What is the distribution of your Willingness to Pay curve?

By Steven Forth

Hang around pricing people and you will hear a lot of discussion of Willingness to Pay, or WTP. This has become one of the most common concepts in pricing and there are quite a few people who will say that good pricing tracks as closely as possible to the customer's Willingness to Pay. Some beknighted people even equate Willingness to Pay with the Value Provided to a Customer ( or Customer Value).

What is 'Willingness to Pay'?

It is a slippery concept, for a number of reasons. Willingness to Pay is different for different companies and varies depending on the situation. Generically, it refers to how much a customer or a market segment will be willing to pay for a solution. It does not track customer value, which is better estimated using a technique like Economic Value Estimation (c) (EVE) and by using data mining tools that can combine economic value with emotional value. Customer value is just one determinant of Willingness to Pay, the others being the cost of the alternatives, risk and pricing power. An estimate for Willingness to Pay does not help one understand the actual market forces that should shape pricing.

How does one know WTP?

This is the real achilles heal of this concept. There is in fact no way to know what Willingness to Pay actually is. There are statistical techniques that look at variations in price actually paid and tries to estimate WTP from this variation. This can be worth doing as an input into pricing design. But it is a secondary input, and one that has to be treated with scepticism.

Can WTP be influenced?

Yes it can. In fact much of marketing and pricing design is designed to change willingness to pay. The value messages, the framing of a price relative to other prices, the connection of the pricing metric to the value metric, risk management - all of these things impact Willingness to Pay. But a value, or even range, for WTP does not help one understand how to shape any of these things. The most one can say, is that when there is a lot of variability in WTP estimates there is probably a lot of opportunity to shape it.

Should pricing track WTP?

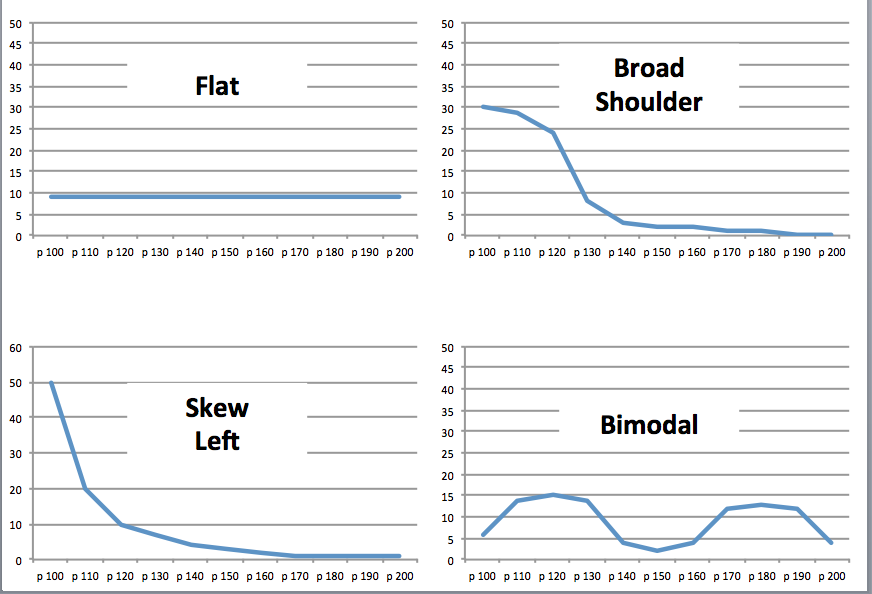

Well, sometimes, depending on your pricing strategy, and the actions you have taken to shape Willingness to Pay. As WTP is a range and a distribution, there is no one price that will optimize WTP for all possible customers. Even more important, the shape of the WTP curve has a big impact on pricing and packaging. Let's dig into this a bit deeper.

Here I have assumed a total market of 100 possible customers and modeled a linear increase in WTP (this assumption is generally wrong, and it is worth exploring geometric or logarithmic distributions).

These different curves have several implications. The first is that the only way to maximize revenues (if that is your goal) is to have a different price for every segment. This is generally impossible of course. In many countries there are legal limitations to this, and in any case. it would extremely difficult to fence the market without fine grained performance pricing. Performance pricing is a pricing system is which the value metric and pricing metric are tightly bound. Today, it is possible only for a certain class of solutions.

Let's assume that one can only have three offers (a fair assumption) and that these offers are able to perfectly map to Willingness to Pay (highly optimistic). How would you design packaging and pricing?

The goal is to capture as many customers as possible at as high a price as possible.

The entry level offer will be priced at the first peak in the WTP graph. That is easy. The harder part is to understand the mid and high tier package. These packages have to offer enough additional value to justify the additional price. Your assumptions about the shape of the WTP distribution will guide you on how to design the offer and set the price. You can only design an offer if you understand the value drivers that support the Willingness to Pay.

Here the red line is the aggregate number of prospects who can be captured (Y-axis) at a specific price (X-axis). I know that price is often put on the Y-Axis, I find it easier to put it on the X-Axis when I am trying to design packaging.

How effective is the packaging? Comparing the ideal (when every prospect can buy an offer that matches their WTP) with the practical (where only a limited number of packages can be offered) we can compare the effectiveness of packaging for each distribution. The exact numbers here will depend on the shape of the distribution but this is directionally correct.

We can see that it is easiest to capture Willingness to Pay for the Left Skew distribution, closely followed by a Broad Shoulder distribution. This is a good thing, as I believe these are the two most common distributions in the real world. When there are multimodal distributions it is critical to craft an offer for each segment. Of course this only helps if (i) you know the actual WTP distribution and (ii) you can actually construct offers that capture most of the people within the WTP range. The latter will only be true if you can align WTP with how the customer gets value and design the right offer.

What do I do about WTP?

Now that you understand this, what should you do?

Do not worry about WTP until you have done some real research into how different segments get value from your offer and you have designed a package for each segment.

Estimate Willingness to Pay for opportunities in each segment. This can be be a SWAG (Scientific Wild Assed Guess) on your first pass as you are just trying to get some insight into the general shape of the distribution.

If you have the time and budget, do some actual research into Willingness to Pay. How you do this will depend on where you are in the product lifecycle. If you are already in the market and have transactional data, you can try to use this to estimate WTP. If you have not entered the market, consider a combination of price sensitivity and conjoint analysis, with the research focussed on the inflection points in the curve.

Ibbaka will be happy to help you think through how the value you provide to your customer impacts Willingness to Pay, the shape of the WTP distribution, and how to design offers and pricing that optimizes WTP capture.