You have new functionality, you've factored it into your price, are your customers getting the value?

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Many companies are excited about the new functionality they are bringing to their customers in 2022. The SaaS model is based on continuous innovation. A quarter with no new functionality is a quarter in which you have fallen behind the market.

New functionality is an opportunity to review your packaging and pricing. To do this effectively you need to first understand who the new functionality creates value for, and how it creates value. Value drivers are the key tool you will use to guide your approach.

There are three categories of value driver, economic, emotional, community. Emotional and community value drivers are important in market segmentation, and impact willingness to pay (WTP) but it is the economic value drivers that are most important in framing the price.

An economic value driver is a simple equation that estimates the dollar impact of the functionality on a customer. They come in six flavors: revenue, operating expenses, operating capital, capital investment, risk and optionality.

So when adding new functionality, and thinking through the impact on packaging and pricing, ask the following questions.

Does the functionality create a new value driver?

Does the functionality improve an existing value driver?

Is the impact more relevant to existing target segments or to new target segments?

Combing the two possibilities gives four possible outcomes as shown above:

Enhance existing value drivers for current targets

Enhance existing value drivers for new targets

Create new value drivers for existing targets

Create new valued rivers for new targets

These four scenarios lead to four different approaches to pricing.

Let’s unpack the implications of each scenario for pricing.

Existing value drivers x existing targets (about 65% of innovations in most categories)

This is the most common case. Product managers naturally focus on functionality for existing customers. Do you have a software application that makes it easier for people to bill and collect payment? You likely have some value drivers that improve revenues, others that reduce operating costs, and still others that reduce the need for operating capital (by shortening the account receivable cycle). New functionality will probably contribute to one or more of these existing value drivers rather than adding a new value driver, like improving employee engagement leading to higher productivity.

When this happens, one needs to make a strategic decision on how to leverage this additional value: raise prices, use it to win more market share, or see if the new functionality can expand the overall market for the category.

Existing value drivers x new targets (about 15% of innovations in most categories)

In some cases the new functionality will open access to new market segments. This can happen when a critical value threshold is passed, or some barrier that was preventing adoption is removed. For example, a billing system that can only handle one currency can not be used by companies with sales in multiple currencies, or a mobile only app may not work for a company that requires work to be done on company managed laptops.

In this case, the current pricing model, if it is build on the value drivers, is likely to work for the new packages being created for the new segment.

New value drivers x current targets (about 15% of innovations in most categories)

When new value drivers are created for existing customers and target customer there are some interesting options. In most cases you will want to create a new package for the functionality. This can be offered as something completely independent of the existing packages or it can be provided as an add on at an additional price. New package or add on? This is one of the most interesting decisions for most product managers. It is for a set of customers they already know well, but has new ways to create value for these customers to work with.

New value drivers x new targets (about 5% of innovations in most categories)

This happens less often than one might expect, mostly because successful companies are focussed on the customers they already serve and know well. My guess is that this represents less than 5% of innovation. But it can be the most important innovation as this is where whole new categories of solution are sometimes created.

This is not always the case of course, in some cases one is entering an existing category rather than creating a new one. Each case requires its own strategy.

When the new functionality can support a category creation strategy one has to begin by establishing the value of the category before one focuses in on the pricing. See See Pricing and value for category creation.

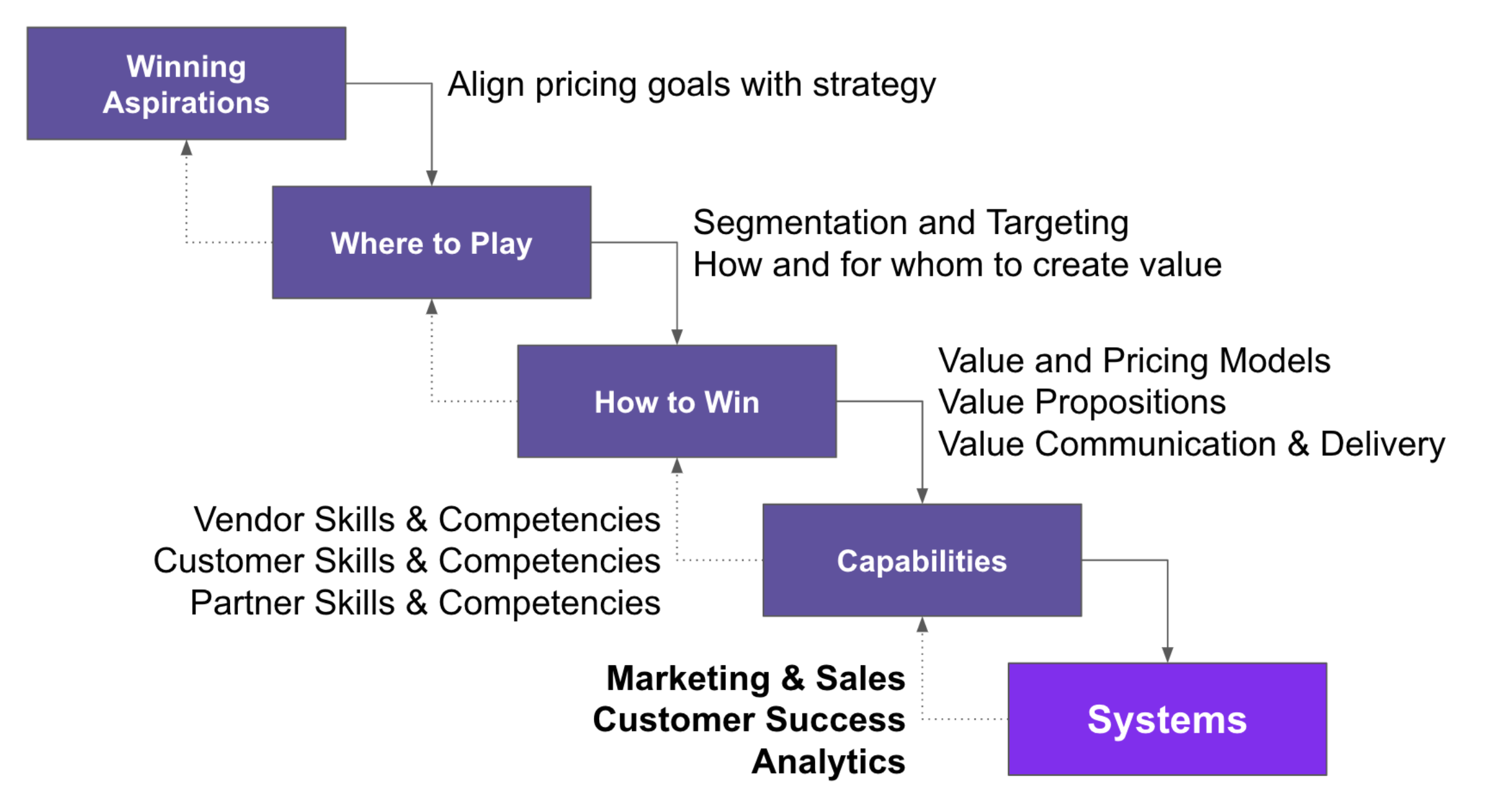

Product strategy should be explicit about what kind of value it is trying to create and who it is being created for. As with other things, a portfolio strategy should be taken. Make some investments to enhance your existing set of value drivers, but explore investments to create new value drivers as well.

Some innovation creates value in several different ways

Of course the same set of functionality can do more than one thing.

It may improve the existing value drivers for a set of current of customers and create a new set of value drivers for a new set of customers. This means that two different packaging strategies are possible. Add the functionality to existing packages and decide how to leverage this (see the thoughts below on leveraging additional value) or create a new package for a new market segment.

Smaller companies will usually want to pick just one alternative. It is complicated and defocusing to try to execute on two different strategies at the same time and is best done by independent teams. Pick the pricing and packaging strategy that is best aligned with the company’s overall strategy. It is a ‘Where to Play’ choice and as such should be governed by the Winning aspirations.

Leveraging additional value

In the most common case, where existing value drivers are enhanced for the current target segments. More value is created for existing customers. The question is then what to do with that additional value. How you answer that question will depend on your strategy and what you are trying to optimize for.

There are several ways you could use the additional value:

Justify price increases (increase the average selling price and deal size)

Improve competitive positioning and increase market share (which basically means increasing volume)

Reduce churn (customers getting more value will be more engaged, have more usage, and be more likely to renew)

Drive up sell and cross sell (by giving customers more options and growth paths

When there is a close correlation between usage and value, this new functionality can be a place where you introduce usage based pricing.

Which of these will have the biggest impact on company value? Model out the different possibilities and leverage the additional value in the most compelling way.

Make sure your customers are actually getting the new value promised

There is an assumption baked into this. That people will actually use the new functionality to get value in the way you expect. That is an hypothesis and like any hypotheses it should be tested.

Good value based pricing, and usage based pricing, aligns with value paths. A value path is the sequence of actions that a user takes that leaves them with something of value.

To justify your price increase, or to win higher volume, or to decrease churn, or layer in usage based pricing, you need to make sure that people are completing the value paths. That is the job of customer value management. Customer value management is an emerging business function that goes beyond customer success and focuses on supporting customers around the value cycle.

By developing the new functionality you have completed the Value Creation step. You still need to communicate, deliver and document the value. Only then can you reliably execute on your value capture (pricing strategy).

Customer Value Management

You have new functionality, you've factored it into your price, are your customers getting the value? (this post)

Ibbaka’s Online Course - Pricing and Customer Value Management

Why documenting value creation is essential to customer value management

The Value Pricing Dashboard is where you integrate applications across the customer journey