Optimizing price - what metrics and goals are you tracking?

Karen Chiang is a Managing Partner at Ibbaka. See her Skill Profile on Ibbaka Talio.

The season is changing.

As we all look forward to making sure we close out the year with the best financial results possible in Q4 2022, I’ve observed a transformation in the job that pricing is being tasked to achieve.

This post shares my thoughts on two items released by Ibbaka this week. The first is my podcast where I discuss why businesses solving complex problems should consider a service-led growth strategy as a alternative or enhancement to product-led or sales-led strategies. The second is a short response to a post by Steven Forth wrote on “what do we mean by price optimization.”

Service-Led Growth Podcast

I was very pleased to be part of Mark Stiving’s podcast where he interviews pricing enthusiasts to share their key learnings and advice to achieve pricing impact. Many of us involved in recommending and executing on pricing strategies have an outcome that we are trying to achieve. There are three follow on messages that I would like to share as a result of that interview.

1 Pricing impacts financial results

There is a reason why Tom Nagle’s Economic Value Estimation is core to pricing strategy. We need to understand the differentiated value we provide so that we can optimize our pricing. Pricing plays the leading role for businesses to achieve their growth targets. To optimize price, price has to be rooted in value. When our customers understand the value and economic impact our offer makes and we can measure this impact, that is where we understand the impact that our pricing has on our financials.

2 Select the right growth strategy

Your growth model needs to fits the needs of your customer.

Value should be defined and measured from the viewpoint of your customer. Similarly, your customer and the market segment you choose are also going to dictate the manner in which they wish to engage. You want to win against alternatives by being in sync with your customers needs and expectations. For example, if you are working with customers which are trying to solve complex problems, which require a more collaborative human touch approach, then you should favour service-led over product-led growth. During the podcast I talk about the three most common growth models: sales-led, product-led, and service led. Read my post on the growth models to best capture revenue.

3 Track the impact of pricing actions

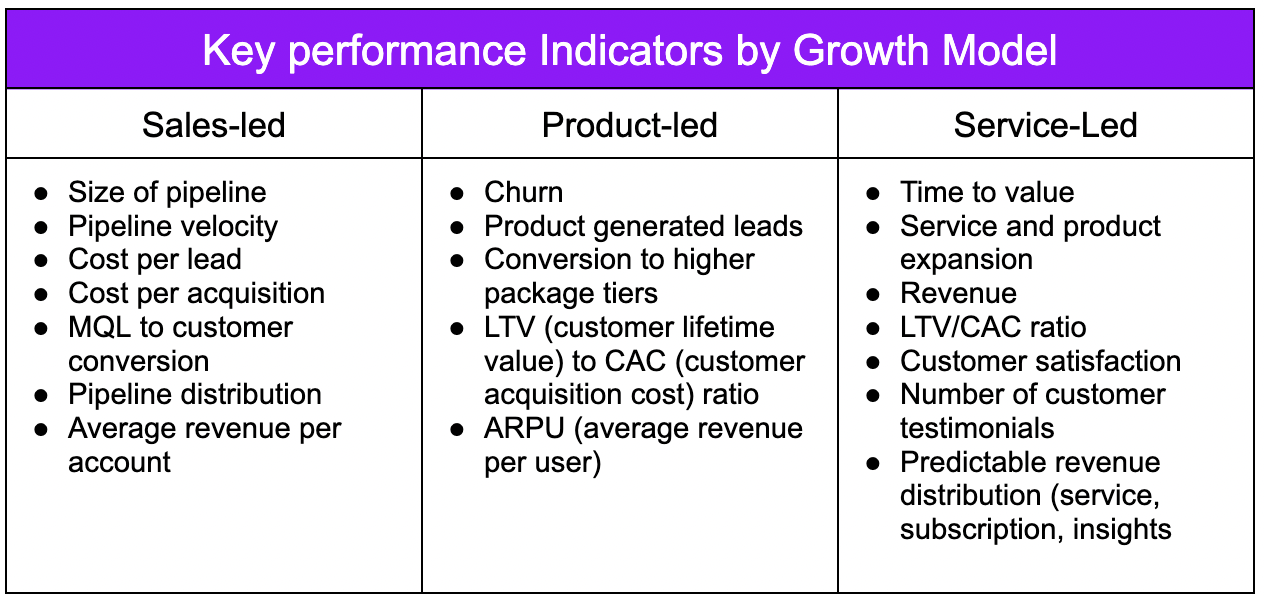

In order to understand the efficacy of your strategy you need to know the outcomes you are shooting for. From an operations and execution standpoint recognize that the data, key performance indicators and financial metrics that will matter are also influence by the growth model you choose.

This table summarizes my thoughts on the key performance indicators that are relevant for each growth model.

For sales led growth, the key metric is revenue. Sales-driven organizations celebrate number of wins – the number one task for sales is to close the deal. For product-led companies, the product itself drives value typical in the form of recurring revenues. Customers will land on a preferred tier, but the aim is to grow spend by a customer over the course of time. Service-led KPIs are more complex, as there are typically a combination of indicators drawn from the other models mentioned in addition to service-led specific metrics.

What does price optimization mean?

The above is a nice segue to Steven’s question to the Professional Pricing Society Community “What do we mean by price optimization?” First, I am enlightened by the poll where a number of different possible uses of ‘price optimization’ is probed:

Using algorithms to set price

Improving the pricing process

A holistic solution to pricing

Other

Perhaps my opinion on this is biased by where my mind is at in writing this post. For me, price optimization means that pricing is optimized to achieve it’s specific goal or job to be done.

I started this post reflecting on how the season is changing. As I contemplate the key goals that our customers had for pricing early in this year of 2022, growing revenues measured in (ARR) was a top priority mentioned by a number of CEOs. Now, as we enter that last quarter of 2022, churn reduction while increasing price is a key goal; this is mirrored with the need to target NDR (net dollar retention) and make sure it is well above 100%. Not surprising, since an NDR above 100% indicates upgrades outweigh churn or downgrades.

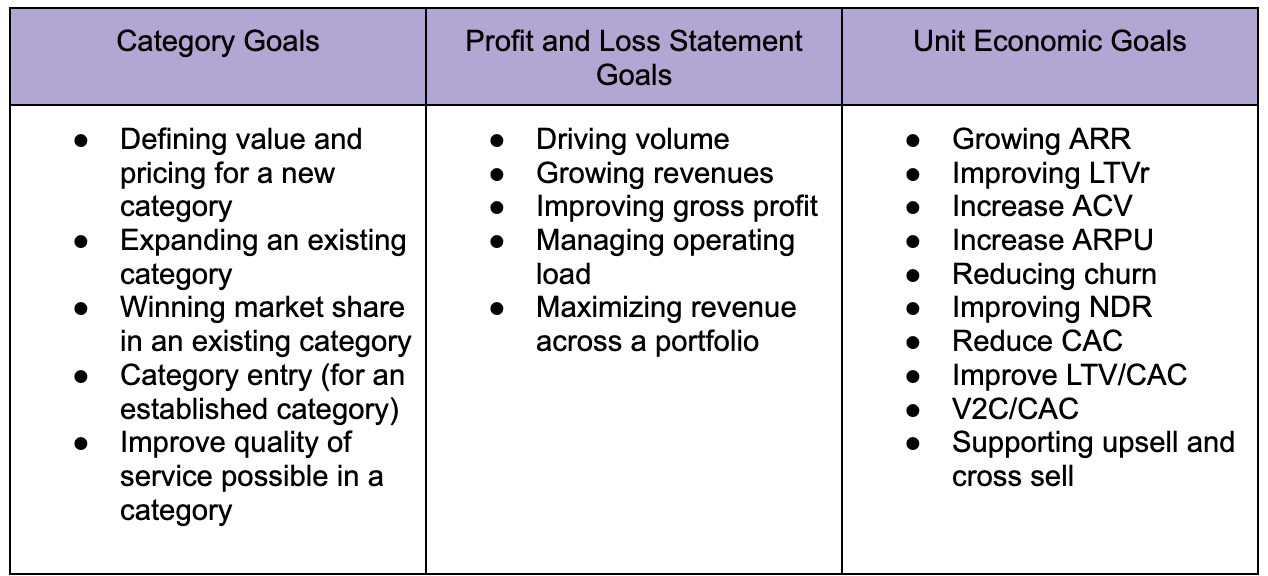

Here are some examples of how we at Ibbaka think about the goals that pricing can impact.

B2B SaaS Metrics Acronyms

ACV Average Contract Value

ARPU Average Revenue per Unit

ARR Annual Recurring Revenue

CAC Customer Acquisition Costs

LTV Lifetime Customer Value

MQL Market Qualified Lead

MRR Monthly Recurring Revenue

NDR Net Dollar Retention

NRR Net Revenue Retention

PQL Product Qualified Lead

SQL Sales Qualified Lead

V2C Value to Customer

I invite you once again to take a listen to the podcast and let me know your thoughts. Also, leave a comment on the growth model you are adopting and the goals you would like pricing to achieve for you.