Ibbaka on 2020 Ready to Rocket - Growth Despite Uncertainty

Karen Chiang is Managing Partner of Ibbaka. See her skill profile on Ibbaka Talent.

Last week, Dave Thomas, Geoff Hansen, Reg Nordman, Thealzel Lee and the crew at Rocket Builders announced their Ready to Rocket and Emerging Rockets lists. At Ibbaka, we're very proud to be a part of this list of early stage companies that are poised and positioned for growth in 2020. In order to graduate this list, companies would either get acquired, achieve $20M in revenue or receive $50M in investment. Beyond this point, they are deemed successful and are no longer tracked.

This year 2020, the Ides of March ushered in a period of foreboding to our world. We are living in interesting times and many of us are rapidly re-assessing our business plans. As business leaders, our focus remains the same… look after the people who are close to us, support our customers, contribute to our communities. As entrepreneurs, our businesses are the way in which we do this. They are the lifeblood through which we can make things happen for those people around us.

In this post, I would like to highlight some of the key observations gathered during the Ready to Rocket 2020 announcement. I’ll wrap up with some key transformations that I have observed since and offer practical steps on what we as entrepreneurs need to continue to do.

Learnings and Observations from the 2020 Ready to Rocket Launch Event

The event was online this year, for the first time in the eighteen year history of the event. This in itself represents a significant change in the way in which we as people are connecting. Each year, I look forward to attending in person the Ready to Rocket event to meet other entrepreneurs, investors, analysis as well as friends. Instead, I am attending the launch online, and I do not have a clear vision of who else is in attendance. It was not possible to strike up a conversation with a stranger -- a lost opportunity to make friends.

Geoff mentioned that the initial path to growth may seem similar for many companies but the difference between those that get to exponential growth, is the difference in ability of not only having a great technology offering, but also being able to get beyond the early market to address a wider horizontal market (broader market) and find that scalable and predictable revenue system. Usually at the $2M revenue mark, some companies falter or plateau because they are unable to adapt to the more highly competitive market they meet at later stages of trying to address a broader market. I consider that now, regardless of where each of us are on our own growth curves, we are still contemplating what are the right decisions that we have to make for our businesses. So let’s reflect on more of what was said in the session.

Ingredients of startup growth

Let’s revisit the criteria used by the Rocket Builders team to evaluate the candidates for the Ready to Rocket list. These include:

Magical technology or an unmatched special sauce that is unique in the marketplace

A clear path to and way to customers within a high-growth market.

The offer is a pain reliever (a MUST HAVE), rather than a vitamin (a nice to have) -- In today’s challenging economic environment, if your solution is “nice to have” you will be in trouble while the pain relievers will still garner business despite slowdown of the economy.

The first item on the list is the requirement of innovation that is going to change the way in which things are solved today. It also calls for the need to be differentiated. Differentiation is what allows for positioning; it enables us to garner a place within the marketplace; it provides us a way to compete.

This differentiation is also the path by which our customers will use to determine whether to do business with us or select a next best competitive alternative. With differentiation, customers will also need to have a clear understanding of the value that we are providing. For consideration to happen, our customer has to establish in his mind that he has a pain to be solved and that we can relieve his pain better than someone else.

To accelerate our growth, we have to find the group of customers that have the same pain to be solved, will find value in what we have to offer, and can reference each other.

Evaluating Moore’s Adoption Cycle

In today’s climate, one of the greatest risks businesses face is the widening of Geoffrey Moore’s chasm. The gap between early adopters and your first scalable market segment. Companies that are in the early adopter phase will have a tougher time crossing the chasm. In today’s slowdown the time it takes to cross the chasm is extended for longer periods of time. This will force companies to spend funds to get across and some will run out of funds and will not make it. On the positive, historical data has shown that the innovators who are driving highly creative emerging technologies and are trying to achieve competitive advantage, are able to remain active during times of slow economic growth.

Punch in the mouth - adapting in times to uncertainty

“Everyone has a plan, ‘til they get punched in the mouth.” is a famous quote from the boxer, Mike Tyson. All of us have been punched by the pandemic. These are the punches that companies are facing:

Jab - No trade shows, fewer inbound leads - Trade shows account for30% or more of most companies' marketing budgets and drive almost 50% of qualified leads. At the same time, there are fewer inbound leads coming from the Internet

Undercut - No deals close, budgets are cut - Deals in your existing pipeline are less likely to close during the lockdown and even beyond the lockdown company budgets will be cut

Right Cross - Collection challenges - Even though some companies have contracts in place, it will be difficult to collect on those contracts

Hook - Churn - A number of customers will stop being customers. Companies will be judged on churn rates as to whether they are viable for investment.

Business Survival Strategies

“At some point, everything's going to go south on you. ‘You're going to say this is it. This is how I end.’ Now you can either accept that… or you can get to work .” Mark Watney, lead character in the movie The Martian. Like Mark, companies are coming up with strategies:

Ration Food - make the cash last

Make Water - assess current customers; it is easier to try to make more money from existing customers than it is to find new ones during these times

Grow Food - identify segments that are ready for your solutions; there is always a subset of customers who are more ready and eager for your solution than others. Prioritize your segment accordingly

Establish Communications - build partnerships, identify new promotional methods to get your word out.

Scenarios Impacting technology companies

Geoff also shared some scenarios resulting from the state of the pandemic and shift in economy based on the type of company industries served:

Immediate demand - telehealth, online learning, remote communications, food delivery, cloud computing - are seeing an increase in demand; immediate uptick

Paused demand, bounce recovery - eCommerce, FinTech, payment, mobile, 3D printing, supply chain - even though there is a temporary pause during lockdown, a strong recovery, post lockdown, can be expected

Paused demand, slow recovery - Real estate, hardware, alternative energy - slow bounce back

Extended pause - Travel, event management - very difficult to understand when you can restart as it is unknown when the market will return.

Factors to sustained growth - concluding observations

I would now like to take the opportunity to share my reflections from the Ides of March through the Celebration of Easter, and beyond. I’ve been told that I am somewhat stubborn and so while I recognize that some of us have readjusted to a survival mindset, I instead continue to mentally push a growth mindset and find ways in which to focus on growth. Setbacks are a part of life however, they are still a part of growing. I also want to stress that business fundamentals are fundamentals for a reason; so, I would like to recap some of these.

Driving Growth - Ibbaka’s Growth Pyramid

At the very beginning of the year, I wrote a post about making choiceful strategic decisions leveraging market and talent insights. I introduced our Ibbaka Growth Pyramid where the key factors that drive outcomes are value and differentiation. When we think about growth, as a business, our main objective is to understand how we are delivering value to our customers. A concept we have termed V2C.

Customers Remain Our Primary Life Extension

Even more so today, we as businesses need to be choiceful in how we spend and allocate our investments. In current times, survival strategies and prudence are indeed necessary; we should always look for ways of life extension. We will quickly realize our business objective remains the same: ACQUIRE and SERVE CUSTOMERS. Customers remain our primary path to life extension.

As such, we understand the value that we can immediately or more readily provide is still required. And, we have to remind ourselves that value is always from the perspective of our customer. Can we help improve our customers' economics in terms of revenue, operational expenditures, operating capital, capital investment, risk reduction or optionality? Can we address their emotional drivers related to self-actualization, self-esteem, community, security or basic operations? And in today’s world, can we help our customers their contributions to their communities through positive social citizens impact, health and well-being, rights and freedoms, security and safety, societal advancements, education?

Understanding groups of customers where we can have the most valuable impacts will help us to be seen as the painkiller versus the vitamin. It is here that we need to prioritize our segmentation and our focus for our marketing efforts.

The steps we need to take to understand our prioritized segments include:

Re-establish and drive deeper to reach out and connect with our market

Understand how our customers business is being affected

Identify the survival tactics that our customers are implementing to get clues changes that will affect our relationship

Understand how our customers’ demand is affected? Are there pockets of their businesses that are affected differently?

Consider the timeline for these adjustments to their business and understand when and how we can be available to assist them.

Evaluate if value perception changed and what value drivers are relevant?

Our People Drive Our Outcomes

As we shift to work at home models, reorganizing our talent to different styles and even different types of work, we want to be sure that we have the capability to execute while rapid change and shift becomes a constant. We will need to understand where the pockets of opportunity lie for us to mobilize our talent. What existing skills are we able to leverage to smooth out transitions. Are there complementary skills we already have that we can take advantage of. As we think about partnering with other firms to improve awareness and build synergistic relationships where we can multiply value delivered, we need to understand how we can truly complement each other.

I would like to recommend reading our e-book that I co-authored with Claude Werder of Brandon Hall which gives practical steps on how to improve talent mobility and engagement. Talent investments must remain persistent in order for organizations to be prepared to steer change and get to outcomes:

Build a culture of continuous learning

Drive individual growth through varied experiences

Align career development and succession planning with employees’ potential

Continually assess to understand capabilities and potential

Develop a team mindset of collaboration and shared leadership

Get our ebook here: “How to drive talent mobility for rapid evolution of an organization.”

Business leaders drive change by answering critical questions

As business leaders, we continue to be tasked with making decisions. These are the key business questions that we are confronted with.

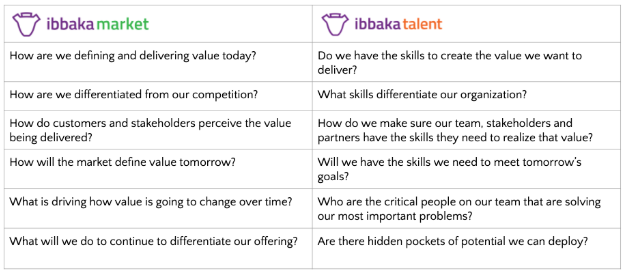

The top three questions appearing in each of the columns are very much operationally based. Required to keep the lights on. The next three questions are where we get more into the strategy as it speaks more so about growth and shaping our futures.

Given this, the role of data in our business will have an increasing role. Data is the primary block through which we can find patterns and use as a gauge to measure our performance. Data will reveal the answers to the questions we are asking. Data is the foundation of getting insights.

Words of appreciation

Again, we would like to call out the Rocket Builders’ Team for their analysis. A big congratulations to our peers on this list. Our team at Ibbaka would like to first and foremost express our huge appreciation to our customers whose guidance, leadership, and support are essential for us to even exist. Our strength is indeed in our relationships and we will get through these times and adjust our course with those we are close to. Let’s continue to look after each other.