Growth Models to Drive your Company's Performance to Best Capture Revenue

Karen Chiang is a Managing Partner at Ibbaka. See her Skill Profile on Ibbaka Talio.

Which growth model will drive your company's performance to best capture revenues?

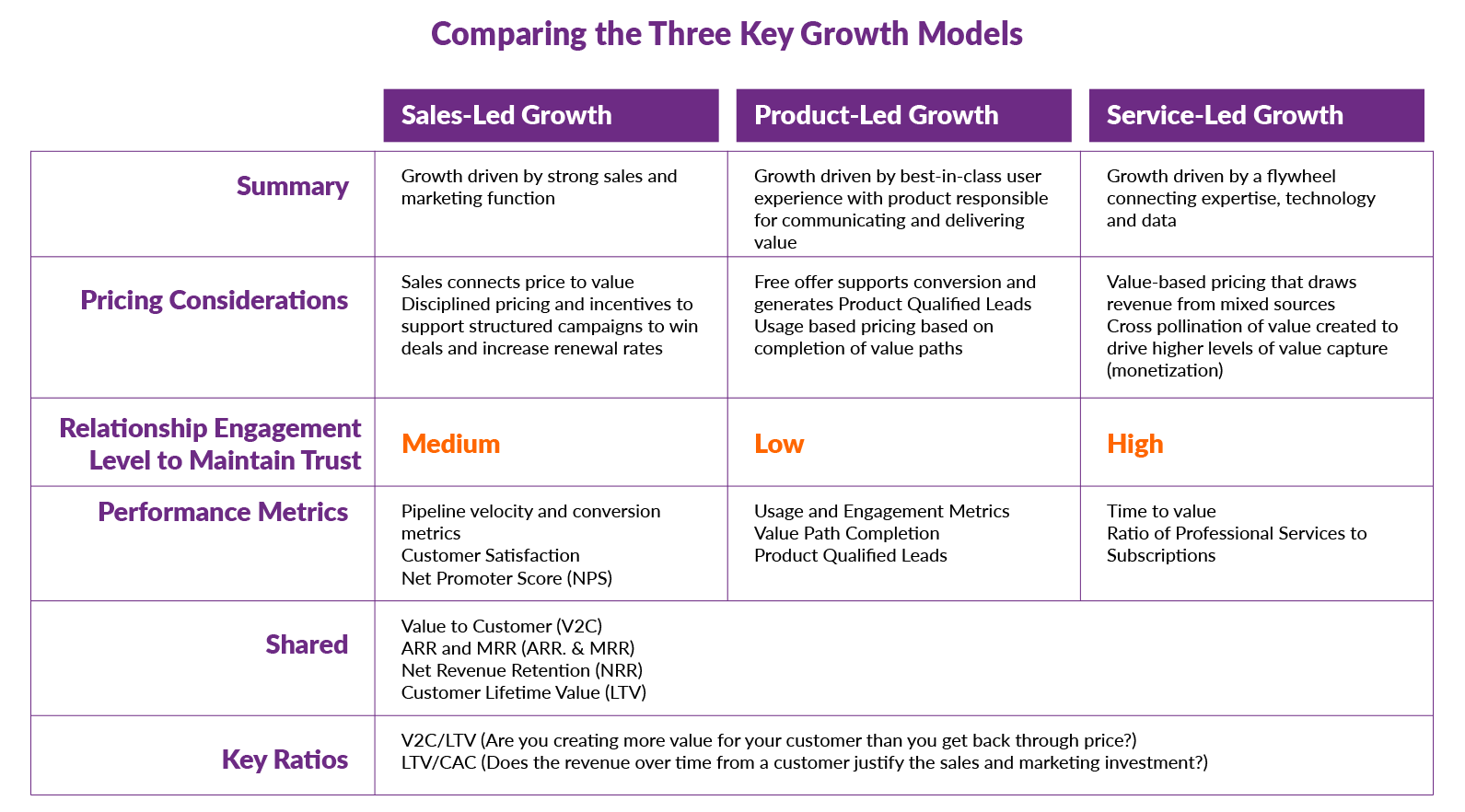

In this post, I will cover the 3 most common growth models. These are sales-led growth, product-led growth and service led-growth. All 3 have a role to play. With this overview, I give insight to the model that is appropriate for your business as you think about accelerating growth. Of course, I will also share my thoughts on pricing considerations for each of the models.

All businesses are tasked with driving growth and need to track key financial performance metrics that matter. This is even more so for businesses who are benefiting with funds from investors. I can certainly understand the pressures faced by CEOs to consider a product-led growth strategy. Heck, I admit to considering this path for Ibbaka as well. For many who hold a C-suite position, it is a constant to understand, analyze, and then execute on the strategic choices we make. Learn more about metrics within the service-led growth model.

Given the current economic conditions, as well as the necessary transformations (digital, business model, human capital, for example) that are taking place today, I’m certain private equity and VC firms are constantly reviewing their portfolio companies to think of ways that can elevate their business performance and returns. Businesses should be mapping growth strategies to how value is being delivered (the offerings and packages), to whom value is delivered to (the prioritized segments and ideal customer profiles), and how to capture a fair part of the value created (price).

Let’s dive deeper into each of these growth models. For this first post of this series, I hope to give a clear definition of the three most common models firms operating in the B2B technology and innovation space need to consider.

Sales-Led Growth to incentivize sales and deal closure

In one of our previous polls, the sales-led growth model was chosen as the most common and preferred growth strategy. This model is dependent on the sales team leading the charge to drive revenues. As such, revenue is based on the sales team’s ability to drive pipeline and progress deals to closure. The key metrics are size of pipeline, pipeline velocity, and win-rate. Heavy investments are made in building out a sales organization. One could argue that sales-led growth is the foremost traditional model that businesses have been built upon. It is not surprising that a sales-led growth model is often used to support other growth strategies. For example, certain types of product-led growth companies will include some form of sales-led growth, especially to capture higher deal sized contracts.

With a sales-led growth model, pricing will need to support sales campaigns and implement clear structural incentives (sometimes known as ‘discounts’). These incentives should only be applied with defined disciplined criteria that will encourage behaviors (around commitments such as accelerated purchasing, extended contract terms, greater spend over time, and/or referrals) that will generate greater revenue flow.

Product-Led Growth for higher LTV/CAC ratios

The product-led growth model has a high prominence nowadays since it can have a big impact on many of the key metrics that PE (private equity) investors are looking to improve. Product-led growth companies tend to have a high ratio of Lifetime Customer Value to Customer Acquisition Costs (LTV/CAC). The vision is to have an extremely scalable level of growth without having to invest in large sales and delivery teams.

This model focuses on having the product itself drive sales and adoption. To win, one must provide an exceptional user experience across the customer journey. Mapping value to prioritized segments to get the right package offer with an associated price is the key to success. Time to value is expected to be very short. Often, at least one value path needs to be completed in a free or trial version. Sales is product driven, low touch, self-serve.

The aim of the pricing strategy in this scenario is to recognize the distinct value delivered by each package. At the center of this, is having a value metric mapped to price that can scale with the value generated for the customer. The product also needs to track the data needed to generate insights that will inform usage on how customers derive value. Another key characteristic is that use of the platform itself acts as a marketing engine to draw adoption by those invited to interact with and consume content provided by the platform.

When considering pricing for product-led growth, a top priority is reducing any barriers to adoption. As such, the de facto pricing architecture often defaults to good, better, best. The aim is to have users of your product quickly identify and self-select which package makes the most sense for them to use. We also typically see some sort of free offer. I tend to be skeptical about the concept of free. Despite the label of “freemium” there is still an exchange of value. This may not be in the form of a dollar exchange (monetization). Rather, it may be in the form of data or input that brings value to the paying users of the system. Or, the exchange may be something that can help generate greater chances of monetization. In designing for “free,” let’s be sure of what value we are generating. Also, you will need to consider whether the “free” offer should be time bound or perpetual based on the behavior you are trying to encourage. Where companies stumble, is not designing trigger points that will enforce their customers need to move from one tier to the next.

LinkedIn is a classic example of where its freemium offer is the launchpad to monetization. Anyone can create a LinkedIn profile for free. For the person creating this free profile we are actually providing value to LinkedIn in the form of providing information about ourselves. This data is highly valuable: there is information about who we are in terms of the role we play in our companies, the industry we work in, connections to our peer groups, the skills we use in our jobs, and much more. The greater number of profiles that are part of the LinkedIn community, the better LinkedIn can create value for its paid subscribers. As a professional network that has access to the data mentioned above, LinkedIn can support different buyer types. One of these buyer types is the sales professional. They are willing to pay for LinkedIn to help them target the right people and companies to talk to. Sales professionals can use LinkedIn to track individual interests, relationships and company changes, making it easier to shape the context of the sales conversation. Also, it provides a permission-based community to reach out and prospect.

Aside from the data that LinkedIn gleans from our usage, LinkedIn has essentially enticed us professionals to use the platform as our go-to calling card. As users of the system, we have become advocates and promoters of LinkedIn enabling the viral loop of adoption. Each time we share our profile with others, post a blog, invite people to join our LinkedIn groups or utilize features of LinkedIn, we encourage and promote usage and consumption of the data and information provided. You can see the cleverness of how LinkedIn has mapped value to its products and to how it charges for value delivered.

Join our Service-Led Growth group and be part of our LinkedIn community

Service-Led Growth for higher sustainable predictable revenue growth

I’d like to spend the remainder of this post focused on the service-led growth model. Having served the B2B technology space for the majority of my career, I’ve observed that product-led growth, while tempting, is not for all. Product-led growth is best for simple point solutions that solve one well-defined problem. This describes only a subset of business problems. I personally believe that there is potential for the service-led growth model to disrupt how companies with the right mix of resources (services, technology, and data) to drive greater growth metrics than their product or sales-led growth model counterparts.

Given the nature of who is being served and how customers are expecting to receive value, the service-led growth model can drive higher levels of sustainable and predictable revenue. The service-led growth model is a more powerful way to increase and accelerate value delivered as customer relationships mature over time.

For companies that provide a high level of subject matter expertise (know-how) that is used to solve complex initiatives (such as the case for certain enterprise software and the introduction of new technologies), a service-led approach is a better strategic option. If your customer finds greater value as a result of human interactions and expertise, then a service-led growth model should be considered. This model, by nature, fosters collaboration and partnership with the customer.

Consider professional service companies. These businesses are looking for ways to scale their expertise while differentiating against their next best competitive alternatives. Professional service firms are beginning to leverage technology to systematize their know-how, as well as to improve the efficacy of their consulting experience. They are using data gathered in engagements to configure and feed software applications that will strengthen their engagement (McKinsey Periscope is a well known example). The value in service-led growth is that it accelerates the ability to get insights, standardizes process, and provides greater consistency of outcomes. From a differentiation perspective, the professional service firm is able to embed their know-how and expertise into a platform that generates unique reports and insights. Revenue sources can be expanded to include platform subscriptions and insights reporting.

At the center of the service-led growth flywheel (as illustrated below) is that trust is coupled with perpetual value delivery. To do this, there is a cycle of value being generated from expertise (services), platform (technology), and insights (data). The key is to create a model of positive feedback between the service-led growth components.

Subscriptions lead to a sustained engagement that generates ongoing insights. Expertise and know-how drive recommendations. Expertise is applied to get greater value out of the platform while also informing how the platform can evolve to generate better insights. The platform itself is a tool that collects and provides a view of insights to both the consultant and end-user. These insights will inform the need for both additional services as well as improvements for the platform.

When considering pricing for service-led growth companies, the three inputs of monetization are:

the expertise

the platform

the insights

When designing pricing, we need to take into account the value generated as a result of the synergy of these inputs in the context of the outcomes that we are trying to achieve. This is what shapes the customer journey and delivers the customer experience.

Considerations to optimize value capture in pricing for service-led growth

Start by identifying the types of customers being served. Ask “how do they prioritize the value they need?”

Certain types of businesses (knowledge-based enterprises, for example) often place a high value on subject matter expertise as they look to transform their businesses (changing behavior & workflows, cultural mindsets, jobs, and roles). They value the depth of knowledge, methods, and insight that is derived from the experience of a knowledgeable subject matter expert. The higher value that is placed on your ability to differentiate your services, reinforces your ability to gain higher margins on your expertise.

Service-led growth uses technology to deliver value. Value and value capture is NOT based on professional services alone. A service-led growth platform is essentially a dashboard the supports the delivery, analysis and implementation of the solution you provide. SaaS companies that are able to reduce time to value, map the packaging of their offerings to the right segment, through their technology, the ability to design a good, better best subscription model is in itself a differentiator.

A key component of the service-led growth model is the ability to capture value through data. Here we need to understand, “are customers really interested in the end goal of getting to decision and insights?” Your customer may only be interested in the reports and recommendations so that they can operate and execute.

Thinking through the above, you can then determine the ratio of the revenue mix.

In the table below, I summarize some of the key characteristics of each of the models.

I hope you enjoyed this topic. Please let me know if there are areas you would like me to cover more deeply. I welcome you to read some of our other associated posts on Service-Led Growth below.