Are you leaving money on the table?

By Rashaqa Rahman

In a recently conducted survey by Ibbaka, we asked individuals responsible for pricing decisions across different industries, what they believed to be the main pricing challenges faced by their organizations. 60% of respondents said they feared they were leaving money on the table, while 41% said they were discounting more than they should.

Do these pricing concerns sound familiar? In this blog, we will discuss the ways in which pricing strategies commonly fall short, resulting in the inability to effectively capture customer value. We will also consider best practices to mitigate these risks and to optimize pricing.

when looking at pricing decisions 60% of respondents said they feared leaving money on the table while 41% said they were discounting more than they should

An introduction to the value cascade

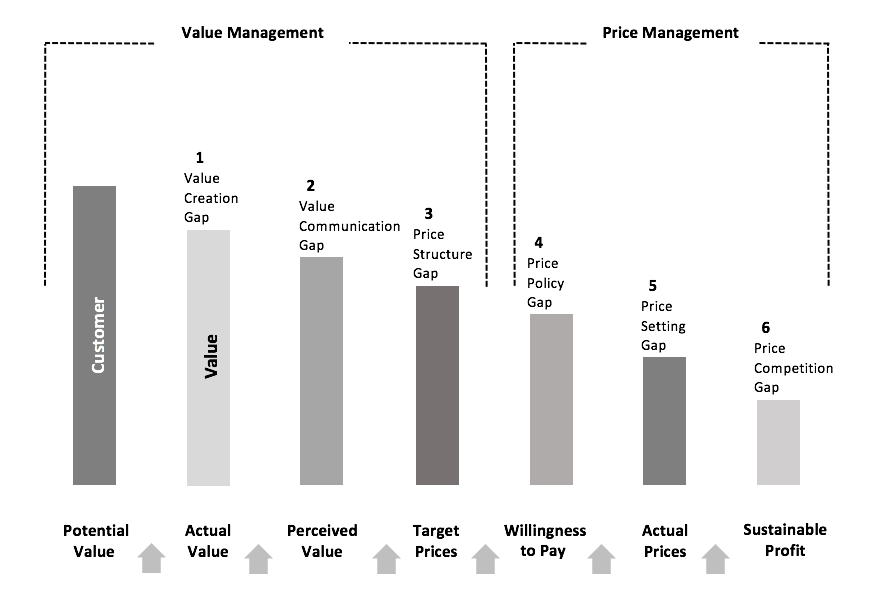

The Value Cascade (figure below) by Tom Nagle and Georg Müller is a new framework introduced in the Sixth Edition of TheStrategy and Tactics of Pricing. It identifies different stages in the customer value creation and pricing processes that can create a price-value gap. Each of these gaps make it difficult for organizations to maximize returns through pricing.

Source: The Value Cascade: Strategic Pricing Requires Effective Management of Both Value and Price. Copied from The Strategy and Tactics of Pricing - A Guide to Growing More Profitably , Sixth Edition (p. 11), by T. Nagle & G. Müller, 2018, New York, Routledge.

Best practices to reduce the price-value gap

So how do we reduce the price-value gap, maximize returns and not leave money on the table?

Start with creating value

There are no shortcuts to effective pricing. Good pricing decisions always start with robust market segmentation. A product/service offer is meant to address a customer need or pain point. There will be a gap between the potential value of your offer and the actual value to customers, because it is very difficult to solve any problem “perfectly.” However your aim should be to minimize this value creation gap by creating differentiated value for your target segment(s).

If you are all things to all people, you will not be able to close this gap. Market segmentation helps identify target segment(s) that you, as an organization, are best suited to serve. You can close part of the value creation gap by addressing the target segment(s)’ needs better and/or differently than their next best competitive alternative . This is the foundation of value-based pricing.

Move to capturing value

Perceived Value:Customer value perception plays a key role in determining how much of the differentiated value created can be effectively captured through fair pricing. You will only be able to maximize returns from your offer if your customers perceive your offer to be valuable. If you have a differentiated offer, but your customers do not fully understand the differentiation, it takes away from your pricing power. Your organization should proactively shape customer perception by effectively communicating the value of your offer to your target customers.

Design your pricing

Pricing should capture a fair share of the customer value created. Even when charging a premium for a value-added, differentiated offer, the price should not aim to recoup the full value you create for your customers. Your price should leave a consumer surplus - that is, the customer should feel they are getting more value than the amount they spent. So, there will be some inevitable price-value gap here.

Also when designing your pricing, if you have a tiered pricing structure:

make sure each pricing tier has a role to play in revenue generation, and

set clear targets for the percentage of customers per pricing tier, the percentage of customers you expect to up sell between tiers, the minimum level of churn, as well as target renewal rates

You should track regularly to ensure each tier is effective in its assigned role. Usually, within a multi-tiered pricing structure, the target pricing tier is framed by lower and upper tiers.

Make sure the the lower tiers are providing the correct framing and guiding customers towards your target or optimal pricing tier. If you are unable to up sell from the lower tier, then chances are either:

your target tier offer is not value-added or differentiated, and you are overpriced,

OR,

you have designed your target tier offer wrong and may be giving away too much value at a lower price.

Generally speaking, the target pricing tier should generate about 50% - 70% of your unit sales. If your highest tier is generating more than 30% of your unit sales, it may mean that you have underestimated how much your customers value your offer, and are likely leaving money on the table.

What roles does willingness to pay and discounting play?

Contrary to popular belief, the customers’ willingness to pay is not static. Clear value communication can help shape perception, and informed customers are more likely to have a higher willingness to pay. Effectively communicating the value of a differentiated offer is critical to the sustained success of value-based pricing. Undisciplined discounting can devalue your brand. There should be organizational policies around discounting, as well as compensation plans, that motivate your sales personnel to carry out value-based sales.

What about the role of competitors in my pricing design?

Being aware of your customers' alternatives is an important part of pricing. However, do not price your offer relative to the competitors’ price. Doing so will make it difficult to assert your differentiation and you will lose control over your pricing. Your pricing should be based on the differentiated value you create for your target segment(s).

Though some value-price gap is required (you need to create more value than you claim in price), you should evaluate your organizational effectiveness at each step in the Value Cascade. Ask yourself hard questions as you move from left to right across the cascade and tighten any loose ends which may be resulting in unnecessary value leaks.

Pricing decisions may seem daunting, but a disciplined, value-based approach to pricing can make it less so. We hope you will find this no strings attached exercise helpful in how you think about your pricing strategy.