Insights from the Ibbaka workshop at the Professional Pricing Society Spring 2021 Conference

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Karen Chiang and Steven Forth gave a two day workshop on how to apply the strategic choice cascade to pricing choices at the Professional Pricing Society Spring 2021 Conference.

This framework was developed by Roger Martin, who has made many contributions to strategy, design thinking, and the interplay of strategy and society. Ibbaka uses this framework in many ways, from talent strategy to how to think through your pricing choices.

Pricing strategy is part of overall business strategy. The strategic choice cascade is a compelling way to both think through pricing strategy and to align pricing with other dimensions of strategy.

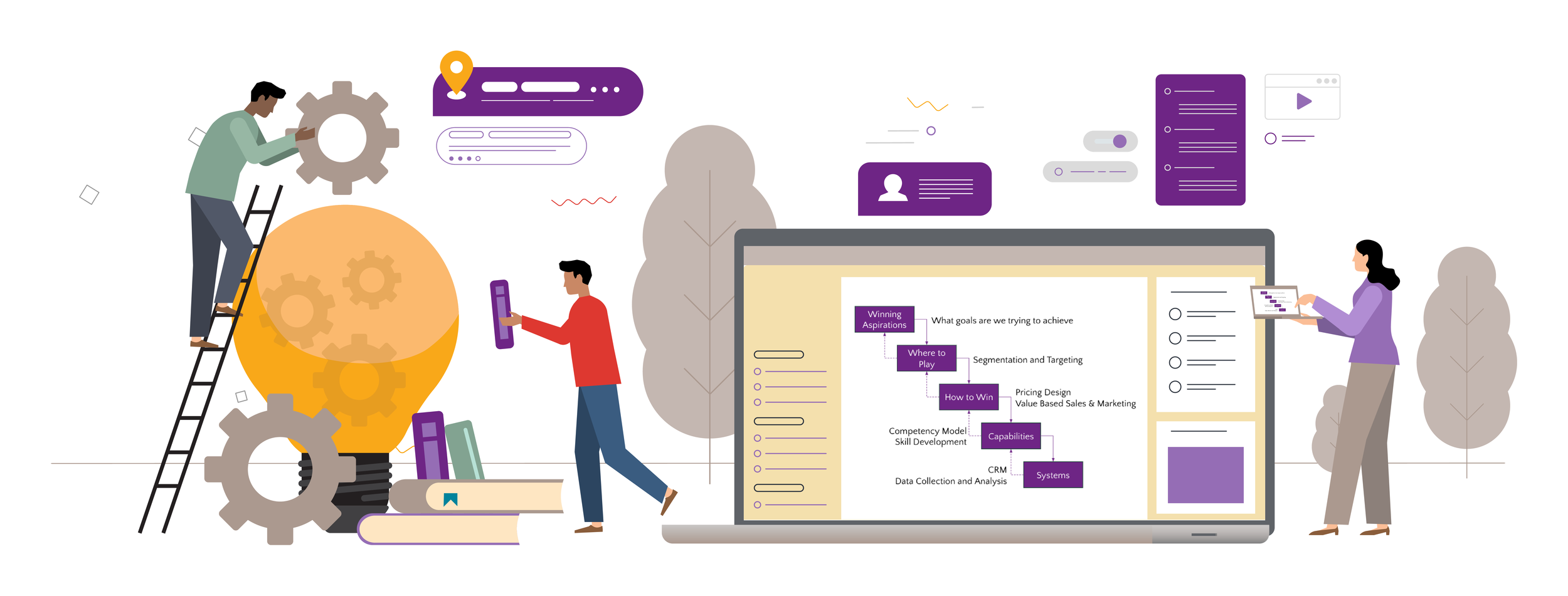

This is how we focus the strategic price cascade on pricing.

The Ibbaka Strategic Choice Cascade for Pricing

The workshop included a case study in which we separated into two breakout groups to make a series of strategic pricing choices for a fictional company looking to monetize data. These breakout sessions worked well, even in a virtual environment, and provoked many discussions and insights. We would like to share some of these with you here.

The case study featured a precision agriculture company that as part of its business gathers a large amount of data from farms. The board had directed the management team to investigate the possibility of finding new ways to monetize this data.

Each group acted as the other groups ‘board’ and was able to ask them questions about their choices (in practice, we only had time to play this out for the Winning Aspirations choice, but it was a good design feature of the case study).

Karen and I had hoped that each group would make different choices, to show how the choice to do one thing is also a choice not to do another. Cascade is in the title for a reason. Strategic choice-making is about making real commitments.

Here is a much-abbreviated summary of the choices made by each group.

Winning Aspirations

Group one chose the following Winning Aspiration.

Diversify revenue streams

Group two made a very different choice.

Deliver more value to farmers and their communities

From these two different choices flowed very different strategies.

Where to Play

Group one then analyzed the value chain for the agricultural industry. They divided the value chain into three large links.

Upstream providers of inputs into farming

Downstream traders, logistics companies, distributors and retailers

Horizontal providers of financing, insurance, data (a missing link) and consulting across the value chain

The where to play choice was to focus on the upstream providers of inputs. This choice opened some interesting How to Win pricing choices.

Sell data to upstream input providers

Group two focussed on the farms where the company already has a presence and relationships. The Where to Play choice was to sell aggregated data (aggregated across farms) to owner-operated farms. These farms do not have as much data of their own as the massive industrial farms, puting them at a disadvantage. The new offer is meant to help to level the playing field.

Sell data to small-to-mid sized owner-operated farms

How to Win

The How to Win choices in pricing are focused on value communication, delivery, documentation, and capture (the value cycle). This group asked how to price the data. This was one of the most interesting parts of the session. The group moved on rapidly from per-user or per farm-based pricing metrics (a pricing metric is the unit of consumption for which a customer pays). Usage-based pricing was considered but it was too difficult to connect this pricing metric to a value metric (the unit of consumption by which a customer gets value). The key insight was that this data would allow upstream producers to innovate on their own pricing models and thereby capture more of the new value they would create.

The principle that the company that can best understand and manage risk should take on that risk in return for higher prices. See Risk Discounts and Usage-Based Pricing.

Enable new pricing models for upstream providers that help them capture more of the new value they are creating.

This is an interesting and innovative strategy, but there would be many practical details to work out.

Group two went deep into the emotional, community, and economic value drivers for its target market. Understanding value is the axle on which the value cycle turns. They defined a number of value metrics and then decided to capture these as in an outcomes-based pricing metric around improvements to crop yield and quality.

Use outcomes based pricing. Price the data based on its contribution to crop yield and quality.

It is interesting that both groups came up with some form of outcomes-based pricing. There is no doubt that outcome-based pricing is the future of pricing. To get to that future will require enormous amounts of data and Judea Pearl style analysis of causality. The current data explosion is beginning to open that future.

Capabilities

In pricing work, there are two key questions to ask about capabilities.

What new skills does the vendor need to create, communicate, document, and capture the value?

What new skills does the buyer need to recognize the need, understand the solution, and then adopt the solution to get value?

Pricing, value, and capabilities are tightly linked.

One participant made the important point that in today’s world, capabilities mean more than just human skills. Capabilities are a bundle of human skills, artificial intelligence, processes, and material supports.

Group one focussed on three new capabilities.

The ability of the vendor to sell to a new set of customers

The ability of the customers to design and execute on new pricing models

The need on both sides for more data scientists and analysts

Group two focussed on the new skills that would be needed by the farmers and how the company would support this. The skills needs of the customers would catalyze the need for new skills on the part of the vendor, which would have to develop new capabilities to train its customers.

Invest in the capabilities of the farmers

Improve data analysis and predictive analysis capabilities

One of the principles of the strategic choice cascade is that it flows in both directions. Each choice informs the one below it. But the ability to execute on each lower level choice constrains the ones above it. So as one moves down the strategic choice cascade one has to constantly test back up to make sure that the higher-level choice is achievable.

A good way to test choices is to ask of each choice ‘what needs to be true for this to be a good choice?

In this case study, we did not have time to work back up the cascade. Had we done so, different choices might have emerged,

Systems

Capabilities are often enabled by systems and these data many of these systems are built on software or as Internet of Things applications. In this workshop, we ran out of time before we got down to this level.

It is worth emphasizing that systems are at the bottom of the cascade. Do not make final choices on what systems to use until you have worked up and down the cascade in both directions a few times.

Systems are mean to enable the capabilities that support strategy, not to constrain them. Do not let your systems dictate your strategy or limit your capabilities.

Read other posts in the Strategic Choice Cascade for Pricing series

Winning Aspirations - What pricing goals are we trying to achieve

Where to Play - Making Pricing Choices to Define your Market

Systems in the Strategic Choice Cascade - Tools and applications used to across the value cycle