Understand your market's dynamics before you set your pricing strategy

By Steven Forth

Before you set your pricing strategy, or even make tactical pricing decisions, it is a good idea to understand the market dynamics for your offer. Economists tell us that prices will trend to the point where the line for price elasticity of demand intersects the line for the price elasticity of supply. That is the theory anyway. It is only true for commodities where there is no differentiation of buyers or sellers, and it is somewhat approaching perfect information. This does not describe your market. If your product development teams are doing a good job, there is no perfect substitute for your offer and your customers come in all different shapes and sizes, with different needs and pricing sensitivities.

This does not mean you can ignore the connection between price and demand. The shape of the price elasticity of demand curve is an important constraint on your strategy. Here are sketches of four typical demand curves. Which of these reflects your market? If you don't know the answer, you can often figure this out by looking at your own transactional data (if you have pricing software it may help you to do this), or through market research or even by talking to experts in your market and applying common sense.

The simplest assumption (top left) is that demand will increase more or less linearly as you reduce price. If this is even approximately true, then you have a lot of room to set your strategic direction. Most markets are not like this though.

In many markets, demand is not all that sensitive to price at the top end of the market, but very sensitive to price in the bottom end (top right). If this is the case you need to have a premium strategy and stay in the top end of the market, or you need to be able to compete for market share with a low price in the bottom end of the market. It is often difficult to survive in the middle. We are seeing a lot of markets move towards this sort of concave structure with a resulting hollowing out of the middle. This can put a lot of pressure on companies with mid-market offers. If this is happening in your market, you need a strategy to compete at the high end or the low end, or you may even need to move into an adjacent market. In B2B software, we are seeing this trend in markets that are commoditizing, like customer relationship management (CRM), learning management systems, (LMS) and supply chain management (SCM). One of our hypotheses is that this is going to happen very quickly with artificial intelligence (AI) and that the many companies investing in this area are going to get caught in a mid-market squeeze.

On the other hand, there are plenty of markets with a convex demand curve (bottom left). These markets are similar to the linear case, but with a price floor that it does not make sense to go below. At the bottom end of the market, the lower prices will not make up for the small increase in demand.

S-shaped curves (seen in the bottom middle and bottom right) can create interesting market dynamics. In the bottom middle curve, there is usually a small 'luxury' market and a large mid-market with almost no low end (it is too difficult to make money at the low end of these markets). This is an alternative possible outcome for AI, with a very small number of high end offers and a large number of mid-market offers. The curve on the bottom right also generates an interesting market dynamic, with solid high end and low end markets, but little in between. Many pharmaceutical products have this market structure.

Even when the demand curve has the same shape, the slope is an important question. Markets with a steep slope are very price sensitive and price changes require careful thought and monitoring. If the slope is flatter there is more room for experiment and some forgiveness of error. In general, the more competitive a market and the less differentiation, the steeper the slope.

Price elasticity of demand is only one determinant of market dynamics. Equally important is cross price elasticity. This is the tendency for people to switch to a substitute in response to a price change. If the price of coffee at Starbucks goes up are you likely to switch to another coffee shop or will you remain loyal to Starbucks? At some point you will switch. You will probably not pay $15 for a cup of coffee, but generally speaking Starbucks has a low cross-price elasticity. On the other hand, the cross-price elasticity for things that are easily substituted tends to be high, such as bottled water.

This gets really interesting when you combine price elasticity of demand with cross price elasticity. It is possible to have high cross price elasticity and low price elasticity of demand. I this case, lower prices do not grow the market but the can shift market share from one supplier to another.

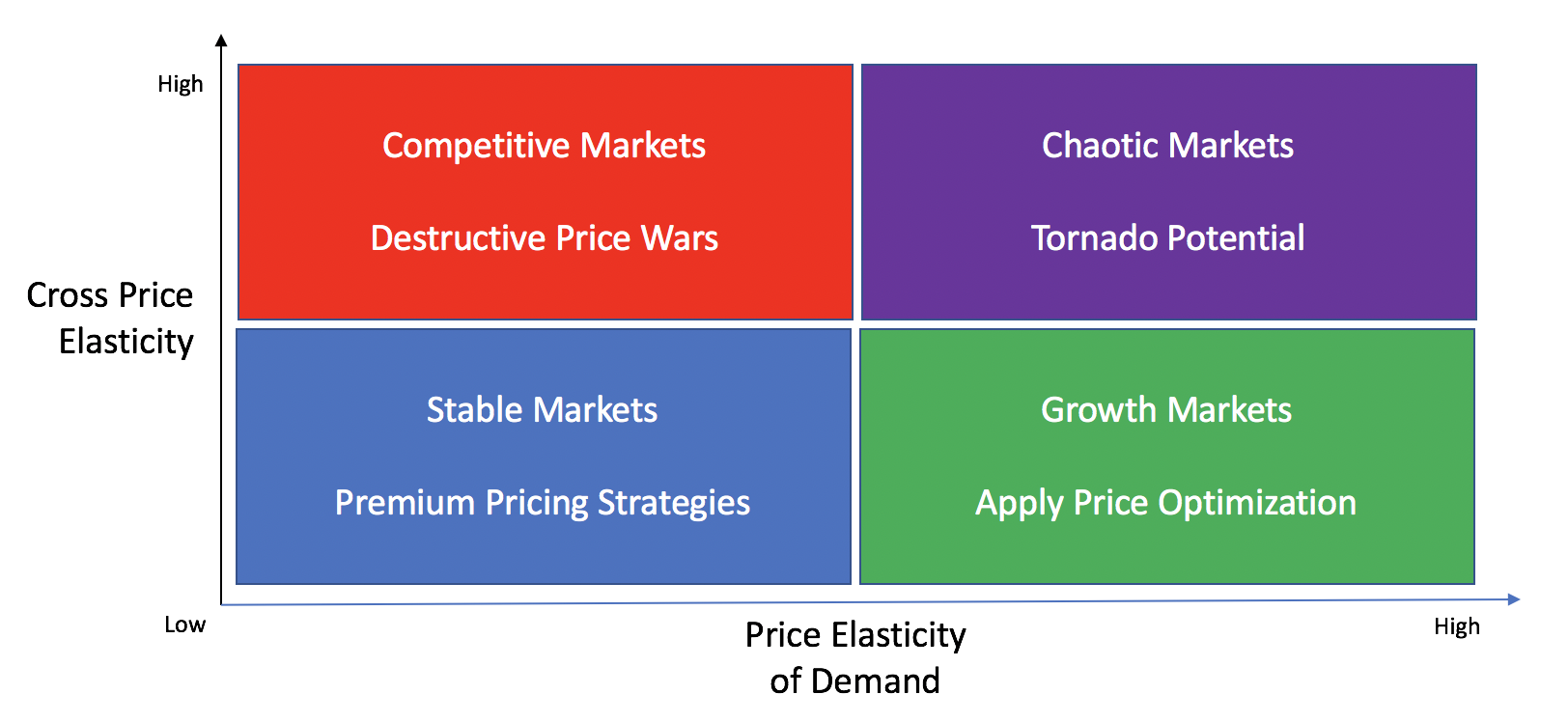

Let's look at four possible scenarios: Low Price Elasticity of Demand and Low Cross Price Elasticity; Low Price Elasticity of Demand and High Cross Price Elasticity; High Price Elasticity of Demand and Low Cross Price Elasticity; and High Price Elasticity of Demand and High Cross Price Elasticity. You need to know which of these four quadrants you are in.

Stable Markets: Low Price Elasticity of Demand and Low Cross Price Elasticity

These are nice markets to operate in. The focus is on value rather than price, there are many opportunities for differentiation, value-based segmentation and customer targeting are the key. The combination of low price elasticity of demand and low cross price elasticity means that a premium pricing strategy is almost certainly the right choice. On the down side, these markets often grow slower than markets with high price elasticity of demand.

Competitive Markets: Low Price Elasticity of Demand and High Cross Price Elasticity

These are the toughest markets to operate in. There is not a lot of room to grow the overall market (to 'grow the pie' so to speak). Any price cut generally leads to a price war that destroys value for all competitors and any price increase pushes demand over to competitors. In this type of market you have to be willing and able to send out strong pricing signals such as "we will not be undersold" or "everyday low prices." Mature markets where there is a lot of commoditization are generally in this quadrant.

Growth Markets: High Price Elasticity of Demand and Low Cross Price Elasticity

These are some of the most interesting markets as there are many different pricing strategies that will work. You can adopt a premium pricing strategy and optimize gross profit, or go for more of a penetration strategy and try to grow market share and revenue. Many early-stage markets have this structure. (If it is not a growth market why are you investing in innovating here?) Differentiation is important in these markets, and one of the ways you can differentiate is with your pricing strategy.

Chaotic Markets: High Price Elasticity of Demand and High Cross Price Elasticity

As understanding of a market grows among both buyers and sellers, a chaotic situation can emerge in which both price elasticity of demand and cross price elasticity are high. In these markets, which are often Geoffrey Moore's tornado markets, pricing is dynamic and needs to be reviewed weekly, sometimes daily. Prices will trend down as there is a lot of pressure to both grow the market and to capture market share. Pure premium strategies are likely to fail as competitors compete to undermine your value propositions, which are increasingly well understood and easily copied. Penetration strategies will provoke competitive responses, but unlike Competitive Markets there is often enough growth to make up for lower prices. In chaotic markets pricing needs to be central to strategy and pricing experts who are able to think on their feet stay aware of shifts in the market are critical.

Questions to ask about pricing strategy and market dynamics

You can't set a pricing strategy without understanding the market dynamics. Make sure you know which quadrant you are acting in and which direction the market is heading. Stable markets can become chaotic when disruptive solutions bring in new customers. Growth markets become more competitive as they mature. If you are acting in a chaotic market, will it mature unto a growth or competitive market?

As you develop and evolve your pricing strategy, make sure you can answer the following questions.

If I raise my prices, what will my competitors do? Will they raise prices along with me or will they lower prices and try to take away my customers?

If I raise prices, what will my customers do? Will they accept the raise while expecting more value or will they look for other solutions?

If I lower my prices, what will my competitors do? Will they lower their prices to match me or will they stay put?

If I lower my prices, what will my customers do? Will they buy more or simply pocket the price reduction?

If my competitor raises prices, what will I do? Will I also raise prices or will I try to steal some of their customers using the new price differential?

If my competitor raises prices, what will their customers do? Can they carry their customers with them to the new price level? Will they be seen as the stronger solution that provides more value? Or will some of their customers start to look for alternatives?

If my competitor lowers prices, what will I do? Will I have to follow suit and risk a price war or can I afford to ignore this?

If my competitor lowers prices, what will their customers do? Does my competitor have an opportunity to trigger overall market growth or is this more about market share?

You need to ask these questions many times, and track how your answers change as the market evolves. Markets are dynamic systems, and pricing has to respond to changes in market dynamics. Put this on the agenda for your next leadership meeting.