The Critical Questions to Ask about Pricing in 2022

Steven Forth is CEO/Co-founder at Ibbaka.

As we enter 2022, there are some critical questions we should be asking about our pricing strategies. Some are driven by external changes in the environment, like the possibility of inflation and higher interest rates. Others reflect corporate priorities, like how to increase company value. At the same time, best practices in pricing are evolving, and we need to keep asking ourselves if we have the right value and pricing metrics, if we should expand usage-based pricing, and how to evolve our pricing processes and the connections of pricing and value to customer value management.

In particular, organizations should consider how business value selling and value-based conversations can be incorporated into their pricing approach to drive better results.

Key Questions for 2022:

What impact will inflation have on your pricing?

What impact will higher interest rates have on your pricing?

How can you use pricing to increase company value?

How are best practices in pricing changing?

Does your pricing track the value you deliver to your target segments?

Can your pricing process detect change early and adapt rapidly?

Are you leveraging value selling examples and value selling definition to inform your strategy?

What impact will inflation have on your pricing?

Will inflation settle in during 2022, or is this a temporary phenomenon that will fade away as the economy settles into its post-pandemic configuration and supply chains sort themselves out? None of us really knows, so the smart move is to be prepared.

The first question to ask is how inflation will impact your customers and their business models. Will the critical value drivers change, and how will this impact the connection between your value metric (the unit of consumption by which a user gets value) and your pricing metric (the unit of consumption that the buyer pays for)?

This is a prime opportunity to engage in value-based conversations with your customers, ensuring your pricing continues building value in sales even as market conditions shift.

Inflation could change your customer segmentation if different customer sets are impacted by inflation in different ways. Think this through and then go out and survey your customers. Ask if it is time to resegment and reprice, and consider how value-based selling can help you maintain alignment with your customers’ evolving needs.

Board and executive teams will be asking:

Is inflation an opportunity to raise our prices?

What will inflation do to our own costs? (And do we need to raise prices in response?)

Tread carefully here. These are reasonable questions and need to be investigated, but a knee-jerk response to inflation could be counterproductive. Before raising prices in response to inflation, play this out a few moves and think through the inputs on your customers. Selling value, rather than just products, will be critical in this environment.

What impact will higher interest rates have on your pricing?

Central banks are likely to want to cool inflationary expectations, which means easing up on quantitative easing and raising interest rates.

Most central banks will be cautious, but if rates rise, you need to be prepared. The biggest impact is a higher cost of capital, which may lead companies to avoid capital investments if possible. If you have an offer that makes production more efficient, you may be able to position it as a way to defer or avoid capital investment - a powerful value driver. This is a classic value selling example: reframing your solution around the value it delivers in a changing economic context.

How can you use pricing to increase company value?

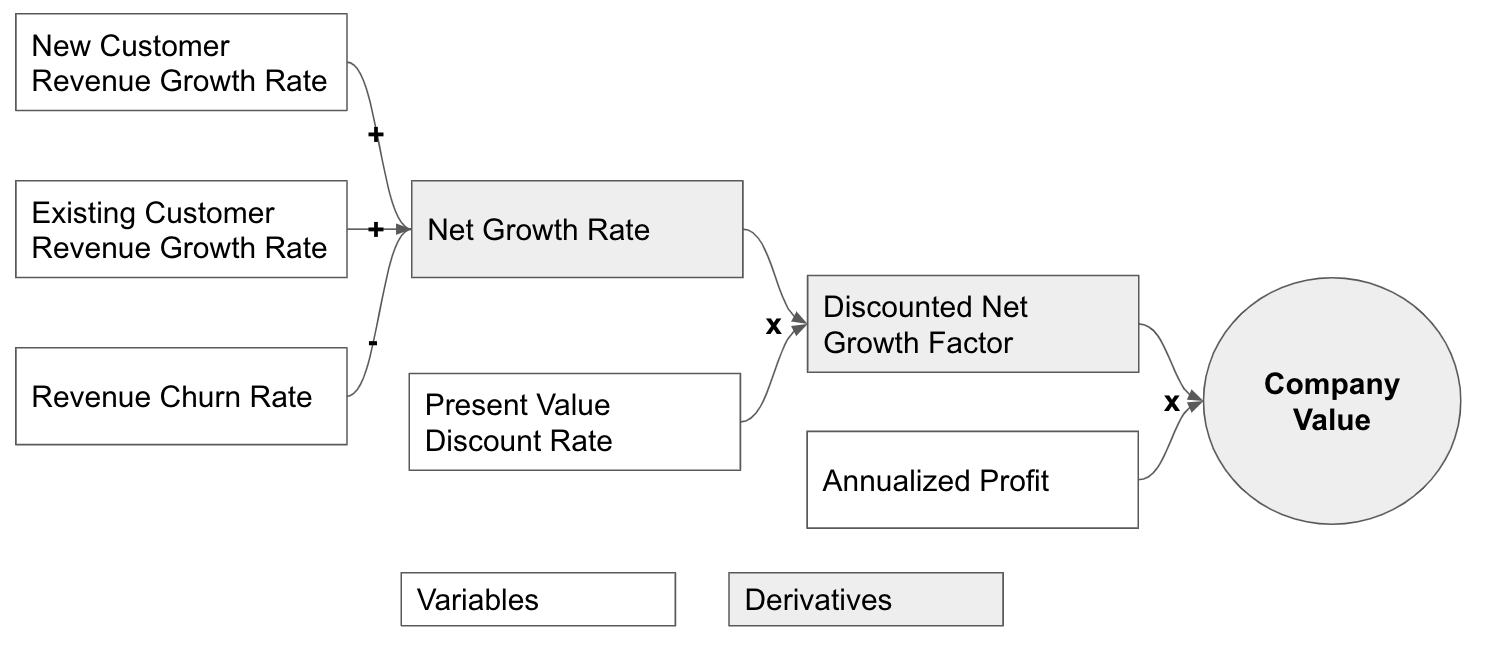

Pricing is a powerful lever, but it cannot be used to do everything at once. So, how do you decide what your pricing objectives should be? The best way to answer this question is to ask what will do the most to increase company value.

This is where business value selling comes into play-aligning your pricing strategy with the value you deliver to customers and the value you want to create for your organization.

At some companies, revenue or ARR (annual recurring revenue) is used as a proxy for value. At others, it is profits or profitability. In fact, all of these contribute to value, and you need to treat company value as a system of interacting parts. Revenue and profit, together with risk, combine to determine value.

What is your 2022 pricing strategy meant to do? Grow revenue from new customers? Grow revenue from existing customers? Reduce churn? Reduce risk? Improve profit? Test your planned pricing actions, even the ones in response to inflation, against each of these factors and think through the interactions.

Consider how to build value in sales and leverage value-based conversation techniques to support these objectives.

How are best practices in pricing changing?

Make sure your pricing process is up to best practices. Pricing is transforming as new technologies become available (especially AI), the connection between price and value is better understood, and the availability of information on the Internet leads to new norms.

The four key pricing best practices you should be aware of are:

Pricing needs to be fair (consistent, transparent, and reflect the value you deliver)

Pricing must be adaptable (even adaptive) - your pricing is responsive to changes in the external and competitive environment and can be changed when needed

Pricing should include a usage component

Pricing must track value

Pricing must align with corporate goals - this sounds obvious, but in many cases, pricing actions are short-term and short-sighted and will not support an organization’s long-term goals

Does your pricing track the value you deliver to your target segments?

Value-based pricing is a powerful thing, but only if price and value are aligned with your target market segment - a core tenet of value-based selling.

A well-defined segment is a group of customers and potential customers who get value in the same way and who buy in the same way. An industry vertical, a company size, or a geography does not define a market segment.

When external market conditions change, as they are likely to change in 2022, segmentation can change.

One of the first questions you should ask as we enter 2022 is:

Have there been changes to how our customers get value?

If the answer is ‘yes’, then ask: Do we need to re-segment our market in response to these changes?

Should we change our target segments and how we price for those segments?

A grounded segmentation is the foundation for pricing (for all marketing, actually), and when there are major changes to the environment, segmentation can change as well. When segmentation changes, pricing needs to change, and so does your approach to selling on value.

Can your pricing process detect change early and adapt rapidly?

What signals do you track that suggest you may need to adjust your pricing? It is hard to have an adaptive pricing model without systems in place to track what is happening in the market and with customers.

There are four major ways you can detect change:

Price signals - price scatterplots (how does price map to other metrics, how consistent is your pricing, what does analysis of usage of your pricing page tell you, what can you learn from sales, how is price impacting renewals)

Value signals - what value driver messages are registering with different segments, how much value is being delivered, is Value to Customer (V2C) larger than the Lifetime Value of a Customer (LTV), how is value delivered changing over time …

Customer signals - How are your customers’ businesses changing? Are they creating value in new ways? Do they face new competitive threats? What are their strategic goals, and how does your solution support those goals?

External signals (market and competitor) - what major social, economic, regulatory, or technology trends could impact your pricing (and how are you tracking these), what are your competitors doing, what alternatives are emerging

Part of your 2022 pricing plan should be to set up or update your data collection process and make it part of your regular pricing review. Depending on the cadence of your business and how fast trends appear, this cadence could be daily, weekly, monthly, or quarterly.

By embedding value-based conversations and value selling principles into your review process, you’ll be better positioned to adapt and thrive.

Originally published on January 4th, 2022. Last updated on May 14th, 2025.