Protect Revenue Retention - Look at Churn

Karen Chiang is a Managing Partner at Ibbaka. Connect on LinkedIn

2023 proved to be a tough year for SaaS businesses and businesses. We continue to see headlines where firms are reducing sales and customer success staff. High-interest rates (higher costs to finance) continue to remain. As the Feds (many of our customers are US-based) forecast inflation to decline, businesses are closing out Q1 2024 with more optimism.

NRR Measures the Health of Revenue Operations

Managing net revenue retention (NRR) targets is a must for all subscription businesses. Rightly so, since NRR is a measure that needs to be consistently achieved to have a sustainable business. It is a key stakeholder metric because it reveals the health of a company’s revenue operations. Given today’s economic atmosphere where net logo growth predictions are conservative, the majority of businesses we work with are focused on finding ways to protect or more proactively drive net revenue retention numbers.

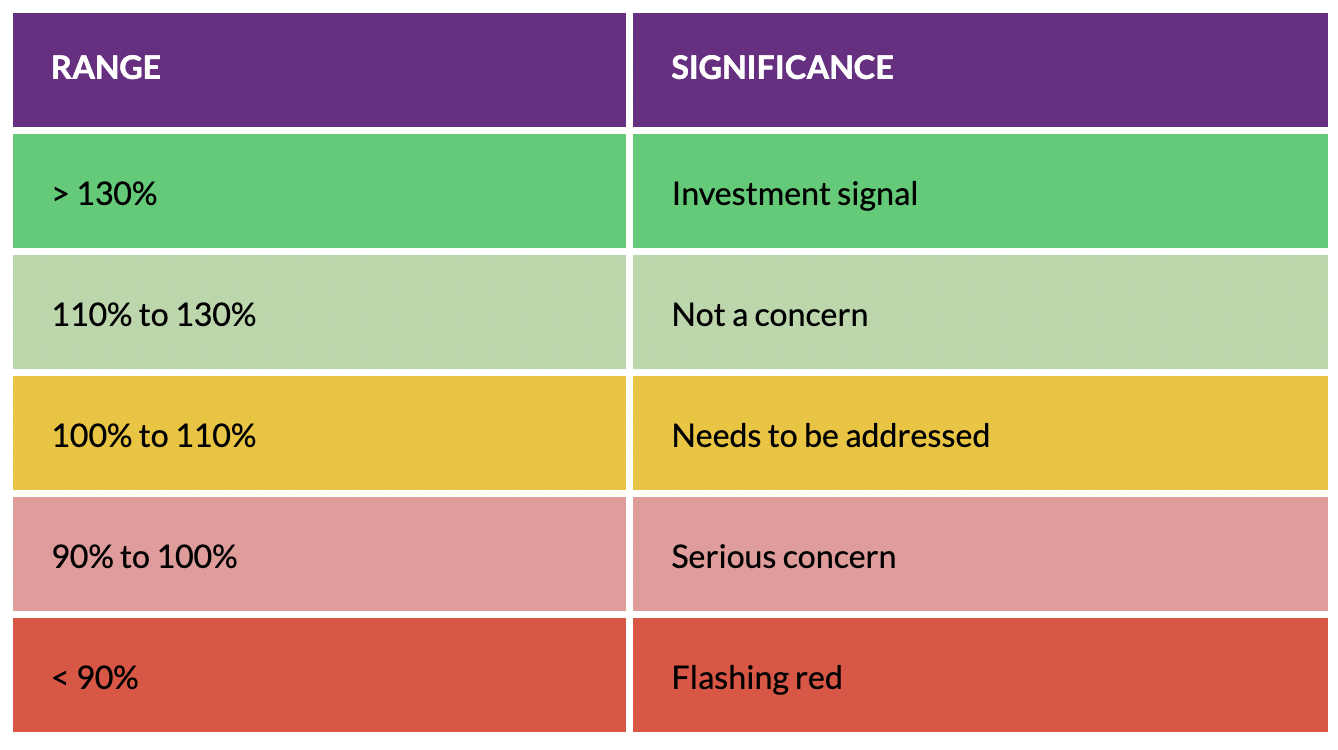

The table below outlines the significance of your NRR number for investors.

The Six NRR Levers

Six levers that determine your NRR. Growth in package, upsell and cross-sell positively impact NRR, while churn, shrinkage in package, and downsell negatively impact NRR.

Focus on Revenue Churn

When managing churn, revenue churn matters more than customer churn. We define revenue churn as recurring revenue loss over a certain period due to cancellations. Customer churn is the number of lost customers at the end of a period divided by the total customers at the start of the period multiplied by one hundred.

Focusing on revenue churn is crucial as it directly impacts cash flow and profitability. Managing revenue churn is key to financial stability.

Being able to understand which customers contribute the most to revenue is important. Especially, when tasked with doing more with less, determine your high-value customer segments to illuminate where retention efforts should be focused.

Ibbaka is focused on helping businesses optimize pricing and monetization strategies, revenue churn directs how changes in packaging and pricing can impact retention.

The Natural Level of Churn

Every business has a natural level of churn, which varies significantly depending on the industry, business model, size of customer, integrations, and other factors. Economic factors can also lead to shifts in churn expectations.

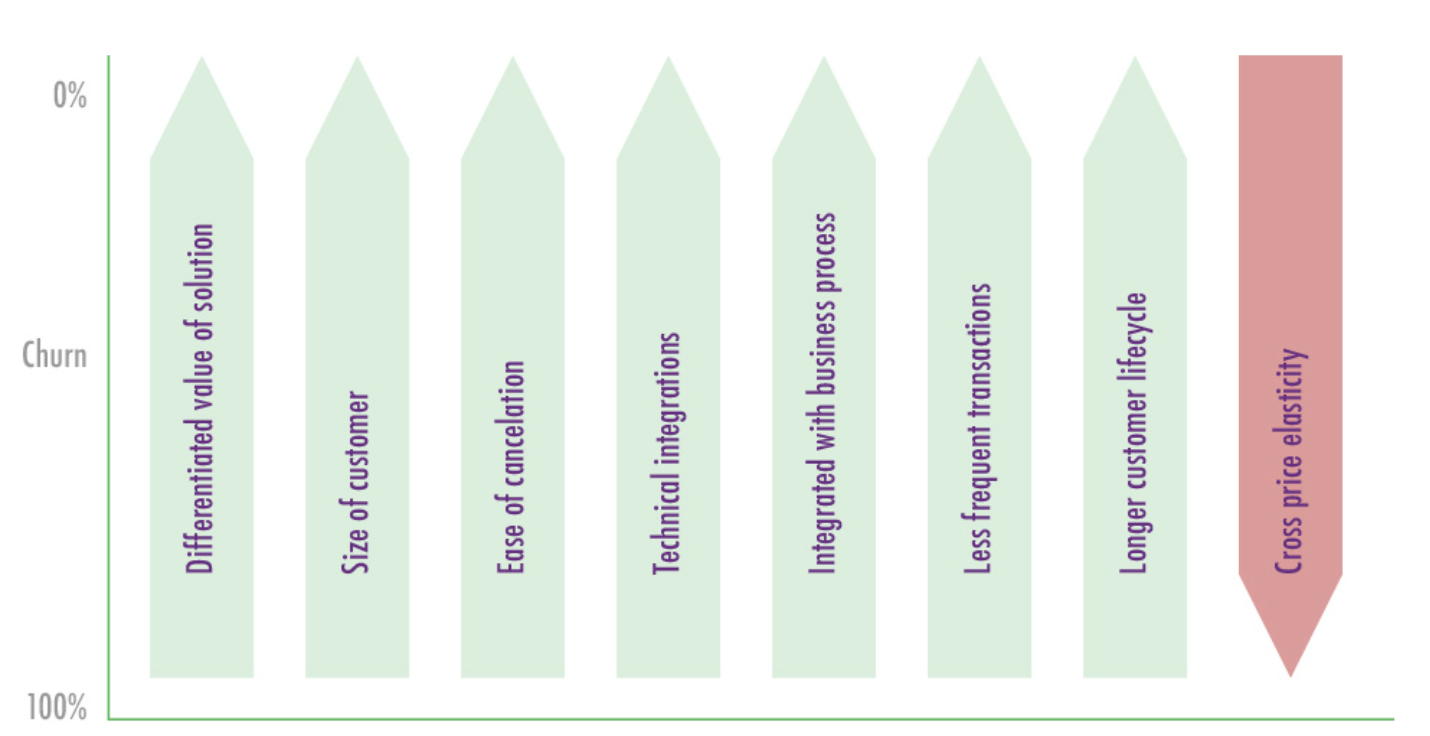

Factors Influencing Churn:

Differentiated value: The greater the differentiated value that you can define, deliver, and communicate, the greater power you will have to reduce churn.

Size of the customer - Larger-sized customers and the associated larger average contract values typically have lower churn rates.

Ease of cancellation - The harder it is to cancel the subscription, the higher the retention rate (lower the churn rate).

Technical integrations - Increased integration and connectivity to complementary systems that are mission-critical to your customers’ operations will also contribute to lower churn rates.

Business process integration - The more entrenched a solution is with customers’ business process and its flow of work, the harder it is for churn to take place.

Less frequent transactions - Fewer transactions indicate a longer customer lifecycle. When customers engage with a company less frequently, each transaction tends to carry greater perceived value which leads to lower churn.

Longer customer lifecycles - The longer the customer lifecycle, the lower churn rates are expected to be. Longer customer lifecycles imply more opportunities for the business to build relationships, understand customer needs, and provide greater value over time.

Cross-price elasticity of demand - This measures the tendency of a buyer to switch vendors in response to price changes. The higher the cross-price elasticity of demand, the greater the risk is for churn.

At the heart of each of these, is the need to continue to prove and deliver value over time. Value is the cure for churn.

Here are some examples of natural churn rates within consideration for ACV and integrations.

Understand the natural level of churn for your business. If you are achieving this rate, spending more effort on churn may be misplaced as you should focus on other NRR levers.

Poll Results

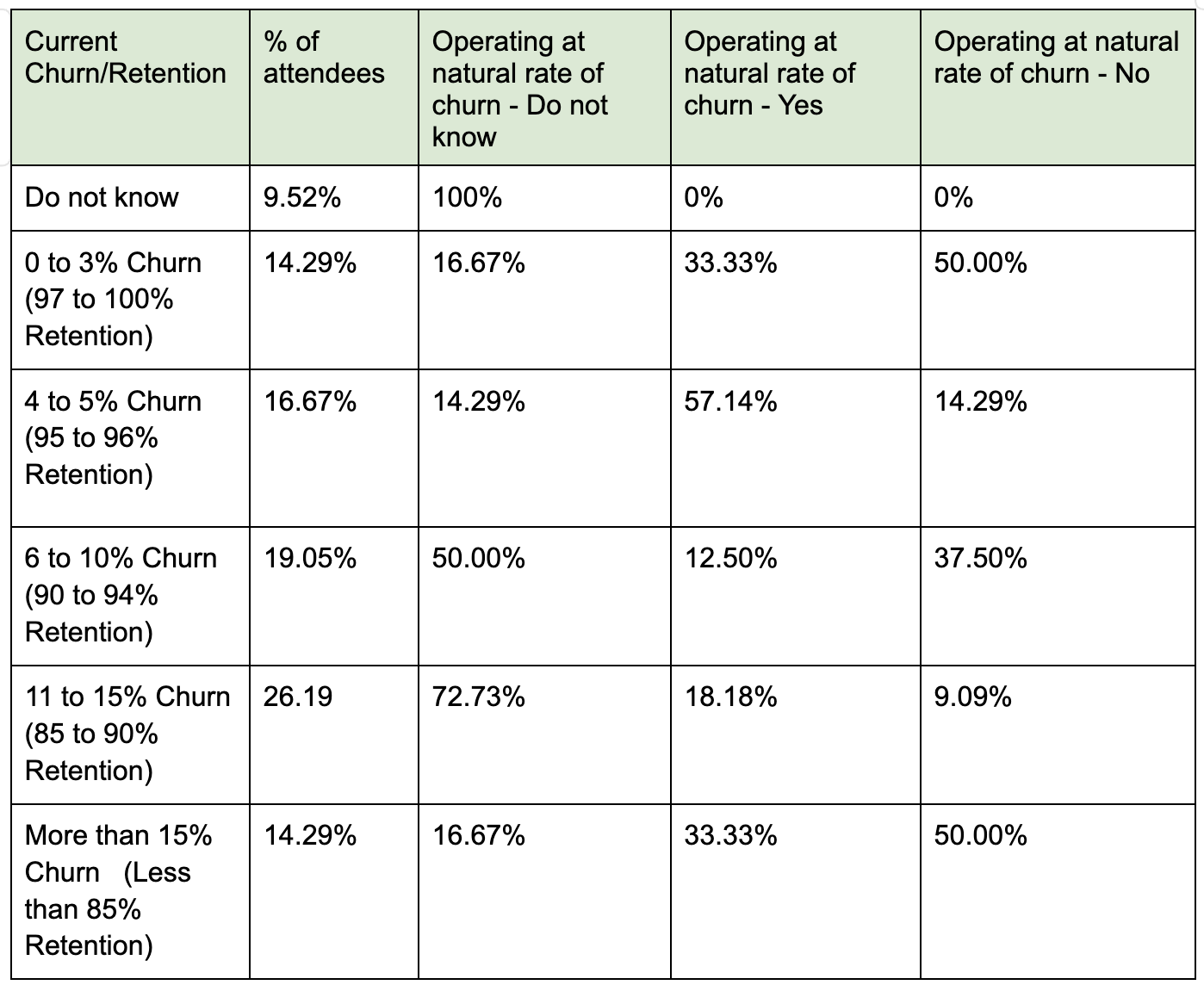

Last week, we conducted a poll during our PeakSpan Master Class: Optimize Pricing & Packaging to Minimize Churn. We asked attendees, “ What is their current level of churn/retention (Per Year)? We also asked, “Are you operating at your natural rate of churn?”

The distribution of churn level is represented in the table below. Overall, 46.23% did not know whether they were operating at their natural churn rate. There was an even split between those who felt they were not at their natural churn and those who were operating at their natural rate of churn. The measure here was 26.83%. This reveals that understanding the natural churn rate is something businesses need to lean into.

The table below shows the percentage allocation of whether attendees felt they were operating at their natural churn rate by churn/retention range.

It’s an anomaly that 50% of firms operating at 0-3% feel that they are not in a natural state of churn. It’s also interesting to note that 33.33% of firms with greater than 15% churn feel that they are operating at a natural state of churn. This emphasizes that natural attrition levels require interpretation and need to be based on the factors that matter for your industry, the customers you are servicing as well as the measurable impact you can provide.

Note: This post is based on our masterclass content and I also leveraged OpenAI. (2024). ChatGPT to generate additional content. https://chat.openai.com or some additional context.

Discover how Ibbaka's tailored solutions can revolutionize your strategy.