How to parse a pricing page

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

I spend a lot of time looking at pricing pages. On most days I will look at 2 or 3 and I will parse at least 1 each week. Sometimes I am doing this out of simple curiosity. I want to know how different companies are packaging their offers, pricing the packages and communicating value. Other times I am looking for one of our customers, checking how the competitive alternatives have communicated their pricing.

To make things simpler, and to gather data, I have developed a bit of a process to parse through a pricing page. Once I discover an actual pricing page, a page that actually has numbers on it (about 30% of the total but 100% of product-led growth companies), I go through the following steps:

What are the key value propositions?

Are there different value propositions for each package?

What is the main pricing metric?

Are there other pricing metrics?

Are there hidden pricing metrics that I need to dig for?

How are the packages fenced?

How am I guided to which package I should buy?

What is the pricing structure and pricing curve?

How do unit prices change across packages?

That is the process for 1 company. Generally when doing this one wants to compare at least 3 of the companies in a category to get a feeling for how pricing is handled. Edward Wong will be sharing an example of this for the user feedback category next week.

Lets’ apply this to an actual pricing page. I will use Zoho Desk for this. You can go to their pricing page here.

Parsing Zoho Desk’s pricing page

What is the key value proposition?

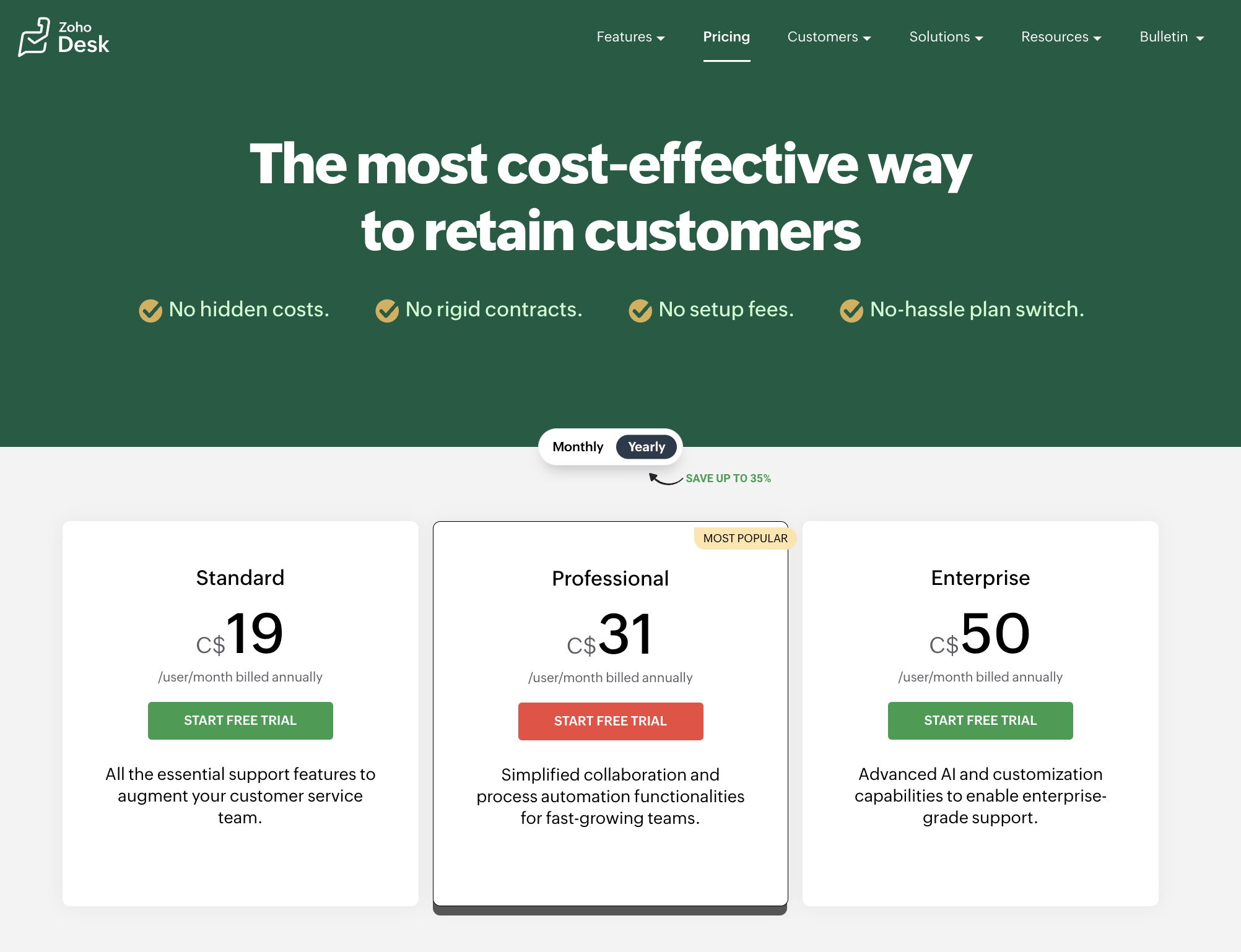

Zoho Desk is Zoho’s competitive alternative to Zendesk. The basic positioning is Zoho Desk: A better alternative to Zendesk.

On the pricing page, the key value proposition is “retain customers.” This is what applications like Zendesk and Zoho Desk are meant to do. They are the platform used by the customer success team to win renewals.

Are there different value propositions for each package?

Zoho Desk does a good job here. The packages build from:

Standard: All the essential support features needed

to

Professional: Collaboration and process automation (this will be interesting when we look at some of the ‘hidden’ pricing metrics

to

Enterprise: AI (everyone’s buzzword) and customization (which large companies generally need)

What is the main pricing metric?

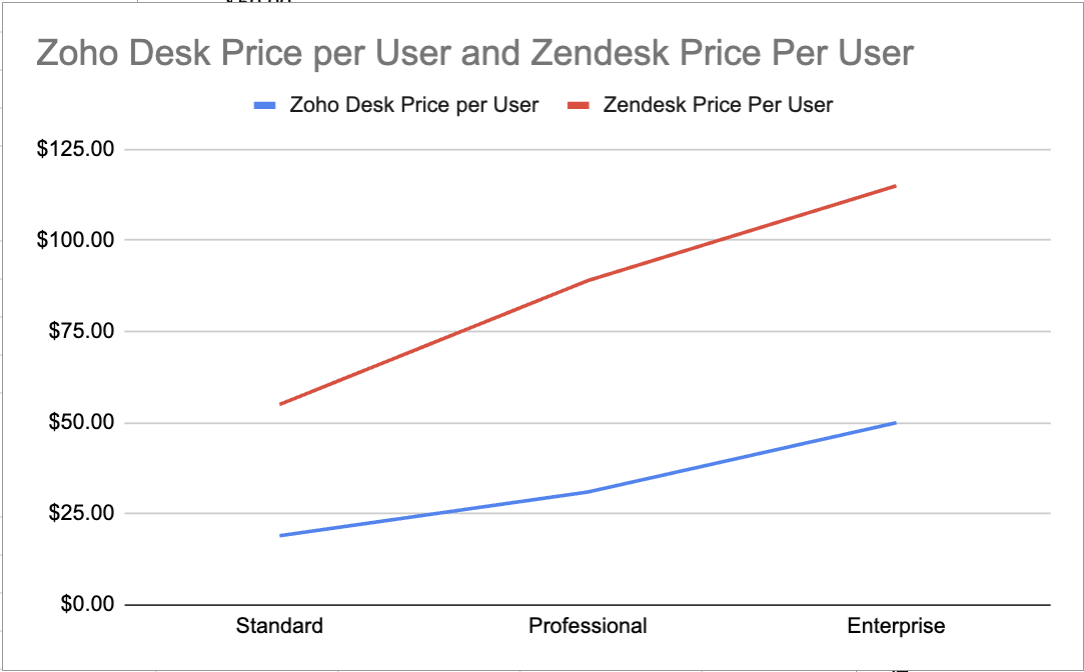

Zoho Desk is priced per user. I am not generally a fan of per user pricing, and I think Zoho or one of its competitors has an opportunity to change the game here by pricing using some metric based on customers supported and not on the agents needed to support them. That said, it is interesting to do a high level comparison of Zoho Desk and Zendesk. This is not an apples to apples comparison, but it is the comparison that many buyers will do before they go deeper. Zoho’s per agent pricing appears to be much cheaper than Zendesk (remember that Zoho does a lot of things beyond offering a customer support pricing and as a result has a lot more flexibility on how it prices one module).

You can check Zendesk’s pricing page here. It is worth exploring Zendesk pricing for different numbers of users, but that is a theme for a future post.

Notice that Zoho’s pricing is concave while Zendesk’s pricing is convex. Generally, one uses a concave pricing curve when targeting smaller companies and convex when targeting larger companies. This aligns with the pricing levels. Zoho Desk is targeting smaller companies than Zendesk.

Are there other pricing metrics?

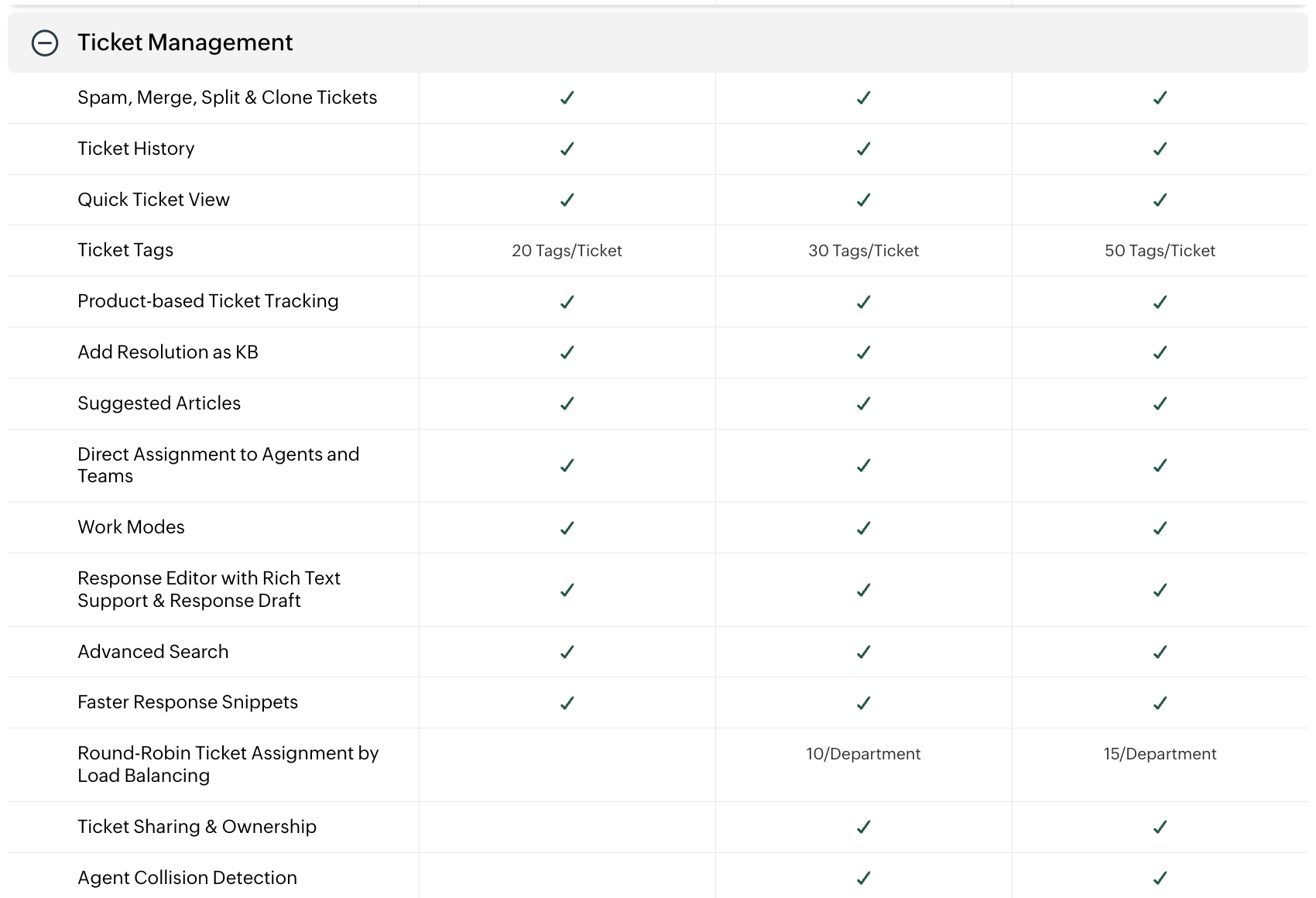

Just looking at the top level of the pricing page you may think no. And part of Zoho’s promise is that there are ‘no hidden fees.’ I guess this means that you do not have to read the small print in the contract to find all the costs. You do need to expand all of the features to discover all of the more granular pricing metrics.

There are a lot of fences and pricing metrics for each of the functionality groups.

Some may think of these that of these as fences, but when there is a number that changes across packages and is tied to price, then this is a kind of secondary pricing metric. There are a number of interesting things to note here.

The first secondary pricing metric is the number of tags per ticket. There is not a lot of information on why I would care about this, there is no real value proposition offered, but generally speaking the tags let one classify and route the tickets. We can graph the price per unit. The graph is shown below. It seems a bit arbitrary. If the value per tag increases with scale (you can make an argument for that) then it is fine for this line to slope up to the right. But, why does it go up and then down? A pricing anomaly perhaps. The nice thing about this sort of pricing anomaly is that once found they are easily fixed.

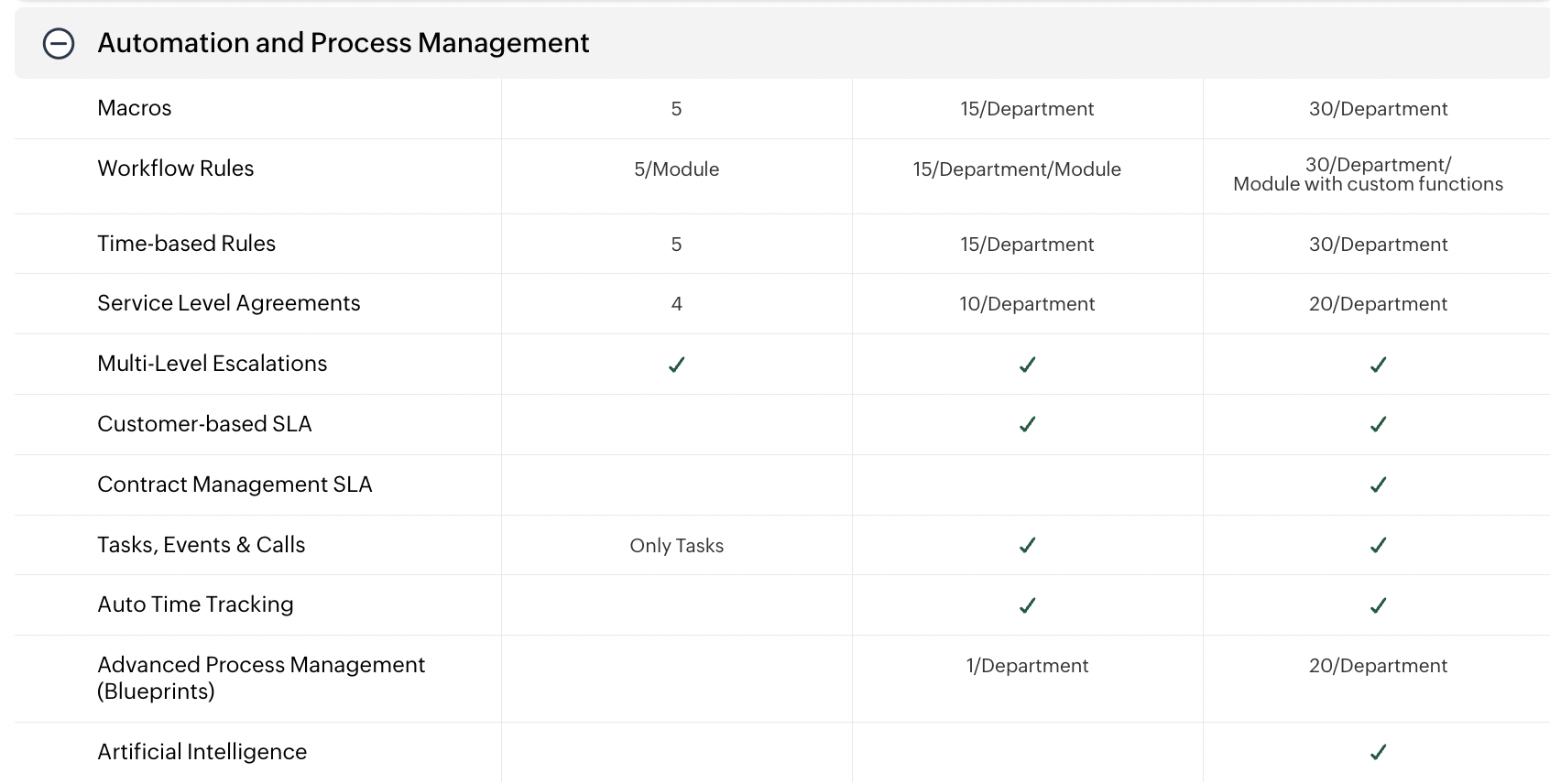

Automation is one of the key value promises, especially for the Enterprise package. There are three metrics buried here, the number of macros, workflow rules and time based rules. One can also support more than one service level agreement.

Advanced Process Management combines fencing to move people from Standard to Professional and then a pricing metric to differentiate Professional and Enterprise.

Here we have a more typical curve where the per unit pricing goes down across the packages. The curve here is concave, the middle point is below what a straight line would give. I am not sure this is the right approach if one wants to really position Enterprise as the automation solution.

Artificial Intelligence is only available in the Enterprise package. I believe that will change quickly over the coming months with AI being added to each package in a differentiated way. Will it be used as a fence or will there be a pricing metric attached?

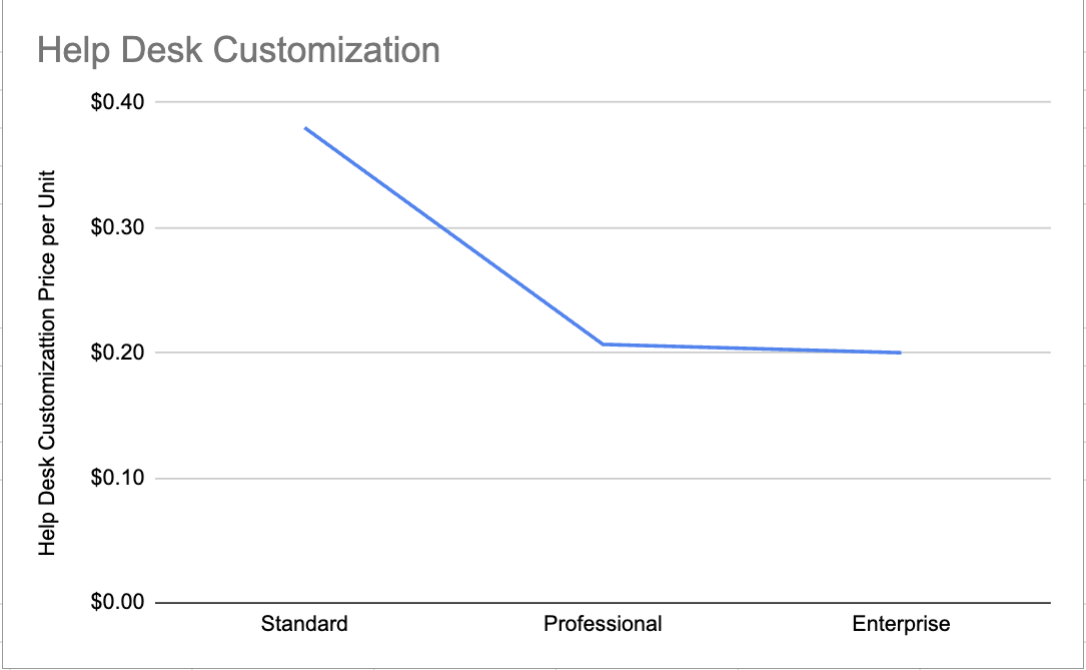

There is another of these pricing metrics on the help desk: the number of custom fields. This sounds to me a bit like the tags I can put on a ticket. But the pricing curve is quite different.

Here there is another concave curve (unlike the tags per ticket). This reinforces my impression that tags per ticket is an anomaly that should be adjusted.

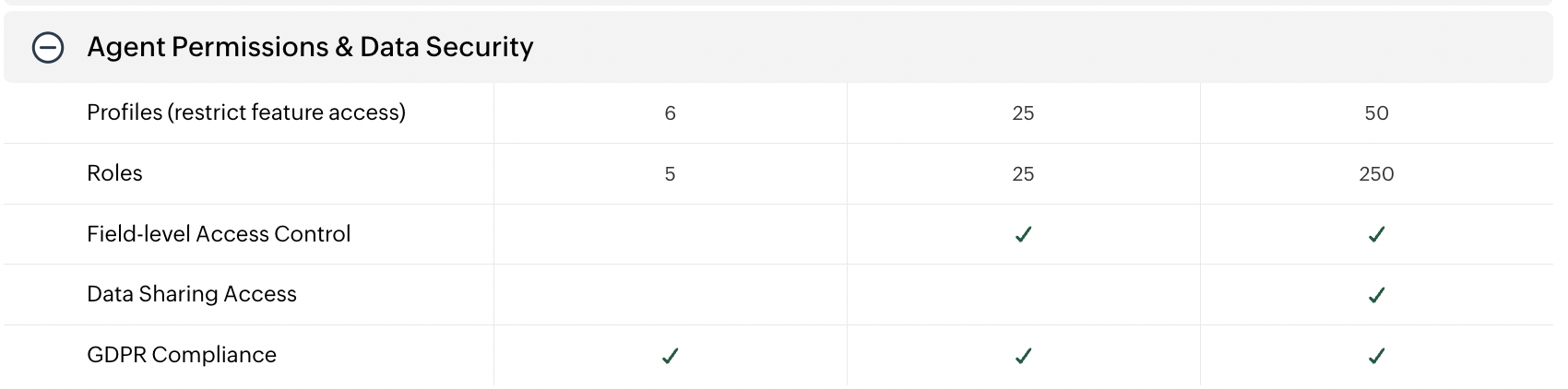

There are two more of these pricing metrics under Agent Permission & Data Security: Profiles and Roles.

It is interesting that the price per role scales down faster than the price per profile. This makes intuitive sense, larger organizations will likely have to support more roles, but I would like to have it articulated for me.

How are the packages fenced?

The many pricing metrics described above are one way that Zoho fences its packages, the other is by functionality. The checkmarks in the screenshots are the fences. They limit functionality in the lower priced packages, pushing people who want that functionality to upgrade.

Upgrades lead to additional revenues and are one of the key ways to win higher Net Revenue Retention.

There are many other ways to fence packages.

Limit some usage metric so that people with high usage are have an incentive to upgrade

Provide different levels of support for different levels so that people who require more support upgrade

Only provide integrations or API access to higher priced packages

How am I guided to which package I should buy?

Zoho Desk clearly signals its most popular package, the Professional level.

The value positioning also helps guide a buyer. If I need collaboration and process automation I am guided towards the Professional package. But if I work for a large enterprise or want a lot of customization and access to advanced functionality like AI, I will be drawn to the Enterprise Package.

The Standard package anchors the bottom end of the pricing. In part, this is intended to make Zendesk look overpriced and to give an easy entry point at the bottom end of the market.

What is the pricing structure and pricing curve? and How do unit prices change across packages?

One can learn a lot about a company’s pricing strategy by looking at pricing curves and how unit prices change across packages. You can see that above, where we graphed the implied unit prices for each of the secondary pricing metrics.

In general one is interested in the slope (up to the left or down to the left), the shape of the curve (concave or convex) and the unit price for each pricing metric for each package.

When designing pricing you need to be aware of all three of these characteristics and make conscious choices on how you position them.

If one gets more value per unit with scale then it can make sense for the slope to be up and to the right. If value per unit declines with scale then it is reasonable that price should come down as well.

Concave curves optimize for markets where there are many small customers and relatively few large customers. The reverse is true for convex. Go back up and compare the pricing curves for Zoho Desk and Zendesk. Zoho wants the lower end of the market while Zendesk is more interested in the larger customers.

Lessons for your own pricing page

Parsing through pricing pages, especially those of your competitors and of adjacent solutions will help you design your own pricing and pricing page. Once you have decided to share pricing publicly on a pricing page (a separate topic) you can use this checklist to think through your pricing and pricing page.

1. Package role

The role of each package should be clear to buyers

Pricing page design will differ if you have an alignment package design or an up-sell packaging design (in align packaging designs you try to get buyers into the package that best suits them and where they can be expected to stay; in an up-sell design you have an entry level or attractor package and your goal is to bring people in and then up-sell them)

Pricing should support the package role

2. Value and positioning

The pricing page should include your overall value proposition

Each package should have a clear value proposition that helps guide people to the package relevant to them (Zoho Desk does a pretty good job of this)

It should be clear to the buyer how the pricing metrics are aligned with value

3. Pricing Metrics

Keep additional pricing metrics to a minimum (two or three)

Do not bury additional pricing metrics, make them easy to find and understand

Choose pricing metrics that track value and explain to the buyer how the pricing metric aligns with value (yes, this repeats the third point above)

Include a pricing calculator if there is any complexity to your pricing (you may want to put this behind a lead capture mechanism)

4. Pricing Curves and Unit Prices

Plot the pricing curves for all pricing metrics and all packages

Make sure that these are consistent and reflect your target market

Make sure the pricing reflects the role you have designed for each package

Check the way that unit prices change across packages

Make sure that the changes in unit prices are consistent

Making a habit of looking at pricing pages is a great way to sharpen your pricing skills and build a general business knowledge. For pages that are especially interesting, because they are the pricing for your competitors or show some best practices, follow the nine steps introduced at the beginning of this post.

What are the key value propositions?

Are there different value propositions for each package?

What is the main pricing metric?

Are there other pricing metrics?

Are there hidden pricing metrics that I need to dig for?

How are the packages fenced?

How am I guided to which package I should buy?

What is the pricing structure and pricing curve?

How do unit prices change across packages?