Is it time for SaaS companies to factor costs into pricing?

Steven Forth is a Managing Partner at Ibbaka (currently on leave). See his Skill Profile on Ibbaka Talent.

SaaS companies have typically had high gross margins and have seldom considered costs when designing pricing. Is that still sustainable in the changing economic climate?

It has been widely reported that SaaS companies are now being evaluated not just on revenue growth but also on profitability and their ability to generate positive cashflow.

At the same time, there has been growing concern that the underlying SaaS business model is broken. Thomas Lah at the TSIA has been arguing this for some time and has done a lot of analysis of publicly traded SaaS companies and compared them with the old school, on-prem, license based companies. See Why are SaaS companies unprofitable? One telling figure from that report is shared below.

NOI is Net Operating Income. Large SaaS companies have very low NOI and are thus vulnerable to economic trends like inflation, interest rates or an economic slowdown.

There has long been an assumption that SaaS companies will become profitable as they scale, so that as long as you are on track for rapid growth the profits will come. This belief is now being called into question. SaaS companies have real costs and how those costs change with scale has become an open question for many companies. The five cost areas that need to be looked at as a company scales are …

Server and processing costs (see note below on the impact of AI)

Customer success (required for renewals in many SaaS businesses)

Customer acquisition (SaaS growth companies invest heavily here)

Professional services (often ignored, outsourced or provided but not monetized)

Ongoing R&D (often not considered an operating cost, but continuous innovation is part of the underlying value promise of SaaS and without this the SaaS model fails)

Note on the impact of AI on SaaS costs: Most SaaS applications will leverage AI in one way or another within the next three years. If ‘software is eating the world’ (Marc Andreessen in 2011) then in 2023 ‘AI is eating software.’ The early evidence is that AI will consume an order of magnitude more processing power than conventional software and the AI infrastructure providers are going to charge for this in a way that changes SaaS cost dynamics.

SaaS businesses have not bothered to monetize many potential revenue streams and have largely relied on unitary pricing metrics (often per user) that do not correlate well with value or cost.

Before we can fix this we need to understand the relationship between value, price and costs and how these chage with scale.

Begin by Analysing how Value, Price and Costs Change with Scale

The first thing to do is to explore how value, revenue (and pricing) and costs change across scale. With SaaS, the question is not so much ‘is this service profitable and what is the gross margin’ as ‘how does profitability and margin change with scale.

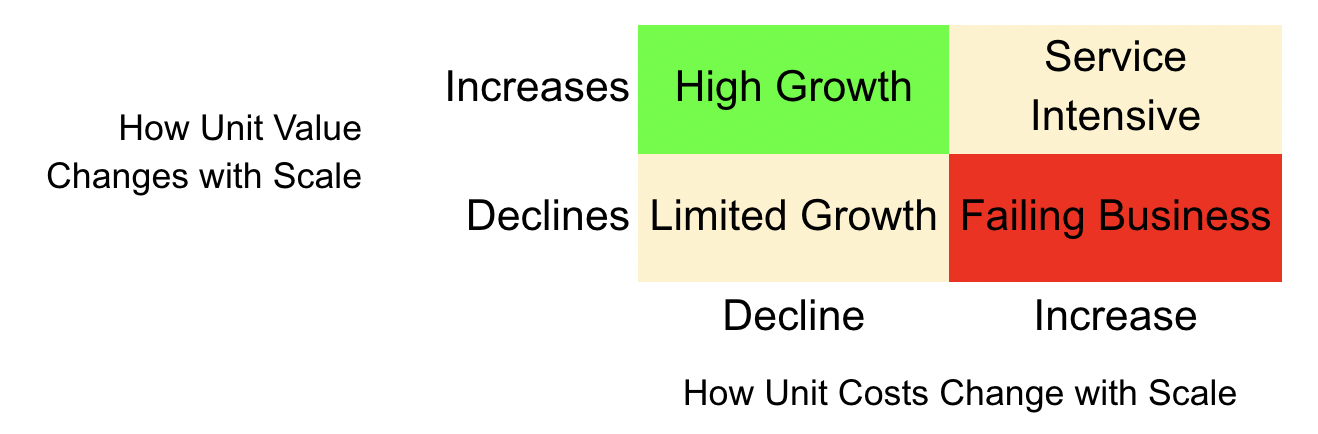

There is an assumption that variable costs per unit go down with scale. This is just that, an assumption. Many SaaS companies have never actually tested this assumption or looked at which scenarios make it true. Let’s do a little 2x2 matrix to compare two sets of assumptions.

How unit costs change with scale

How unit value changes with scale

It helps to focus on value and costs first as if the value part of the system works one can usually design pricing to capture that value.

Let’s start with the positive scenarios. Unit value increases with scale. When this happens, the business is generally in good shape. Increasing value implies a higher willingness to pay (WTP). Start the analysis by seeing how value per unit changes with scale.

Unit Value Increases with Scale x Unit Costs Decrease with Scale: These are the high margin, high growth companies that we dream of. They normally rely in some form of network effect to drive value. Slack is a recent example.

Unit Value Increases with Scale x Unit Costs Increase with Scale: This is a tricky one. It implies a limit to the company’s ability to scale. The nature of this limit will depend on how and why the per unit costs change. Some companies will only be able to sell to SMBs; other companies will only be able to sell to enterprises. Differences in how value and cost scale explain why it is often difficult to cross the SMB/Enterprise barrier in either direction.

Unit value does not always increase with scale. There are many companies where it declines.

Unit Value Decrease with Scale x Unit Costs Decrease with Scale: Companies in this scenario need to shed smaller customers and find the customers at the scale where value is optimized and costs are minimized.

Unit Value Decreases with Scale x Unit Costs Increase with Scale: This is a bad scenario. There may be no sweet point where enough value is created to justify a price that will cover the costs. In any case, one cannot grow out of this scenario.

The Value Pricing and Cost Models Interact

To understand how unit economics changes with scale you need three formal models. A Value Model, a Pricing Model and a Cost Model. Each of these models is a system of equations with variables, constants and operators. There are standard ways to model each of these critical dynamic systems.

The first thing is to understand how each model is impacted by changes to the key variables and then to confirm that the constants used in the models are actually stable across scales (they quite often are not). You should be able to answer three questions about each model.

Which variable or combination of variables drives the greatest change?

Are there edge cases where changes become extreme (often because of interactions between two different equations)?

Are there areas where the changes flatten out or even change direction? (are there asymptotes or inflection points).

Being able to answer these questions will put you well ahead of most SaaS companies but this is not enough to win in the emerging environment.

To win, you need to understand how these three models interact.

The first step in doing this is to identify shared variables that show up in more than one model. If you have done a good job with the modeling, there will be shared variables between the three models. If this is not the case, take another look at each model and see if there are variables that impact value, price or cost that you have overlooked.

The next step is to look at interactions between the three models, driven by the shared variables.

Are there variables that drive value, price and costs in the same direction?

Rate of change with scale is important here. For example, the variable could push cost and value in the same direction, but one could be going up faster than the other.

Are there variables that are driving divergent behaviors? Things can get better, or worse, quickly when the scaling variable drives cost price or value in opposite directions. Value going up with scale while costs go down? Very good. Price going up with scale while costs go down? Also very good, if harder to achieve. Costs going up with scale while value or price goes down? You are in big trouble.

Depending on the equation, the change over scale may not be linear. It can be s-shaped, concave, convex or even change direction at some point. As with all things pricing, the details matter and assumptions are dangerous.

Five steps to analyse how value, price and cost change over scale

Have validated models for how value, price and costs change with scale

Test how value, price and cost change with scale

In what direction does the line go?

Is the line straight or curved: S-Shaped, Concave, Convex?

Does the line change direction at some scale? For example, for costs, is there a point where unit costs stop declining with scale and start to go up?

Look for shared variables, if there are no shared variables ask if there should be

(There are some situations where cost and price share a variable and price and value share a variable, but there is no shared variable between cost and value)Model the covariance between cost, price and value

Are there important crossover points beyond which (in either direction) a solution is no longer viable or becomes viable?

Are there cases where the trend lines move in opposite directions with scale?

Are there interactions between the models? This can happen when an equation in one model is used as an input into another model.

Modeling interacting systems of equations can get complex. In some cases, you will need to use Monte Carlo modelling to simplify this, especially if there uncertainties or ranges involved. But just because something is difficult does not mean you can avoid it. In today’s environment, where valuation, even survival, involves a lot more than top line revenue growth, it is important to understand how value, price and costs change across scale.

A viable solution is one where …

Value > Price > Cost

… and where this relationship holds true across the scales at which you operate.