Applying the Strategic Choice Cascade for Pricing - HSBC Case Study

Rashaqa Rahman is a Principal Consultant at Ibbaka. See her Skill Profile on Ibbaka Talent.

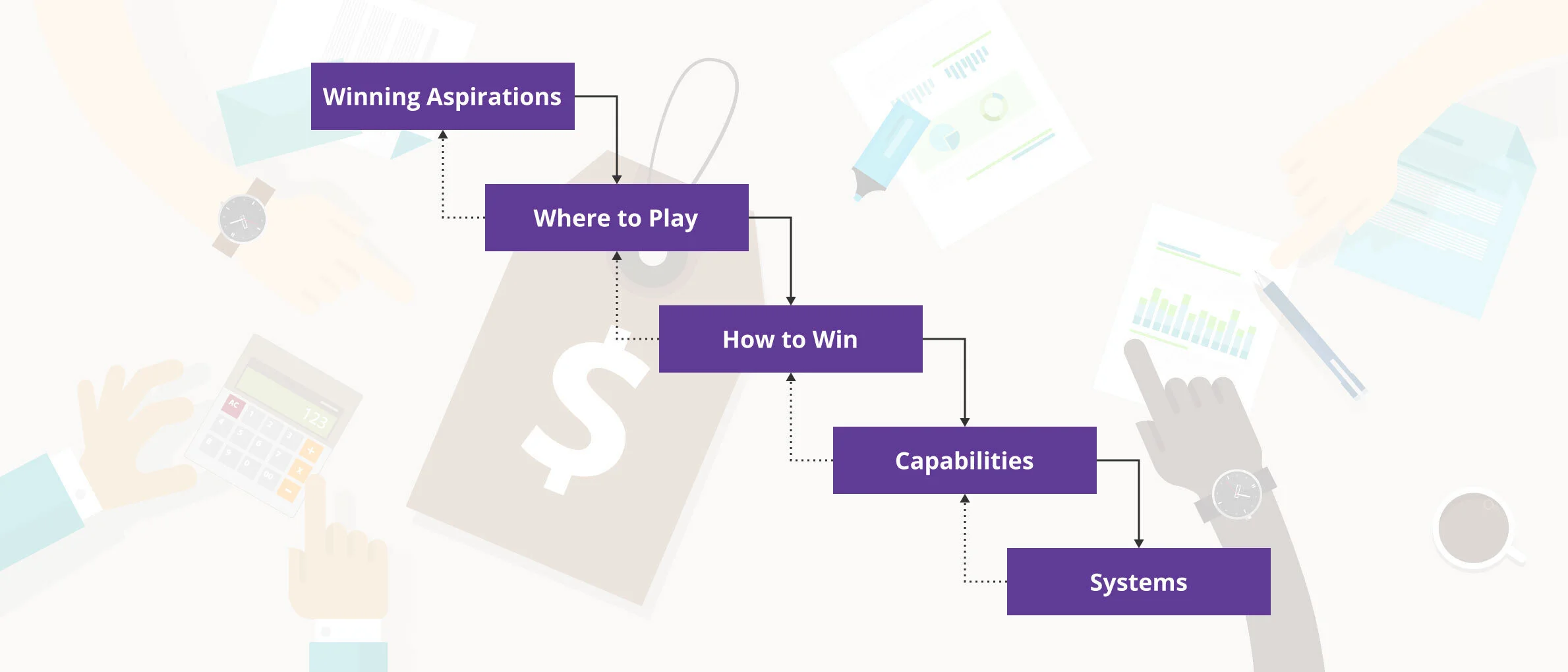

At Ibbaka, we have applied Roger Martin’s Strategic Choice Cascade to develop a simple template that will help organizations think through the strategic choices made in pricing strategy and tactics.

Roger Martin has helped companies like Procter and Gamble as well as Lego reinvent themselves and connect their strategy to execution, using the Strategic Choice Cascade framework. This framework was popularized in the book Playing to Win: How Strategy Really Works, that Roger Martin co-authored with P&G CEO A.G. Lafley, and is sometimes referred to as ‘playing to win choices.’ It is well tested and has been applied in many different contexts. For our purpose, we have created a version that can be used specifically for pricing decisions . It can be used to frame choices and connect pricing and tactics to strategy.

Strategic Choice Cascade for Pricing

We had previously volunteered one of our businesses Ibbaka Talent as an example of how we would apply the cascade. You can read more on that here . For this case study, we thought it would be interesting to apply the Strategic Choice Cascade for Pricing model to publicly available information on a recent pricing strategy shift by HSBC.

By applying the template to the limited information publicly available to date regarding this strategic choice, we hope to give you a feel for how our template can guide decision-making and in-depth thinking, as well as highlight why each step in the cascade is crucial to successful execution on pricing strategy.

In October 2020, HSBC Holding PLC announced that they were doing a pandemic-induced overhaul of their business and shifting from an interest rate-based business model to a fee-based business model. With plummeting worldwide interest rates, a business model primarily dependent on generating interest income from customer deposits is no longer viable.

Let us work through how we would have applied the five steps of the strategic choice cascade template to this pricing decision.

Winning Aspirations

Organizational alignment on winning aspirations is critical. The next steps in the cascade have to achieve the Winning Aspirations. We want to understand, what are the overall winning aspirations for HSBC. How would the pricing aspirations align with the overall strategy? How will they help measure, deliver, and capture value?

HSBC’s winning aspirations are:

Aim to be the world’s leading international bank serving personal, wealth, and corporate clients

Want to have the ability to serve shareholders and stakeholders by acting on the best opportunities for growth

Want to price for longer-term sustainability that allows for an increased return to investors, creates the capacity to invest for the future, and builds a sustainable platform for growth

In essence, any pricing strategy must support the above aspirations.

Where to Play

Where to play choices are the big strategic choices that you make. Where to play choices should address what are the prioritized value-based market segments.

HSBC’s where-to-play choices are:

Increasing investment in the faster-growing, higher-return Asia market

Merging wealth and personal banking in a bid to cross-sell lucrative products

HSBC is doubling down on Asia where even given the geopolitical tensions, the rate of economic recovery from the pandemic is proving resilient compared to Europe. Additionally merging wealth and personal banking is creating a hybrid segment and understanding the customer perception of value at this intersection and capturing a fair part of that value is key to good pricing.

How to Win

How to win choices are tactical. How to win choices should address how you would connect value metrics (the unit of consumption why which the customer derives value) to pricing metrics (the unit in which the offer is priced).

HSBC’s how-to-win choices are:

Charging fees for corporate clients

Charging fees for basic banking services in certain markets where they were free

Introducing a fee-based system may come as a shock to some existing markets. Managing customer expectations and understanding how the customer derives value and whether charging a fee erodes part of that value will be key. Creating and maintaining customer trust is critical. If a new pricing system undermines trust, it will inevitably lead to value erosion. If charging fees erode customer value creation it is bound to fail. Therefore it is critical to understand how new and existing customer segments derive value at each stage of the customer journey, the value promise HSBC makes at each stage, and how this value is delivered, communicated, and captured through pricing - these are all how to win choices. A good tool to use to track customer value creation, delivery, and consumption is a customer journey map. It is a visual representation of every experience a customer has with you. It helps to tell the story of a customer's experience with the brand from original engagement into a long-term relationship.

Capabilities

One cannot execute on strategy without capabilities. There are different types of capabilities: here we are thinking of capabilities as the ones that specifically relate to HSBC’s ability to communicate value to their target market(s). Capabilities and skills need to be built around value communication to a new target segment, value communication around a new or bundled offer, the ability to document and measure the value delivered, as well as consistency and discipline around pricing and value messaging that does not erode trust. The following are some examples of capabilities that are required for the successful execution of strategy.

Skills for employees - One of the most important capabilities is the skills and competencies of the employees. What skills are needed by Product, Pricing, Marketing, Sales, and Customer Success to execute the How to Win and the Where to Play choices by HSBC? A great way to gain insight into the skills needed to execute on strategy is to represent them in a competency model and then map them to the customer journey.

Ability to gather and analyze information to feed value models - Capabilities also need to include the capability to gather and analyze information that lends insight into the monetary value of the offer to specific customer segments and use that to adjust pricing (often at renewal). Developing this value model that connects value creation and consumption to pricing requires an underlying data model.

Skills of the customer - We need to ask what skills are needed by the customer to understand the value proposition and to get value. Customers may need certain knowledge in order to understand the value and new pricing. This should also be part of the customer journey map.

Systems

Systems and processes need to be developed to give people and organizations the capabilities they need and to support the processes used in the how-to-win choices. In the case of HSBC, it could be in the form of:

Analytical tools to help uncover clusters and patterns in market segments

Tools to analyze the data being collected into their data model

Skills and capability management systems

A platform that supports pricing strategy across different offer packages, customer types and geographical locations

A customer success management system that configures value delivered to the customer

We hope this short exercise of applying the strategic choice cascade to an existing pricing strategy will get you thinking about your own pricing. Pricing is not an afterthought but a critical part of the overall organizational strategy. Making pricing decisions out of the context of the larger strategy can be a costly mistake.

Looking to get started on your 2021 strategy? Use our Strategic Choice Cascade for Pricing template as a compelling way to connect pricing choices to other strategic choices and put them into context.