Pricing and Planning: 3 Approaches to Discounting

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

Discounts are part of B2B SaaS. There are a very few companies, primarily using the product led growth (PLG) motion, who have no discounting. And there are good reasons to allow for some, disciplined, discounts in a B2B sales process.

Give sales people agency (this is perhaps the most important reason, sales people are more effective if they are able to shape a deal and have some influence on price)

For a specific customer, the solution is not providing the value assumed in price setting

Competition has reduced the price of the next best competitive alternative or reduced differentiation

Procurement needs to be given some (small) win to justify their involvement (this can be built into the pricing model)

Value changes over time and a discounting function is needed to address this

Discounting should be predictable. When you do your discounting analysis (Ibbaka will be introducing new analytical tools for this in 2024) you should be able to identify the factors that determine the price and calculate the correlation, which for most companies should have an R squared of more than .90.

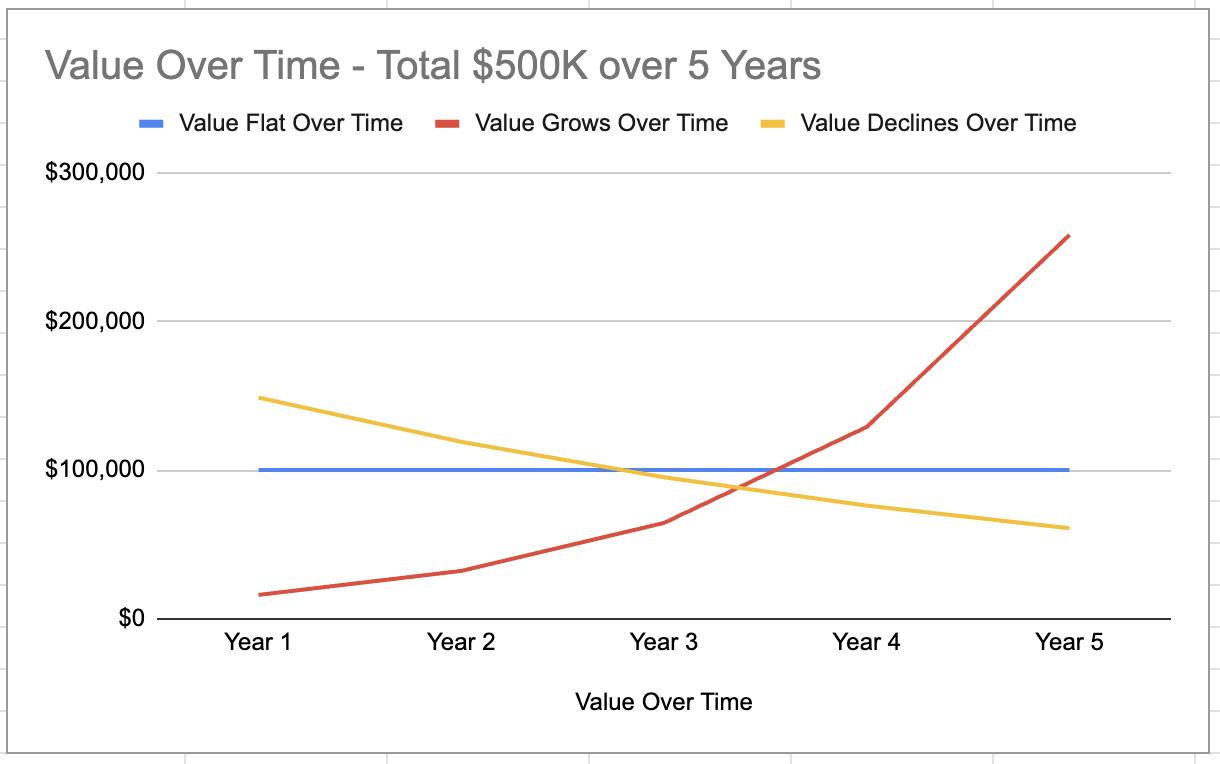

One of the questions you should ask is how value-to-customer evolves. This will have a big impact on how you structure discounts.

Value over time

The value over time curve can differ by solution. There are 5 common patterns.

Constant

Increasing

Decreasing

Cyclical

Episodic (like an insurance claim)

The three patterns that matter most to discount design are constant value, increasing value, and decreasing value. For most solutions, there is a lag between initial provision, adoption, and value, time to value, but even once the value is established it shows different patterns.

Constant value is often a baseline assumption. In practice, it is rather rare.

Many applications build in value over time as more data is collected and AIs kick in providing more and more accurate predictions.

Other applications can have a near immediate impact on value, which then declines over time as the problem is dealt with. Certain planning applications are like this, where there is an immediate gain on having a plan and then the value diminishes as the plan becomes routine and only minor updates are needed.

Discounts over time

One can use discounts to better align price with value. The most common approaches to discounting are a one-time discount as an incentive to buy and a flat discount that continues at the same percentage year after year. In the real world, one-time discounts are often kept when renewal comes up as they establish an anchor that it is hard to shift.

There are two other approaches to discounting that are worth exploring: Declining Discounts and Rising Discounts.

Declining Discounts get smaller and smaller each year until the discount goes away. Even with a one-year commitment it can be worth putting these into the contract. The goal is to have a formal way to make the discount go away over time. One might give the initial discount for different reasons. It could be a simple sales incentive. It could be a way to share some of the adoption and transition costs, once these are covered, there is no longer a need for a discount. Or, as in the scenario explored here, the value may grow over time and the declining discount is a way for the vendor to claim more value as it generates more value. Another way to do this is through progressive price increases of course, but sometimes it is easier to achieve this goal through discounts.

One can also have the discount increase over time. Again, it can be a good idea to lock this in over multiple years even for a one-year commitment. There are several reasons for this discount structure. One is to lock in revenues early and accept that commoditization and competitive pressures will erode pricing power over time. A second reason, the one considered here, is that some solutions lose value over time (as is the example of the planning software given above) and discounting can be used to adjust for declining value.

Designing discounts to align with value over time

In the below table, we combined three value over-time scenarios (value flat, value rising over time, and value declining over time) with three discount regimes (flat, rising discount, and declining discount) to create nine scenarios.

We then calculated the value capture ratio for each scenario.

The value capture ratio is one of the most important ratios in SaaS, and one that is seldom used as you need a value model and a commitment to tracking the impact of your solution in order to calculate it.

There are several ways to calculate this ratio, but the two most common are

One Year Price / One Year Value

Customer Lifetime Value / Value Over Customer Lifetime

In the above table, the simpler One Year Price / One Year Value metric was used.

In B2B SaaS one generally wants to have a value capture ratio between 5% and 20%. Lower than 5% (and in most cases 10% you are leaving money on the table and may have trouble sustaining the business and making ongoing investments in innovation. Above 20% (or 30% in cases where value is well established and buyers and sellers are in agreement) and you are inviting competitors to enter the market and buyers to switch.

When value is flat, any of the approaches could work, and in very competitive markets one might want to use the declining discount approach to make it easier to win deals.

When value is growing over time, it is difficult to make any of these approaches work. You need a lever other than discounting to align price to value. This could be a regular increase to the base price, but a better approach will be a usage metric that scales with value.

When the value is declining, the rising discount approach works best. A flat discount will eventually price you out of the market while a declining discount is even worse.

The key lessons.

Understand how the value of your solution changes over time

Make a strategic decision on how much value you want to capture and when in the customer journey you should be capturing it

Set clear goals for your discounting plans and communicate these to sales, give sales a voice in setting discounting policy

Discounting is not your only tool, design pricing to align with value over time