What is your target value ratio?

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

“The purpose of a business is to create a customer.’

Peter Drucker, Management: Tasks, Responsibilities, Practices, 1973)

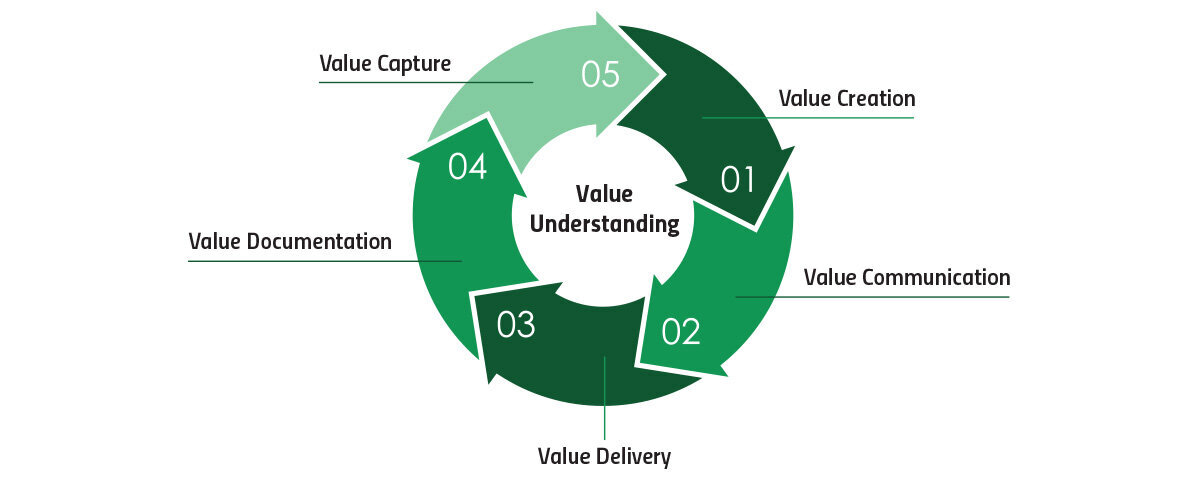

One creates a customer by providing value, preferably differentiated value, that it is difficult to get elsewhere. There are many different ways to create value. Ibbaka looks at economic, emotional and community value in its work. Whatever approach you are taking to creating value, it is important to track the value you are providing to customers and how this is changing over time. The value cycle is just that, a cycle. It turns on a axis of understanding value and travels around a cycle of Create, Communicate, Deliver, Document and Capture value in price.

Your understanding of value will change over time. It is important to gather the information you need in one place, track changes and find patterns. This will be the job of the Ibbaka Value Pricing Dashboard. (See The Value Pricing Dashboard is where you integrate applications across the customer journey.)

What are the key value trends you should be looking for?

One of the most important value trends to track is the Value Ratio. There are actually two Value Ratios to track. Let’s call them the snapshot and the film version. The snapshot is what is generally used in price setting. The film version is used to manage price and value over time.

The snapshot - what percentage of your differentiated value should you claim in price?

One of the key frameworks for value-based pricing is Tom Nagle’s Economic Value Estimation (EVE) approach. In an EVE you find the next best competitive alternative. Then you add up all the different ways you have a favorable impact on your customer’s business (the positive economic value drivers) and subtract your unique costs or shortcomings relative to the next best competitive alternative (the negative value drivers).

The price of the next best competitive alternative, plus all of the positive value drivers, less the negative value drivers, is the total economic value.

The positive economic value drivers, less the negative economic value drivers, is the differentiation value. This defines the premium that you could charge above the price of the next best competitive alternative.

This brings us to our first value ratio. The percentage of the differentiation value that you capture back in price.

Like all metrics, it is important to consider this for individual customers and holistically and to use it as a way to segment customers. Do you have a higher value ratio for one customer than another? Do you know why this is the case? Is it intentional or accidental? Value is too important to leave to chance.

What should the Value Ratio be?

There is no one answer to this question. It depends on your business and pricing strategy, the maturity of the market and competitive conditions. Here are some general rules of thumb.

By pricing strategy

Premium - Generally around 30%, could be as high as 50% but this is aggressive

Market following - Set as a target relative to the Next Best Competitive Alternative; generally set within plus or minus 10% of the alternative (market price)

Penetration - May be negative, that is to say, set below the price of the alternative

The value ratio is most relevant when pursuing a premium pricing strategy.

By maturity (for a premium pricing strategy)

The value ratio tends to change across market maturity

Early adopters - 10% to 20%, lower to account for risk

Early mainstream - 20% to 30%

High Growth - 10% to 20%, lower as market share is important at this stage

Mature - 30% to 50%

End of Life - very dependent on goals (support migration to new solutions; milk the last profits; support legacy user base)

The film - Value to Customer and Lifetime Value of Customer

The lifetime value of the customer (LTV or CLV) has emerged as one of the most important metrics for subscription businesses. To understand this read David Skok’s classic piece SaaS Metrics 2.0 – A Guide to Measuring and Improving what Matters. Over the past three years we have even seen investors use total LTV and LTV growth as a way to value companies. Understanding what drives LTV is critical to all businesses.

Note that one can segment customers by LTV. Not all customers are alike and it is important to understand the differences. Two segments could have the same average LTV but one segment may have a high annual value and relatively higher churn while another has a lower annual contract value but a lower churn. These differences matter.

But what matters most is what supports the customer lifetime value, that is the value delivered to the customer or V2C. The value ratio of V2C/LTV is another critical metric that companies need to track. It captures value over time, which is why I called it the film version.

V2C > LTV

This is clear enough. One needs to provide more value than one extracts. The question is how much more and how does this change over time?

We have found that a good rule of thumb is to deliver 3X the value you claim back through price. There are a lot of nuances though. Ask yourself the following questions:

Do I provide value upfront or does is take time for V2C to build?

Does V2C growth start to decline over time? If so, how can that be changed?

How does the ratio of V2C to LTV change over time?

Be careful to calculate this value ratio as cumulative and for each time period. Remember, customers don’t really care about what you have done for them. What matters is what value you are providing now and what value you will provide in the future.

How the Value Pricing Dashboard helps track the Value Ratio

The Ibbaka Value Pricing Dashboard is designed to help you calculate and track the value ratio snapshot and the ratio of V2C and LTV. This is the foundation of value management.

Additional tools to help with