Pricing Predictions for 2026 - the SaaStr, Growth Unhinged, Theory Capital, Ibbaka Mashup

Predictions based on the concept blends

1: The Rise of "Synthetic PLG" (Product-Led Growth)

Traditional PLG relies on human users trying a product. In 2026, the primary "user" trying your software will be an autonomous agent scouting for tools.

2: The "Bifurcated" Sales Organization

Sales teams won't just "shrink" (Lemkin); they will split into two distinct species, eliminating the middle.

3: "Dynamic Value Stacking" as the Foundation for Pricing

Following Steven Forth’s logic, the "Seat" doesn't disappear, but it becomes a "Container that is part of a credit based pricing model." These models will be directly connected to value models.

4: Corporate Branded Content as a "Data Moat"

As Kyle Poyar notes, "Media assets" become critical. In 2026, companies will acquire media/communities not for leads, but for Training Data Exclusivity.

TL;DR (Too Long;Didn’t Read)

Agent-to-agent sales is coming fast: design your product, pricing, and GTM for autonomous buyer agents that discover, evaluate, negotiate, and activate without humans in the loop.

Shift from SEO to AEO: treat ChatGPT-style agents as your new channel, encode your product’s vibe and trust signals so buyer agents choose you in their recommendations and negotiations.

Prepare for synthetic PLG: build “Agent Ports” (API-first, docs-first, sandbox-first) so an agent can sign up, configure, and reach first value in under 30 seconds—or you effectively don’t exist.

Expect bifurcated revenue orgs: consolidate around ops-architects who orchestrate agent swarms and a small bench of elite closers; the generic BDR/AE layer in the middle disappears.

Move to Dynamic Value Stacking: keep a simple access fee to calm CFOs, but layer on compute/complexity/outcome premiums so high-value, high-complexity work is priced to your true margin targets.

Design for disposable interfaces: anticipate just-in-time, task-specific micro-interfaces spun up by agents and priced via micro-transactions instead of static app + annual subscription bundles.

Treat brand as data moat: lock up high-signal content, communities, and proprietary workflows behind authentication so only your own agents can fully “understand” your domain and defend your pricing power.

Watch the early indicators: new “agent-login” standards, agent-priced offers (e.g., per conversation + license hybrids), emerging “revenue architect” roles, and no-crawl/data-use clauses in contracts will signal when it’s time to double down.

90-day action plan: ship one Agent Port, repackage at least one flagship offer with Dynamic Value Stacking, and launch one concrete move to convert your brand data into a monetizable, defensible AI asset.

It is the season of predictions for the coming year. Many people and organizations are sharing what they expect to happen in the coming year.

In this post we borrow from concept blending to compare and combine predictions from four different perspectives.

Jason Lemkin at SaaSr: Top 10 SaaStr AI Predictions for 2026

Tom Tunguz from Theory Ventures: 12 Predictions for 2026

Kyle Poyar: Some unsolicited predictions for 2026

Steven Forth: B2B SaaS and Agentic AI Pricing Predictions for 2026

The valueIQ Pricing Intelligence Agent is now available, give it a try.

We used Perplexity Research to combine and compare these four predictions using the following prompt sequence.

Act as an expert forecaster with expertise in scenario planning, concept blending and strategic foresight.

You have deep expertise in B2B growth strategies, pricing and monetization with a focus on B2B SaaS, business AI and agentic AI and are familiar with value based pricing and value modeling such as Tom Nagle's Economic Value Estimation and Michael Mansard's COMPASS framework.

Your job is to combine and compare the following four predictions for 2026.

Jason Lemkin at SaaSr: Top 10 SaaStr AI Predictions for 2026

Tom Tunguz from Theory Ventures: 12 Predictions for 2026

Kyle Poyar: Some unsolicited predictions for 2026

Steven Forth: B2B SaaS and Agentic AI Pricing Predictions for 2026

1. Analyse each report

2. Use concept blending to combine insights and predictions from each of the four reports

3. Generare new predictions based on your analysis and concept blends

4. Look for early evidence of each of your predictions

5. Identify early indicators that would suggest whether the predictions are actually emerging

You can see the raw output here.

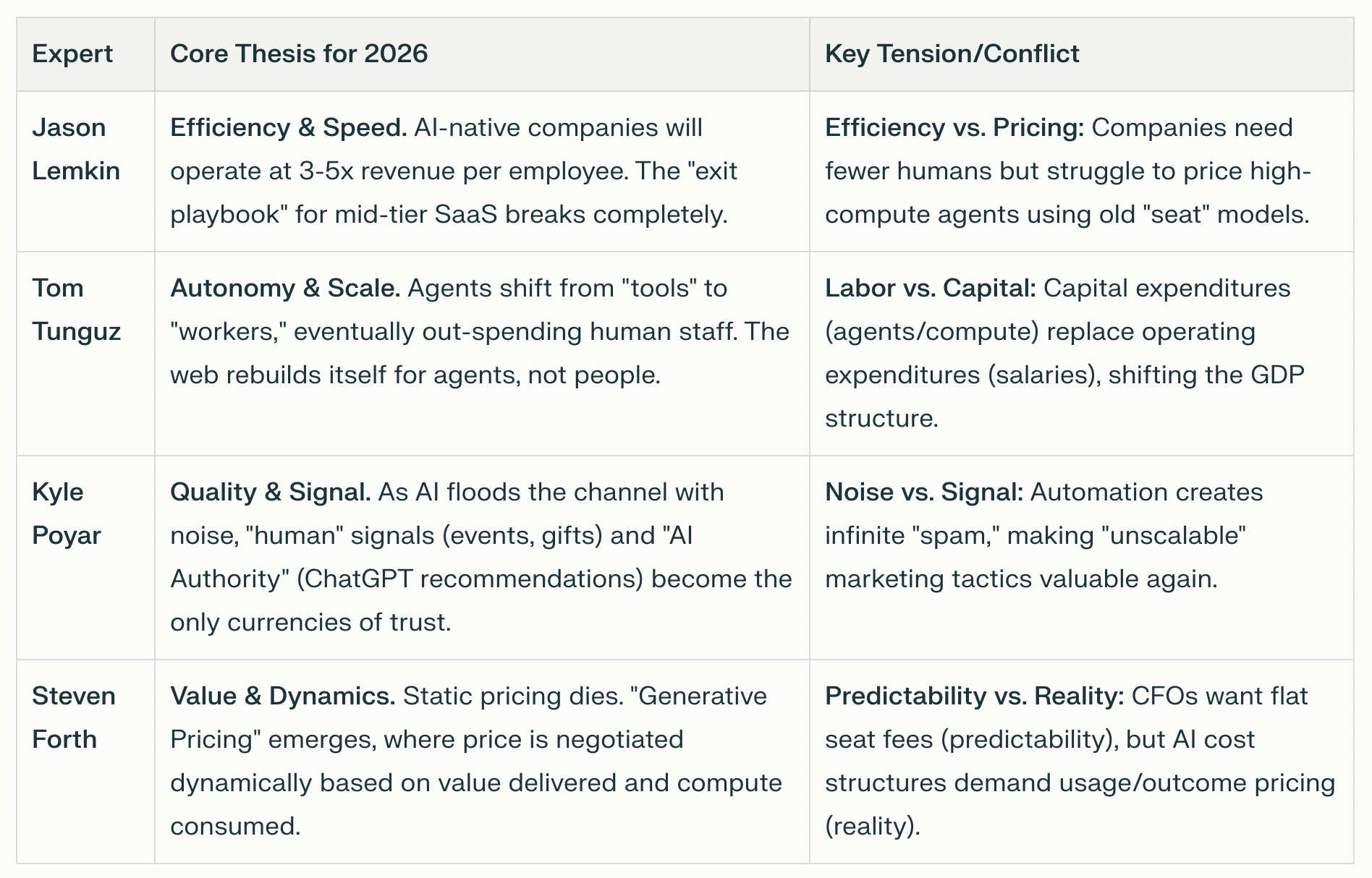

Jason Lemkin (Operational): Focuses on the "P&L of AI," predicting radical efficiency gains (50% smaller sales teams) and the "death of the middle" for SaaS companies that cannot adapt.

Tom Tunguz (Structural): Focuses on the "Plumbing," predicting that AI agents will become the primary labor force (out-earning humans) and necessitating new infrastructure (vector DBs, stablecoins).

Kyle Poyar (Go-to-Market): Focuses on the "Perception," predicting that brand authority will be determined by AI (ChatGPT sentiment) rather than human reviews, forcing a return to high-fidelity marketing (gifting, quality).

Steven Forth (Monetization): Focuses on the "Exchange of Value," predicting a war between legacy seat-based models and dynamic, outcome-based "generative pricing" driven by margin compression.

Comparison of four experts predictions on SaaS, AI and Pricing in 2026, generated Dec. 29, 2025 using Perplexity.

Three concept blends integrating the insights or the four experts

Having understood the four perspectives the AI generated three concept blends.

"Agent-to-Agent" (A2A) Sales Motion

Inputs: Tunguz (Web built for agents) + Poyar (ChatGPT as KPI) + Lemkin (Sales teams shrink).

Synthesis: If sales teams shrink and the web becomes agent-first, B2B sales shifts from "Human convincing Human" to "Seller-Agent convincing Buyer-Agent."

Emergent Insight: Marketing optimization shifts from SEO (Search Engine Optimization) to AEO (Answer Engine Optimization) not just for visibility, but for negotiation. Your product’s "Vibe" (Lemkin) must be encoded so that a procurement agent trusts it enough to execute a contract without a human in the loop.

"Just-in-Time" Software Interface

Inputs: Lemkin ("Vibe coding" internal apps) + Forth (Generative pricing/bundling).

Synthesis: "Apps" as static collections of menus disappear. Instead, interfaces are generated on the fly ("vibe coded") for the specific task, and priced dynamically for that specific session.

Emergent Insight: The "Disposable App." Corporate software becomes a fluid stream of micro-interfaces generated by agents for single-use workflows, priced via micro-transactions (Tunguz’s stablecoins) rather than annual subscriptions.

"Outcome Arbitrage"

Inputs: Forth (Margin compression/Pricing models) + Tunguz (Agents out-earn humans).

Synthesis: If margins compress due to inference costs, but agents do the work of expensive humans, the profit pool moves to the liability layer.

Emergent Insight: Pricing shifts to "Risk-Adjusted Outcomes." You don't pay for the agent; you pay for the insurance that the agent's work is correct. The premium SaaS pricing tier in 2026 is an indemnity clause.

New predictions based on the three concept blends

We can now combine this work to generate some new predictions.

1: The Rise of "Synthetic PLG" (Product-Led Growth)

Traditional PLG relies on human users trying a product. In 2026, the primary "user" trying your software will be an autonomous agent scouting for tools.

The Shift: SaaS companies will build "Agent Ports"—API-first entry points designed specifically for autonomous buyers (Tunguz’s agent-first web).

The Metric: "Agent Activation Rate" replaces "User Activation Rate." If an OpenAI operator cannot autonomously sign up, configure, and derive value from your tool in <30 seconds, you are invisible to the market.

2: The "Bifurcated" Sales Organization

Sales teams won't just "shrink" (Lemkin); they will split into two distinct species, eliminating the middle:

The Ops-Architects: 80% of the team. Technical resources who manage the agent swarm, optimize prompts, and debug sales logic. (Low EQ, High IQ).

The Closers: 20% of the team. Hyper-specialized humans sent in only for the "Last Mile" of 7-figure deals to provide the emotional reassurance (Poyar’s "gifting/empathy") that agents cannot simulate.

Result: The "Average BDR/AE" role ceases to exist.

3: "Dynamic Value Stacking" Pricing

Following Steven Forth’s logic, the "Seat" doesn't disappear, but it becomes a "Container."

The Model: Companies will charge a low "Access Fee" (Seat) to satisfy CFO predictability, stacked with a volatile "Compute/Outcome Premium."

The Mechanism: Similar to Uber Surge pricing, B2B tools will have "Complexity Surcharges." Ask the AI to write a tweet? Free. Ask it to re-architect a database schema? $50 one-time fee. This aligns revenue with the 70% gross margin targets Lemkin identifies.

4: Corporate Brand as a "Data Moat"

As Kyle Poyar notes, "Media assets" become critical. In 2026, companies will acquire media/communities not for leads, but for Training Data Exclusivity.

The Strategy: To prevent competitors’ agents from understanding your niche deeps, you will "close the garden." High-value content (proprietary methodologies, community discussions) will be moved behind login walls to prevent LLMs from training on them, making your proprietary agent the only one capable of answering domain-specific questions (AEO Defense).

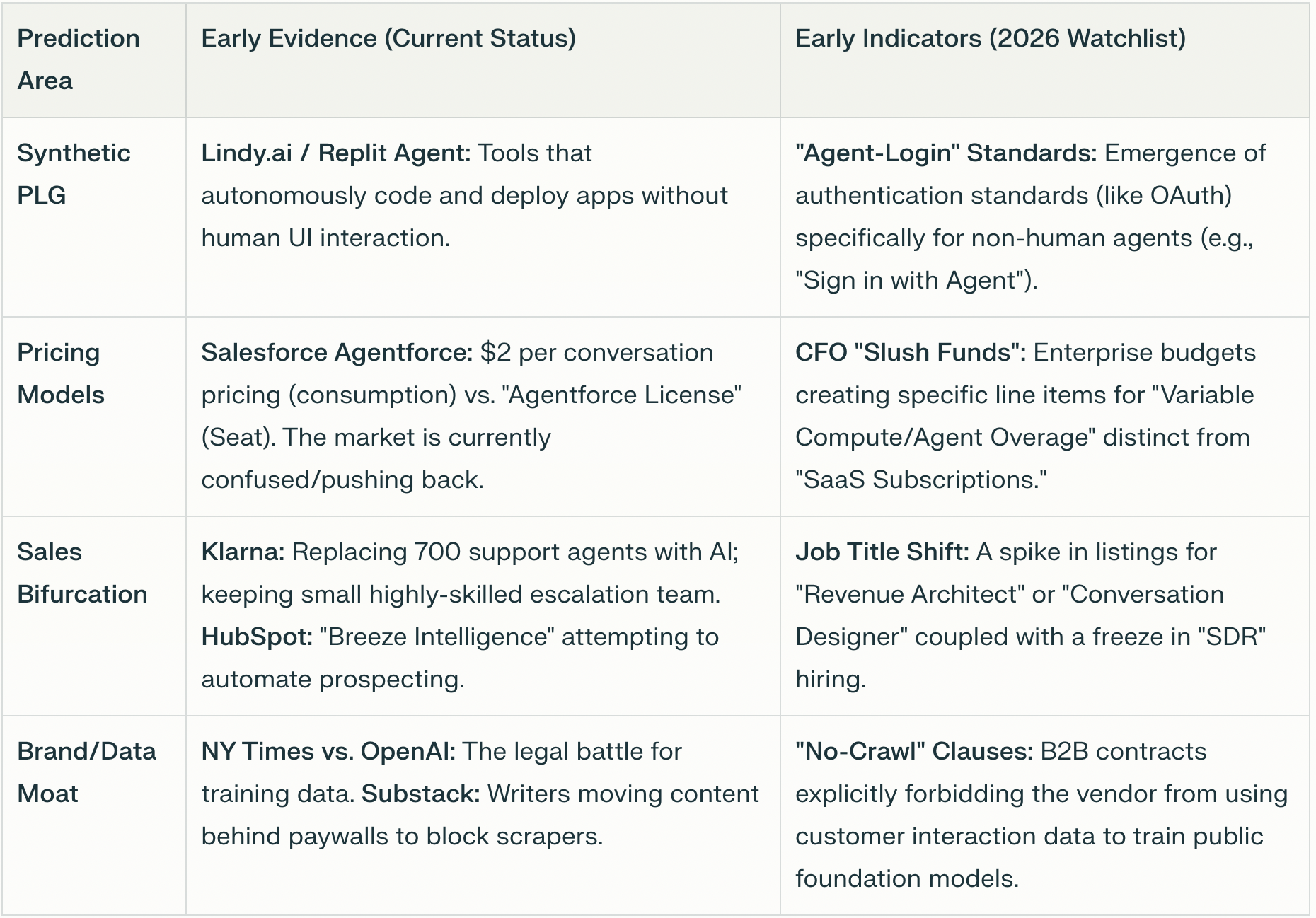

Early Evidence & Indicators (Watchlist)

Which of these predictions will come true? The advantage will go to the person or organization that recognizes real trends early and acts. Here is a cheat sheet to help you do this.

Early indicators for the predictions.

Conclusions

The executives who win this cycle will treat these predictions as a product and pricing roadmap, not a thought exercise. The shift to agent-to-agent sales, disposable interfaces, and risk-adjusted outcomes is already visible at the edges of the market; waiting for mainstream proof is choosing to be priced by others’ rules.

Over the next 90 days:

Stand up at least one Agent Port where an autonomous buyer can trial, configure, and activate your product without human help.

Redesign one flagship offer around Dynamic Value Stacking—an access fee plus a compute or outcome premium tied to value.

Launch one concrete move to turn your brand into a data moat: lock high-value content, structure proprietary data, and start training a domain agent that only your customers can access.

Pricing is about to become your sharpest strategic weapon or your biggest constraint. Choose a bet, instrument it with early indicators from this watchlist, and move before your competitors’ agents decide your value for you.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com