SaaS grows up (and gets grown up pricing problems)

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

It takes about 20 years for a technology based business model to get adoption and mature (let’s remember this as we hype Generative AI). Salesforce had its IPO in 2004, so it seems fair to say that the SaaS (Software as a Service) model is now mature. With SaaStr Europe happening this week in London (Ibabka was there) it seems like a good time to ask what maturity means for SaaS and SaaS pricing.

Maturity means several different things for SaaS and SaaS pricing.

Pricing pressure as customers ask for clear demonstration of how value is created, they will want to see that value documented before renewing

Procurement involvement in purchasing - procurement will become more involved in purchasing to the general detriment of innovation (if the past is a guide to the future)

Control over deployment by central IT functions, which has implications for the product led growth motion

Verticalization as vendors look to differentiate and buyers look for solutions geared to their specific challenges

There is a big open question though. Artificial Intelligence. AI and specifically generative AIs are threatening to upend many business models. This will be happening in parallel with SaaS maturity and will cause many creative tensions from which new solutions (and ways to price) will erupt.

Pricing excellence will help to cross the second chasm

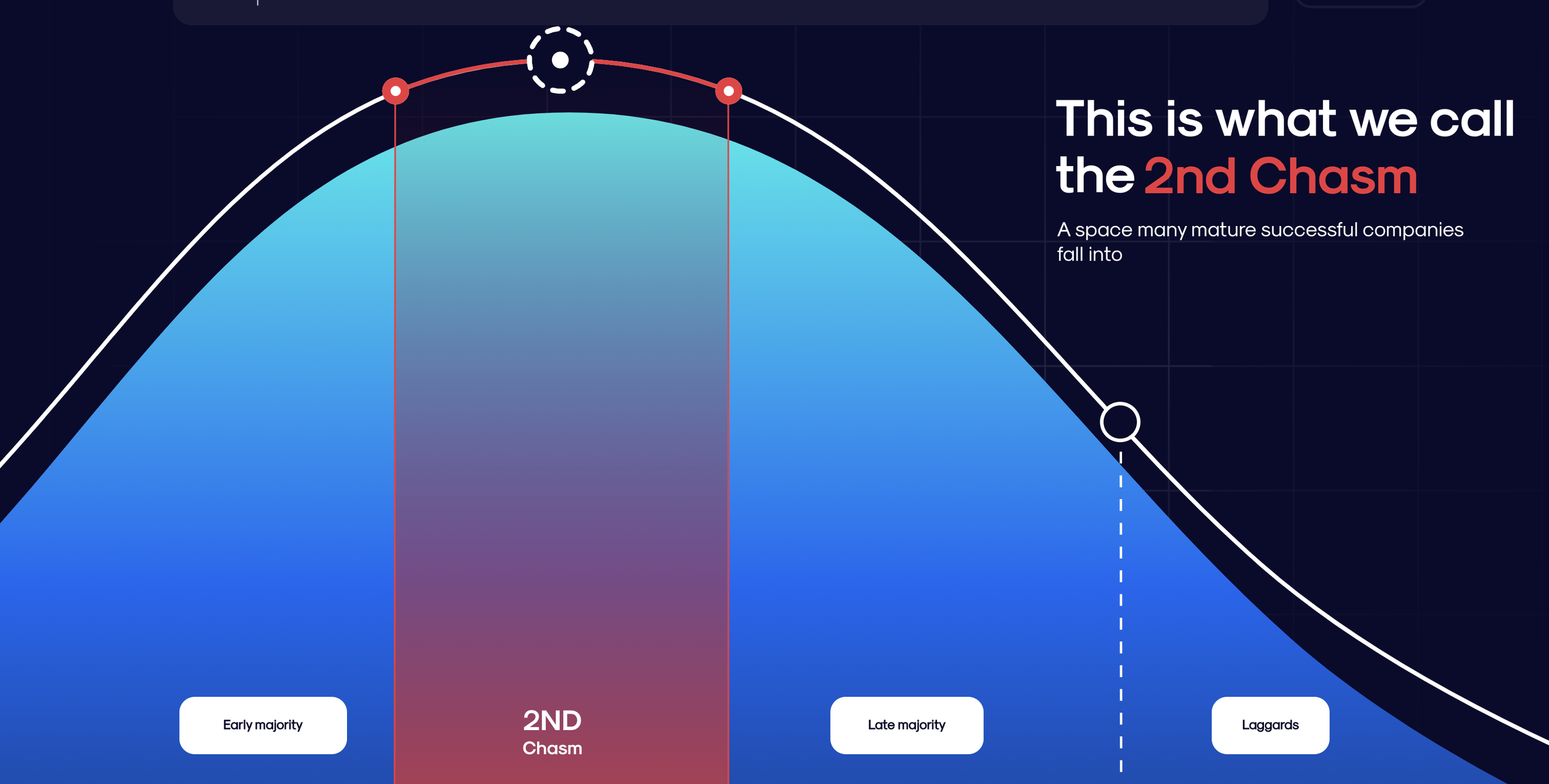

One interesting piece of evidence of SaaS maturation is the emergence of the meme of a second chasm. People in technology are well aware of Geoffrey Moore’s Technology Adoption Cycle where there is a gap, the chasm, between early adopters and the main mainstream market. There is now talk of a second chasm between early and late majority. Many growth-stage SaaS companies are caught in this chasm.

Ionic Partners is one company looking to leverage the second chasm to acquire SaaS companies and guide them across the gap (the image below comes from their website).

In the second chasm growth slows, revenue efficiency declines (the new revenue generated by each dollar invested in sales and marketing) and net revenue retention languishes, sometimes even dipping under 100.

Pricing excellence is going to be key to helping companies cross this second chasm. In industrial products, the key to crossing this chasm has been value-based pricing. (See for example Stephan Liozu’s extensive research on value-based pricing).

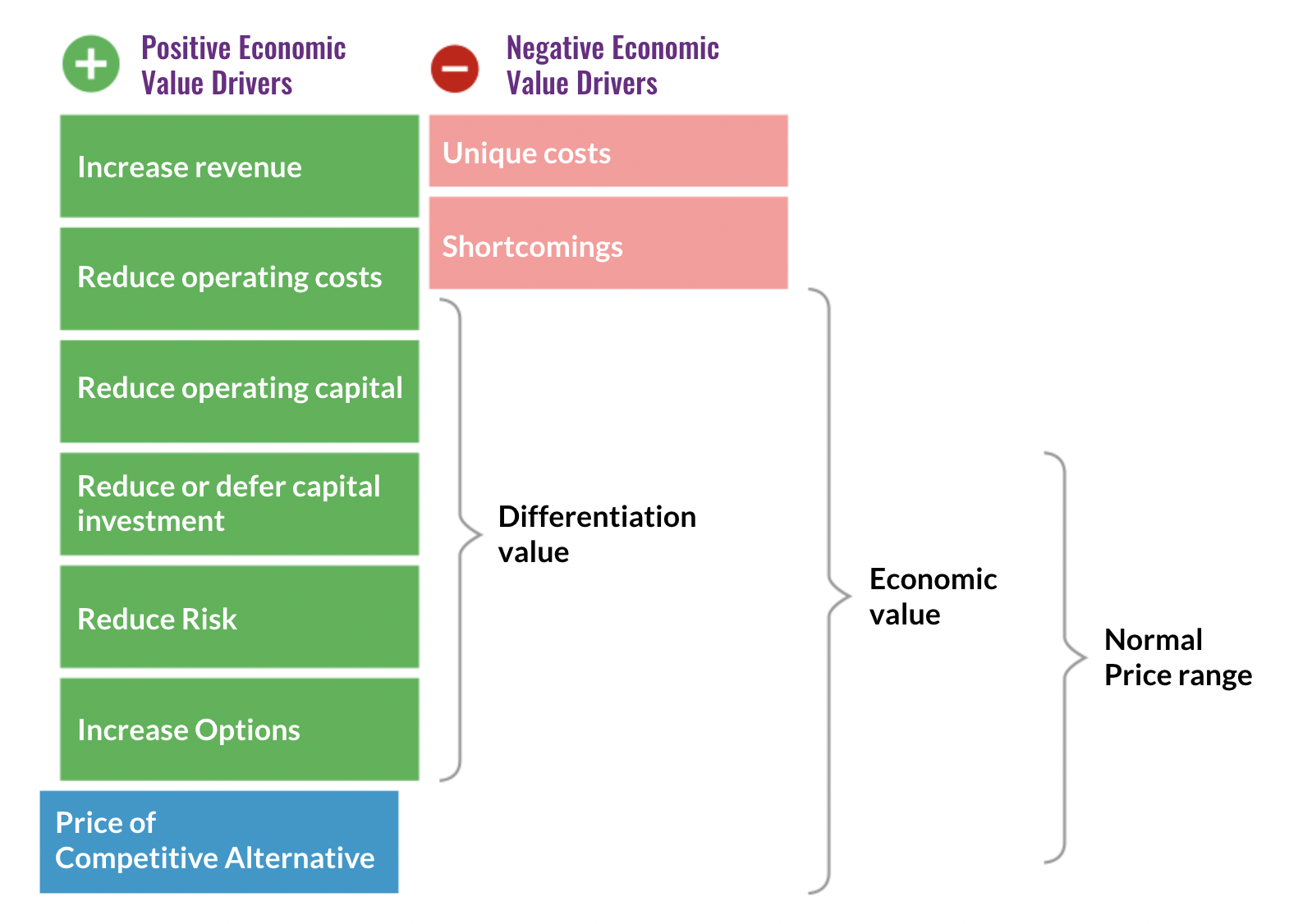

In value-based pricing, one begins with a formal value model (most commonly the Economic Value Estimation or EVE model developed by Tom Nagle and associates). A value model is a system of equations that estimates the value of your solution to a customer or customer segment. That it is a system of equations makes it amenable to modern AI systems which are going to transform SaaS pricing.

Note: Many people (including some pricing consultants) confuse customer value and willingness to pay (WTP). They are NOT the same thing. Customer value is one of the factors shaping WTP but it is not the only one. WTP is something that can be shaped by the vendor, it is not a given to be discovered in transactional data or through surveys.

The pricing model is then derived from variables used in the value model. In most cases, there are more variables in the value model than can, or should, be used for pricing. Pricing model design is based in part on choosing a small number of pricing variables to define prices for different packages (use of more than one pricing variable is generally referred to as hybrid pricing).

In this way, value and price are closely connected and it becomes much easier to

Sell on value (rather than price)

Document value (to ensure renewals)

Focus development (to make sure that differentiated value is being continually developed)

The standard visual representation of a value model looks like this.

Procurement consultants apply pressure to SaaS pricing

At SaaStr Europa (held in London June 6 and 7) there were a surprising number of companies offering to help …. manage, rationalize, optimize, reduce spend on the SaaS stack. These offers range from optimizing your AWS or other infrastructure spend, to eliminating duplicate users or unused seats, to demand aggregation and purchasing power.

Some of the companies in this space are (in alphabetical order)

Cledara “All your software in one place. Finally.”

Pengu “We run your business. We save on your SaaS.”

Vendr “Save on SaaS. Create procurement magic.”

Vertice “Effortless SaaS purchasing.”

Viio “Unified SaaS buying and management platform that pays for itself.”

(I wonder why. so many of these companies have chosen names starting with V, but then Ibabka’s pricing and customer value management platform Valio also starts with a V.)

If these companies are successful, and with the centralization of purchasing and the dwindling of discretionary budgets it is likely that they will be, pricing is going to have to develop relationships with them.

If they behave like conventional procurement intermediaries seen in older categories they will work to drive prices down, encourage commoditization so that solutions can be swapped in and out, and move competition away from value to price. This is not in anyone’s long term interest as it tends to drive innovation out of a category.

SaaS pricing and revenue generation teams will have to develop strategies to manage these companies and the procurement groups they serve.

Some of the approaches that have worked in older industries will be useful.

Strict discipline on discounting

Sell value to the business buyer before discussing price

Be willing to take out value to keep price and value aligned (switch features on and off - feature tagging will be important, note LaunchDarkly)

Have more packages available so that you can present business buyers and procurement with more options when necessary

Equip sales with value selling tools

Train sales on how to negotiate with procurement

Document value, document value, document value

Product Led Growth (PLG) will also provide a way to counter procurement.

Get bottom up adoption

Have a freemium offer, not just a free trial, and make sure the freemium offer is generating data of value to the enterprise

Have a single user offer that is is priced so that it can be expensed

Allow users from the same company to connect on your app (find other users from my company style functionality)

An example of the messages being put out by the SaaS procurement vendors can be found in SaaS Purchasing Insights: May 2023 from Vertice.

Vertice reports on discounting in different categories. Look at the chart below. This is why discounting discipline is going to be so important as SaaS matures. Discounting opens the door to procurement to drive down prices.

Vertice sometimes characterizes SaaS pricing practices in negative terms.

“Sneaky ways SaaS vendors are increasing prices.”

“Amid all of this pricing chaos, businesses must look for ways to mitigate the impact and reduce their overall spend.”

And they provide guidance on how to negotiate discounts.

“Amplitude pricing: how to negotiate a discount”

“Snowflake pricing: how much does it cost?’

The best way to counter this is to make sure that your pricing is fair. This means three things.

Pricing is transparent (either in the price levels or how price is set)

Price is based on value and clarity on how that value is shared

Pricing is consistent and unbiased, so that procurement can not use inconsistencies as a wedge to open negotiations

If you offer fair pricing and are disciplined about discounting SaaS procurement companies can even be your friend.

How will maturity impact product led growth?

There has been speculation recently that the maturation of SaaS will work against the product led growth motion. At the end of May, Techcrunch published an article “Have enterprise buyers finally soured on ‘bottoms-up’ tech sales?”

Bottom up, PLG style adoption has been important, especially when selling to technology buyers.

Personally, I don’t see that changing. Engineers are going to continue to adopt the tools they need and not wait on lengthy formal procurement processes. If imposed, they will find a way around them.

What will have to work well though, better than it does in most companies, is the connection between the PLG team and the sales team. Kyle Poyar at OpenView characterizes this as the shift from PQLs (Product Qualified Leads) to PQAs (Product Qualified Accounts). Well designed, freemium and easy entry point packages, that are designed to provide evidence (value documentation) of the value of wider adoption of a higher priced package, will be part of how almost all SaaS is sold to enterprise buyers.

When we talk about PLG we are actually talking about three related things: PLD, PLA and PLE.

PLD or Product Led Distribution. This is how a you first get a product into user’s hands. Freemium, free trial, reverse trial (when a user gets a full featured product for trial before being downgraded to freemium) are all going to remain important, as is viral product design, word of mouth and other networked distribution.

PLA or Product Led Adoption. The best products, no matter how they are sold, are designed to support their own adoption. This will become more and more important as SaaS matures. Smart procurement teams will even ask for adoption metrics to justify spend.

PLE or Product Led Expansion. This is a critical part of the NDR/NRR strategy of many SaaS companies. We are already seeing this in our survey on Net Revenue Retention Strategy in 2023. Procurement is likely to put barriers in place here and PLG teams are going to need to find new tactics to deal with this. There may include free trial of higher tiers within the product, versions of reverse trial after purchase, and other techniques. Give them a taste of what they are missing and collect value documentation as you go.

PLG is not dead or dying. It will remain one of the most vibrant ways to distribute SaaS, get adoption and then expand. But new packaging and pricing strategies are needed to make sure it continues to thrive as SaaS matures.

Will artificial intelligence change the game?

Looming over all discussion of SaaS is the transformation that will be wrought by AI, especially Generative AI.

AI will bring innovation to every part of SaaS.

Existing processes will be automated

Data will become more valuable and will be used in new ways

Existing functionality will be enhanced

New functionality will be developed

New products will emerge

Existing solutions will be replaced

New categories will be created

New ways of thinking about how software and humans coexist will emerge

This could completely disrupt SaaS market maturity over the next three years. We are entering a new phase of human experience as transformative as the adoption of the printing press and the spread of reading. In a few years today’s applications, all of them, will seem primitive and irrelevant. New ways of distributing, adopting and expanding software and data will emerge. Even the distinction between software and data may fade away, as data structures will have intelligence coded in.

SaaS maturity may turn out to be a fleeting thing.