How to negotiate price (getting to positive-sum pricing)

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Pricing negotiations are some of the most difficult conversations we have in business. There is often a lot at stake on both sides of the table, and short-term decisions can have long-term consequences.

How does one set up pricing negotiations for success?

The short answer …

Avoid negative sum games, especially as they play out over time

Convert zero-sum games to positive-sum games if you can, this requires meaningful differentiation from alternative solutions

Support positive-sum games through negotiations on the value exchanged between each party, and the wider community, over time

This framing comes from game theory. Game theory is the study of strategic interaction among rational decision-makers (yes, behavioral economics has shown us that most decision-making is not purely rational). Film buffs will remember the 2001 movie A Beautiful Mind about John Nash. Nash is one of the most important thinkers in game theory.

One of the most common ways to describe games is as Zero-Sum or Positive-Sum.

Zero-sum game In a zero-sum game, there is a fixed reward and if one party gets more the other party gets less. This is how pricing negotiations are often seen. Think of these as a win-lose scenario.

Positive-sum games are games where, depending on the choices made, both parties can end up doing better. This is the classic win-win scenario.

Negative-sum games are those games where, if the parties are not careful, they can both end up losing (technically negative-sum games are a subset of positive-sum games, but when discussing pricing strategy, it is worth calling them out).

We asked about pricing negotiations on the LinkedIn groups for the Professional Pricing Society and the Coalition for the Advancement of Pricing in the last week of 2020. Here are the responses summed across sites.

Several people commented that all 3 types of games show up in pricing negotiations. What determines which approach prevails?

Let’s start with negative-sum games. The prevalence of negative-sum games in pricing negotiations is not something people like to acknowledge (this can be seen when comparing the comments to the responses in the poll). A negative-sum game occurs when both parties lose out in the negotiations. There are two main ways this can happen.

Differentiation gets squeezed out as the buyer tries to find alternatives that are easily compared. This is often seen in RFPs (Requests for Proposal) that define features rather than identify the problems to be solved.

Sellers are not left with enough of a surplus to invest in ongoing innovation, leading to stagnation and a loss of opportunity. Cost-plus pricing often results in this situation.

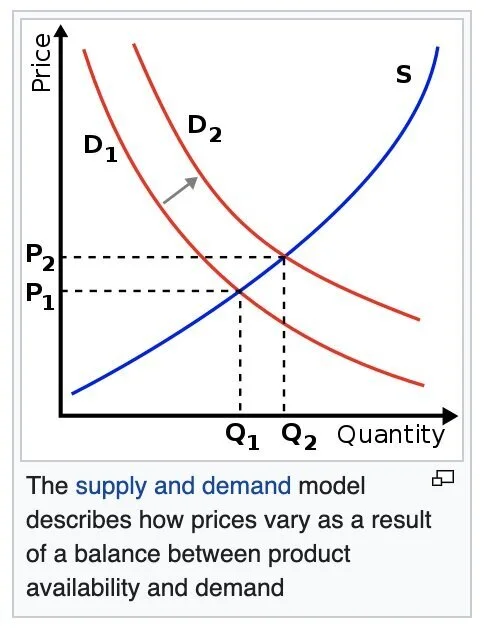

Zero-sum games are for pure commodities, where there is no meaningful differentiation between alternatives and where prices are negotiated on the spot market. In this case, pricing is a zero-sum game by definition. This is the situation studied in neoclassical economics and best represented by the supply and demand model that is thought, even today in some circles, to determine how prices are set. (Other ways of thinking about economics associated with the Santa Fe Institute are more relevant to pricing, this is something we will explore in 2021.)

Positive-sum negotiations are the goal of value-based pricing. This is one reason that willingness-to-pay is a poor substitute for actual value-based approaches. Here, the negotiations focus on how to collaborate in creating value and how to share it fairly over time. The critical thing here is that the buyer and seller work together to optimize value for both parties.

Avoid negative sum games, especially as they play out over time

Negative-sum games are the worst possible outcome. They are most likely to occur in purely transactional settings where the only relationship between buyer and seller is the transaction and there may not be future transactions. In this case, both parties are motivated to conceal information and to try to get the best possible price.

This behavior has been studied in the game of Prisoner’s Dilemma. In this well-known game, there are two prisoners. Each has the choice of defecting, and admitting to a crime, or staying silent. If both defect and accuse the other (trying to get an advantage) they generate the worst outcome. If both stay silent, they both get off with a light sentence. But if one defects and the other stays silent, well then the defector wins and the silent prisoner has the worst possible outcome.

Research has shown that when this game is played by the same people over many iterations the best strategy is to cooperate, to reward cooperation, but to punish defection.

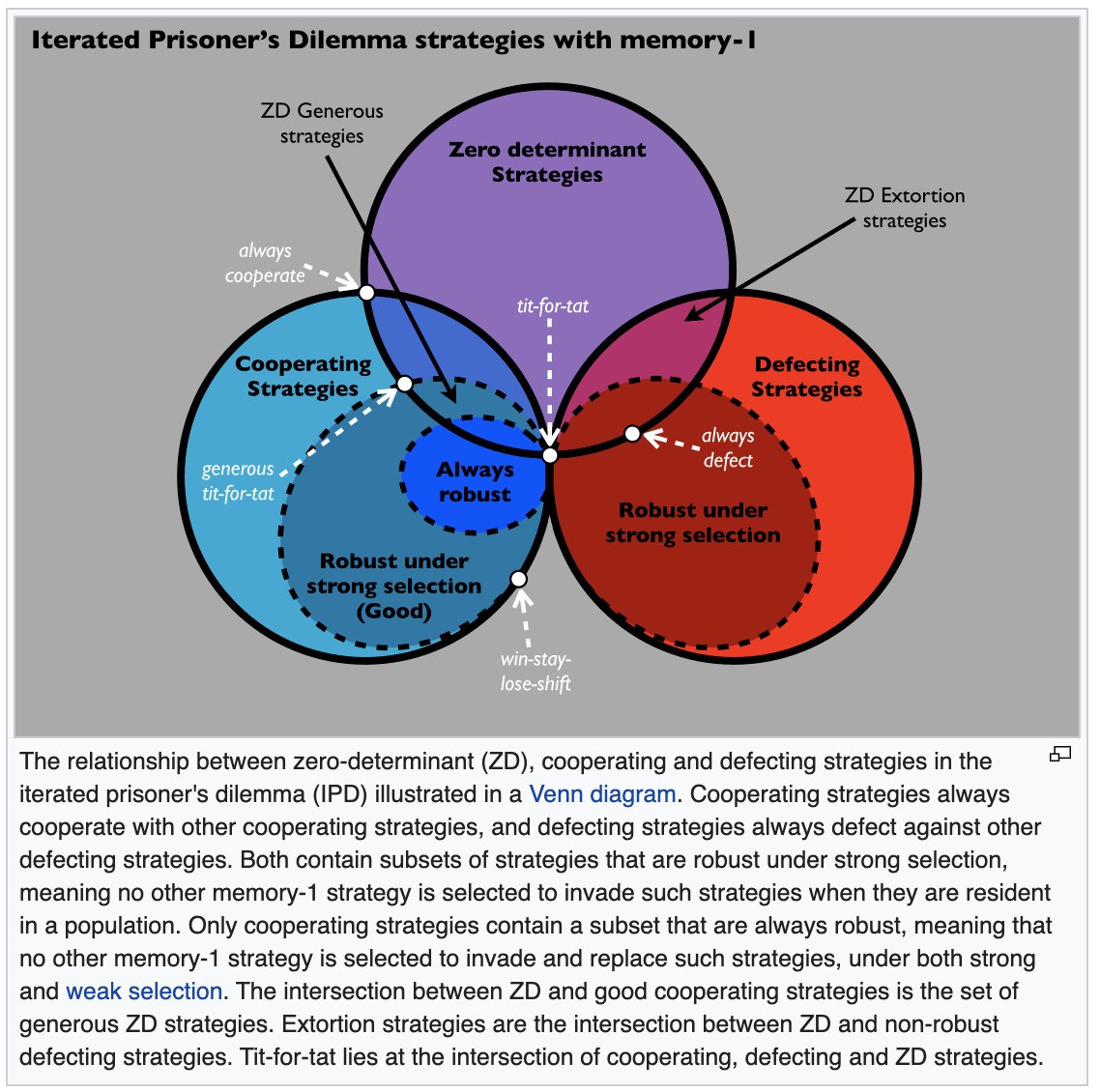

A deeper question is what strategies will be able to compete with other strategies and themselves. The results are summarized below (this is from the excellent summary on Wikipedia).

(Note, zero determinant or ZD strategies are a recent advance in game theory that has many implications for pricing. For a useful overview see the first paper on this by William Price and Freeman Dyson, Iterated Prisoner’s Dilemma contains strategies that dominate any evolutionary opponent and Evolutionary instability of zero-determinant strategies demonstrates that winning is not everything by Christoph Adami and Arend Hintze in Nature.)

The thing to note is that cooperative strategies are the most successful over time, and are able to coexist. This has implications for pricing.

Pricing negotiations are more likely to be successful (to avoid negative-sum outcomes) when there are repeated transactions between the two parties over time.

Pricing negotiations are more likely to be successful when both parties are transparent and share information. (This is difficult for many of us to accept and we will explore transparency in pricing more over the course of 2021.)

Convert zero-sum games to positive-sum games if you can, this requires meaningful differentiation from alternative solutions

Zero-sum games, where if one party wins the other party loses, can easily degrade into negative-sum games. This happens when pricing becomes purely transactional and where conventional supply-and-demand logic determines prices.

The best way to avoid this is to provide and seek meaningful differentiation. Meaningful differentiation exists when you can provide value that your customer cares about that is not available from the alternatives. The below image is cast in terms of economic value drivers and uses the Economic Value Estimation (trademark by Deloitte) approach. A full treatment would include emotional and community value drivers.

Support positive-sum games through negotiations on the value exchanged between each party, and the wider community, over time

Value-based pricing works best when it is part of a long-term partnership between buyer and seller.

For this to really work, and get to that promised world of generous zero-determinant strategies, three things are needed.

Trust - positive-sum games require the sharing of information by both parties and a willingness, especially on the part of the seller, to adjust prices to reflect value.

Long-Term Partnership - value frequently takes time to be realized (especially for enterprise-level B2B applications) and may require additional functionality or reconfiguration, both parties need to stay engaged for value to be created

Investments in Meaningful Differentiation - differentiation is a moving target, what was once differentiated becomes commoditized, and the buyer’s needs can change

Conclusion - pricing negotiations can be a positive-sum game

How would you characterize your current pricing negotiations?

If they are negative-sum games, then you and your customers are both in trouble and your industry is being pushed toward decline.

If they are zero-sum games, it will be difficult to build enough value and profit to fuel innovation and future value creation.

Positive-sum pricing should be your goal. Here, each pricing negotiation is an exploration of how to create value together.

As the economy emerges from Covid 19 and the new normal establishes itself let’s make pricing a positive-sum game.

Looking for tips for enterprise software pricing strategies?

How to use indexed pricing as the economy recovers from the pandemic

How to price your learning resources

When to price predictive analytics

How to hire a pricing consultant

Pricing professional services is a challenge for SaaS companies