Pricing for profit - the paradigm shift in B2B SaaS pricing

Steven Forth is a Managing Partner at Ibbaka (currently on leave). See his Skill Profile on Ibbaka Talio.

There has been a paradigm shift in how investors are thinking about their B2B SaaS portfolio. The changing economic climate (fear of slowdown or recession), inflation and higher interest rates are leading investors to pay more attention to NDR/NRR (net dollar retention or net revenue retention), gross profit and cashflow. This is cascading through to changes in pricing strategy.

For the past decade, B2B SaaS has been built around topline revenue growth and little else mattered. The most common valuation metric was a multiple of 12 month forward subscription revenues. This multiple varied greatly depending on market conditions and other factors (the rule of 40, growth rate, operating profit) from 3X to up to 100X.

This approach to valuation led to some dysfunctional behaviors. One of the key metrics used to determine marketing spend is the ratio of market spend to revenue growth. Many businesses invested up to a ratio of 1:1. They would invest $1 in marketing in return for $1 in revenue growth. With a gross margin of, say 80%, this meant that they were investing in marketing past the point of a positive return. The situation was made worse by valuing companies based on a multiple of revenues. Some of these companies would continue investing up to a $3 marketing investment driving a $1 increase in revenues.

It made a kind of warped economic sense to continue to invest in growth up to the point where marketing spend and valuation growth balanced, and to accept the growing losses that this implied.

Those days are gone.

SaaS companies have been optimizing pricing for revenue growth and not for profit. In general, this led SaaS companies to underprice. It is time to correct this.

The impact of price increases on a SaaS business

Assuming that demand goes up when price goes down (and even this assumption should be tested in B2B markets where there is often a range of price indifference) the volume optimizing price, revenue optimizing price and profit optimizing price are all different.

Ibbaka has a simple tool that helps you calculate this. The results are often surprising.

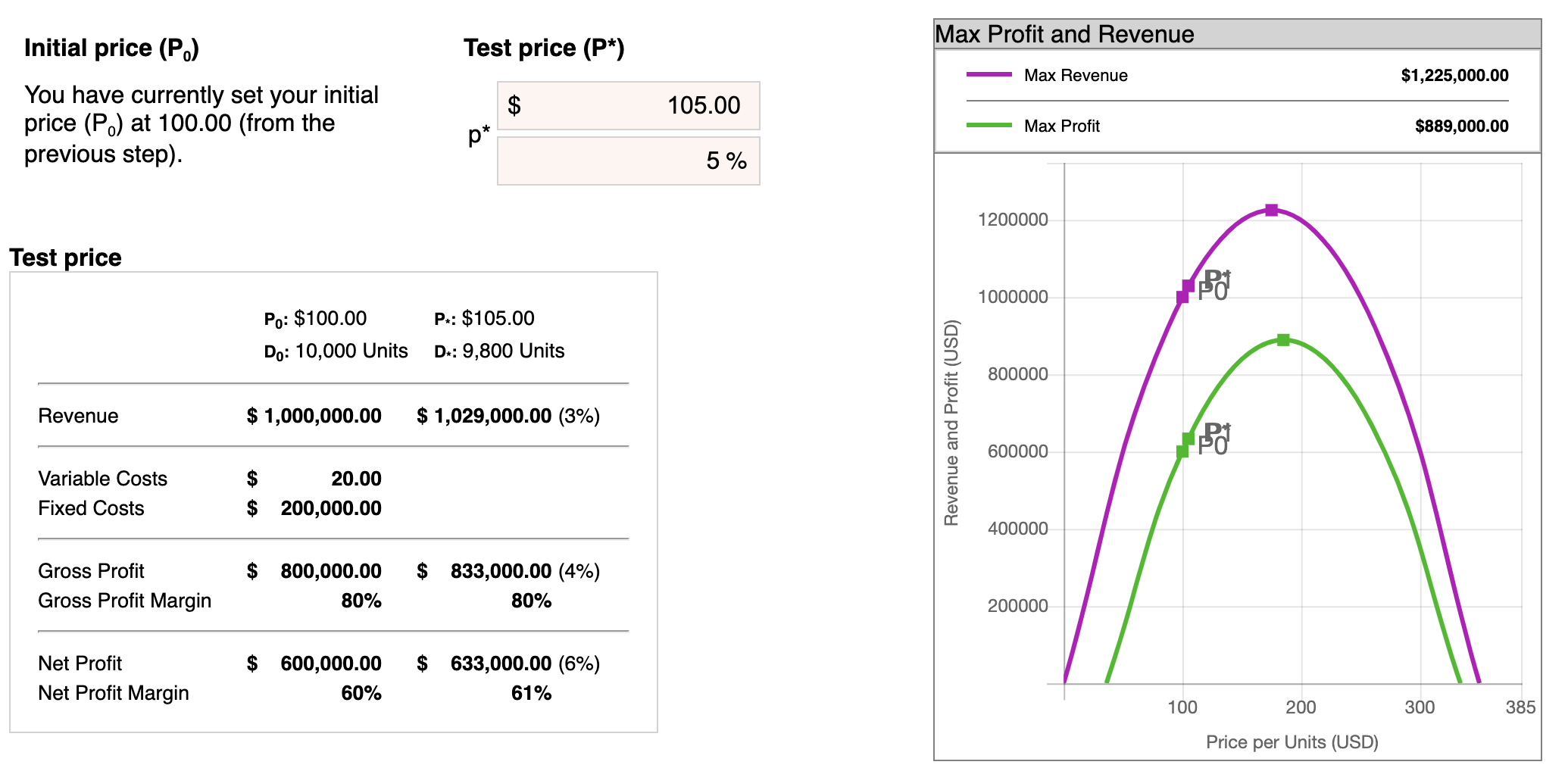

Let’s take a simple base case. A SaaS company has an annual subscription of $100 per year, a gross margin of 80%, 10,000 subscriptions and fixed costs of $200,000.

A 5% price increase is planned and analysis of historical data plus input from sales suggests that this will lead to a decline in demand of 2%, all else being equal.

Let’s assume for a moment that this is a reasonable estimate of price elasticity of demand.

What price change would actually maximize revenue and price, assuming the company is willing to accept the decline on volume.

For revenue the answer is …

For profit the answer is …

This suggests that a price increase much higher that 5% (from $100 to $105) should be considered.

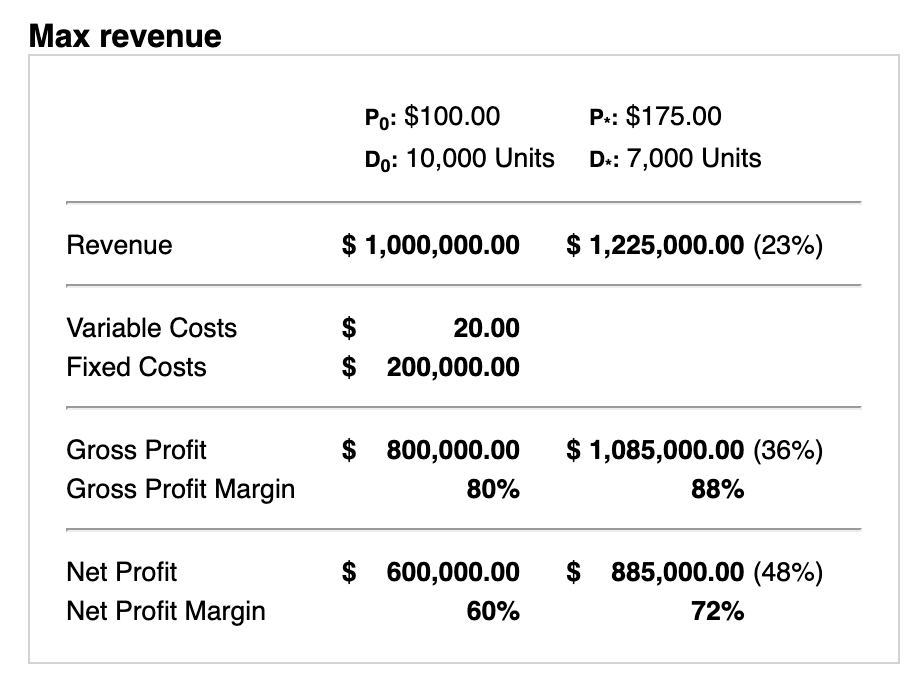

To optimize revenues the price should be increased to $175 with a 30% decrease in volume.

To optimize profit the price should be increased to $185 with a 34% decrease in volume.

Of course this should not be done in one large price increase. Prices should be increased in steps, with the actual price elasticity of demand (impact on volume) and competitive responses tested at each step.

It is also critical to keep the value ratio in balance. The value ratio is the Value to Customer / Lifetime Value of a Customer or V2C/LTV. In most markets this needs to be at least 3X and in early stage markets as much as 10X.

Are price increases the solution then?

Not necessarily. Just increasing the price is usually not the optimal strategy. Other factors need to be considered.

To optimize gross margin diversify the revenue mix

Thomas Lah at the TSIA has been doing some important research on Why SaaS Companies are Unprofitable. Take some time to read through his findings, a few of the results are summarized below.

SaaS companies are less profitable than traditional software companies that sell licenses. In the past this was not important as it was assumed that SaaS companies would grow into profitability and that growth was the only thing that really mattered in valuation. If investors start to include profitability and cashflow in their valuation calculations the picture will change.

SaaS companies are heavily dependent on subscription revenues and get relatively little revenue from annuity services or project services.

Annuity services can be things like enhanced customer support or service levels, training and so on. Project services are one-off pieces of consulting or integration work.

According to the TSIA, SaaS companies generally run a negative margin of 5% on the project services part of their business. This has led them to deprecate these businesses and push them over to partners.

That may be about to change.

SaaS growth and profitability will depend on hybrid revenue and pricing models

In his excellent book Price for Growth Jeff Robinson proposes a framework for evaluating pricing decisions. You can learn more about that model in Pricing for Net Dollar Retention.

Your pricing and revenue strategy needs to address all of the variables in Jeff’s model. It is difficult to do this if one only has one variable, price level, and one revenue stream, subscriptions, to play with.

For SaaS companies the key to profitable growth will be the following.

Make sure that all activities are contributing to profitable growth and not just top line growth

Consider expanding professional services and making sure that you are getting best in class margins on customer services

Move to hybrid pricing models that include usage based pricing metrics

Building in additional levers may require changes to packaging, the addition of professional services, the adoption of a hybrid pricing model. This is now urgent for many SaaS businesses.