricing Agentic AI Solutions

The COMPASS framework, co-designed by Michael Mansard of Zuora and Steven Forth of Ibbaka, is rapidly becoming the go-to methodology for navigating the complexity of pricing agentic AI solutions. As outlined in their recent webinar and supporting materials, COMPASS—short for Choice of Optimal Metrics for Pricing Agentic Systems & Solutions—offers a structured, two-part approach to selecting and evaluating pricing metrics that truly align with the value delivered by AI agents.

See Michael Mansard’s latest article (July 2nd, 2025): Agentforce Pricing Under the COMPASS Lens: Why Salesforce’s Step ‘Backward’ is a Smart Move Forward

At its core, the COMPASS framework begins with a 3x3 matrix that maps pricing metric typologies along two critical axes: the scope of the agent’s work (from simple tasks to autonomous goal achievement) and the level of attributability (how directly the agent’s actions can be linked to business outcomes). This matrix helps companies pinpoint whether their optimal pricing metric should be based on agent access, activity, output, or outcomes—each representing a different alignment with value creation and customer expectations. The framework then guides teams through a seven-step process: starting with defining the agent’s job-to-be-done, mapping to the right metric typology, considering adjacent options, listing and benchmarking potential metrics, layering multiple metrics if needed, and iterating as the solution and market evolve.

What sets COMPASS apart is its rigorous Metric Evaluator, a 12-factor scoring system that assesses each candidate metric on dimensions such as value alignment, feasibility, acceptability, attributability, predictability, customer-centricity, and profitability. This ensures that pricing not only reflects the value delivered but is also practical to implement, transparent for buyers, and robust against future market shifts. The result is a pragmatic, evidence-based path for AI vendors to move beyond guesswork and legacy SaaS models—empowering them to monetize innovation while building trust and flexibility into their pricing strategy.

The AI-Driven Value Revolution

Traditional user-based pricing is becoming irrelevant. When Alphabet reports 30% of code is AI-generated, and Microsoft's CTO predicts 95% by 2030, seat-based models make no sense.

The efficiency examples are staggering:

Cursor: $200M ARR with 60 employees—$3M+ per employee

Klarna: ARR per employee increased from $575k to $1M through AI initiatives

The pricing implications: Survey participants cite internal costs and margins as the most important factor when pricing AI capabilities. This represents a shift from pure value-based pricing to cost-plus models as companies grapple with significant AI infrastructure expenses.

The fundamental challenge? Value creation is disconnecting from user count. Companies that solve this first will capture disproportionate market share.

Hybrid Pricing: The Dominant Transition Model

Hybrid pricing has become the fastest-growing model with a 21% median growth rate. Companies exceeding 40% annual growth overwhelmingly prefer hybrid models.

Successful hybrid variations include:

Pay-as-you-go with caps: Buyer peace of mind plus flexible consumption

Platform fee plus usage: Predictable revenue with scalable consumption

Three-part tariff: Base fee with included usage plus additional consumption

Adaptive flat rate: Usage-tier commitment that adjusts at renewal

Why hybrid models succeed:

Minimize Disruption: Layer onto existing subscriptions without an overhaul

Create Upsell Paths: "Try for free" approaches that monetize with growth

Control Margins: Cap usage to prevent unprofitable relationships

Maintain Predictability: Stay within familiar paradigms while adding flexibility

Hybrid isn't just a temporary destination; it's the bridge to outcome-based models.

The Transformation Timeline: What's Coming

2024-2025: Hybrid model dominance as transition mechanism

2025-2028: Gradual shift toward outcome-based models

Beyond 2028: Fully AI-driven dynamic pricing emerges

Key obstacles remain:

Billing System Limitations: 38% lose deals due to inflexible systems

Complexity Management: Sophisticated models require buyer education

Organizational Readiness: Most lack dedicated pricing expertise and tooling

The research reveals a truth we see daily: successful navigation requires both technological infrastructure and organizational capabilities that most companies are still developing.

The Value-Centric Future

While appetite for pricing innovation runs high, execution remains the differentiator. The companies that build agile pricing functions, invest in appropriate technology infrastructure, and develop clear value propositions around their pricing models will capture disproportionate value.

At Ibbaka, we believe the future belongs to companies that understand a fundamental truth: pricing isn't just about capturing value—it's about creating it. The organizations that master this balance will define the next era of B2B SaaS growth.

The transformation is already well underway. The question isn't whether it will happen, it's whether you'll lead it or follow it.

The data shows the path forward.

The question is: are you prepared to take it?