Pricing and Planning: Establishing a Baseline

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

There are three steps to developing your pricing plan for 2024 and integrating it into the rest of your business planning.

One cannot know where one is going without having a good picture of where you are and how you got there. This means establishing a baseline.

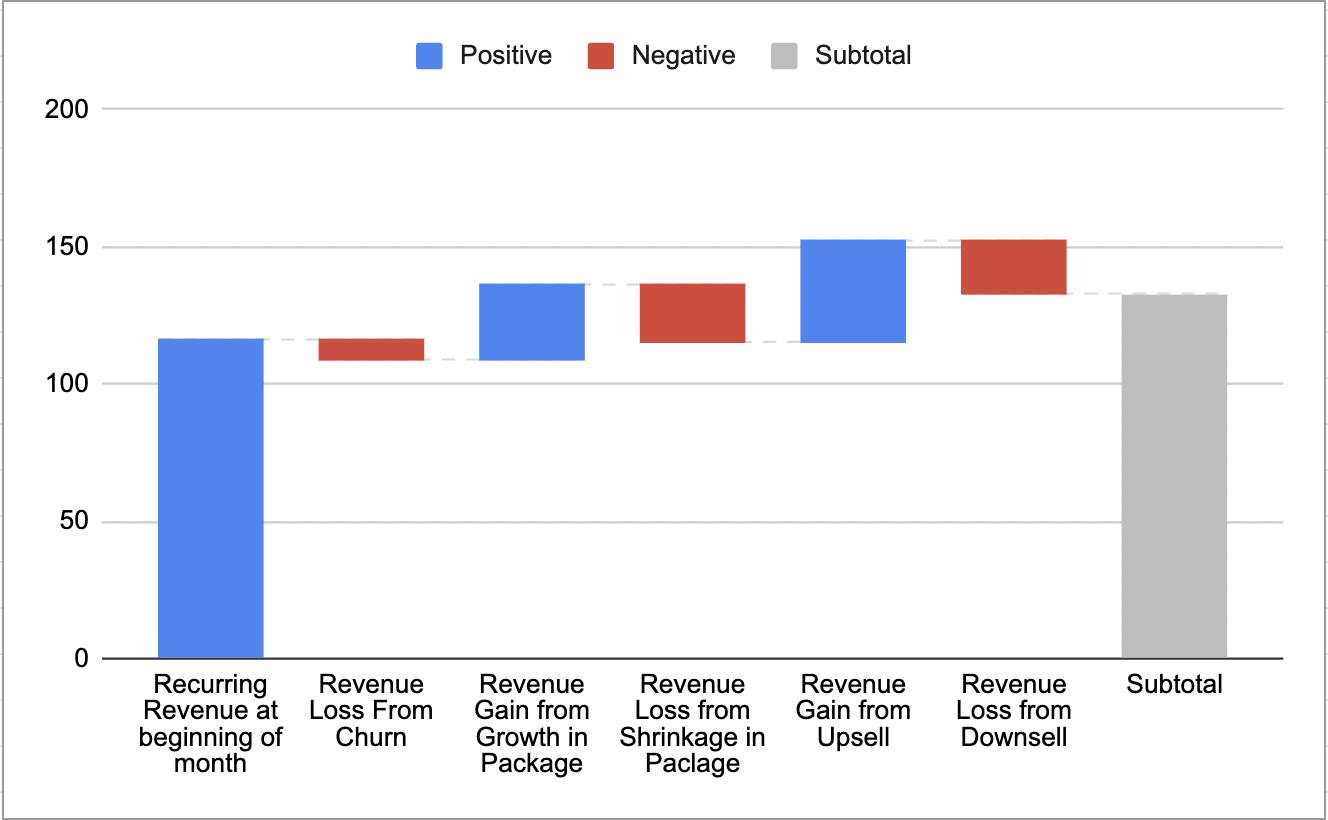

A baseline should be more than just a number or a snapshot in time. One needs to know the trend and the change in the trend. Here is an example from Net Revenue Retention data.

This is more detail than most companies prepare, but one cannot make good decisions without at least this much data. This company has NRR of just over 16%. Churn is 7.6%. Growth in package is a healthy 28% for customers that grew in package, most of this is lost by the -22% number for customers that shrunk in package. Upsell was better. Customers that moved up a to a higher tier drove a 38% gain in revenue, while losses from downsell were 20% giving a net gain of 18%.

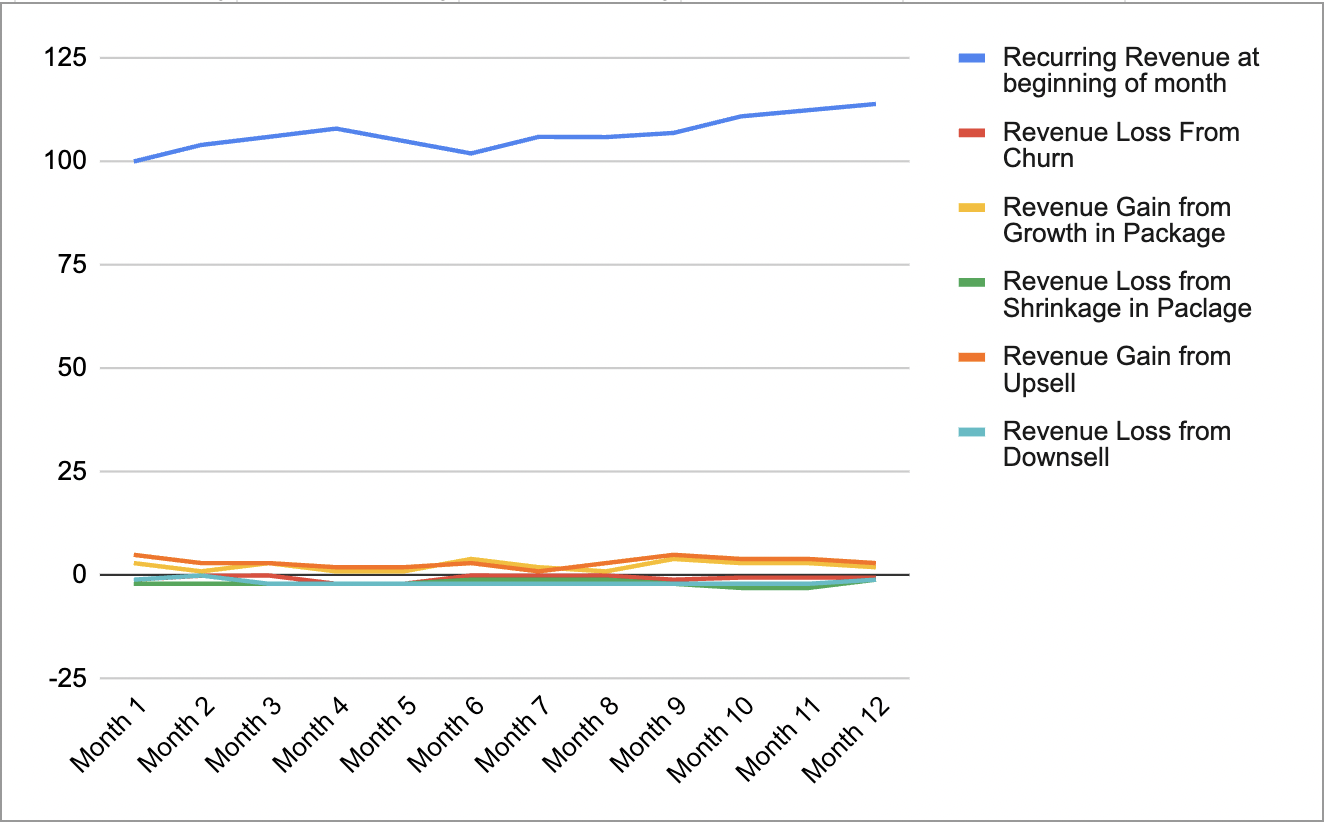

We can get more insights by looking at trends in these factors.

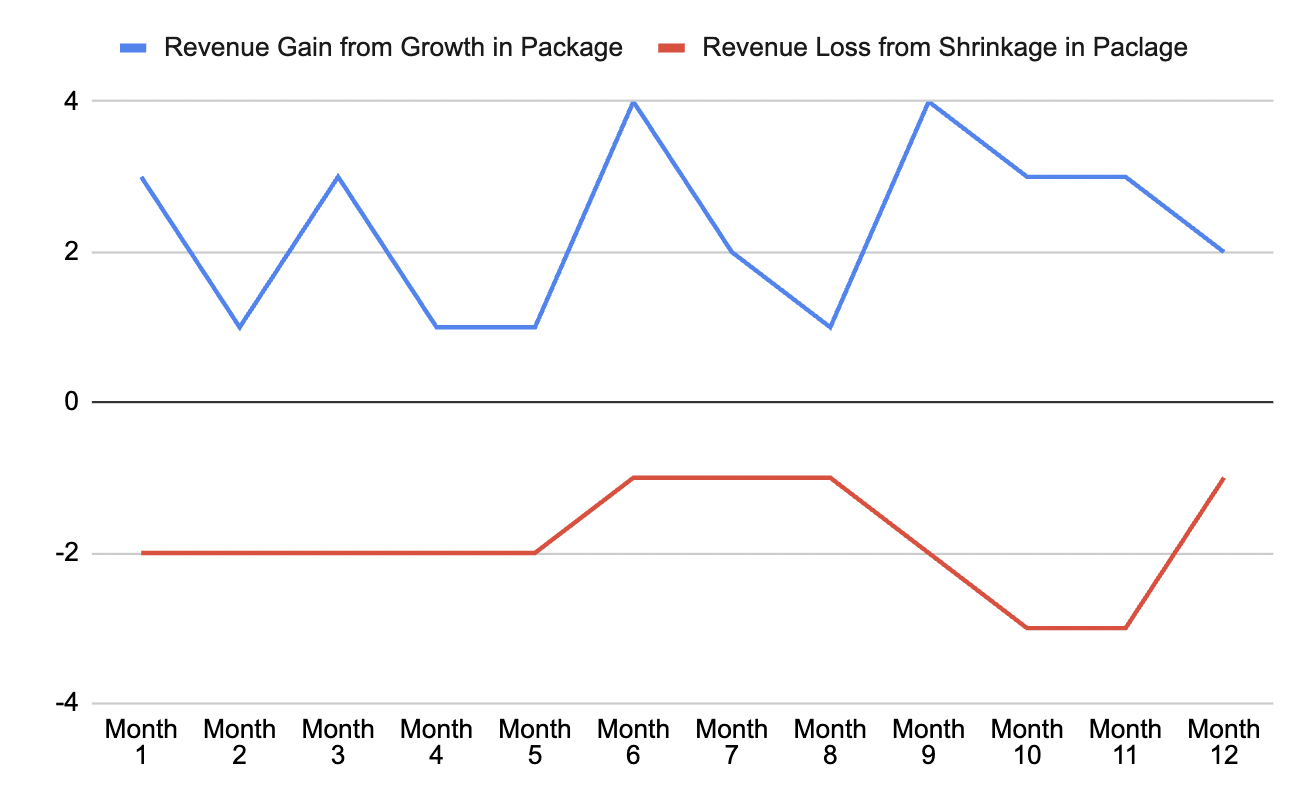

In establishing the baseline one generally wants to look at Revenue Gain from Growth in Package and Revenue Loss from Shrinkage in package together.

Here one can see that there is a lot more variation in growth in package than there is for shrinkage in package. This underlines the need to analyse these independently rather than just looking at usage based pricing as one factor.

The same applies to upsell and downsell.

Once one looks at these paired factors it can be interesting to look for crossover effects between different factors. The order of questions is as follows.

What drives (or predicts) renewal performance?

Is renewal performance correlated to any of the other five NRR factors?

What drives (or predicts) Growth in Package?

What drives (or predicts) Shrinkage in Package?

Are growth and shrinkage correlated or independent?

What drives (or predicts) upsell?

What drives (or predicts) downsell ?

Are upsell and downsell correlated or independent?

Does growth in package predict upsell (and vice versa)?

Does shrinkage in package predict downsell (and vice versa)?

Consider the impact of price changes

Missing from the above analysis is the impact of price changes that you may have implemented over the course of the year. Did you change prices (increase or decrease) during the year? If so, you need to do some analysis and see how this impacted each of the NRR factors. There can be a significant time lag here as most price changes are implemented on renewal.

Did the price change lead to more opportunities or to higher quality opportunities?

Did the price change impact the win/loss rate and other stages in pipeline conversion?

Did the price change impact pipeline velcoity?

Did the price change impact renewals (churn)?

What was the time lag for the impact on renewals?

Did the price change impact any of the other five NRR factors (upsell, downsell, growth in package, shrinkage in package, cross sell)

Discounting

Discounting is a serious problem at many B2B SaaS companies. Or to be more specific, it is undisciplined or ad-hoc discounting that is the problem. The question you need to ask is …

Does your pricing model represent your actual price?

Another way to ask. this is …

Is your discounting predictable and being used to shape the market or is it undisciplined and reactive?

Discounting is the first thing to fix at any B2B SaaS company. If discounting is broken, pricing actions are like pouring water into a leaky bucket.

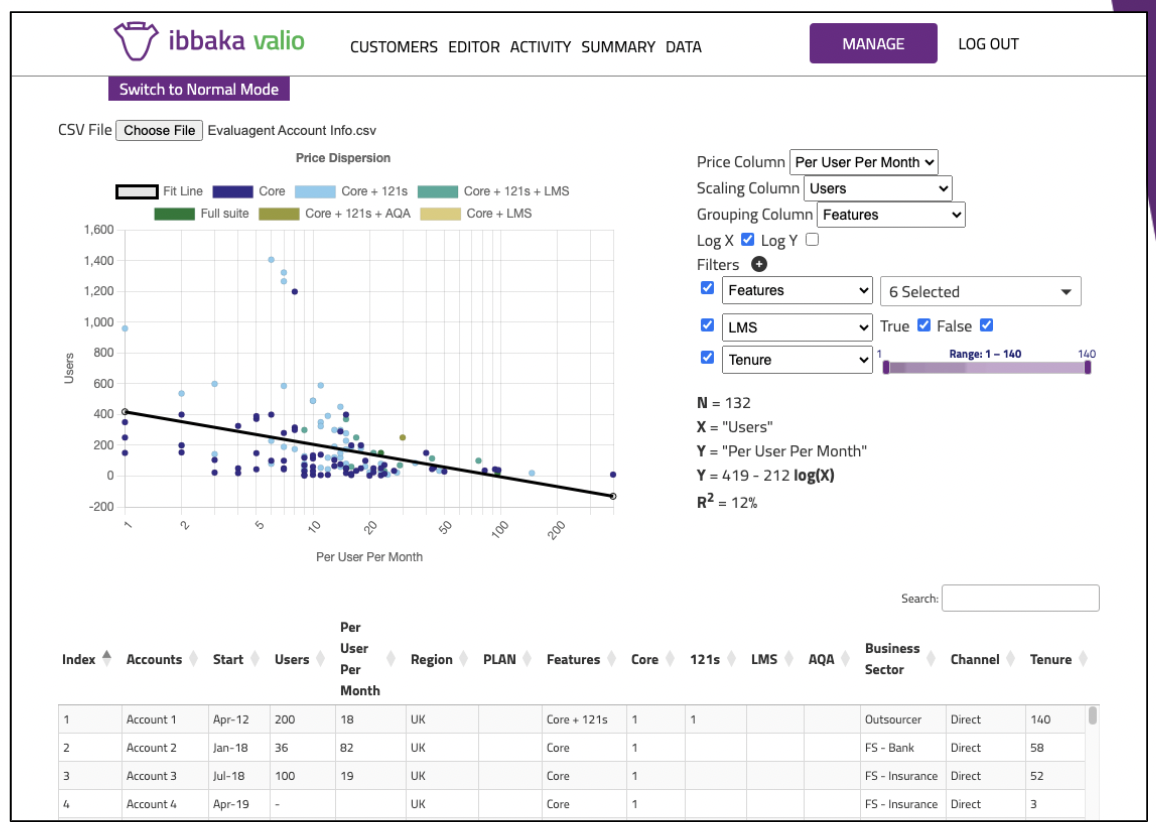

Ibbaka will be rolling out a new tool for analysing historical discounting and Net Revenue Retention and for predicting future performance.

Competitor Pricing Moves

Competitors are one of the 4Cs of pricing (the other three are Customer Value , Customer Willingness to Pay and Costs see The 4Cs of Pricing and How they Interact). The buyer will understand your pricing in the context of your competitor so one of the things you need to do is see what your competitor has done on pricing in 2023.

Have competitors changed published prices

Have competitors changed packaging

What is sales saying about competitor pricing actions

What are customers saying about competitor pricing actions

Once you have established a baseline for how pricing performed in 2023 you can go on and work out how pricing can support larger strategic goals in 2024.