How to Capture the Right Value Metrics to Accurately Price Your Product

Edward Wong is a Project Manager at Ibbaka. See his LinkedIn profile.

At the core of effective pricing strategies lies a robust data model, which Ibbaka likens to the ‘DNA’ of a business. It determines the scope of your business capabilities and strategic decision-making. But the question remains: what data should your model capture?

Advanced pricing strategies rely heavily on information. This information is increasingly sourced directly from the system being priced. The design of your data model, system instrumentation, and pricing model are inherently intertwined.

Developing a Value Model:

Effective pricing metrics are based on the value delivered. The greater the value, the higher the price warranted. Thus, as you refine your system and construct your data model, ensure you're capturing pertinent data on the value rendered. This can be usage data, but even more important is outcome data.

How do you achieve this? It commences with a commitment to understanding your customer and their business model. Without this understanding, your pricing becomes a shot in the dark.

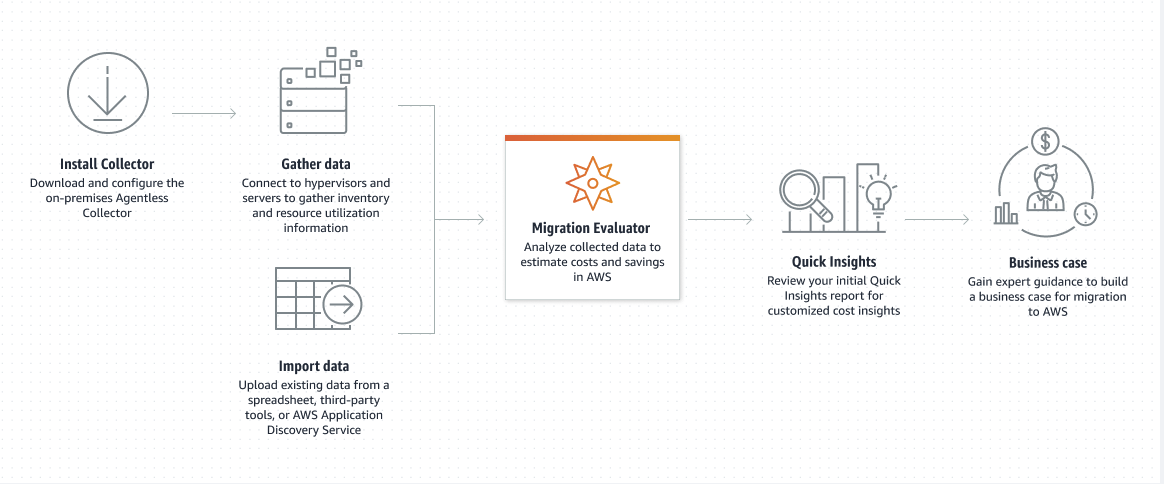

A practical starting point is to have an ROI (Return on Investment) calculator, readily accessible on your website. An example of a company that does this is TSO Logic, acquired by Amazon Web Services (AWS) in 2019, who effectively uses its Migration Evaluator platform to provide actionable insights that enhance IT performance and cost-efficiency, ultimately guiding enterprise computing transformations.

TSO Logic embeds metrics deep within its system, even furnishing a dashboard illustrating potential cost savings through server reconfiguration.

Implementing a Value-Centric Data Model

1. Develop a value model (tailored per market segment, if properly segmented)

2. Categorize calculator variables into:

(a) Data directly collectible by your system

(b) External data feeds that can be integrated

(c) Possible integrations with customer systems

(d) Variables necessitating estimation and benchmarking

3. Incorporate direct (2a) and external (2b) data into your platform

4. Facilitate integrations with internal systems (2c) to enrich data-driven value calculations

5. Enable customer input to adjust the estimates and duly record alterations (2d)

6. Use this data (with the value model) to estimate value to the customer (V2C)

7. Display the value on product dashboards to keep the customer aware of the value they are getting

Once you have this data you can use it in your pricing models, ensuring that price is aligned with the value being delivered.

Key Data Types for Pricing

Understanding the interplay between different types of data is crucial for advanced pricing strategies. These include:

Usage Data: How and how much the customers use the product

Value Data: The benefits and outcomes that customers derive from the product

Pricing Data: Information about how much customers are willing to pay for these benefits

These different types of data are most powerful when they overlap. It is at the intersection of value, usage and pricing data that you should focus your attention when designing pricing.

Advanced Value Estimation Techniques

One of the best ways to build a value model is by using Economic Value Estimation (EVE®) approach pioneered by pricing expert Tom Nagle in "The Strategy and Tactics of Pricing." EVE offers more nuanced insights than the broad brush taken by ROI calculators. While incorporating EVE into software may pose challenges, the precision it brings yields more compelling and precise understanding of value.

The diagram illustrates the Economic Value Estimation (EVE) model. It depicts how to determine the economic value of a product by comparing positive and negative economic value drivers. Positive drivers include factors that increase revenue, reduce costs, and decrease risk, which all contribute to the differentiation value of a product. The differentiation value, when measured against the price of a competitive alternative, leads to the economic value of the product. This economic value then dictates the normal price range for the product. This model helps businesses quantify the unique value they offer and set appropriate pricing strategies.

Crafting your data model to capture essential data on usage, value, and pricing is the key to ensuring your pricing reflects the true worth of your product. Such strategic alignment not only bolsters your pricing framework but also fortifies customer trust by transparently showcasing the tangible benefits they gain and how that value is being shared. This holistic approach serves as the foundation for a sustainable pricing strategy that resonates with both market demands and customer expectations.