Four perspectives on credit based pricing for AI agents

Steven Forth is a principle at Ibbaka and valueIQ.ai. Connect on LinkedIn

Credit based pricing is the trending topic in pricing and monetization of AI agents.

And agents are the fastest growing approach to packaging new AI functionality and taking it to market.

On October 16th, Ibbaka will host Brandon Hickie, Senior Director of Monetization Strategy at LinkedIn and a Venture Partner at Companyon Ventures, for a deep dive into credit models.

We will go into the critical questions that agent monetization teams are asking.

What is an agent?

What is credit based pricing?

Why the move to credit based pricing for agents?

Who is doing a great job?

What to worry about when designing credit based pricing for agents

What can go wrong?

Will credits extend across companies?

Directions for the agent economy (what might happen next)?

To help people wrap their heads around credit based pricing, here are 4 key articles plus a series of case studies.

Why Everyone’s Switching to AI Credits - Kyle Poyar on Growth Unhinged

2025 Playbook for Pricing AI Agents - Chargebee

2025 Field Report from Leading SaaS Teams - Metronome

Here is a summary of the key points.

table

Insights

Credit-based models are spreading rapidly, with most companies using credits as a bridge strategy before moving to clearer, more value-aligned pricing.

Customers prefer output or outcome-based credits (easy to forecast) over raw consumption units like tokens.

Unpredictable costs and lack of transparency are leading obstacles, so clear dashboards and detailed usage metering are strongly recommended.

Successful vendors combine credits with other axes (subscriptions, features) and enable sales teams with strong value narratives.

Case studies bring these into focus the key motivators, opportunities, and challenges for credit based pricing.

Salesforce Agentforce Flex Credits: Overcoming the "Conversation Problem"

The Challenge: Salesforce originally charged $2 per conversation for Agentforce, but customers complained that complex conversations involving multiple actions created unpredictable costs and poor value alignment.

The Solution: In May 2025, Salesforce introduced Flex Credits at $0.10 per action (20 credits), sold in packs of 100,000 credits for $500.

Key Design Principles Applied:

Output-based pricing: Credits are consumed only when agents complete actual work, like updating records or resolving cases

Transparency: Digital Wallet provides detailed usage analytics and forecasting tools

Baseline inclusion: Enterprise customers get 100,000 credits free with Salesforce Foundations

Results: The shift reduced barriers to AI adoption while directly tying costs to business outcomes. Most use cases now cost 10-30 cents per interaction versus the previous $2 flat rate.

Cursor: A Cautionary Tale of Poor Communication

The Problem: In June 2025, Cursor transitioned from 500 fast requests per month to $20 worth of API credits without clear communication to users.

What Went Wrong:

Lack of transparency: Users discovered the change only after hitting unexpected usage limits

No predictability tools: No way for users to estimate credit consumption before taking actions

Poor change management: Conflicting messaging across blog posts and pricing pages

User Backlash: Heavy users of models like Claude Opus ran out of credits within days, leading to surprise overage charges and widespread complaints on social media.

The Recovery: CEO Michael Truell issued a public apology and offered refunds, acknowledging "we didn't handle this pricing rollout well".

Lessons Learned: This case perfectly illustrates the importance of transparent communication and predictability tools highlighted in all four reports.

Clay: Multi-Axis Hybrid Model Success

Implementation: Clay combines subscription tiers with credit-based usage, where credits cost $16-75 per 1,000 depending on the plan level.

Design Features:

Baseline credits included: Each plan includes monthly credit allowances (2,000 to 50,000+)

Credit rollover: Unused credits roll over to prevent "use it or lose it" frustration

Transparent pricing: Clear credit costs for each action (1-25 credits depending on data complexity)

Multi-axis pricing: Combines feature access (subscription tiers) with usage (credits)

Results: Clay successfully scales from small teams to enterprise customers while maintaining predictable costs and flexible usage patterns.

HubSpot Breeze: Expanding Access Through Credits

Strategic Approach: HubSpot introduced credit-based pricing for Breeze Customer Agent in June 2025, expanding access from Service Hub to all Pro/Enterprise customers.

Design Elements:

Included baseline: 3,000 credits/month for Pro, 5,000 for Enterprise customers

Clear value proposition: Credits tied to specific customer interactions and data enrichment actions

Predictable scaling: Additional credits available at $10 per 1,000 credits

Strategic Value: HubSpot used credits as a way to expand AI adoption across its customer base while maintaining usage-based revenue alignment.

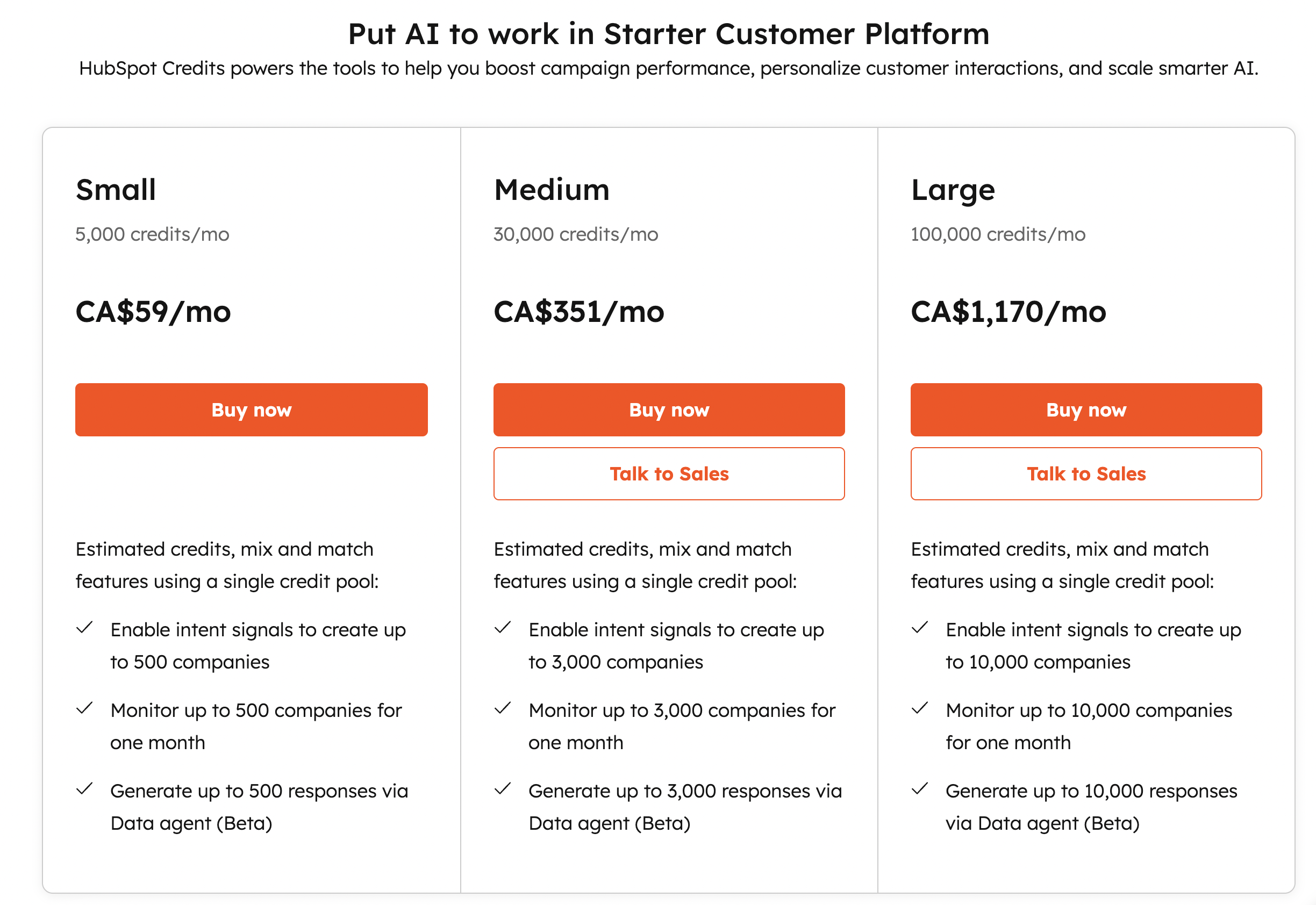

HubSpot AI Credit Packages

Note that the pricing curve across packages is convex, suggesting that HubSpot believes most of its opportunities are with small and medium sized companies, but that the price per credit is basically flat across packages at about $0.008 per credit or $8,700 per million credits. Compare this to OpenAI’s price of $1.25 per million input credits and $10.00 for one million output credits. HubSpot needs to create several orders of magnitude of value above what one could get from making API calls to GPT5.

Replit Agent: Checkpoint-Based Innovation

Unique Approach: Replit pioneered "checkpoint-based" pricing, where credits are consumed only when agents complete meaningful work milestones.

Evolution: Originally $0.25 per checkpoint, Replit shifted to "effort-based pricing" where simple tasks cost less than $0.25 and complex tasks may cost more, but align with actual computational effort.

Key Features:

Outcome-based: Users only pay for completed functionality, not thinking or processing time

Transparent controls: Users can choose "high power" or "extended thinking" modes with clear cost implications

Monthly credits: Core subscriptions include $25/month in credits (~100 checkpoints)

OpenAI Enterprise: The Credit Migration

Strategic Shift: OpenAI moved from fixed enterprise pricing to credit-based models for ChatGPT Enterprise, allowing businesses to scale spending based on actual usage.

Implementation:

Flexible pricing: Credits can be used across different OpenAI services and models

Volume incentives: Long-term contracts receive 10-20% discounts on credit purchases

Model differentiation: Different models consume different credit amounts based on computational complexity

Key Themes

These case studies validate the four reports' main findings:

Transparency is Critical: Cursor's failure demonstrates the importance of clear communication and usage visibility that all reports emphasized.

Output-Based Pricing Works Better: Salesforce's success with action-based credits versus conversation-based pricing supports the shift toward outcome-based models.

Hybrid Models Dominate: Clay, HubSpot, and others successfully combine credits with other pricing axes, confirming the hybrid approach recommended across reports.

Baseline Inclusion Reduces Friction: All successful implementations include baseline credits to enable habit formation, as recommended in Growth Unhinged.

Predictability Trumps Precision: Companies that provide clear usage forecasting and spend controls see better adoption than those focused purely on cost-plus models.

These real-world examples demonstrate both the potential and pitfalls of credit-based pricing, reinforcing the strategic guidance provided in the four analyzed reports.

Key Lessons Learned from Credit-Based Pricing Case Studies

Based on the comprehensive analysis of case studies and research, several critical lessons emerge for companies implementing credit-based pricing for AI agents:

Communication and Transparency Are Make-or-Break

The Cursor debacle provides the most instructive failure case. Their transition from unlimited usage to credit limits caused massive user backlash, not because the model was inherently flawed, but because of catastrophic communication failures:

Lesson: Never surprise customers with pricing changes. Cursor users discovered new limits only after hitting unexpected usage walls

Implementation: Provide 30-60 day advance notice, clear migration paths, and transparent usage dashboards before any pricing model shifts

Trust factor: As one expert noted, "credit-based pricing sounds great on paper...but the execution is almost always messy, unpredictable, and (if you're not suuuper careful) a trust killer"

Predictability Trumps Precision

Multiple case studies reveal that customer anxiety over unpredictable costs is the primary barrier to credit adoption:

Salesforce's success came from providing clear action-based pricing ($0.10 per completed task) rather than complex conversation-based models

Clay's hybrid approach works because users know exactly what each action costs (1-25 credits) with transparent pricing tiers

Lesson: Customers prefer slightly higher but predictable costs over complex, variable pricing that creates budget uncertainty

Baseline Credits Reduce Adoption Friction

Every successful implementation includes meaningful credit allowances in base plans:

HubSpot provides 3,000-5,000 credits monthly in Pro/Enterprise plans

Salesforce includes 100,000 credits free with Salesforce Foundations

Clay bundles 2,000-50,000+ credits depending on tier

Lesson: The "batteries included" approach prevents users from feeling nickel-and-dimed during their first month of usage

Output-Based Pricing Outperforms Cost-Plus Models

Companies that tie credits to successful outcomes rather than raw computational costs see better adoption:

Replit's checkpoint model charges only for completed work milestones, not processing time

Salesforce Agentforce credits are consumed only when agents complete actual business actions

Lesson: Customers care about results delivered, not your underlying infrastructure costs. Value-based credit pricing builds stronger customer relationships than pass-through LLM costs

Multi-Axis Pricing Prevents Commoditization

Pure credit models risk becoming commoditized, leading to margin pressure:

Clay's success combines subscription tiers (features) with credits (usage), preventing direct price comparison

HubSpot uses credits as expansion revenue on top of existing subscription relationships

Lesson: Successful companies layer credits onto other value drivers (features, seats, enterprise capabilities) rather than making credits the sole pricing axis

Real-Time Usage Visibility Is Table Stakes

B2B customers increasingly demand transparent usage tracking:

Salesforce Digital Wallet provides detailed credit consumption analytics and forecasting

Clay offers clear credit cost visibility before actions are taken

Cursor's failure partially stemmed from users having no visibility into credit consumption patterns

Lesson: Credit dashboards, usage alerts, and spend forecasting tools are not nice-to-haves but essential features for enterprise adoption

Credit Rollover and Flexibility Drive Retention

Several companies discovered that unused credit policies significantly impact customer behavior:

Credit rollover reduces hoarding behavior and increases actual product usage rather than conservation

Annual vs. monthly limits give customers more flexibility to adapt to seasonal usage patterns

Lesson: Punitive credit expiration policies create negative customer experiences and reduce platform engagement

Sales Enablement Requires New Playbooks

Credit-based models create unique challenges for go-to-market teams:

Complex ROI calculations: Sales teams must help customers forecast credit consumption and business value

New objection handling: Common concerns include "how do we budget for this?" and "what happens if we run out mid-month?"

Lesson: Successful implementations require extensive sales training, customer success playbooks, and clear value narrative frameworks

Infrastructure Complexity Is Often Underestimated

The operational challenges of credit-based pricing extend far beyond pricing strategy:

Real-time metering: Requires robust data pipelines to track billions of usage events

Complex billing rules: Credit rollovers, volume discounts, and custom enterprise terms create intricate billing logic

Integration challenges: Credits must integrate seamlessly with existing CRM, CPQ, and ERP systems

Lesson: Technical infrastructure investment often exceeds initial expectations. Plan for 6-12 month implementation timelines for enterprise-ready credit systems

Market Education Takes Time

Even successful implementations face adoption curves:

OpenAI and Salesforce are doing the "heavy lifting" of market education, making it easier for smaller companies to adopt similar models

Customer procurement teams remain skeptical of unpredictable spending models

Lesson: Credit-based pricing adoption accelerates when industry leaders validate the model, but early movers should expect longer sales cycles and more customer education requirements

Framework for Success

The most successful companies treat credit-based pricing as a bridge strategy rather than an end state:

Start simple: Begin with output-based credits tied to clear customer value

Invest in transparency: Build robust usage dashboards and forecasting tools

Layer value: Combine credits with other pricing axes to avoid commoditization

Plan for evolution: Design systems that can adapt as AI costs and capabilities change

Focus on outcomes: Tie credit consumption to successful customer outcomes rather than computational costs

These lessons reveal that while credit-based pricing offers significant strategic advantages for AI companies, successful implementation requires careful attention to customer psychology, operational complexity, and market dynamics.

Companies that master these elements can achieve both sustainable unit economics and strong customer relationships, while those that ignore these lessons risk damaging customer trust and market position.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com