Price It Right: Value over Time shapes pricing

Liam Hannaford is the Marketing Manager at Ibbaka. Find him on LinkedIn

In our recent research, we've discovered that the timing of value delivery is just as important as the method of delivery. Determining when value is delivered is a critical factor in shaping your pricing framework.

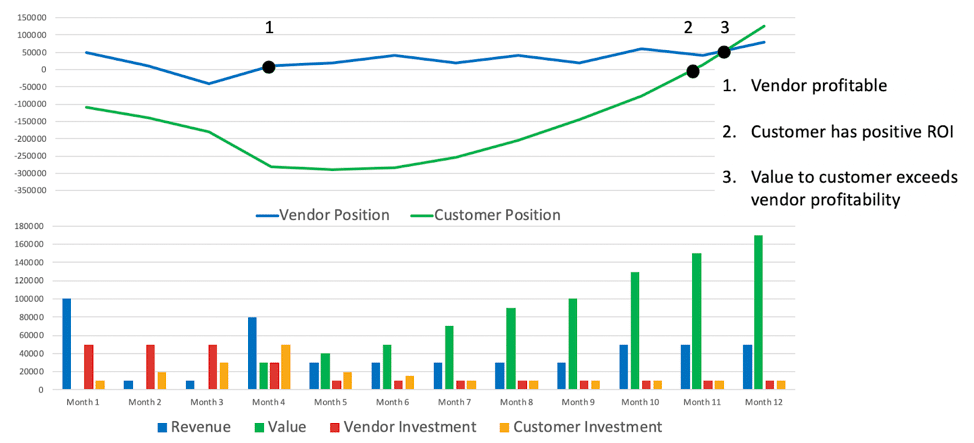

While collaborating with a prominent B2B SaaS enterprise characterized by extensive implementation and configuration phases, we found discrepancies between their pricing structure and the actual value acquisition by the customer. Essentially, this discrepancy resulted in internal conflicts among the sales, finance, implementation, and customer success teams.

This company manages time to capture implementation costs (how many months will it take until revenue collected exceeds investment in implementation), with a target to capture these within 4 months. It is a good idea to track these formally as they are as important as your customer acquisition costs (CAC).

Looking at the diagram above, Vendor Position represents Revenue minus Vendor Investment, while Customer Position reflects Value minus Customer Investment.

Calculation of Customer Value is a pivotal aspect of our conversations at Ibbaka, as we specialize in customer value management and provide expertise in this area.

There are various approaches the company can employ to address these tensions. One effective strategy may involve redesigning the solution and implementation processes to commence delivering value to the customer at an earlier stage. Implementing a major SaaS solution often unveils valuable insights about the company. Can these insights be transformed into offerings that the customer finds valuable? Time to value should be considered a fundamental design metric. Additionally, the pricing model may need to be reexamined to better synchronize revenue generation with customer value (V2C).

This research prompted us to inquire about the distribution of V2C over time and its potential influence on pricing model formulation. Upon examining our findings and conducting a review of prevalent SaaS business models, we identified several distinct patterns.

The most straightforward scenario arises when the value to the customer increases steadily over time. However, we believe this occurrence is uncommon in reality, despite being a common assumption in many pricing models.

A more typical scenario is the "S curve." Imagine it like a rollercoaster ride: at first, things start slow as the value engine gears up. But once it's in full swing, the value shoots up rapidly until it levels off. This pattern is very common in B2B SaaS businesses, like those that handle market automation or human resources applications.

The tricky part is that people notice changes more than when things stay the same, and they're often thinking ahead: "What's next for me?" In this situation, how much value customers think you're giving them can drop quickly, which makes it harder to keep them coming back.

On the flip side, there's something called a "Z curve," which is when software is used to solve a pressing problem. Once that problem's fixed, the urgency fades away, and so does the need for the software.

Sometimes, a subscription model might not be the best choice. Instead of committing to a long-term subscription, think about combining the software with consulting services. This way, you can gather important information over time to help plan future projects. This is the approach we take at Ibbaka because we specialize in studying market trends and creating pricing strategies that match.

In other situations, the value customers get from the software comes and goes. This could be because of seasonal changes or shifts in the industry.

Dealing with pricing for offers where the value comes and goes can be challenging. The first step is to understand what causes these value cycles. You want to make sure that when it's time for customers to renew, they're getting the most value out of your product or service.

You might also think about using pricing strategies that adjust based on demand. It's important to keep in touch with customers and keep an eye on what's happening in the market to handle this situation well.

Finally, value can be episodic, based on external events. When the situation is normal the solution may offer little value, but when you need it you really need it, and it is too late to put it in place.

This is known as episodic value and the approach to pricing and selling these solutions is similar to an insurance policy.

To sum it up, you can match how the value of your product or service changes over time with the way you set your prices.

When examining how value is delivered to customers over time, consider the following

Begin by understanding the value that customers receive.

Learn how this value evolves over time.

Also, consider how your costs change over time.

Then, create pricing strategies that ensure the delivery of value and the capturing of value are balanced and in sync.

Look at all the different ways you can deliver value over time, including services

One way to (partially) address the value over time challenge is through discounts. For more on this see Pricing and Planning: 3 Approaches to Discounting.

Read other posts on AI Monetization & Pricing Design

AI Pricing: Will the popularity of RAGs change how we price AI?

AI Pricing: Operating Costs will play a big role in pricing AI functionality

AI Pricing: Early insights from the AI Monetization in 2024 research

What to Price? What to Optimize? How to Optimize? 3 Key Pricing Questions

Pricing under uncertainty and the need for usage-based pricing

Enabling Usage-Based Pricing - Interview with Adam Howatson of LogiSense