Trends in SaaS pricing from Q2 2023

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Interested in pricing and customer value management platforms? Help shape the category by contributing to this survey.

Q1 2023 is done. It was a tough quarter for a lot of B2B SaaS companies. The new operating reality sank in and is showing up in results.

What is this new operating reality for SaaS pricing?

Buyers are delaying buying decisions

The focus is applications that are absolutely needed

Buyers are pushing back on rote price increases

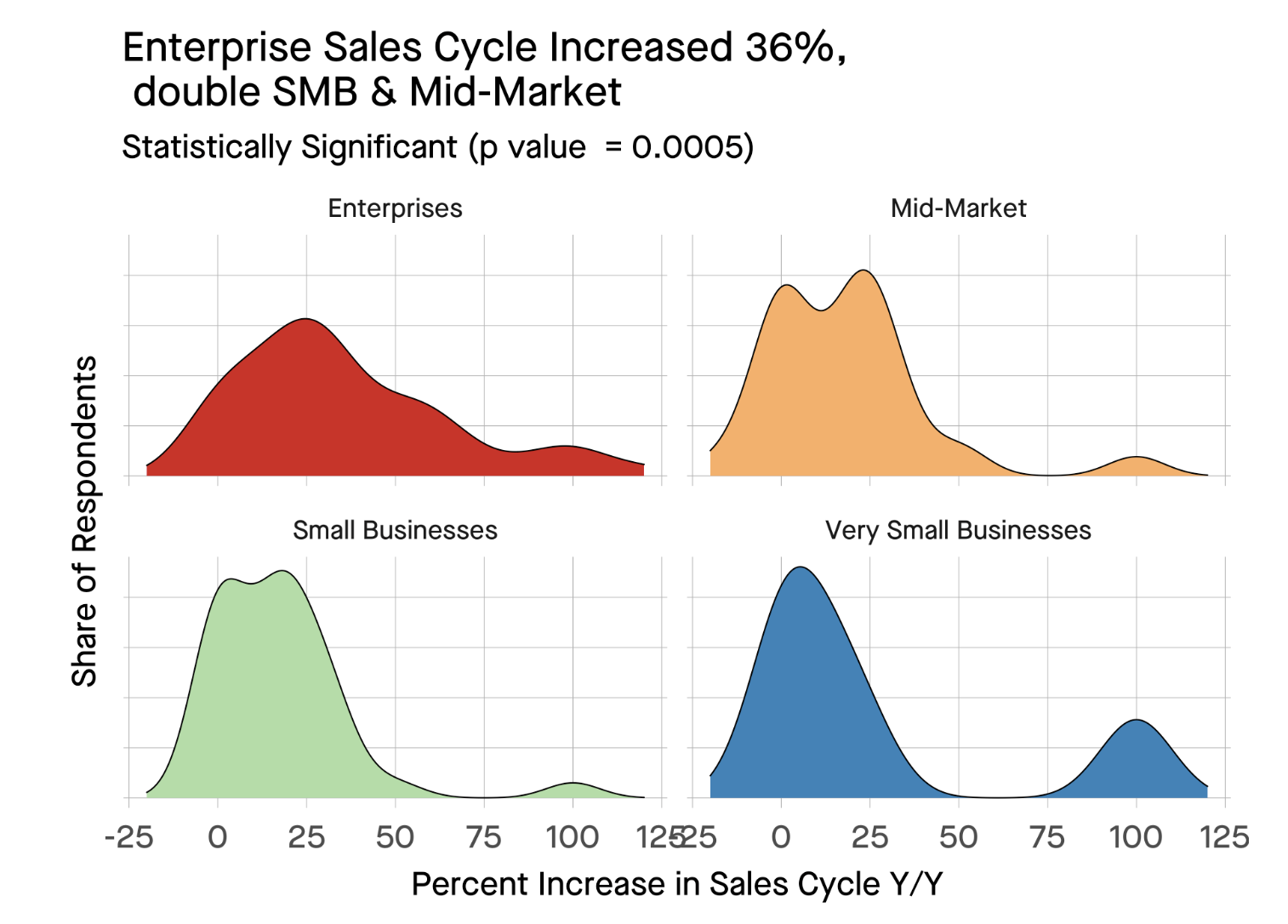

Tom Tunguz recently published some important analysis of SaaS pipeline velocity. “The Typical Startup Saw a 24% Increase in Sales Cycle in 2023.”

Pipeline velocity is one of the key components of a revenue value driver (the others being number of opportunities entering the pipeline, conversion rates and average contract value). Pipeline velocity is slowing down. This is putting pressure on cashflow and on operating capital. For many SaaS companies this is a double hit as the cost of capital has gone up sharply, whether this is debt (higher interest rates) or equity (lower valuations).

Even as they delay decisions, buyers are focussing in on applications seen as essential and proven. This is putting a damper on smaller companies with innovative solutions, who are under a lot of pressure to demonstrate documented value of the gate.

There were a lot of price increases in Q1. Many of these were justified by inflation and applied across the board with no attempt to segment customers. This was a recipe for disaster and the expected pushback has occurred. Companies like Vertice.one are taking advantage of this to help buyers reduce their SaaS spend.

What do people think will happen in SaaS pricing for the rest of the year?

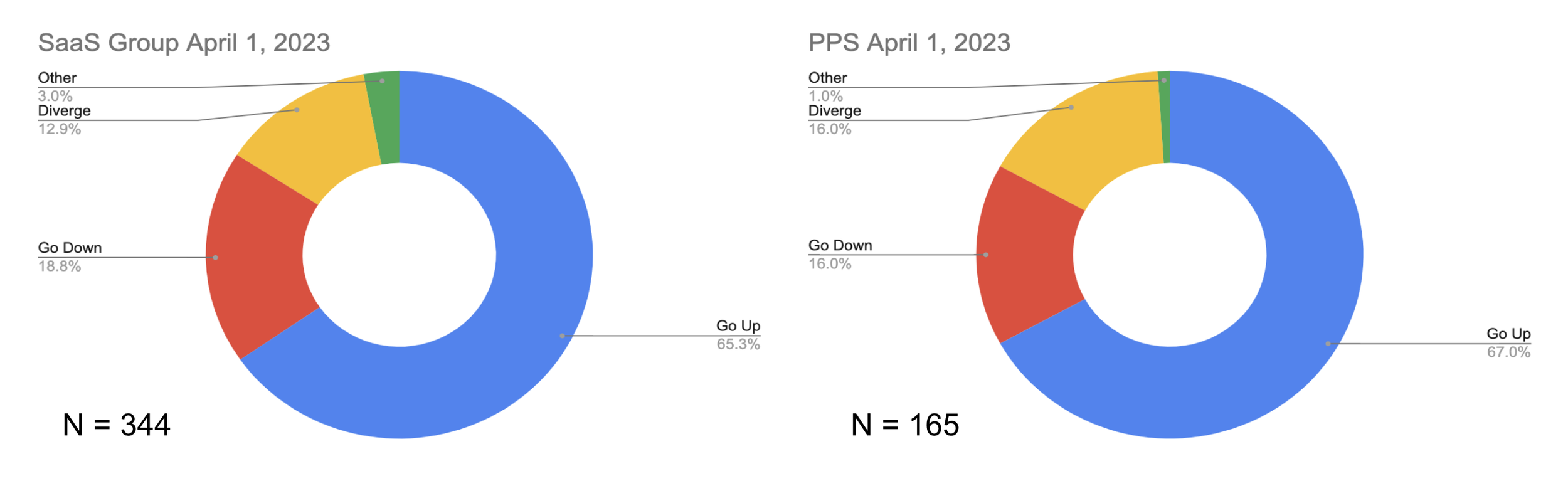

To get a feel for what people think will happen for the rest of 2023 we polled two communities: the 155,000 member Software as a Service - SaaS group on LinkedIn and the the 19,000 member group associated with the Professional Pricing Society. The former is composed of people who operate and invest in SaaS companies. The later is people who work in pricing and monetization across many industries. There is little overlap between the two groups, only three people responded to both polls, so the total N was 506. The options in the poll were that over the rest of 2023 SaaS pricing will

Increase

Decrease

Diverge

Other

It seems that most people in both communities expect prices to continue to go up.

As always, the comments were interesting.

From PPS

“Prices have to go down. Technology will be more and more available with more competition.

Actually, any company can develop its own pricing algorithms rather than subscribing to an over the shelf solution.”“Everyone has raised prices, Microsoft raised prices, all cloud pricing is up including Google etc. almost everyone is going up.”

”Even if their profitability was unharmed going into the last quarter no one wanted to miss the boat when price increases are a norm in the current environment.”

From the SaaS group

“SaaS prices will go down because AI will undercut sooooooo many companies. We are seeing it now.”

“The recent fluctuations in pricing strategies reflect businesses' attempts to adapt to economic shifts and maintain a competitive edge.”

My own perspective is different. I choose the answer that pricing will diverge. It will diverge in the following ways:

Companies in favoured segments will continue to raise prices (see below)

Companies with strong, positive value differentiation will raise prices in a target way

Companies under pressure to increase profits will raise prices

On the other hand

Buyers will have smaller wallets and will be pressing for discounts and reducing usage

Broad, inflation based price increases will be rejected by the market

The favoured segments will be as follows:

Cybersecurity (threats are growing and companies are becoming very risk sensitive)

Cash management (anything that can improve cashflow and reduce operating capital)

Operational efficiency (a broad category that speaks to operating cost value drivers and is dependent on target market)

AI enabled innovation (the big exception, driven by the current hype and compelling demonstration of Microsoft Copilot)

The best positioned companies will combine two of the above characteristics.

The X-Factor: Pricing for revenue or pricing for profit?

One thing that could drive SaaS prices up over the rest of 2023 is a move from pricing for revenue growth to pricing for profit growth. The price point that optimizes revenue growth is lower than the price point that optimizes profit growth. More on that in an upcoming post.

How do you need to respond to these changes?

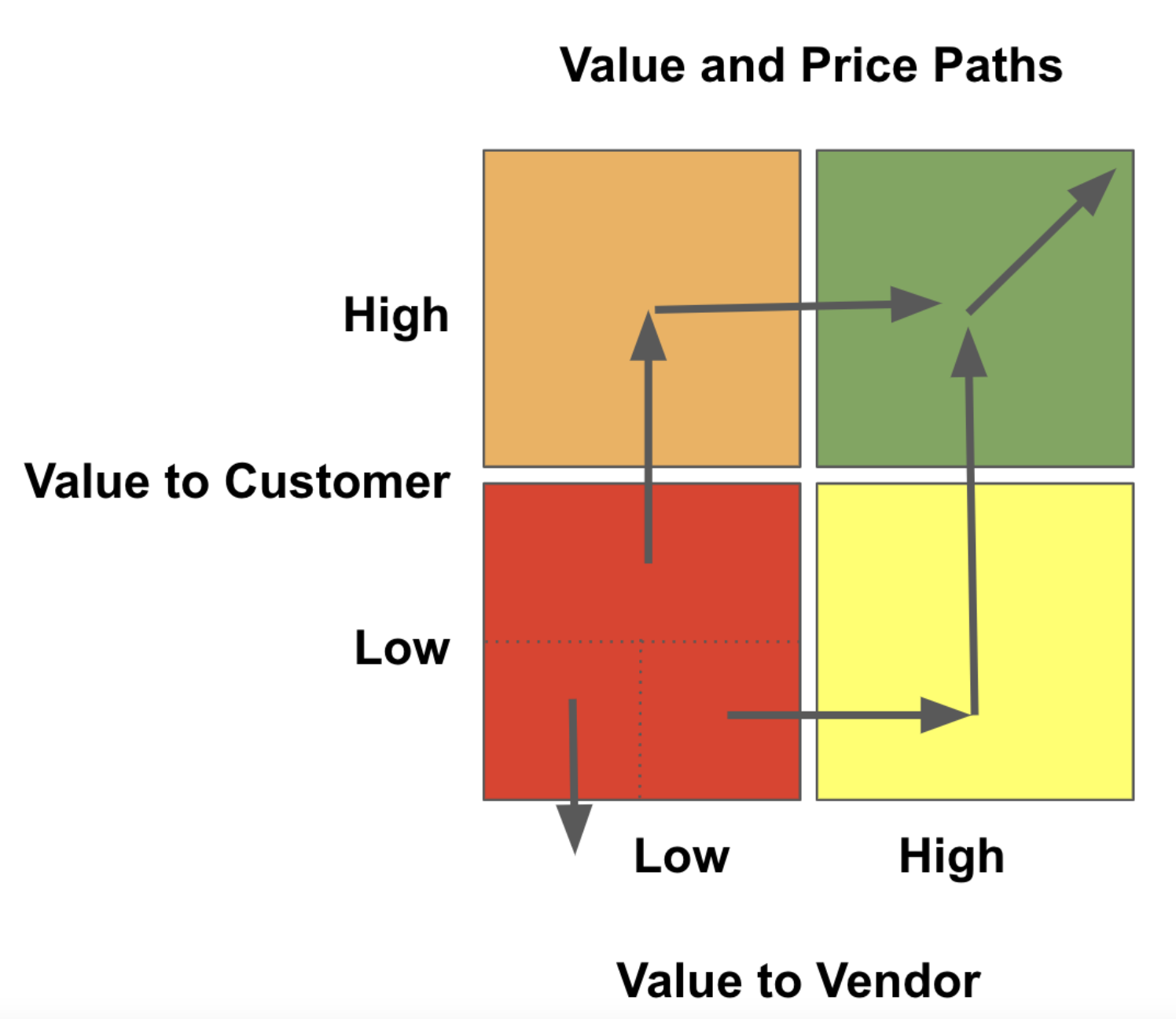

So how should you approach pricing for the rest of 2023? Stop peanut butter spreading. Your customers are not all the same and they will not all respond the same way to price changes.

Your solution needs to be essential to your customers and not an option that can be deferred. Make sure you can help with at least one of the three priorities: risk reduction, cash management or operating efficiency.

Focus on value before you talk about price or consider price increases. You should have a formal value model (a system of equations that shows how you provide value to specific customers or customer segments) and be documenting the value you deliver. That value has to be communicated in a value story.

Adopt hybrid pricing. Hybrid pricing combines two pricing metrics, for example a user subscription and a consumption metric. The two metrics should not be closely correlated (if they are then combine them into one metric). Hybrid metrics let you respond more flexibly to your customers and to capture more value. See Why SaaS Companies are Considering Hybrid Pricing Models on the Arthur Ventures blog.

The rest of 2023 is going to be tough and smart pricing will be a key to success. Smart pricing means segmenting your customers by how much value you are providing to them and how much value you are capturing back. Each segment needs to be treated differently.